[ad_1]

Hey, Merchants!! Welcome to the article about The Mars EA!!´ll spare you the bullshits, about Distinctive, Secret, Synthetic, and so forth… The Mars is an Ea that trades towards retail, particularly towards Escape merchants. I’ll attempt to describe the buying and selling logic and capabilities of this method, so you should utilize it successfully with my settings or construct your individual portfolios too. I’ve added a number of back-tests with a variety of the settings on the 99.9% tick information on the backside of the article, you’ll as effectively discover their excel tab so you possibly can simply determine by your self tips on how to use the EA and if this danger to reward is value it for you. However I counsel doing your individual back-tests with correct information. The best way to do it’s on this weblog submit.

I am positive that each one of us has ever tried guide buying and selling. All of us purchased some buying and selling books to start with or spend cash on some buying and selling programs, the place principally the identical garbage is taught. 95% of authors who wrote the books, are nice academics and excellent at explaining on charts what already occurred, exhibiting right here what you should purchase and the place you promote. Straightforward :), isn´t it?

Nicely, if it is so simple as within the books, then all of us can be billionaires already. Markets and particularly Forex are extremely manipulated by giant speculators and pushed by central bankers’ IPDA (Interbank Value Supply Algo). Currencies are the merchandise of central banks, they usually dictate the worth, regardless of how a lot any teams purchase or promote. IPDA ship worth the place it is wanted and the place it does enterprise. IPDA is continually searching for liquidity which could be within the type of cease losses of retail merchants. That’s really nice as a result of by understanding retail merchants’ behaviour we all know the place the liquidity is and the place the IPDA will probably take the worth subsequent. The worst entries to the markets principally have break-out merchants and that is what The Mars EA trades towards with a bit of assist from the grid.

How is liquidity created?

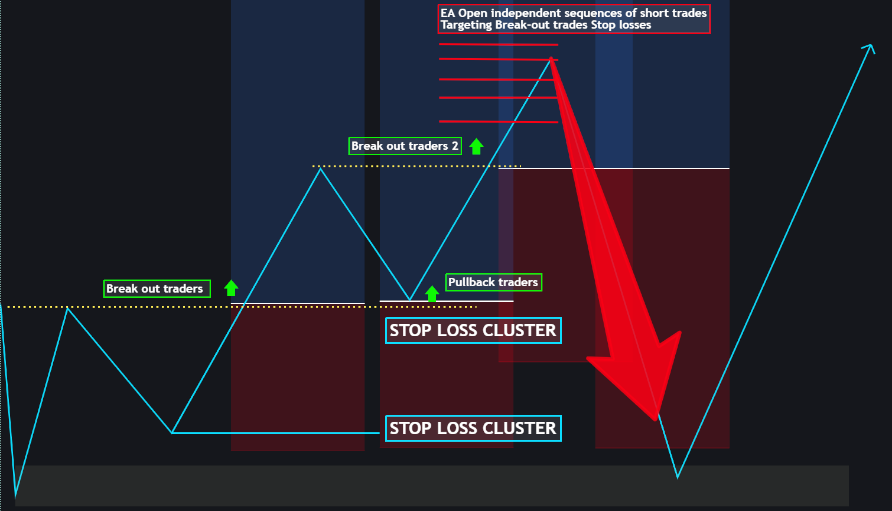

I’ve highlighted the degrees the place are principally the breakout merchants getting into the markets and primarily the place they place their cease orders. (Markets Construction Image Beneath)

1) Break of the consolidations, escape merchants getting into the market they usually put their SL beneath the final swing low.

2) After the worth breaks and pullbacks again to the outdated excessive. One other group of merchants is getting into with SL bellow swing lows as they discovered within the books.

3) Break of the outdated excessive, brings one other group of merchants who’re getting into the third wave once more. They put stops beneath the newest or earlier swing low.

4) Completely worst entry has FOMO merchants who see the market flying they usually wish to catch it, these principally enter on the highest/backside of the imply reversal.

This behaviour of the merchants which locations their stops to comparable zones beneath swing lows creates cease loss cluster = Liquidity. Now Giant speculators usually are not searching for our stops, as a result of they want to destroy us, however they should fill the order. Now give it some thought this fashion, cease losses of consumers is definitely a promote cease. Giant speculators want somebody to promote to allow them to purchase, that is why the worth fairly often drops to those liquidity zones earlier than the enlargement transfer and that is the market actions by which The Mars EA needs to take part with a number of positions and targets to the liquidity zone.

