[ad_1]

Value sample analogues are enjoyable to search out and monitor, so long as one understands that the correlation is rarely going to be completely excellent. And the extra level that should be understood is that each sample analogue breaks correlation ultimately — they most frequently achieve this at a cut-off date if you end up most relying on them to maintain working.

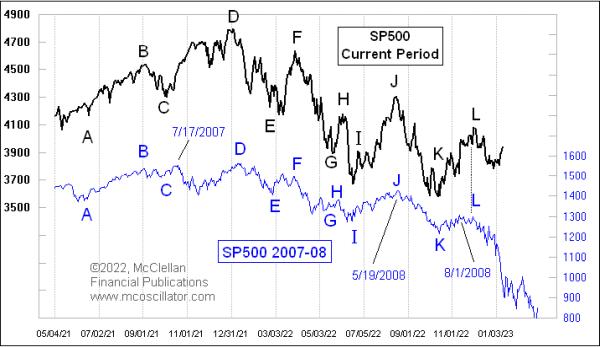

This week’s chart reveals a reasonably thorough breaking of correlation with a previous sample, on this case the bear market of 2007-09. It has been working properly all through 2022. The letters within the chart are only a technique of figuring out factors of similarity between the 2 worth plots. The correlation of the 2 patterns was a little bit bit weaker at first, on the left finish of the chart, however received tighter as 2022 wore on.

If the inventory market in 2023 was going to proceed following this sample analogue, then we must be seeing a pointy decline proper now, the echo of the inventory market’s drop in September 2008 occasioned by the collapse of Lehman Brothers. As an alternative, the inventory market is displaying good energy in January 2023, organising hopes for the “January Barometer” to point a bullish 12 months. That omen of inventory market habits has some statistical issues, as I detailed right here again in 2019.

However folks can nonetheless consider in one thing which the statistics don’t help, and that may create market pleasure for some time. Regardless of the supply of the brand new energy, and no matter its long run that means is perhaps, the energy we’re seeing now in January 2023 is a particular break from the 2008 sample, and so we are able to file this one away as a sample analogue that was enjoyable whereas it lasted, however which has damaged its correlation and shouldn’t be anticipated to work any extra going ahead.

As a ultimate be aware, one of many ways in which an analogue can begin to break correlation is that we might even see the patterns invert, nonetheless matching the timing of the dance steps of the prior sample, however doing so inversely. It could be that we’re seeing that now. However any sample which is fickle sufficient to invert its correlation can be fickle sufficient to disinvert with out discover, so one shouldn’t depend on that efficiency on this case.

Subscribe to Prime Advisors Nook to be notified every time a brand new put up is added to this weblog!

[ad_2]