[ad_1]

As we famous in our Basic Evaluation at the moment, USD/JPY is rising at the moment, recovering from the largest losses of this and final month, buying and selling close to the 130.00 mark on the time of this publication.

Further strain on the yen is exerted by information on the amount of orders for engineering merchandise, introduced earlier this week. So, in November, their quantity in annual phrases decreased by -3.7% after a rise of +0.4% a month earlier, though economists anticipated an acceleration in development to +2.4%. In month-to-month phrases, the indicator fell by -8.3%.

On the identical time, though the nation’s industrial manufacturing elevated by +0.2% after falling by -0.1% a month earlier, it decreased in November, in response to information printed final Wednesday, by -0.9% in annual phrases. For the export-oriented financial system of Japan, the place the commercial sector performs a key function, this can be a very unfavorable issue.

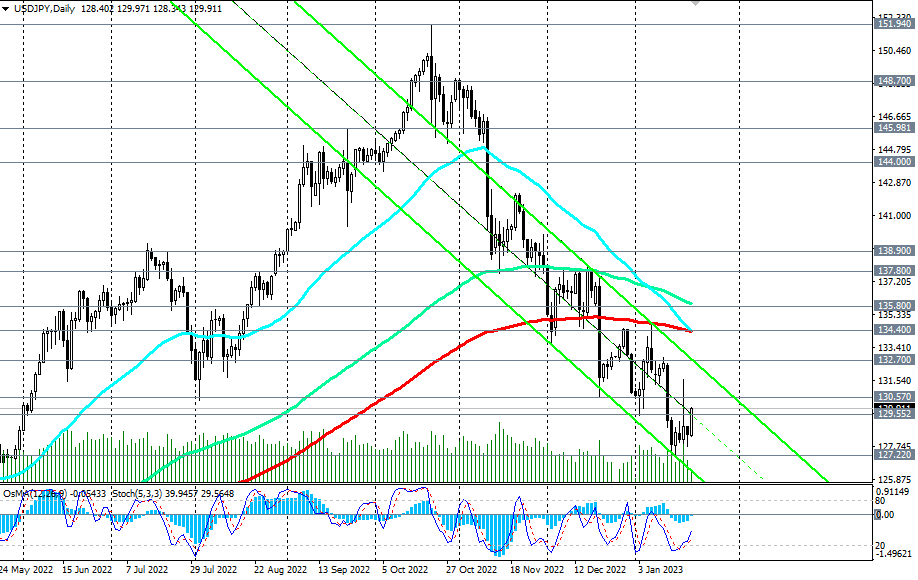

Beneath the important thing resistance degree 134.40, the pair stays within the long-term bear market zone. Subsequently, regardless of the present corrective development, quick positions nonetheless stay preferable, and a breakdown of the assist degree of 129.55 shall be a sign for his or her resumption.

That is the principle state of affairs.

Within the different state of affairs, the expansion of USD/JPY will proceed, as we famous above, in the direction of the extent 132.70 with an intermediate goal of 130.57. A break of the 134.40 resistance degree will return USD/JPY to the worldwide bull market zone.

*) For essential occasions of the upcoming week, see Key financial occasions of the week 01/23/2023 – 01/29/2023.

Assist ranges: 129.55, 129.00, 128.00, 127.22, 127.00

Resistance ranges: 130.57, 131.00, 132.00, 132.70, 134.00, 134.40, 135.80

[ad_2]