As you possibly can see two breakouts with new highs induced 3 teams of merchants to enter the market, however they’re getting into late or too early (earlier than the liquidity loaded). It is a drawback of break-out buying and selling. I do not say it is not working. However principally if escape is near the each day ATR excessive/low ranges it is faux. And buying and selling towards break-out techniques provides extra possibilities and profitability in long run. The Mars EA takes these benefits with a number of unbiased grid sequences of orders to focus on the teams’ Escape techniques.

Trades instance in Metatrader

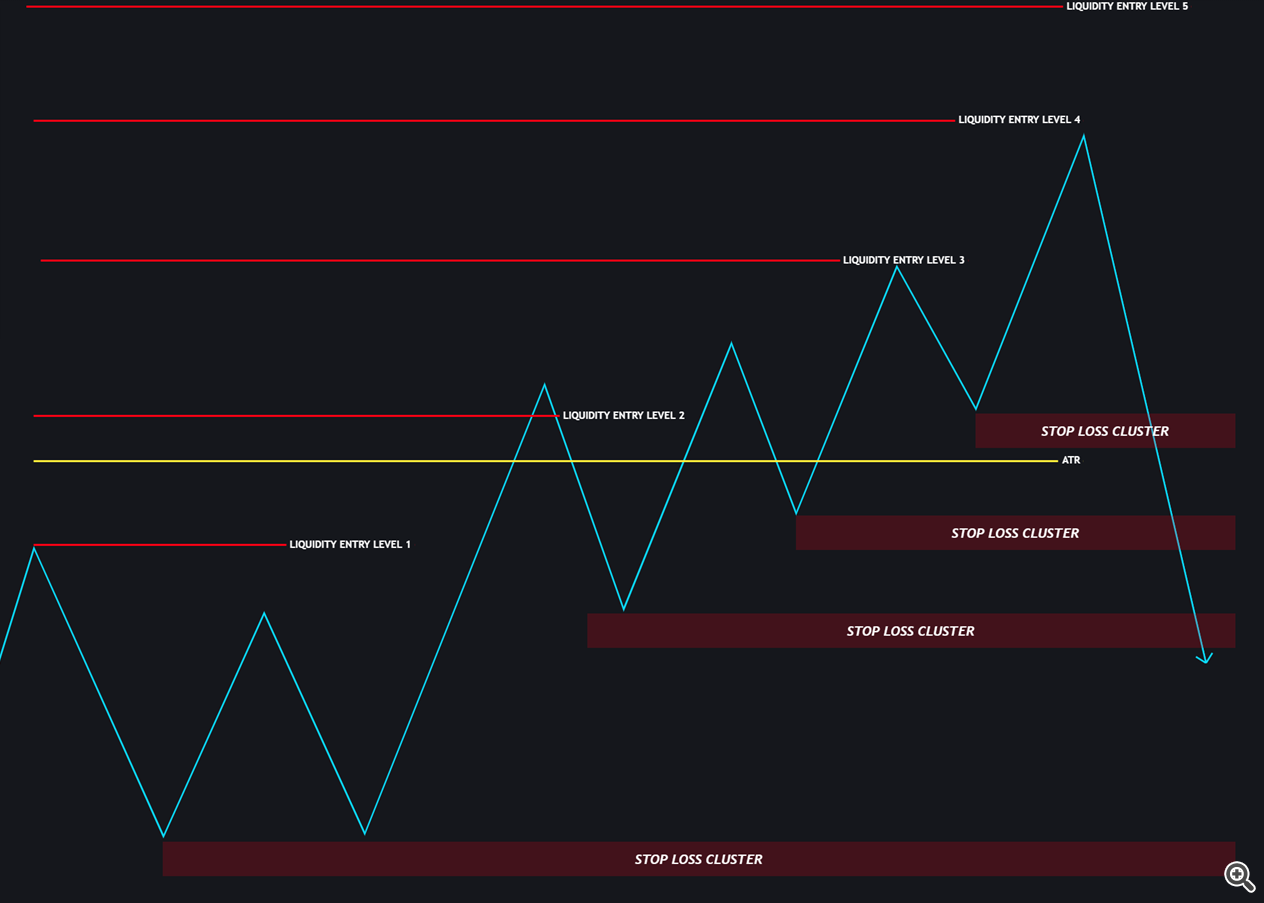

Within the image beneath you possibly can see how the EA is putting the trades as soon as the worth breaks new highs within the overbought circumstances above the each day ATR and within the pre-determined liquidity ranges. Which we will alter within the EA settings. For higher understanding, I like to recommend working visible backrests.

