[ad_1]

Within the good outdated days, a number of associates and I preferred having beers after every softball sport. We obtained to discussing what’s the one ingredient obligatory for reaching monetary independence early.

Right here have been a few of their responses:

All of those elements are vital for serving to all of us obtain monetary independence.

Nonetheless, the #1 ingredient that drove me to FIRE, which no one talked about, was FEAR.

Extra particularly, the concern of failure. The extra you concern one thing dangerous occurring, the extra you’re taking motion to verify it doesn’t come true.

Let me share some examples to elucidate what I imply. Then maybe you may share your individual examples within the feedback part under.

The One Ingredient Obligatory For Attaining Monetary Independence

Worry is throughout us, particularly at present. Many nonetheless concern getting a virus that incapacitates us. We concern shedding cash in our investments when the economic system goes right into a recession. A few of us even concern dwelling a life stuffed with remorse.

Worry will be debilitating if we let it overwhelm us. Nonetheless, concern can also be a improbable motivator for change. The secret’s to take up simply the correct amount of concern to get going as an alternative of preserving us paralyzed.

Listed here are some examples the place concern of failure performed an enormous position in my life. With out such concern, I wouldn’t have damaged free of labor at age 34.

Childhood Expectations – Worry Of Disappointing My Mother and father

My mother and father instructed me at an early age that lecturers was the primary technique to a greater life as a result of I wasn’t going to change into knowledgeable tennis participant. They instilled in me a concern that if I used to be a C-student, I’d solely have the ability to stay a C-or-worse life-style.

Not solely did I concern dwelling a mediocre life-style as an grownup, I additionally feared disappointing my mother and father. I used to be all the time moving into hassle as a child. Every time I did, I noticed the disgrace of their eyes. I lastly stopped being a degenerate as soon as I went to varsity.

All through my childhood, my mother and father labored lengthy hours. I particularly felt dangerous for my mom who didn’t significantly benefit from the work she did within the U.S. International Service. International service work was my father’s dream, not my mom’s.

My Expensive Mom

After I was 12, I keep in mind visiting my mom sooner or later on the US Embassy in Kuala Lumpur as a shock. I didn’t fairly perceive what she did, solely that she labored within the cultural attaché division.

She was all the time so chipper at work, and her colleagues all the time sang her praises. It felt like a wonderland to roam across the halls of what appeared like a fortress on the time.

After I arrived, she was tidying up the magazines on the espresso desk. As an alternative of working in her personal workplace, my mother labored within the reception space exterior of her bosses huge workplace. Oh, I obtained it now. My mom was the assistant, not the officer.

She instructed me how she had sacrificed her dream of changing into a biologist by foregoing a graduate scholarship from Duke College to marry my father. She nonetheless had what most would name an excellent journey, working world wide. However I knew deep down she is going to all the time marvel what may have been.

If my mom was going to surrender her skilled desires for her kids, I rattling nicely wasn’t going to disappoint her!

Rising A Profession – Worry Of Losing Cash And Time On Faculty

Working within the monetary providers trade from 1999-2012 all the time made me paranoid about shedding my job. The trade is very cyclical, which suggests throughout down cycles, there are all the time a number of rounds of layoffs. And not using a job, I might really feel like a failure. And with out a regular paycheck, I wouldn’t have the ability to pay my mortgage on time.

The concern of being one of many hundreds of individuals let go through the dotcom bust and the 2008 – 2009 monetary disaster led me to work further lengthy hours. I wanted so as to add as a lot worth as attainable to my agency. There was numerous distress moving into the workplace by 5:30 am and getting berated by shoppers all day.

At any time when I felt depressing working at 10 pm to catch my Asia-based colleagues, I all the time reminded myself of associates who had misplaced their jobs. Then I’d simply intestine it by means of sooner or later at at time.

It wasn’t till I began listening to the life of different folks working in different industries did I understand how irregular it was to all the time be in concern of shedding your job.

Perpetual failure made me save 50% – 80% of my paycheck yearly for 13 years. The concern ingredient made me determine one of the best ways to take a position my cash with a purpose to sooner or later generate sufficient passive revenue to confidently go away my job.

If I used to be comfy at work, I’d mockingly nonetheless be working.

Sustaining A Profitable Web site – Worry Of Public Failure

I take pleasure in running a blog. I actually do. Each morning type of really feels like Christmas as a result of it’s all the time so enjoyable to learn what different folks need to say.

Nonetheless, there’s actually no good purpose to proceed publishing 3X every week anymore. At present’s posts attain 100X as many individuals as they as soon as did in 2009. However as a result of I publicly made a dedication to put in writing 3X every week, nevertheless, I concern being labeled as weak or dishonest if I don’t observe by means of.

I’ve needed to simply go out by midnight many occasions since my youngsters have been born, however I pressured myself to put in writing to maintain up my streak. All habits die laborious.

I’ve this concern of letting you down, particularly these of you who could also be going by means of a tough time financially. I keep in mind how comforting it was to learn and work together with other people through the monetary disaster.

