[ad_1]

Worth motion is the motion of worth over time, this motion leaves behind a ‘footprint’, the footprint of cash. This footprint, as soon as understood correctly, reveals to us the story on the chart…

Worth motion evaluation is the act of analyzing and making sense of the footprint of cash on the chart. By understanding this footprint, we will start to place collectively a ‘story’ of the market, one bar at a time. These footprints are worth bars, they usually present us the habits of all market contributors; the ‘massive boys’, good cash, hedge fund managers, and even the not so good cash.

By analyzing and following the footprint left behind as the worth motion develops over time, we will learn what is going on on a chart, what has occurred and what would possibly occur subsequent. Studying a chart is not only about “technical evaluation”, it’s about understanding and making use out of the psychology of the market that’s ‘hidden’ within the worth bars. On this lesson, you’ll uncover what studying the charts bar-by-bar after which utilizing that to get a fowl’s eye view, will do to your buying and selling…

The psychology of worth bars and studying the market like a ebook

Worth motion, for many who are new right here, is basically the ‘footprint’ that’s left behind as worth strikes over time, this worth motion footprint is seen by a worth chart of any market or buying and selling instrument. For an expanded definition of worth motion, learn my introduction to cost motion right here.

Every particular person worth bar is basically a mirrored image of the collective psychology of all market contributors for the time interval the bar represents. For instance, on a each day chart time-frame, every worth bar is exhibiting whether or not bulls or bears gained the battle that day. We will drill-down additional and dissect every worth bar based on how lengthy or quick its tail / wick / shadow was in addition to the entire size of the bar and some different options.

The psychology of particular person worth bars is one thing that has been studied for a whole bunch of years, ever since Munehisa Homma, the primary worth motion dealer, started utilizing candlestick charts within the 1700’s. Homma found that by monitoring the worth motion of a market over time (worth motion / footprint of cash), he may really see the psychological habits of different market contributors and use that information to develop a buying and selling technique.

Shifting past indicators, buying and selling techniques and all the net buying and selling hype, by merely studying a ‘bare’ worth chart we’re in a position to learn the market like a sequence of chapters in a ebook; the story reveals itself from left to proper over time.

What are the first focus factors when studying a chart from left to proper?

- Studying the worth motion and technical evaluation of charts will reveal lots of information and it’s rather more than simply bars and contours, it’s psychology, market sentiment and bringing all of it collectively to type an actionable plan of assault.

- We will interpret the story by studying the charts like a ebook, from left to proper; what occurred earlier within the chart / ebook often has an impression on what is going on at present and what would possibly occur subsequent.

- Every particular person worth bar has one thing to say and performs a task within the story the chart is telling you.

- The obvious piece of knowledge we see after we take a look at a chart is the course of the market or the development. We additionally will simply discover whether or not the market is making massive directional swings or smaller / shallower swings. Notice: At present, many markets are experiencing massive / deep directional swings.

- We additionally need to make word of whether or not a market is respecting technical ranges (assist / resistance, transferring averages, and so on.) constantly. By analyzing the footprint of cash and studying the story on the charts, we will see whether or not a market is respect key technical ranges and if is is, this implies it’s a very good time to search for trades. At present, we’re in a structured market that’s respecting key ranges, trending properly and alerts are forming with worth transferring within the course of the sign most of the time.

- We need to pay attention to how worth is behaving round key ranges, if it’s not respecting them, then what’s it doing? Is it taking pictures previous them with out a lot as a thought? If that’s the case, that tells us quite a bit as properly, it tells us that the course of the extent break has lots of momentum being it, so look to commerce in that course.

Every of the factors above are issues we need to search for as we learn the chart from left to proper. They every assist us to grasp the psychology of the chart and provides us the power to ‘paint’ an image of what would possibly occur subsequent. Consider the story the market is telling you as a “window into the long run”; you don’t all the time know what the long run will maintain, however while you examine previous occasions and the way they connect with present occasions, you may make an excellent educated guess.

Our purpose, as worth motion analysts, is to see and skim the market by utilizing the worth motion evaluation mannequin; bars, ranges, developments, decoding worth motion alerts, and so on. The day-to-day circulate of cash and day-to-day worth power vs. weak spot is revealed by particular person each day and weekly worth bars (I exploit candlestick bars).