Liquidity Entry Ranges

As already talked about, The Mars EA trades towards the breakout merchants, but it surely must be in oversold /overbought circumstances that are filtered by the ATR and primarily by the IPDA ranges 60 buying and selling days again within the ranges — Earlier Day’s H/L, Earlier Weeks H/L, Earlier Months H/L and its equilibriums adjusted to the NY time. As a result of the brand new day begins at NY Midnight time and never as what most MT4 brokers has as their each day shut. By re-adjusting this we get fully totally different views to the market, however you do not have to fret about this and your dealer time, its coded within the system. Essential factor to grasp right here is following buying and selling logic, which I’ll clarify on bullish market construction (Similar logic applies to bearish state of affairs)

Extra waves of escape, means extra inducements and extra merchants within the markets means larger cease loss clusters (liquidity) bellow swing lows. We all know that after inducement the manipulation will probably come, however FX market shouldn’t be centralized and as we do not know if the amount in cease loss clusters is already sufficiently big for big speculators to fill their orders. We are able to speculate that manipulation will begin on particular ranges, however we actually by no means know when. Thats why the EA employs the sequences of trades within the grid to common our entry and diversify the targets. We don’t wish to have only a silly grid that provides positions with some predefined pips gaps so we can set the effectivity of the EA for getting into on particular liquidity ranges. Which provides totally different possibilities and accuracy as you possibly can see within the variable 10 years again exams. Notice: that is the Grid / Martin EA it could possibly have giant DD.

Liquidity Entry Ranges Logic

1) Excessive Liquidity degree – Higher accuracy, Fewer trades, Much less drawdown

2) Low Liquidity degree – Extra trades, greater drawdown, Much less accuracy

EA trades solely from the Liquidity ranges 3, its carried out within the predefined settings, however only for the reason

Liquidity Entry Degree 1 – The extent the place first countertrend merchants getting into, market can begin reversing from right here however principally it is too early

Liquidity Entry Degree 2 – barely beneath each day H/L, it provides extra trades however nonetheless its much less correct, we skip this one as effectively

Liquidity Entry Degree 3 – barely above each day ATR and Commonplace deviation – one of the best entry oversold / overbought circumstances

Liquidity Entry Degree 4 – greater above each day ATR and with these settings. This gives only a few trades on our commodity portfolios