For the longest time, I’ve despatched the message to by no means fail resulting from a scarcity of effort as a result of laborious work requires no ability. Due to this fact, if I cease working laborious, then I’m simply one other hypocrite who doesn’t observe his personal recommendation.

Fashionable Day Society – Worry Of Not Being Good Sufficient

Whereas I used to be working, it felt tougher to get forward when there was hardly anyone who seemed like me in management positions. For instance, I labored in Asian equities and for half my profession, all my bosses have been white.

After I lived in numerous Asian international locations rising up, I used to be the bulk. Every little thing felt regular. However once I arrived in Virginia as a highschool freshman in 1991, the contrasting actuality of being a minority as an alternative of a majority grew to become obvious.

In a single day, it appeared I needed to handle stereotypes, hearken to racial slurs, and endure numerous kinds of discrimination that I had by no means encountered whereas dwelling in Taiwan, Malaysia, or Japan. The ingredient of concern started to sprinkle in my thoughts at age 14.

I feared being pigeon holed as an Asian man who was solely an educational. Due to this fact, I additionally labored laborious on my athletics. I went to a liberal arts faculty was to change into a extra well-rounded particular person.

Maybe one of many explanation why I’m so towards the pursuit of status and standing is as a result of getting these amorphous issues is tough for me. As an alternative of working laborious to raise my pedigree, it’s simpler to simply look down upon those that do. It’s additionally simpler to not attempt.

The Worry Of Poverty

Ever since I lived in Malaysia as a 11-13 yr outdated, I’ve been hyper conscious of the haves and the have-nots. To see a few of my associates stay so poorly actually wigged me out as a child. I usually questioned why life was so unfair for thus many individuals.

Because of this, I made a promise by no means to take any job or monetary alternative with no consideration. I needed my youngsters to develop up with the ability to research and play quite than being pressured to work to assist assist the household.

After you’ve achieved your retirement quantity, will you proceed to work as laborious? For most folk, I feel the reply is logically no.

As a result of my concern of by no means having sufficient cash, I’m afraid of getting complacent. Because of this, I like to begin over every year and faux I’ve nothing.

Rising up seeing poverty every day made me afraid of shedding every thing sooner or later. You’re all the time questioning when will your luck run out. The longer you go with none unlucky occasions, the extra you brace your self for cataclysmic catastrophe.

Bodily Health – Worry Of Dying Earlier than My Youngsters Are Adults

At age 45, my well being is inferior to it as soon as was. It looks like the bronchial asthma I had as a child is slowly making a comeback. My colds have gotten longer and my muscle tissues take longer to heal.

When you have dependents and liabilities, for the love of god, please get life insurance coverage. Your well being will ultimately catch as much as you, irrespective of how wholesome your life-style. One among my regrets is just not getting extra inexpensive time period life insurance coverage earlier than I had youngsters.

I lastly obtained an inexpensive 20-year time period life coverage through the pandemic. I can’t inform you how significantly better I really feel mentally. The anxiousness of dying early has declined. That’s price excess of my month-to-month life insurance coverage premiums.

The explanation why I haven’t let myself go is just not resulting from self-importance. Once you’re not within the courting scene, who cares about having four-pack abs? I attempt to keep match as a result of I concern an sooner than regular loss of life. My two younger kids are relying on me till they change into adults.

A single buddy as soon as instructed me he enjoys meals greater than he enjoys the prospect at a more healthy life. “If I die early, so be it! I’m not going to disclaim myself my best pleasure only for the unknown likelihood of dwelling till 90.” He clearly didn’t imagine within the ingredient of concern as a motivator to remain in form.

This kind of pondering is definitely fairly liberating. To not have anyone depend upon you generally is a nice blessing. To not care the way you look to different folks can also be wonderful.

Nonetheless, as a mother or father, I don’t have such luxurious. Due to this fact, common train and never over-eating proceed to be obligatory habits. I hate figuring out. Fortunately, I’ve discovered a enjoyable sport in pickleball to assist me keep in form these days.

Who is aware of whether or not staying in form will prolong my life. Nonetheless, I need to give myself one of the best likelihood at survival by being extra risk-averse with my well being.

Consolation Could Be Our Best Enemy For Attaining Monetary Independence

Maybe one of many worst issues that may occur to you is if you’re born with every thing.

Your mother and father are wealthy so you don’t respect cash. They purchase you a automobile, a home, and pay your bank card payments. Why trouble even attempting to be financially impartial?

Let’s say you might be born good wanting. Everyone is far nicer to you in consequence. However your seems will ultimately fade. In case you don’t work in your persona within the meantime, you would possibly find yourself lonely and depressed when everyone begins to remain away.

Or let’s say you have been giving issues primarily based in your id and not primarily based on advantage. You begin cruising since you imagine society will all the time offer you a serving to hand. However sooner or later, the elites would possibly resolve you and your individuals are not worthy of particular favors. When that point comes, you would possibly wrestle to compete primarily based on abilities alone.

