[ad_1]

Working with Colin Hines as Finance for the Future, I’ve printed this report this morning:

On the core of this report is a straightforward suggestion. That suggestion is that as a way to restore the NHS to the relative state that it was in when Labour left workplace in 2010 would now require any authorities to spend an extra £30 billion a 12 months, which ought to then develop by a minimum of 4% a 12 months in actual phrases. Fulfilling the mandate that Finance for the Future has been given by its funders, the Polden Puckham Charitable Basis, I then go on to elucidate how this cash could possibly be raised.

The report’s abstract is as follows, however I counsel the entire thing (together with the appendices) m proper be price learn as there may be a variety of explanatory materials in there:

Abstract

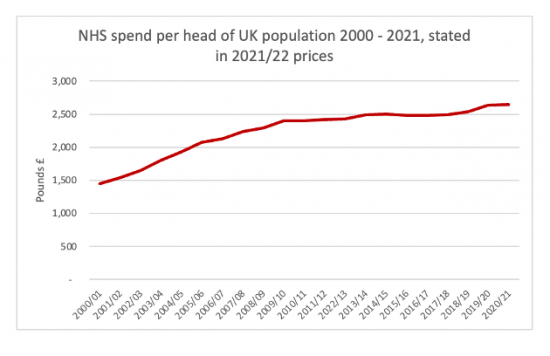

This report appears on the funding of the NHS over time. What it exhibits, utilizing information on NHS spending from HM Treasury, inflation information from the Workplace for Funds Accountability, inhabitants information and opinion from the revered healthcare assume tank, The Kings Fund, is that it’s seemingly that the NHS is now underfunded by £30 billion a 12 months.

This underfunding is the results of austerity in NHS spending since 2010 when bearing in mind the calls for of an growing inhabitants within the UK and the rising prices of NHS remedies because the vary of circumstances that the NHS can sort out has grown over time.

The consequence of this underfunding is that at current the NHS needs to be funded by £3,058 for every individual within the nation if providers provided had been to match the equal service stage in 2009/10 when the Labour Social gathering was final in workplace, however precise spending for every individual within the UK is about £2,642, which means that there’s a shortfall of greater than £400 per individual a 12 months in NHS funding within the UK at current.

The pattern in spending per individual, all said at 2021/22 worth ranges, has been as follows:

Spending per individual grew quickly below Labour. It has stagnated since then, a minimum of till the Covid period started.

Precise development in spending after permitting for inhabitants change since 2010 has been lower than 0.9% each year, and ignoring inhabitants change 1.56% pe annum.

The King’s Fund has steered that the final determine needs to be 4% each year, apparently taking inhabitants change under consideration in that determine. The Labour Social gathering delivered development of greater than 5% each year for the primary decade of this century. It’s the shortfall since then that has cumulatively created the annual shortfall of £30 billion of spending each year that’s prone to exist now.

The query to be requested in that case is how this sum could be funded? Figuring out an issue with out suggesting an answer helps nobody. This report suggests {that a} vary of choices can be found:

- £10 billion of the funding for this extra value will come up on account of the extra taxes paid by these employed by the NHS to ship the providers which can be required. These taxes will probably be paid by these lured again to the service by higher working circumstances and better pay, lots of whom now work in lower-paid jobs within the non-public sector, and by these lured again into work having given up on the NHS and work altogether. The affect of the additional NHS spending on development elsewhere within the economic system can also be taken under consideration on this estimate[1].

- At the least £5 billion could be raised from taxes paid by these capable of return to the workforce both as a result of their very own circumstances will probably be sufficiently nicely managed to permit this or as a result of people who they look after will get pleasure from higher well being, letting them return to work.

In that case it’s steered that a minimum of half of the funding required to carry the NHS as much as required service ranges will probably be immediately generated from the advantages created by that further spending.

There are, it’s steered, a variety of choices to satisfy the remaining £15 billion spending requirement. Three relate to borrowing in numerous methods:

- A authorities might merely determine to run an even bigger deficit to fund the £15 billion requirement. The affect on the nationwide debt is insignificant, at lower than 0.6% of nationwide debt on the idea that the federal government likes to state it each year.

- In its place, The Financial institution of England at present has in place a quantitative tightening programme[2] of promoting the federal government debt that it owns that it purchased below the quantitative easing programmes that paid for the banking crises of 2008/9, the Brexit disaster of 2016 and the Covid disaster of 2020/21. If £15bn of this programme was cancelled every year and bonds to fund the NHS had been offered as a substitute the funding to ship the healthcare we want could possibly be discovered. On this case there could be no internet affect on the quantity of UK nationwide debt owned by third events.

- If an alternative choice is required, Nationwide Financial savings and Investments might situation NHS Bonds in ISA accounts to supply the funding. £70 billion is saved in ISAs every year. Correctly marketed, it will be straightforward to seek out £15 billion a 12 months this fashion.

Alternatively, adjustments to the tax system that may haven’t any affect on the overwhelming majority of taxpayers might elevate the extra funds. These would possibly embody:

- Halving the tax reliefs on financial savings out there to the wealthiest 10% of individuals within the UK every year. At current it’s seemingly that this group get pleasure from a minimum of £30 billion of pension and ISA tax reliefs every year when they’re already rich. That subsidy per rich individual would possibly exceed common Common Credit score funds to every individual in receipt of that profit. Halving this reduction would nonetheless present the rich with very beneficiant subsidies for his or her financial savings however would additionally depart us with the NHS all of us want, the rich included.

- Alternatively, because the Public Accounts Committee of the Home of Commons has discovered that for each £1 spent on tax investigations £18 of further tax is raised, investing £1 billion in further funding with HM Income & Customs could be sufficient to get better the funds required for the NHS every year.

- If an alternative choice was required, the speed of capital positive aspects tax within the UK is at present set at half the speed of revenue tax normally. This tax could be very largely paid by the wealthiest teams in society. If the capital positive aspects tax price was set on the similar price because the revenue tax price then it’s attainable that the income from this tax would possibly double, elevating £15 billion a 12 months.

- Different choices are additionally attainable, every elevating lower than £15 billion. For instance, one other £6 billion a 12 months could be raised by charging an extra 15% revenue tax on funding revenue of these under pensionable age who’ve greater than £5,000 of funding revenue a 12 months since they don’t pay nationwide insurance coverage on this however get pleasure from the advantages of the NHS. And, because the Labour Social gathering has been arguing, the so-called ‘non-dom’ rule that lets rich individuals with an origin outdoors the UK dwell right here however not pay tax on their abroad revenue could possibly be abolished, elevating possibly £3 billion of tax a 12 months.

It could, after all, be solely attainable to combine and match these choices: there is no such thing as a want for only one supply of funding for use.

What is obvious is that to argue that there are not any funds for the NHS is fallacious: there are a number of choices out there to fund the NHS that all of us want, and the identical logic famous right here used may be utilized to different important public providers as nicely.

No political social gathering has an excuse for saying we can’t have wonderful public providers in that case: we will afford them. All that we want is the political will to ship them.

[1] That is generally referred to as the multiplier impact

[2] See the appendix to the report for a proof of quantitative tightening

[ad_2]