For instance, worth motion evaluation permits us to identify potential ‘traps’ out there, like false breakouts and fakey patterns, these patterns reveal the place the market is being manipulated by the “good cash gamers” and which course it could reverse into. On this approach, the worth motion, the footprint of cash, permits us to see contained in the good cash minds; to really see what they’re pondering based mostly on what they’re doing. That is how we learn the psychology of the market on a bar-by-bar foundation. We’ll take a look at some chart examples of this to comply with…

Easy methods to Learn the ‘Footprint’ of Cash…

Now, let’s get into the nitty-gritty of this, let’s stroll via 4 totally different charts and analyze the worth motion from left to proper. These charts will go from straightforward to tougher in order that any newer merchants studying this get a greater really feel for a way I comply with the footprint of the worth motion to develop a narrative on the charts, in order that I could make an informed guess as to the place to search for my subsequent commerce…

Chart 1. – Studying the chart from left to proper

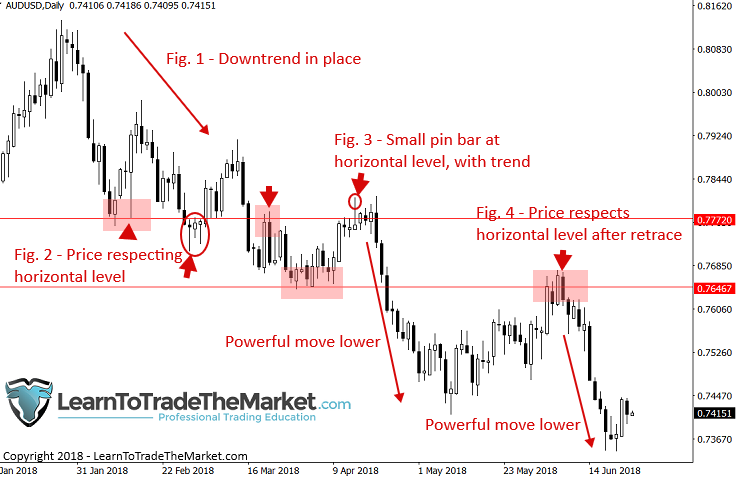

Within the chart beneath, we’re studying the story on the AUDUSD each day chart time-frame:

Determine 1. – The very first thing we’re noticing, ranging from the fitting aspect of the chart is that the general each day chart development was down, decrease highs and decrease lows had been being printed. This offers us our bias – bearish, we need to promote.

Determine 2. – Subsequent, we need to determine apparent horizontal ranges of assist or resistance, drawn on the main market swing factors / turning factors. These ranges are the place we’ll focus our consideration sooner or later for potential worth motion commerce setups.

Determine 3. – Discover, a small bearish pin bar shaped, on the current swing level (earlier swing low which is now resistance), this pin is in-line with the downtrend as properly. Thus, now we have a T.L.S. setup or Development, Stage, Sign, and while you get all three of those it’s like a golden hen that may typically give golden egg commerce setups.

Determine 4. – After the highly effective down transfer that came about following the earlier pin bar sign, worth retraced larger over the following few weeks, again as much as re-test that earlier swing low / resistance degree. We will see that after a short pause again at that resistance, worth sold-off closely once more, offering merchants who missed the primary transfer with a possible second-chance entry into this down-trending market.

Chart 2. – Analyzing particular person worth bar psychology

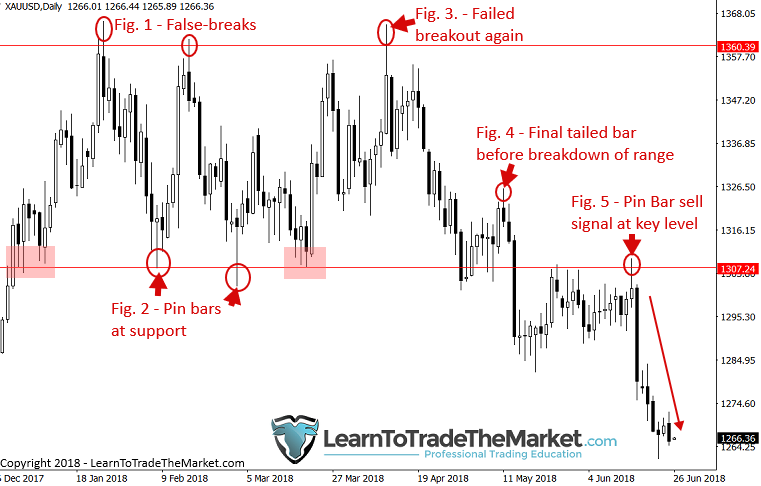

Within the chart beneath, we’re following the good cash worth footprint on the each day Gold chart:

