[ad_1]

Earnings season is near ending, as over 80% of firms within the S&P 500 have reported their 4th quarter outcomes already. The biggest % gainers amongst shares over the previous 4 weeks have been those who reported robust earnings or the place administration guided progress estimates larger going ahead. With this all in thoughts, savvy traders needs to be placing a watch checklist collectively to make the most of the potential outperformance amongst firms which have but to report.

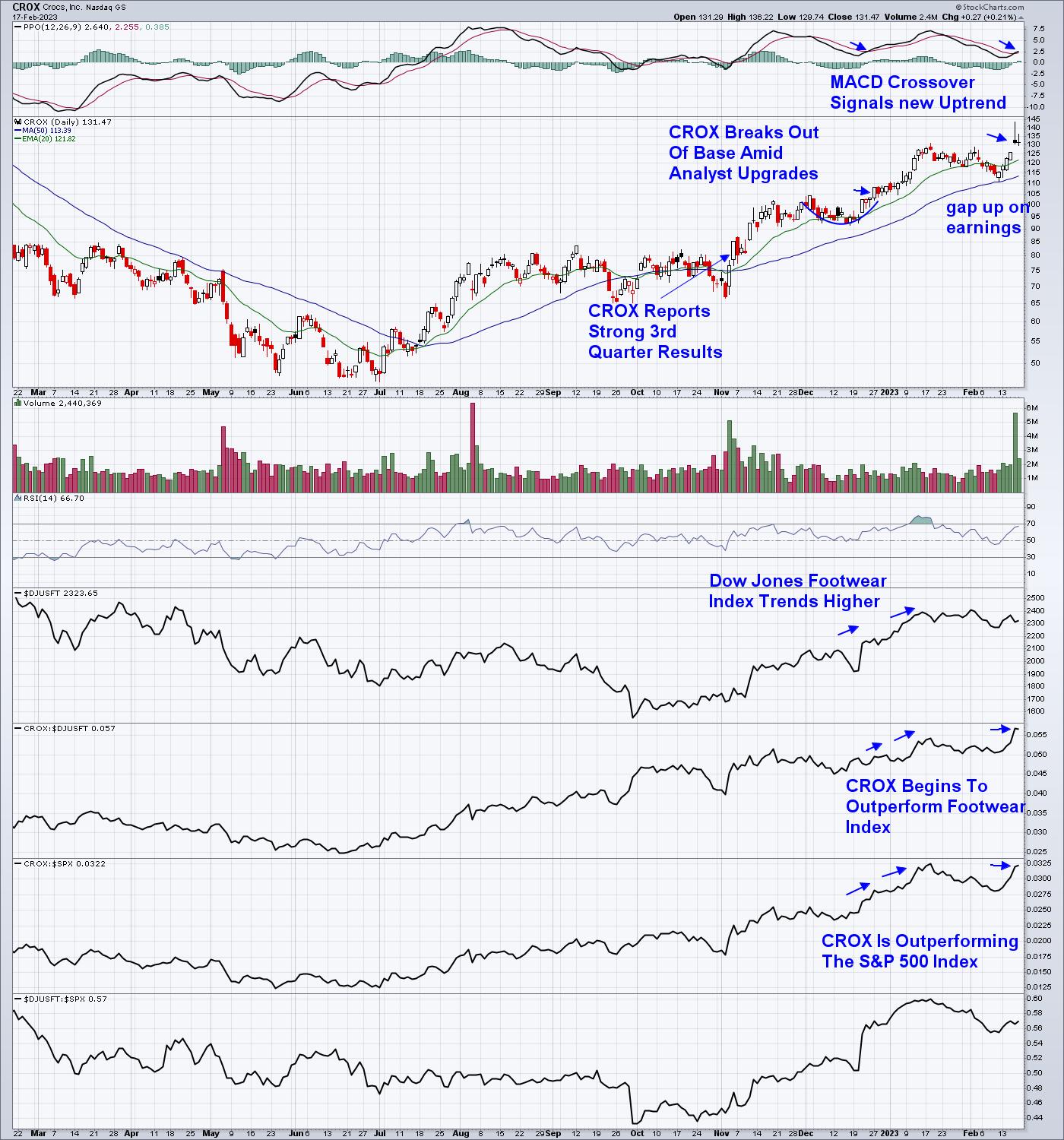

An instance of 1 such outperformer is Crocs (CROX), which gained 14% final week after a rally into earnings that was capped by a 4.5% hole up after reporting outcomes that had been above estimates. Subscribers to my MEM Edge Report had been alerted to CROX final December after it broke out of a 3-week base amid analyst upgrades.

DAILY CHART OF CROCS INC. (CROX)

Analyst upgrades going into earnings is one merchandise to be careful for as you set collectively your watchlist. It is because Wall Road researchers typically have entry to extra detailed info relative to particular person traders, and so they’re unlikely to place their neck on the road with an improve that is not effectively researched. You may keep on high of upgrades and downgrades to estimates with providers equivalent to MarketWatch.

Tuning into the power of a inventory’s business group is one other approach to uncover candidates to your watch checklist. You will need your organization to be in an space the place different shares are trending larger as effectively, as, most certainly, there’s progress going down throughout the business. This business group power can simply be uncovered utilizing StockCharts.com’s SCTR score underneath the Sector Abstract sub Trade Group checklist.

As well as, your greatest watchlist candidates will probably be high performers inside their group, as their successful methods will typically proceed after they report optimistic outcomes. Once more, the SCTR score of shares inside an business group is a perfect approach to uncover the relative outperformers with the best-looking charts.

From right here, you may wish to take note of the shares earnings releases from the previous as, statistically, an organization that has a historical past of reporting outcomes above estimates will proceed to take action. This was true of CROX, proven above.

DAILY CHART OF S&P RETAIL ETF (XRT)

Over the subsequent a number of weeks, many retailers will probably be revealing their quarterly earnings and gross sales outcomes, as they’re the final space to report. The excellent news is Retail Gross sales surged in January, which will enhance the potential of a optimistic outlook for progress going ahead. An in depth take a look at Wednesday’s Retail Gross sales reveals that meals service led all main classes after rising by 7.2%.

Subsequent week, one of many eleven shares on the Steered Holdings Record of my MEM Edge Report is because of report their earnings. Not solely is it within the Restaurant group, the place the biggest surge in retail gross sales occurred, however it’s the high relative performer amid analyst upgrades. You will get quick entry to this inventory by utilizing this hyperlink right here. You will additionally obtain 4 weeks of this highly-regarded, twice-weekly report delivered on to your e-mail going ahead.

Whereas not talked about above, the standing of the broader markets is without doubt one of the most vital facets to find out should you ought to get entangled with a inventory. The MEM Edge Report gives an in depth outlook of the markets as effectively. I hope you may be a part of the various happy subscribers to this report so that you simply, too, can make investments efficiently and with confidence.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing advisor and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra

Subscribe to The MEM Edge to be notified at any time when a brand new publish is added to this weblog!

[ad_2]