[ad_1]

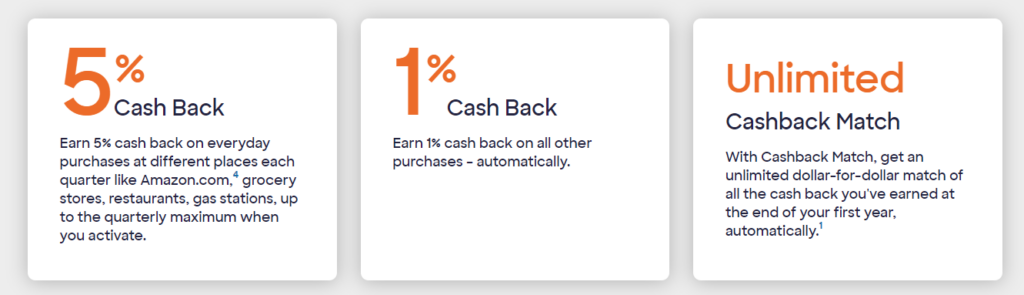

Uncover it® Money Again is a money again bank card with no annual price and a pleasant rewards scheme. The cardboard earns a base price of 1% money again on all purchases, however choose rotating classes — for instance, gasoline stations, eating places, and shops — earn 5% money again on as much as $1,500 in purchases per quarter. Uncover it Money Again is an element of a bigger household of money again and journey rewards bank cards, with stablemates equivalent to Uncover it Chrome, Uncover it Miles, and Uncover it for College students.

Uncover it Money Again competes with plenty of common money again bank cards, not together with its Uncover-branded friends. The closest analogues is Chase Freedom Flex, which additionally has rotating 5% bonus cash-back classes. It’s usually talked about in the identical breath as flat-rate cash-back playing cards like Capital One Quicksilver Money Rewards Credit score Card and Citi Double Money Card too.

In the event you’re available in the market for a brand new cash-back bank card with no annual price and the potential to reliably earn 5% on eligible purchases, preserve studying. Uncover it Money Again may what you’ve been ready for.

What Units the Uncover it Money Again Card Aside

The Uncover it Money Again Card shouldn’t be your customary cash-back bank card. Three options set it other than most rivals:

- Double Money Again within the First 12 months. Uncover’s Cashback Match characteristic boosts your first-year cash-back earnings by 100%, no matter how a lot you earn. This can be a highly effective incentive to make Uncover it Money Again your main bank card, a minimum of for the primary 12 months it’s in your pockets.

- Earn As much as $300 in Bonus Money Every 12 months. Uncover caps bonus cash-back earnings in its rotating 5% classes at $75 per quarter ($1,500 bonus class spend). However that’s nonetheless $300 per yr when absolutely utilized, a pleasant haul for a bank card with no annual price.

- Above-and-Past Safety Options. Each bank card claims to be safe, and federal legislation and regulation require a slew of normal security measures in any card obtainable to U.S. shoppers. However Uncover goes above and past with options like On-line Privateness Safety, which commonly scrubs cardholders’ information from common people-search websites which will promote it (and are weak to hacking moreover).

Key Options of the Uncover it Money Again Card

These are crucial options of the Uncover it Money Again Card. Notice the Cashback Match (double money again through the first yr your account is open) and signature 5% bonus classes that rotate quarterly.

First-12 months Double Money Again (Cashback Match)

In your first card membership anniversary, Uncover it Money Again robotically doubles all money again earned in that yr, with no caps or restrictions. This contains money again you earn by the Uncover Offers procuring portal, which may pay north of 5% on eligible purchases.

The extra you spend, the extra helpful this profit is, and there’s no higher restrict in your first-year Cashback Match. $200 in first-year money again turns into $400, $400 into $800, $800 into $1,600, and so forth.

