[ad_1]

If there may be one factor that I needs to be grateful to the Financial institution of England Financial Coverage Committee for it’s that their incompetence offers me with seemingly infinite materials for this weblog.

Take, as instance, the rationale that they revealed for his or her choice to extend rates of interest, revealed yesterday. 4 options are price highlighting.

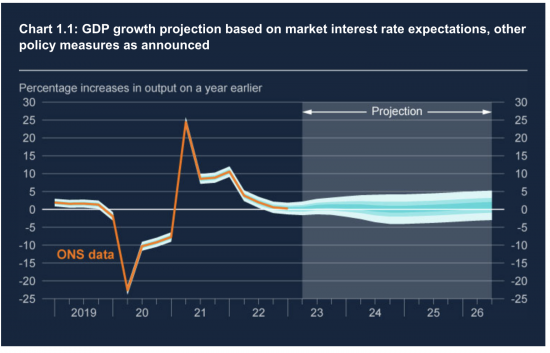

The primary is that the Financial institution of England is successfully forecasting no development on account of its coverage to create recessionary threat:

In impact, development has disappeared in 2024 and 2025, albeit it stays doable inside the margins for error inside the forecast. Rishi Sunak goes to remorse promising excessive development and low inflation concurrently consequently. There shall be no pre-election bounce now, in keeping with the Financial institution.

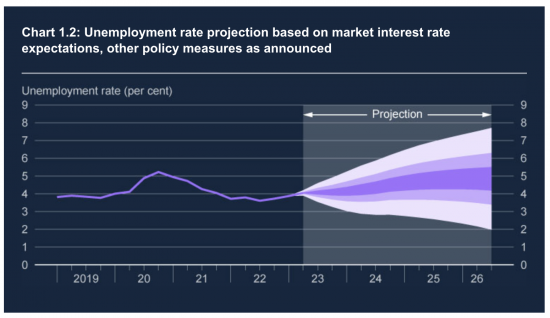

Second, and as a consequence, the Financial institution is forecasting rising unemployment:

The central forecast is for unemployment to extend by 350,000. I believe that, with the earlier remark, justifies most of the feedback I’ve been making for a very long time in regards to the Financial institution having the purpose of making a recession.

Third, there may be their forecast trajectory for deflation:

As is clear, the Financial institution assume inflation goes to tumble over the following eighteen months. That may seem like the excellent news.

Nevertheless, as they admitted yesterday, the choice they’d simply introduced on rates of interest is unlikely to have an financial influence till no less than 18 months have elapsed. That may also be true for all these related choices made in current months.

What which means is that once we get to early 2025 we are going to nonetheless be experiencing the influence of those choices on rate of interest rises on the financial system. If, because the Financial institution claims, these choices will lead to falling charges of inflation, as a result of as they declare they cut back demand inside the financial system, then come Spring 2025 there have been shall be vital quantities of such influence nonetheless working its approach via the financial system when inflation charges may have already hit two per cent.

There’s, after all, no cause why inflation will simply cease falling when it hits 2%, because the Financial institution likes to indicate. Actually, there isn’t any cause why it want cease at an inflation charge of zero, as their charts recommend to be extra doubtless. As a substitute, deflation is kind of doable, most particularly if lots of people have taken new fixed-rate mortgages at a lot increased charges than they’ve beforehand been used to between now and spring 2025. The lagged consequence of that can final for a while. The chance of a severe overshoot by the Financial institution on inflation now appears to be very actual, with recession inevitably following.

In that case, what we must always have been listening to about yesterday was what measures have been being to taken to stop deflation and recession, however there was no trace of coverage on these points of their report. That may be a huge omission on the Financial institution’s half and a deeply worrying signal of their incapacity. I believe that overshoot is probably going now.

I most particularly assume that’s the case when, fourthly, there was inside the report a projection of future Financial institution of England base charges. These might, after all, be fabrications to go well with the Financial institution’s present narrative, however let me presume that they’re as a substitute a good illustration of what the Financial institution expects to occur. In that case they’re surprising as a result of the speed forecast for 2025 is for a base charge of 5 per cent when it’s fairly doubtless, primarily based on the Financial institution’s personal projections, that the speed of inflation at the moment shall be at or close to zero per cent.

In different phrases, what the Financial institution is projecting is that we have now robust, optimistic rates of interest sooner or later inside our financial system, which means that for the primary time in fifteen years these paying curiosity shall be struggling an actual web price to take action in comparison with inflation.

This can perpetuate the mortgage shock on UK households, with all of the ghastly penalties we are actually seeing.

It’ll additionally crush the prospect of funding by UK companies. That can drive down employment and development and go away the nation nonetheless scuffling with productiveness points.

It’ll additionally crush family spending. No marvel that they forecast this:

It’ll additionally imply elevating funding for the local weather transition that we want shall be more durable.

And it’s designed to ensure authorities austerity given the mindset of neoliberal governments, which is what we may have.

Add all of it up, and the Financial institution clearly desires to perpetuate the catastrophe created by it elevating financial institution charges wholly unnecessarily.

Not solely will the Financial institution’s beating of the financial system not reduce in severity, however it’s now their obvious want to maintain it stepping into perpetuity.

I despair.

And I fear in regards to the wholly pointless ache that’s going to circulate from this utter incompetence nicely into the longer term.

[ad_2]