Liquidity Entry Degree 5 – provides virtually no trades

Commodity Portfolio

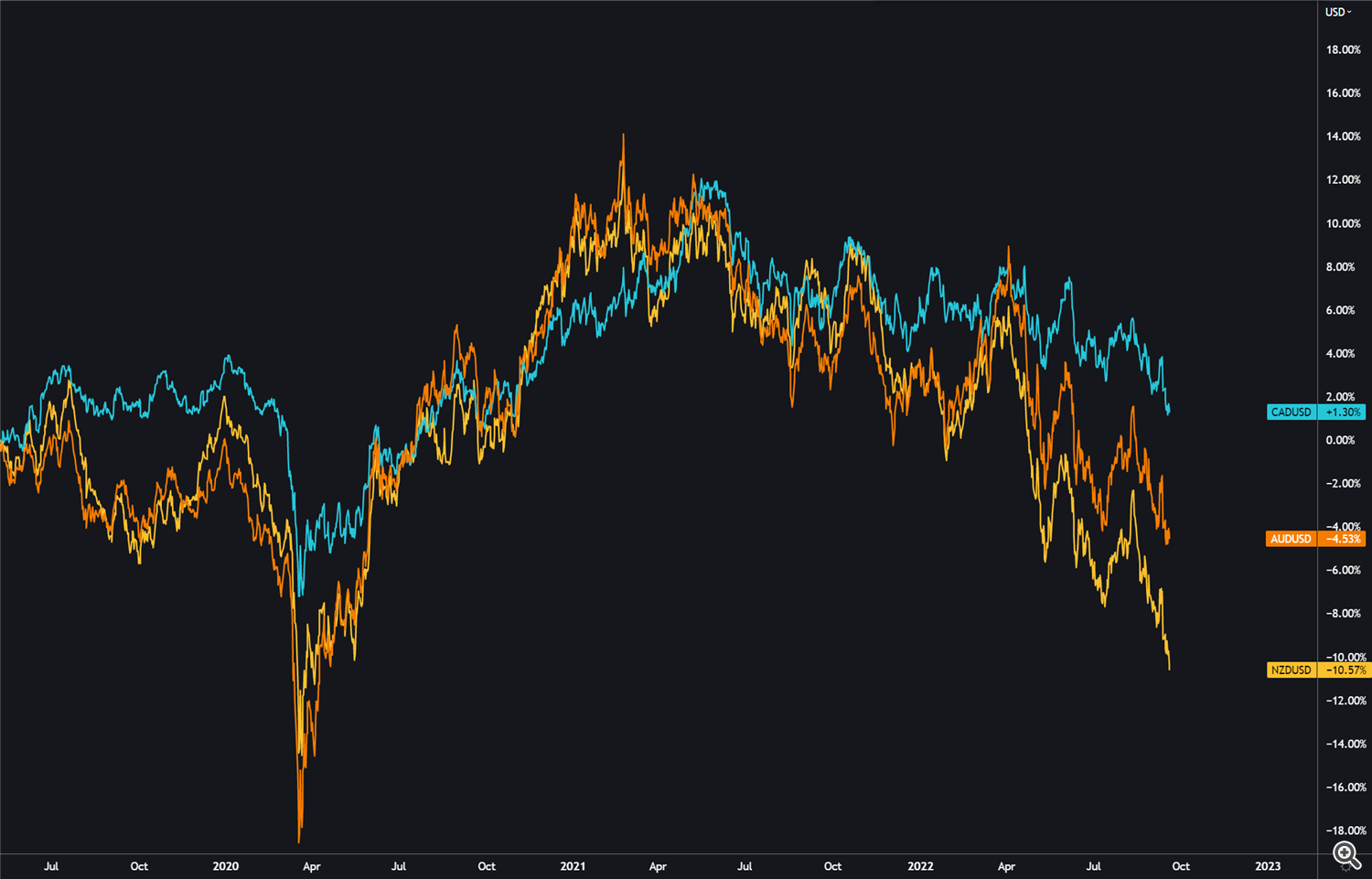

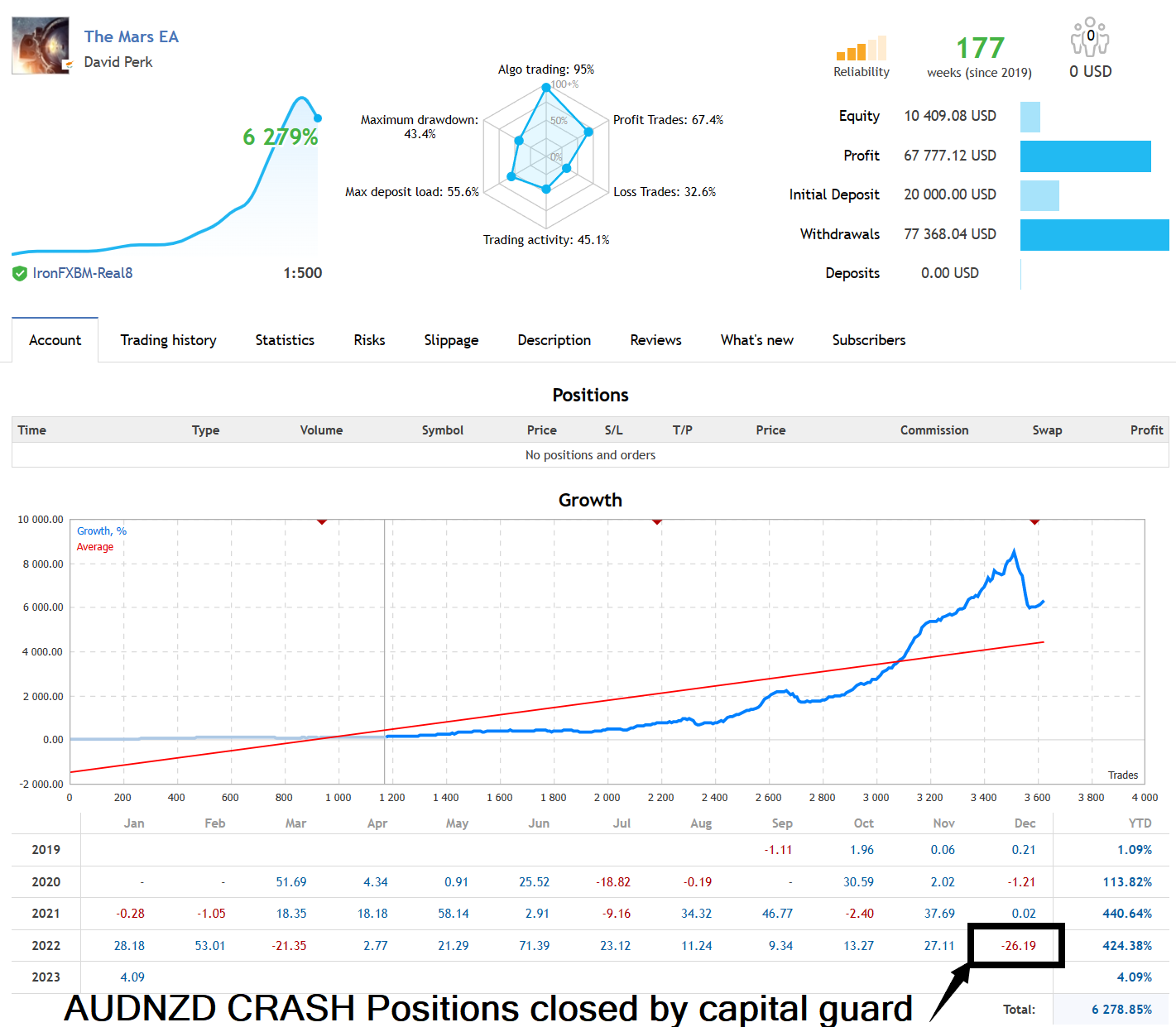

The Mars could be very versatile system that may commerce on many of the FX pairs, however essentially the most stability it delivers on the commodity pairs triangle AUD/NZD/CAD. These three correlates collectively (see image beneath). There are solely few conditions in the course of the yr when a few of the foreign money transfer quicker than different towards the USD. However these commodity pairs at all times go collectively. So principally, buying and selling simply triangle of those three – AUDNZD, AUDCAD, NZDCAD is sufficient to be worthwhile with comparatively low danger and make steady features each month with minimal capital $1000. You’ll be able to test 👉 THE MARS EA LOW RISK efficiency on approx. $10K USD account. Similar % features with low danger are potential to realize with $3000 account. Commodity portfolio could be traded on $500 with particular settings (shared on the underside) but it surely’s Excessive-Danger buying and selling as I run right here 👉 THE MARS HIGH RISK. One other outcomes could be discovered right here – Dealer’s profile (mql5.com)

I do now need give monetary recommendation, however when you dont have not less than 5K capital, it’s best to higher use cent account, EA will serve you significantly better as a result of extra precize lot sizing and quicker accumulation of earnings. Higher on the cent than on basic account the place you will need to run excessive danger particularly if you wish to use full potential of the EA.

Capital Guard

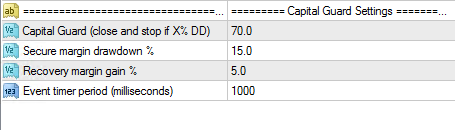

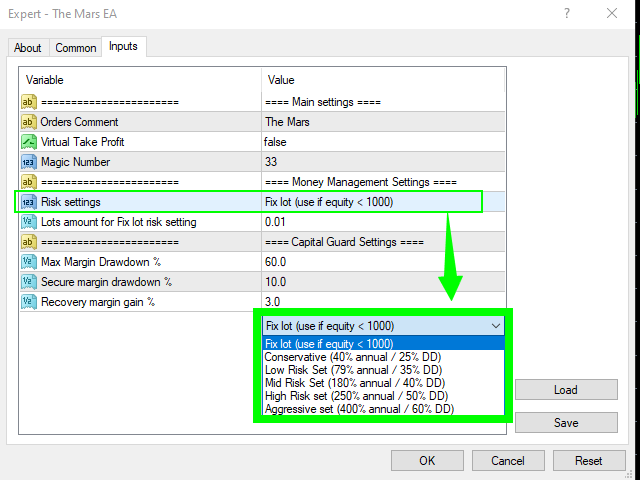

For securing our accounts I’ve implement capital guard protections, which has couple settings that does not permit to occur drawdown on all of the pairs on the similar second or it shut all positions and cease buying and selling when X% DD happens in case of the black swan occasion.