Incomes Money Again

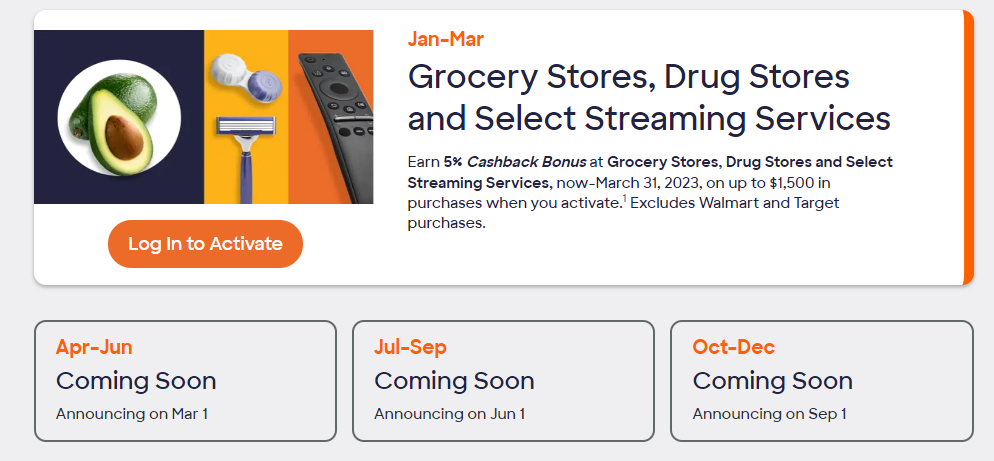

Uncover it Money Again earns 5% money again on choose quarterly rotating classes. Common classes embrace gasoline station purchases, division retailer purchases, and restaurant purchases — try our information to latest and future 5% bonus classes for extra examples and a peek at what’s forward.

The 5% money again profit applies to the primary $1,500 spent throughout all rotating classes in a given quarter. When you hit $1,500, future purchases within the rotating classes earn a vast 1% money again. Notice that you must manually activate your 5% money again classes every quarter, and cash-back earnings are usually not retroactive to the start of the quarter, so it pays to activate earlier than the primary day.

All different purchases additionally earn a vast 1% money again, except for choose purchases made by the Uncover Offers on-line mall. These purchases can earn 5% or extra, topic to buy and merchandise restrictions.

Redeeming Money Again

You may redeem your accrued money again rewards for assertion credit, checking account deposits, pay-with-points at Amazon.com, and digital and bodily reward playing cards. Assertion credit score and checking account deposit redemptions may be made at any time, in any quantity. Present card redemptions include a $20 minimal.

Freeze It

Uncover’s Freeze It characteristic permits you to lock your account with a single click on from any Web-connected gadget, stopping new purchases, money advances, and different actions. It is useful while you misplace your card or suspect that your account has been compromised.

In the event you later discover your card, you’ll be able to unfreeze your account utilizing the identical technique. Remember that balances proceed to accrue curiosity and automated funds for payments and different recurring bills proceed to execute as regular when your account is frozen.

Introductory APR

Uncover it Money Again comes with a 15-month 0% introductory APR on purchases and stability transfers. To qualify, stability transfers have to be made by the tenth day of the third month after you open your account. As an illustration, accounts opened in January have till April tenth to make the most of the promotion.

Free FICO Rating

Uncover it Money Again features a free FICO credit score rating on each month-to-month paper or digital assertion. You can too entry your FICO rating at any time by your on-line account dashboard.

Customized Card Design

Uncover enables you to customise your card face’s design — a worthless however enjoyable perk that many bank card issuers don’t hassle with. Select from 25 designs depicting all the pieces from clover vegetation to the New York Metropolis skyline.

Necessary Charges

There isn’t a annual price or international transaction price. Stability transfers value a flat 3% of the transferred quantity. Money advances at all times value the better of $10 or 5%, and late and returned funds value $35.

Credit score Required

This card requires excellent to wonderful credit score. Any blemishes of notice are prone to be disqualifying.

Further Card Options

The Uncover it Money Again Card has two different notable options: a card safety suite that features free Social Safety quantity alerts (nice for those who suspect you’re the sufferer of identification theft) and an internet privateness safety characteristic that removes your private data from common people-search web sites identified for promoting shopper information.

Benefits of the Uncover it Money Again Card

These are crucial benefits of the Uncover it Money Again Card. Are they spectacular sufficient so that you can add this card to your spending lineup?

- No Annual Charge. Uncover it Money Again doesn’t have an annual price. That’s a pleasant benefit over competing playing cards equivalent to Blue Money Most well-liked Credit score Card from American Specific and Capital One QuicksilverOne Money Rewards Credit score Card.

- First-12 months Money Again Increase Dramatically Will increase Incomes Energy. Uncover it Money Again’s limitless first-year money again bonus doubles the money again you earn throughout your first yr of card membership. That successfully raises the 1% baseline money again to 2%, which is increased than rivals equivalent to Capital One Quicksilver. Even higher, the first-year bonus raises your 5% money again price to 10%, which is principally unparalleled amongst fellow money again playing cards.

- No Penalty APR. Uncover it Money Again doesn’t cost penalty curiosity and waives the late price in your first late cost. That’s a pleasant break for cardholders who sometimes miss funds — and a bonus over rivals equivalent to Chase Freedom Flex.

