[ad_1]

Say what you need, however January has confirmed to be a really dependable predictor of U.S. inventory market motion from February by way of December since 1950 and, with just a bit greater than per week left to go in January 2023, market motion is suggesting that we will have a really robust yr. It is only one extra historic truth that means larger costs are forward of us. I’ve additionally talked about just lately that of the earlier 13 bear markets since 1950, excluding the 2022 cyclical bear market, 6 ended throughout the calendar month of October. If October 2022 proves to be the last word low, that’ll make 7 out of 14, 50% of all bear markets. That is one other piece of compelling proof that the bear market low is IN.

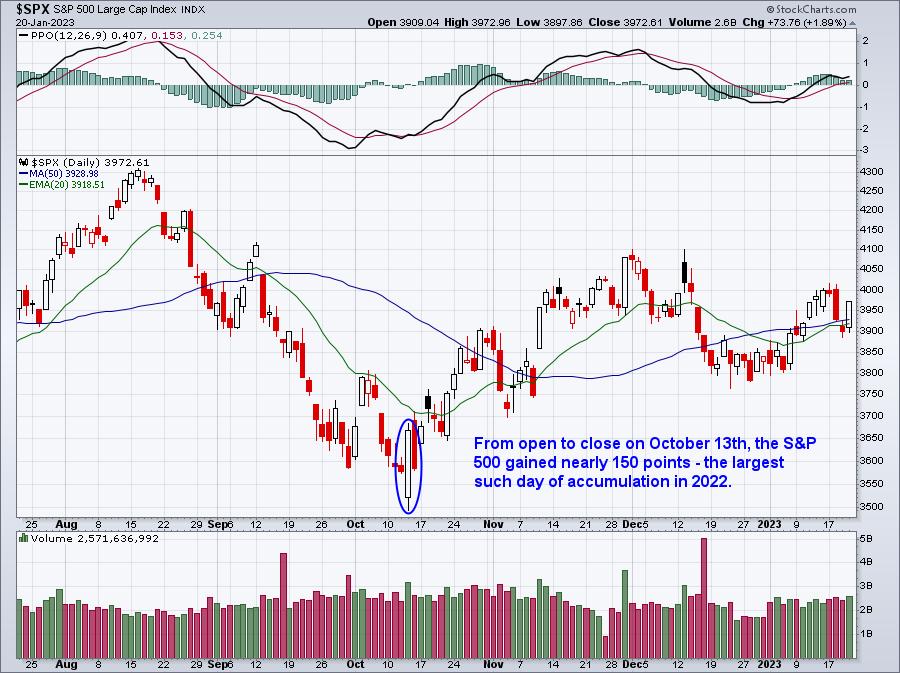

If I step away from historic tendencies, nevertheless, and easily have a look at the S&P 500 chart, the downtrend line because the starting of 2022 is what practically each technician is watching:

The downtrend line presently intersects at roughly 4000, relying on the way you draw your development line. In my opinion, that is the primary important degree to clear so as to verify the tip of the bear market decline. Try the delicate distinction that we’re seeing in January 2023, although. After the final 3 demise crosses and bearish PPO centerline crosses, we noticed promoting speed up and new lows shortly reached. We’re seeing one thing fully completely different this time. The PPO has turned again above centerline resistance in bullish vogue and we have additionally seen a bullish “golden cross” just some weeks after the demise cross urged we might head decrease. What’s occurring? Effectively, I can inform you what I believe is going on. We’re chopping in preparation for a stable yr forward. Many are ready for value motion to verify what’s been happening beneath the floor for months. I informed our members and the whole investing public that June 2022 had the traits of a serious market backside and that it was time to focus on lengthy positions, letting go of the bear mentality that was applicable throughout the first six months of 2022. I do not assume I might have been a lot clearer:

