[ad_1]

Let’s cease slicing its working price range.

Headlines on CNN characterised Social Safety’s incapacity course of as “damaged.” That evaluation is heartbreaking, but in addition the results of purposeful neglect. For individuals who view authorities as an intrusion, the technique has been to frustrate folks the place they work together with authorities. And most of the people work together with the federal authorities in one in all two locations – the Inside Income Service and the Social Safety Administration. Congress has starved each of those businesses. The American folks deserve higher.

Social Safety is wonderful. Designed within the Nineteen Thirties, it nonetheless suits the wants of at present’s Individuals. It’s the spine of our retirement system, presently offering month-to-month advantages to 49 million retired employees and three million spouses and kids, in addition to 6 million survivors of retired employees. As well as, this system offers incapacity insurance coverage advantages to 9 million folks, together with these with disabilities themselves, their spouses, and kids.

Dispersing $1.2 trillion yearly to 66 million folks requires ample employees and up to date expertise. However Congress has underinvested in Social Safety for greater than a decade, and the challenges dealing with the company have been exacerbated by COVID.

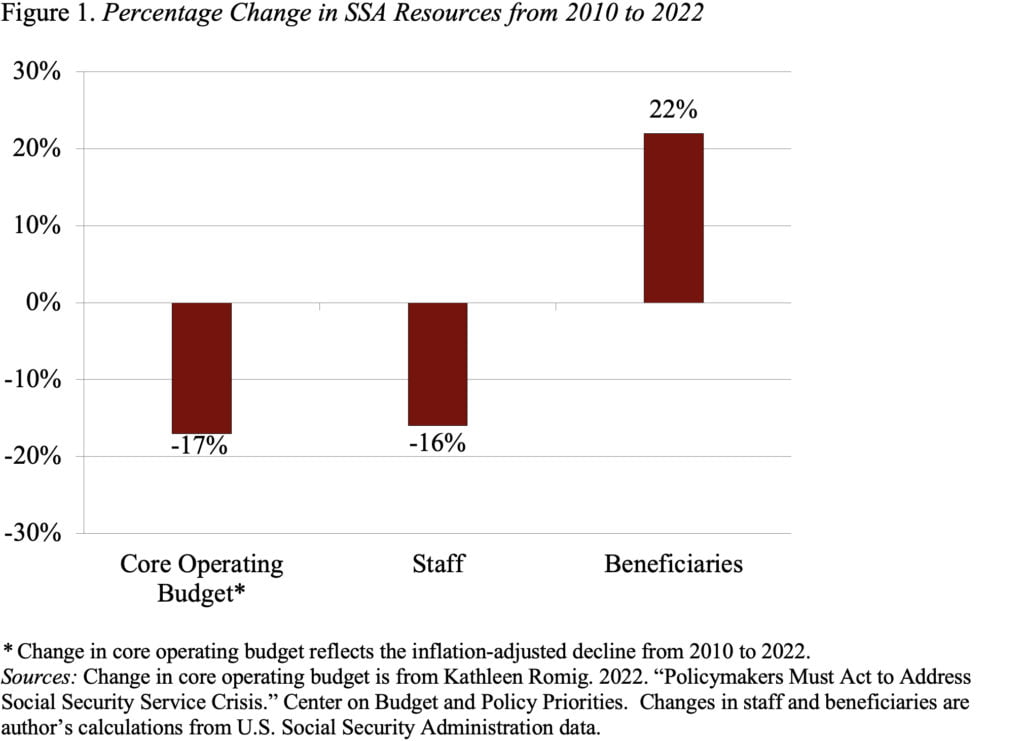

Whereas the cash to manage Social Safety comes from employees’ contributions to this system – not from normal revenues – Congress units limits on the quantity that SSA might spend on its operations every year. Between 2010 and 2022, Congress shrank SSA’s working price range by 17 p.c in inflation-adjusted phrases (see Determine 1). These cuts occurred simply as child boomers reached their peak years for claiming retirement and incapacity advantages. In consequence, SSA’s employees is down 16 p.c over a interval when Social Safety beneficiaries have elevated by 22 p.c (Determine 1).