Determine 1. – Discover the false breakout above the extent close to 1360. There was an current resistance degree close to 1360 from again in 2017. The higher tail on the bar signifies the psychology of the market – consumers ran out and have become exhausted, the amateurs purchased into the breakout of the extent solely to see the larger gamers are available in and push worth decrease.

Determine 2. – We will see two apparent bullish pin bars that shaped close to a key assist at 1307 space. We might be leaving each this 1307 assist and 1360 resistance on our charts to observe the worth motion at these ranges into the long run. At this level, a transparent buying and selling vary was established and the story on the chart is that worth is oscillating between these ranges and the weaker palms are getting flushed out on the boundaries of the vary by attempting to anticipate a breakout earlier than it really occurs.

Determine 3. – Yet one more false breakout of resistance, you may see how repetitive people are and the way they don’t study – they are going to do the identical factor again and again, the great factor is, you may revenue from their ignorance! Look ahead to these lengthy tails at key ranges, particularly in buying and selling ranges, and fade them or commerce the other approach, again into the vary.

Determine 4. – Discover, after a number of days of consolidation close to the buying and selling vary assist, after a average pop larger worth shaped a bearish tailed bar, a transparent warning signal that worth wouldn’t make one other surge as much as the buying and selling vary prime. After this warning sign, we will see worth capitulated, lastly breaking down and out of the buying and selling vary for good. If you see a strong shut exterior of a variety, adopted by a number of extra days of consolidation / closes exterior the vary, as we see right here, then it’s secure to imagine the breakout is actual.

Determine 5. – Now that the breakout has been confirmed we will look to commerce in-line with that course (down). Discover after a couple of weeks of consolidating underneath the vary assist, worth tried to poke again up above it, solely to get pushed decrease by bears, forming a small pin bar promote sign earlier than one other massive sell-off.

Chart 3. Worth bars reveal contrarian alternatives

Within the chart beneath, we’re analyzing how worth bars can reveal contrarian buying and selling alternatives.

Determine 1. – After a really aggressive and a few would possibly say “scary” sell-off, the S&P500 reversed dramatically, placing in two long-tailed bullish bars that to the skilled, indicated an up-move was coming quickly. Most amateurs had been nonetheless feeling the extreme sell-off and never prepared to purchase at this level. Once more, pay extra consideration to WHAT THE PRICE ACTION is telling you than what your emotions are telling you. On the time, this could have been a really contrarian feeling purchase entry – everybody had simply liquidated shorts and had been afraid to purchase. Simply bear in mind, when everyone seems to be afraid, you need to purchase, when nobody is afraid, try to be getting afraid and trying to promote!

Determine 2. – After a pleasant transfer larger from the aforementioned bullish tailed bars, worth pulled again to that very same assist space, forming a pair extra apparent bullish tails that confirmed a false-break of that assist, once more indicating an up transfer was probably in retailer.

Determine 3. – If the earlier two alternatives weren’t apparent sufficient, we received a 3rd one, a really nice-looking pin bar purchase sign on the identical assist degree because the final two alternatives. Discover how trades like this may take weeks or months to develop, however after they do, you must act. Having adopted this story on the chart up till that final pin bar shaped, you’ll have recognized what to do on the time – BUY!

Chart. 4. What can we study from failed worth motion alerts?