- No International Transaction Charge. Uncover it Money Again doesn’t cost a international transaction price. That’s nice information for cardholders who journey overseas with any frequency. Some competing playing cards, together with Amex EveryDay Card from American Specific, include international transaction charges starting from 2% to three%. Nevertheless, Uncover isn’t accepted by as many worldwide retailers as Amex, Visa, or Mastercard.

- Good Intro APR Interval. Uncover it Money Again has a 15-month 0% introductory promotional interval on purchases and stability transfers, which is nice information if you must make a giant upfront buy or switch a high-interest stability from one other bank card.

- No Minimal Redemption Threshold for Money Redemptions. You may redeem your accrued money again rewards for assertion credit, checking account deposits, and Amazon.com purchases at any time and in any quantity. That’s a giant benefit over competing playing cards with minimal redemption necessities.

- Don’t Want Wonderful Credit score. Whereas Uncover it Money Again isn’t marketed as a software for constructing credit score, nor as a bank card possibility for folks with weak credit, it doesn’t have exacting qualification requirements for brand spanking new candidates. If in case you have good to excellent credit score, there’s a powerful probability you’re going to be accredited for this card, albeit at a decrease credit score restrict than somebody with wonderful credit score. Another money again bank cards, together with Blue Money Most well-liked Card from American Specific and American Specific EveryDay Most well-liked, require wonderful applicant credit score.

Disadvantages of the Uncover it Money Again Card

These are the most important downsides of the Uncover it Money Again Card. Solely you’ll be able to resolve in the event that they’re sufficient to warn you off this card altogether.

- No Fastened Signal-up Bonus. Uncover it Money Again doesn’t provide a fixed-rate sign-up bonus, solely the double first-year money perk. For mild spenders, that’s a disadvantage in comparison with competing playing cards equivalent to Financial institution of America Money Rewards Credit score Card.

- 1% Baseline Money Again Is Decrease Than Some Rivals. Uncover it Money Again’s 1% baseline money again is decrease than that provided by many competing playing cards. In the event you don’t take full benefit of the 5% money again classes, this places you at a severe drawback to competing playing cards with increased baseline money again charges. As an illustration, Citi Double Money Card has an efficient 2% limitless money again price on all purchases, whereas Capital One Quicksilver has a vast 1.5% money again price.

- Handbook Money Again Activation Required. Uncover it Money Again requires you to manually activate your 5% money again classes every quarter. You are able to do so on-line or by cellphone. Whereas activation isn’t extremely time-consuming, it’s definitely inconvenient, and raises busy cardholders’ threat of merely forgetting to make the most of the 5% bonus. Many different money again playing cards, together with Blue Money On a regular basis from American Specific, don’t require you to activate quarterly classes.

- Bonus Money Again Isn’t Retroactive to the Starting of the Quarter. This can be a disadvantage relative to Chase Freedom Flex, which does make money again retroactive so long as you activate by the 14th day of the quarter’s final month. If you wish to max out your potential cash-back earnings right here, remember to activate earlier than the primary day of the quarter.

How the Uncover it Money Again Card Stacks Up

The Uncover it Money Again Card’s closest competitor — or, a minimum of, its most comparable competitor — is the Chase Freedom Flex Credit score Card.

The comparability desk reveals why. See how the 2 playing cards stack up and resolve which is best for you.

| Uncover it Money Again | Chase Freedom Flex | |

| 5% Rewards | As much as $1,500 spent in quarterly rotating classes | As much as $1,500 spent in quarterly rotating classes, plus limitless on Chase Journey purchases |

| Handbook Activation for five% Rewards | Sure | Sure |

| Retroactive Money Again in 5% Classes | No | Sure |

| 3% Rewards | None | Eating places and drugstores, each limitless |

| 1% Rewards | All different eligible purchases | All different eligible purchases |

| First-12 months Money Again Match | Sure | No |

| On-line Privateness Safety | Sure, masking 10 common people-search websites | No |

| 0% APR Provide | 0% APR on purchases and stability transfers for 15 months from account opening | 0% APR on purchases and stability transfers for 15 months from account opening |

| Annual Charge | $0 | $0 |

Ultimate Phrase

Like Chase Freedom Flex and different money again rewards playing cards with tiered, rotating spending classes, Uncover it® Money Again rewards you for guaranteeing sorts of purchases at sure occasions. That’s nice information for candidates who intend to make use of this as a main bank card and make all kinds of purchases with it.

Nevertheless, Uncover it Money Again’s strategy to money again definitely isn’t the one strategy to do such issues. In the event you desire a card with out quarterly rotating classes or spending caps, there are many nice options available on the market.

[ad_2]