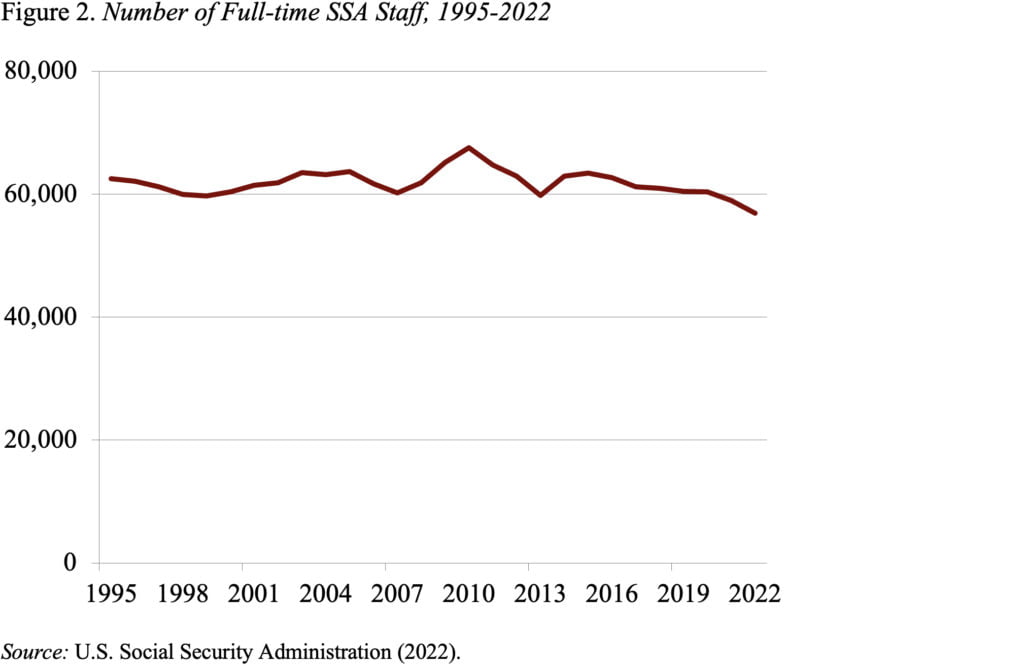

COVID has made issues even tougher. SSA was compelled to shut its subject places of work in March 2020, which solely re-opened final spring. And the company misplaced about 4,000 staff in the course of the pandemic, decreasing staffing to its lowest degree in many years (see Determine 2). More and more, the company has to depend on extra time to course of a crucial workload. The affect of the COVID workplace closures and a shrinking employees have clearly affected service supply – for the reason that onset of the pandemic, the common processing time for preliminary incapacity claims has elevated by two-thirds (from 132 to 220 days).

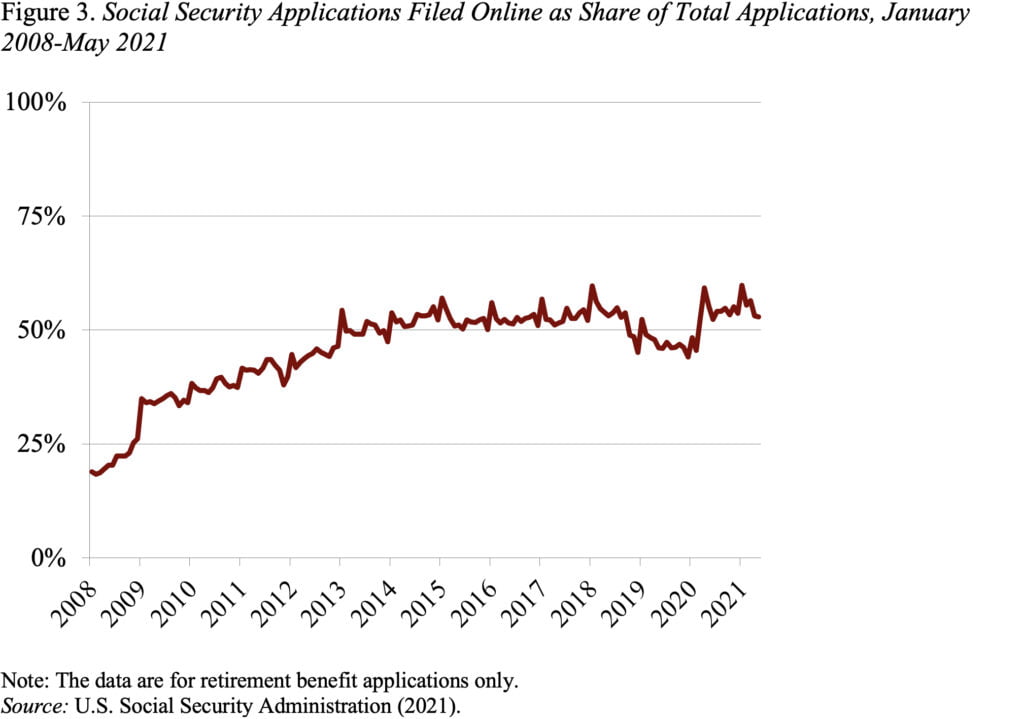

One may argue that, at the very least on the retirement aspect, web-based instruments may assist ease the burden on employees. Certainly, SSA launched its first on-line claims utility for retirement advantages in 2000. Though the month-to-month on-line utility price initially grew considerably, it has slowed significantly within the final decade – hovering at round 50 p.c since 2013 (see Determine 3). Furthermore, a latest examine by my colleague JP Aubry concluded that even a lot of those that declare on-line contact SSA sooner or later within the course of. So the share of those that claimed completely on-line is properly under 50 p.c. This proportion might improve considerably sooner or later as youthful cohorts come by with extra familiarity with on-line instruments, however a major share will proceed to contact SSA in-person or by cellphone when claiming advantages.

Briefly, on-line choices won’t clear up Social Safety’s drawback. The company wants extra money for employees and expertise to function successfully. Social Safety has the cash – our payroll tax contributions – the Congress solely must let the company spend it.

[ad_2]