[ad_1]

I’m hardwired to not carry bank card balances. If I can’t afford it, I don’t cost it.

Normally. Infrequently, I come throughout a 0% introductory APR provide that’s just too good to cross up. Then I’ll break my rule, front-load purchases I might have revamped a interval of many months, and pay them off steadily with out incurring any curiosity costs.

Should you’re like me, you’ll need to try the Wells Fargo Mirror® Card. It’s one of the best new 0% APR bank card in current reminiscence, with equal advantages for purchases and steadiness transfers. See if it’s price including to your bank card lineup.

What Is the Wells Fargo Mirror Card?

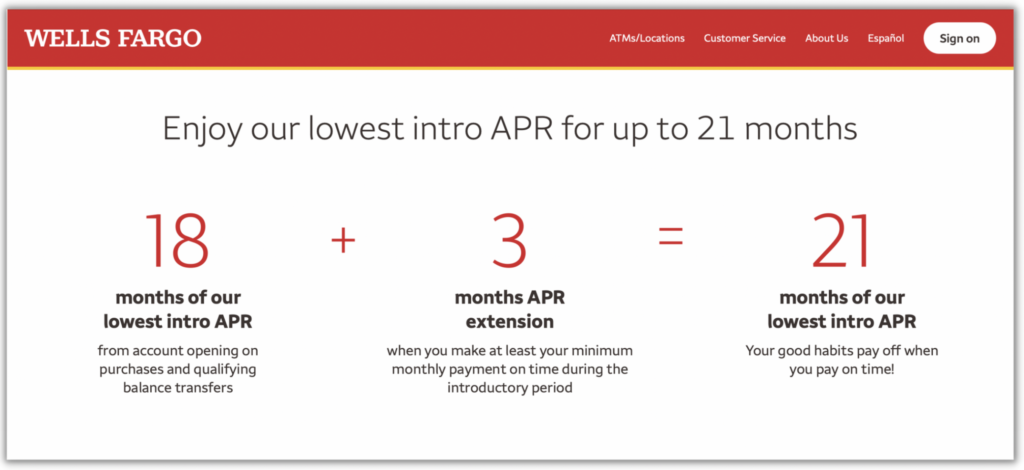

The Wells Fargo Mirror Card is a low-APR bank card with one of many longest 0% APR introductory promotions round: 18 months for positive, and three months longer while you make well timed, in-full funds throughout your first yr and three-quarters as a cardholder. That’s a complete of 21 months with no curiosity costs.

Key Options of the Wells Fargo Mirror Card

Past the lengthy 0% APR promotion, Mirror doesn’t have lots going for it. It has no rewards program, no sign-up bonus, few journey or buy advantages, and few different perks to differentiate it. However that’s nearly a part of its attraction. There’s completely no secret what it’s good for.

0% APR Introductory Promotion

The Wells Fargo Mirror Card costs no curiosity on purchases or steadiness transfers for no less than 18 months from account opening. Qualifying steadiness switch requests have to be made inside 120 days of account opening. In any other case, variable common APR applies to these transfers.

Following the top of the 0% APR introductory interval, variable common APR applies to all purchases and steadiness transfers until you qualify for the 0% APR interval extension.

0% APR Interval Extension

Qualifying for the 0% APR interval extension shouldn’t be too troublesome. Should you make on-time minimal funds in the course of the preliminary 0% APR promotion interval and the extension interval, you earn a three-month extension of the 0% APR window.

That ends in a complete of 21 consecutive months of purchases and steadiness transfers at 0% APR.

Following the top of any extension interval you earn, variable common APR applies (for actual this time). Repay all of your costs or transfers in full earlier than the speed resets if you wish to keep away from curiosity. Should you don’t, you lose out on the promo and need to pay all that curiosity you’d saved your self anyway.

Cellphone Safety

Wells Fargo Mirror comes with complimentary cellphone safety while you pay your eligible cellphone invoice in full with the cardboard every month.

There’s a profit cap of $600 per declare with a $25 deductible and not more than two paid claims per 12-month interval. However it’s important to be fairly careless to wish three new telephones in 12 months.

Wells Fargo Offers

As a Mirror cardholder, you may reap the benefits of personalised cash-back rewards from quite a lot of collaborating retailers via My Wells Fargo Offers. Gives fluctuate, however you may look forward to finding the equal of 5% to 10% off purchases with fashionable nationwide chains, from eating places like Panera to automotive service companies like SpeeDee Oil Change.

Whereas this isn’t an everyday cash-back rewards program and doesn’t promise a return on each buy, it’s a pleasant approach to cut back the online price of sure purchases made in your Mirror card.

Roadside Dispatch

Get pleasure from entry to a 24/7 roadside dispatch community that gives on-demand towing, lockout, and different roadside help in coated geographies. You’ll have to pay out of pocket for some or all providers, and their use isn’t limitless, however they’re good to have in a pinch.

Credit score Shut-Up

Enroll in Wells Fargo’s free Credit score Shut-Up program to see your FICO rating, get entry to your Experian credit score report, arrange personalised credit score alerts, and get custom-made ideas to assist enhance your rating. Enrollment doesn’t have an effect on your credit score rating, so there’s no purpose to not take this step.

Necessary Charges

Wells Fargo Mirror costs no annual price. The international transaction price is 3% of the overall transaction quantity for any worldwide transaction transformed to U.S. {dollars}.