It’s unimaginable to completely respect how good we’ve it if we don’t undergo some struggling first. The longer our struggling, the extra appreciative we might be.

We want a regular dose of uncertainty to maintain us hungry. Due to this fact, maybe this pandemic will inspire us to alter poor habits. Motivation is so vital for constructing wealth and staying wholesome.

I keep in mind as quickly as I paid off one rental property mortgage in 2015, my motivation to hustle went away. I made a decision to drop all my consulting shoppers, journey by means of Asia for 8 weeks, then go to NYC to observe the US Open for two weeks!

Consolation prevents us from attempting tougher.

Worry: The One Ingredient For A Higher Life

As time passes, I’ve been capable of be much less petrified of failure. Teachers, work, and societal fears are behind me now. It feels good to not be beholden to anybody. To talk your thoughts and do what you need is a blessing.

My most important concern now could be not being a ok father. Though a mother or father can solely achieve this a lot to show their kids proper from unsuitable, I nonetheless fear how they’ll prove. There are some actually tousled folks in society who most likely had caring mother and father.

Though much less, cash concern nonetheless persists as a result of I’ve now obtained three folks relying on me This concern is tempered by means of a correct internet price asset allocation, preserving bills beneath management, and discovering methods to earn supplemental revenue.

Don’t let concern paralyze you. As an alternative, embrace concern as the important thing ingredient for reaching monetary independence. The concern in our heads is usually better than actuality!

Obtain Monetary Independence By Actual Property

Actual property is my favourite technique to reaching monetary independence as a result of it’s a tangible asset that’s much less risky, supplies utility, and generates revenue. By the point I used to be 30, I had purchased two properties in San Francisco and one property in Lake Tahoe. These properties now generate a big quantity of principally passive revenue.

In 2016, I began diversifying into heartland actual property to make the most of decrease valuations and better cap charges. I did so by investing $810,000 with actual property crowdfunding platforms. With rates of interest down, the worth of money circulate is up. Additional, the pandemic has made working from residence extra frequent.

Check out my favourite actual property crowdfunding platforms, Fundrise. With Fundrise, you may diversify into actual property by means of personal funds. Fundrise has been round since 2012 and has persistently generated regular returns, significantly throughout occasions of uncertainty. The platform manages over $3 billion and has over 350,00 buyers.

Learn The Finest Guide On Attaining Monetary Independence

If you wish to learn one of the best ebook on reaching monetary freedom sooner, try Purchase This, Not That: Spend Your Method To Wealth And Freedom. BTNT is jam-packed with all my insights after spending 30 years working in, learning, and writing about private finance.

Constructing wealth is simply part of the equation. Constantly making optimum selections on a few of life’s largest dilemmas is the opposite. My ebook helps you decrease remorse and stay a extra purposeful life as you construct extra passive revenue.

You should buy a duplicate of my prompt WSJ bestseller on Amazon at present. The richest folks on the planet are all the time studying and all the time studying new issues. Be taught from those that are already the place you need to go.

Keep On High Of Your Funds

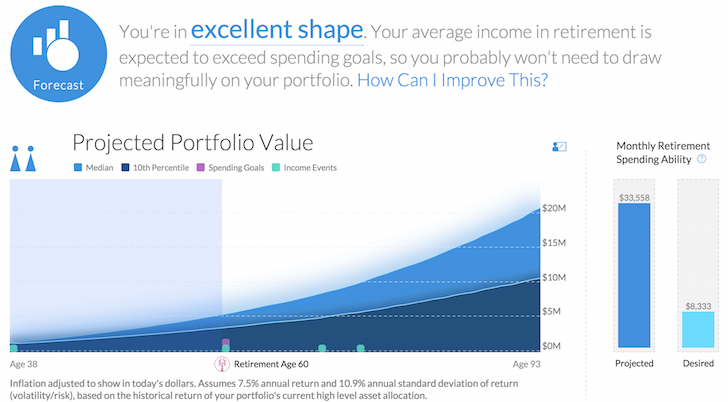

To attain monetary independence you’ve additionally obtained to trace your funds like a hawk. To take action, join Private Capital, the net’s #1 free wealth administration instrument.

Along with higher cash oversight, run your investments by means of their award-winning Funding Checkup instrument. I’ll present you precisely how a lot you might be paying in charges. I used to be paying $1,700 a yr in charges I had no concept I used to be paying.

After you hyperlink all of your accounts, use their Retirement Planning calculator. It pulls your actual information to present you as pure an estimation of your monetary future as attainable utilizing Monte Carlo simulation algorithms. Undoubtedly run your numbers to see the way you’re doing.

I’ve been utilizing Private Capital since 2012. On this time, I’ve seen my internet price skyrocket thanks to raised cash administration.

To join my personal free publication, be part of 60,000+ others, and click on right here. I’ve been serving to folks obtain monetary independence since 2009. I share all of the elements obligatory for reaching monetary independence.

[ad_2]