Did we ultimately transfer barely decrease in October? Sure we did. I am nonetheless fairly pleased, although, with my indicators that urged shorting the S&P 500 initially of the yr and transferring to a protracted place in mid-June 2022. The S&P 500 closed decrease than 3636 on 5 separate buying and selling days from September thirtieth by way of October 14th. Since my backside name, the S&P 500 has closed larger on 143 completely different buying and selling days. I believe I have been on the correct aspect of the market since June and 2023 will show that the October 2022 low was THE final bear market low. Ready for additional indicators, in my humble opinion, will lead to decrease returns, however I suppose time will inform. I stay very bullish and mentioned all through 2022 that the bear market was of a cyclical (short-term) nature.

One other important technical element that tells me the worst is behind us is that we’re seeing shopping for with dangerous information. The October low noticed a large reversing candle after a much-worse-than-expected September CPI inflation report. After a spot decrease, shopping for was intense ALL DAY LONG. Test it out:

One other very constructive growth is that after a brutal 4th quarter for a lot of development shares, the solar is all of the sudden shining in 2023. The ten-year treasury yield ($TNX) set a brand new latest low and this time, development is performing significantly better than worth. That is a vital change in market character, as a result of many of those development shares have massive market cap valuations and might rather more simply transfer our benchmark indices just like the S&P 500. Try the sudden enchancment in development shares in 2023:

The drop within the TNX in November/December did not have fairly the identical bullish impact on massive cap development shares (IWF) that the June/July drop had. Development vs. worth (IWF:IWD), nevertheless, is transferring solidly larger in 2023, clearly benefiting from the decrease TNX. I’ve highlighted in pink the months of detrimental relative momentum that development shares have skilled. Whereas issues have actually improved, we have not seen any vital affirmation of long-term renewed power. The bulls nonetheless have work to do.

An encouraging half, nevertheless, has been key particular person shares’ resilience to dangerous basic information. Take Salesforce.com (CRM) for instance. It downtrended all through 2022 and was the Dow Jones worst-performing element inventory for the yr. However then, after asserting 8,000 layoffs, or 10% of its work pressure, CRM rallied strongly:

The inexperienced arrow highlights the profitable 20-day EMA check the day that the layoffs have been introduced and you may see the following rally. CRM has now damaged above its latest downtrend channel and is on the verge of clearing necessary relative power resistance vs. its software program friends ($DJUSSW).

Final week, at our quarterly “Sneak Preview: Q3 Earnings” occasion, I highlighted Netflix (NFLX) as considered one of my favourite firms heading into earnings season. NFLX completely loves the month of January and January 2023 has been no exception. Try this seasonality chart:

Over the past 20 years, NFLX has averaged gaining 15.7 throughout the month of January. That is unbelievable which explains why NFLX was our favourite seasonal inventory for January 2023 and handed alongside to our EB.com members to open the month. These bullish ideas proved to be right as NFLX is presently larger by roughly 17% this month. Quarterly outcomes have been reported on Thursday and have been stable, as anticipated.

Tomorrow, I will be internet hosting our “This fall Earnings” occasion at 4:30pm ET and I will be offering my favourite 10 firms that may report earnings over the subsequent 2-3 weeks as earnings season actually heats up. I am going to additionally disclose the ten firms that I would utterly keep away from heading into earnings. I am going to focus on dozens of different firms reporting quarterly outcomes as properly. I exploit a key technical indicator to guage firms previous to their quarterly earnings report and it is confirmed to be extraordinarily efficient in predicting reported outcomes. If you would like to affix me tomorrow, merely CLICK HERE and join a FREE 30-day trial. You possibly can take a look at our total service without charge for a whole month! I hope to see you tomorrow!

Glad buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Day by day Market Report (DMR), offering steering to EB.com members day by day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as properly, mixing a singular talent set to method the U.S. inventory market.

Subscribe to Buying and selling Locations with Tom Bowley to be notified each time a brand new submit is added to this weblog!

[ad_2]