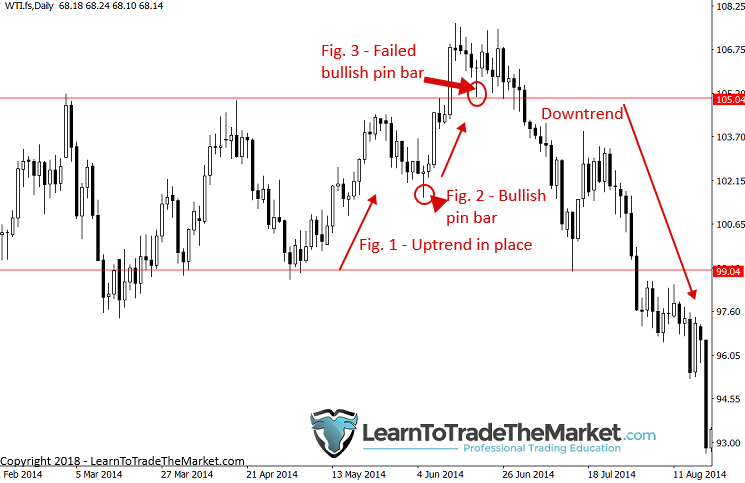

Within the chart beneath, we’re what failed worth motion alerts can inform us.

Determine 1. – Wanting from left to proper, we will see a transparent uptrend was in place as worth bounced from $99.00 assist in Crude Oil. Thus, we might have been trying to purchase this market on bullish alerts.

Determine 2. – After a modest pullback, a bullish pin bar shaped, worth pushed larger as we would anticipate, netting anybody who traded this pin bar a pleasant revenue.

Determine 3. – As worth pulled again once more and shaped the same pin bar to Fig. 2. we noticed little to no follow-through. As an alternative, worth simply consolidated for a number of days after this pin bar shaped, even forming a pair bearish tails inside that consolidation. As soon as we noticed worth shut underneath the low of the pin bar, we knew that pin was more likely to fail / failing. We will see what occurred subsequent. A failed worth motion sign like this may typically be a sign unto itself, telling us to take a look at the other aspect of the market now.

I hope from the above pictures you may start to grasp how I analyze the story on the charts and the way vital particular person worth bars could be. One of the best ways to get extra aware of the method of decoding the story the market is telling you, is by analyzing the footprint the worth motion leaves on the charts.

I like to recommend you observe this in a buying and selling journal by making a each day diary of your favourite markets, noting down the issues mentioned above; development, key ranges, any alerts that shaped and what occurred after them. Doing this 5 days every week like I do in my each day members market commentary, is a superb approach and actually the one option to keep the intimate connection to the market that you must precisely perceive what the market is saying to you.

Beginning tomorrow…

If you open your charts tomorrow, I would like you to refer again to this lesson and get a pen and paper out. Start to research the market from left to proper, as I’ve carried out for you right here. Preserve your buying and selling journal / diary in a pocket book and you’ll start to grasp what I imply by the ‘story’ the market is telling. You’ll begin feeling a reference to the market, and if you happen to do that lengthy sufficient you’ll develop your buying and selling instinct which can act nearly as a ‘sixth sense’, serving to you to shortly determine high-probability buying and selling alternatives in real-time, as they type.

The first factors to remove from immediately’s lesson are:

- Worth motion is actually the ‘footprint’ of cash throughout a chart, permitting us to see the habits of all market contributors.

- We will discover ways to interpret this worth motion and the market psychology it represents to place collectively the ‘story’ being advised on the chart.

- Particular person worth bars every play a task out there’s story, so studying to interpret their that means is essential.

- Start analyzing your favourite markets every single day and monitoring your notes in a buying and selling diary. It will enable you to higher perceive the story the market is telling and what would possibly occur within the subsequent ‘chapter’.

Remaining Ideas:

Mastering the artwork of studying worth motion has taken me 16+ years, 1000’s of hours of examine and 1000’s extra hours of actual dwell buying and selling display screen time. This weblog and the five hundred+ classes I’ve authored, in addition to my Skilled Worth Motion Buying and selling Course are right here that can assist you dramatically fast-track your information and enable you to obtain buying and selling success sooner. The entire buying and selling tutorials I’ve produced for my college students since 2008 are the precise sort of actual world schooling sources I want I had entry to once I began my buying and selling journey all these years in the past. If you happen to apply your self and follow the core philosophies of studying worth motion bar by bar and protecting your general buying and selling methodology easy, then your possibilities of making it on the planet {of professional} buying and selling are elevated considerably.

Cheers to your future buying and selling success, Nial.

What did you consider this lesson? Please go away your feedback & suggestions beneath!

If You Have Any Questions, Please E-mail Me Right here.

[ad_2]