Through the 120-day introductory steadiness switch window, the steadiness switch price is 3% of the switch quantity (minimal $5). After that, the price rises to five% of the switch quantity (minimal $5).

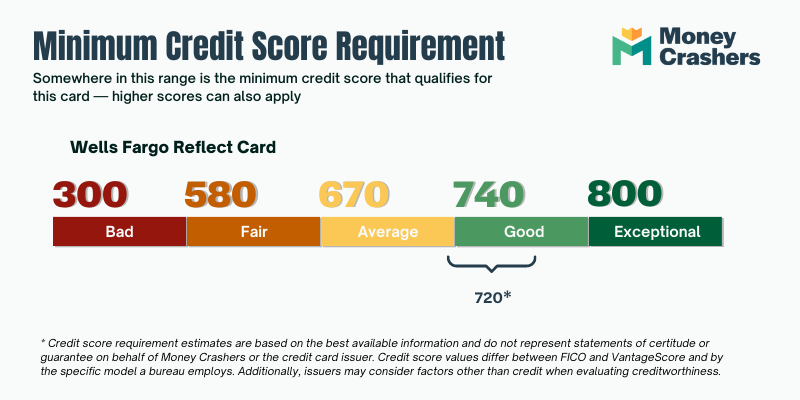

Credit score Required

This card requires a good to glorious credit score rating. Important blemishes in your credit score historical past that decrease your credit score rating may adversely have an effect on your software.

Benefits of the Wells Fargo Mirror Card

The Wells Fargo Mirror Card is likely one of the higher 0% APR bank cards available on the market. Right here’s the place it shines.

- Lengthy 0% APR Introductory Promotion. Wells Fargo Mirror has a really lengthy 0% rate of interest introductory promotion. It stretches for 18 months on each purchases and steadiness transfers, though you will need to make steadiness transfers inside 120 days of account opening to qualify.

- Alternative to Lengthen the 0% Intro APR Promotion for Three Extra Months. Mirror’s three-month 0% APR extension interval pushes it into category-leading territory. Make on-time minimal funds in the course of the preliminary and prolonged promotional intervals and pay no curiosity on eligible massive purchases or steadiness transfers for 21 months (billing cycles) from account opening.

- No Annual Charge. Wells Fargo Mirror costs no annual price. That’s simply as properly as a result of it has no common rewards program to ship a dependable return on spending.

- As much as $600 in Cellphone Safety Per Declare. Mirror affords complimentary cellphone safety protection while you pay your cellphone invoice in full together with your card. It’s price as much as $600 per declare and $1,200 per rolling 12-month interval, although there’s a $25 deductible per declare.

- Customized Buying Offers By way of My Wells Fargo Offers. My Wells Fargo Offers isn’t a correct cash-back rewards program, however it does ship a pleasant return on eligible purchases with well-known nationwide retailers.

Disadvantages of the Wells Fargo Mirror Card

Wells Fargo Mirror has some vital downsides, like no rewards program or sign-up bonus for brand spanking new account holders.

- No Common Rewards Program. Wells Fargo Mirror doesn’t have an everyday rewards program. That’s a disadvantage compared to cash-back bank cards with comparable 0% APR introductory affords, just like the Citi Customized Money Card.

- No Signal-Up Bonus. Wells Fargo Mirror doesn’t have a sign-up bonus for brand spanking new account holders both. You need to make do with the admittedly beneficiant 0% APR introductory promotion.

- Comparatively Excessive Steadiness Switch Charge. After a 120-day interval throughout which the steadiness switch price is the better of three% or $5, the price rises to account for as a lot as 5% of the switch quantity (minimal $5). That’s a bit dear for a card that rightly touts its lengthy 0% APR introductory promotion.

- 3% International Transaction Charge. Wells Fargo Mirror levies a 3% surcharge on international transactions. Should you routinely journey exterior the U.S. or patronize abroad retailers that cost patrons within the service provider’s native foreign money, use one other card.

How the Wells Fargo Mirror Card Stacks Up

The Wells Fargo Mirror Card is an above-average low-APR bank card, however it doesn’t have the house to itself. Right here’s the way it stacks as much as the Chase Slate Edge Card, a preferred competitor with comparable advantages.

| Wells Fargo Mirror | Chase Slate Edge | |

| 0% APR Interval | As much as 21 months complete | 18 months |

| Applies To | Purchases and steadiness transfers | Purchases and steadiness transfers |

| Annual Charge | $0 | $0 |

| Credit score Required | Good to glorious | Good to glorious |

| Rewards | None | None |

Different Options to Contemplate

Earlier than you apply for the Mirror Card — or Chase Slate Edge, for that matter — contemplate these options. Every has no less than one energy not shared by Mirror.

Remaining Phrase

Should you’re severely contemplating making use of for the Wells Fargo Mirror® Card, you’re most probably after a really lengthy 0% intro APR provide on certainly one of two issues: purchases or steadiness transfers.

This card doesn’t have many secrets and techniques, in any case. However that’s OK — it’s among the many greatest bank cards for doing what it does, which is lowering the price of bank card financing. Should you’re searching for a beneficiant rewards program or luxe journey perks, look elsewhere. In any other case, you’re in the correct place.

[ad_2]