Capital Guard (shut and cease if XpercentDD) – 70 – If the worth of 70 %DD is reached the EA will shut all trades and cease buying and selling

Safe margin drawdown – 15 if the worth of 15 %DD is reached the EA won’t begin buying and selling on different pairs the place the sequences of trades usually are not open but till the %DD drops again to the worth of Restoration margin achieve which third settings in capital guard

Restoration margin achieve % – 5 – worth of the drawdown when the EA opens the trades on all pairs buying and selling was blocked by secured margin earlier than.

Occasion Timer Interval (milliseconds) – 1000 – specifies how typically the EA ought to test the account

In December 2022 – AUDNZD has crashed over 800 pips with out pullback. Sure this conditions are harmful for this EA. On the fairness beneath you possibly can see how the EA closed loss decrease then 30%. Capital guard settings is as much as you. However have in your thoughts that when you unfastened extra then 50% than you want 100% achieve to get better. I really feel snug to shut 30% loss and begin over. It should probably get better in few months. Sure its painful however higher than unfastened capital fully.

What to anticipate?

To start with, this isn’t a fast wealthy EA. However based mostly on my Stay outcomes and again check you may get steady partial earnings. In my opinion the again check actually by no means mirrors the actual buying and selling circumstances, so I higher calculated with deviations to fifteen% greater drawdown and 15% decrease earnings than what is the end result of the again exams.

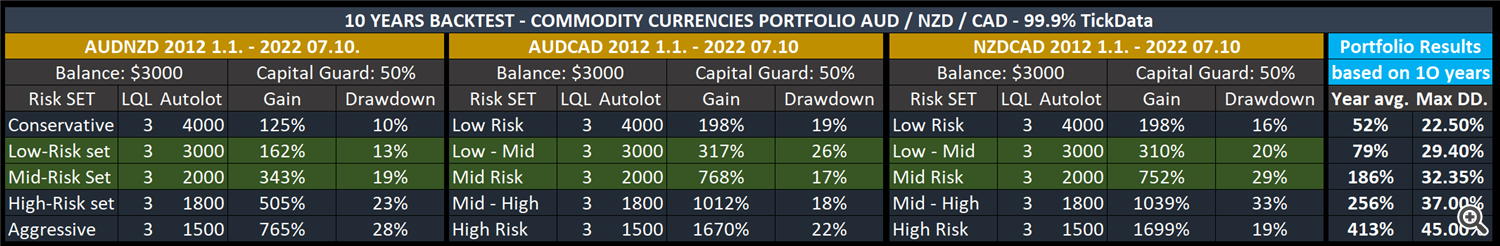

Primarily based on 10 years again check for the essential commodity portfolio. With most two optimum settings carried out in common yearly revenue 79 – 186% with, max drawdown 35% within the excessive circumstances for the only pair. Which is superb outcomes.

The Mars Safe margin drawdown operate does not permit the drawdown to occur in the identical second on all pairs. My calculations for the worst-case drawdown with optimum portfolio can be bellow 45%. So, with comparatively conservative settings we will count on between 5 -10% month-to-month common with normal drawdown 15% and our worst drawdown shouldn’t exceed 45%.

On the tab bellow you possibly can see 10 years again exams of the only pairs with the totally different auto lot settings. On the precise facet of the tab is calculated common yearly revenue and drawdowns.

* That is the again check based mostly on the ten years of historical past. Notice that world is within the recession. Market can behave in another way.

Set up

All of the settings talked about above had been carried out to the EA and solely factor you must do is to select up what suits you most. When you need assistance you possibly can after all contact me anytime however keep in mind. I am not monetary advisor. I solely present my device that servers me effectively and based mostly on the possibilities it may proceed to take action sooner or later.

Principal benefit of buying and selling with professional advisors is that it eliminates emotional based mostly selections and errors which we may do as people.

Commerce with such settings s which you could sleep calmly and with out checking your telephone each hour.

After shopping for the EA, please remark and write overview and I’ll add you to our personal discord group.

[ad_2]