[ad_1]

Overview

Ontario has all the time been a premier jurisdiction for mining in Canada. Nevertheless, one in every of Ontario’s earliest gold camps within the province’s northwestern area is exhibiting indicators of high-grade revitalization.

The city of Atikokan in Ontario is thought for its two large iron ore pits mined in the course of the Second World Conflict and operated till the late Seventies. The earliest gold exploration dates again to the 1800s, with vital manufacturing reaching upwards of roughly 52,000 ounces of gold and 174,000 ounces of silver in that interval. With over 50 occurrences, prospects and producers of gold since Atikokan’s preliminary discovery, the gold camp boasts exploration potential for traders worldwide.

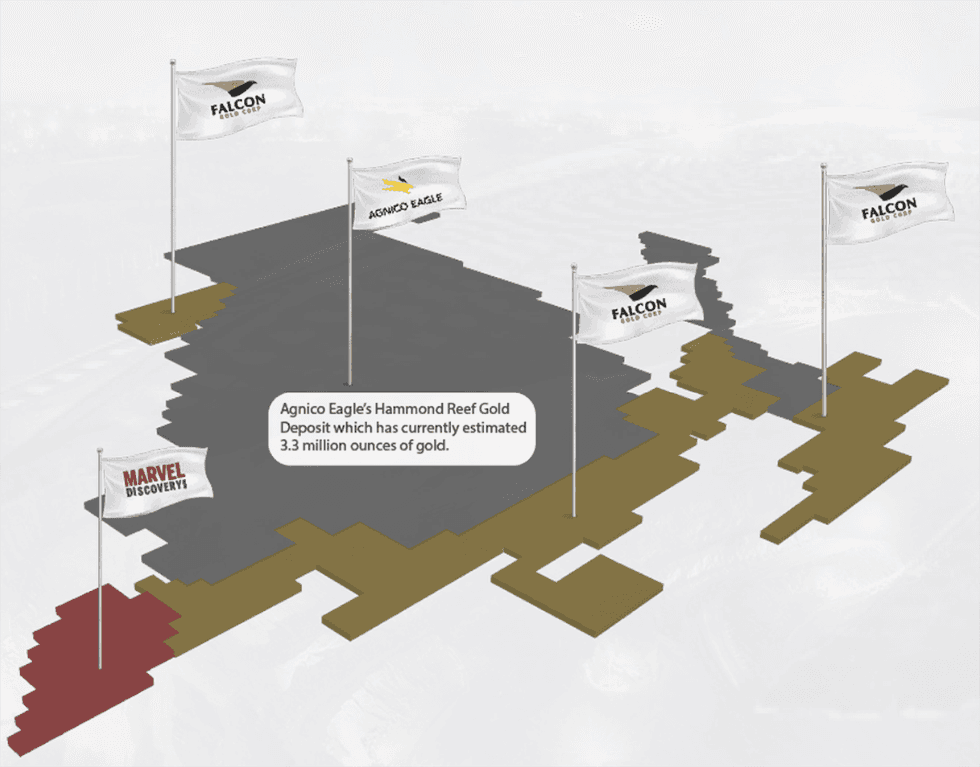

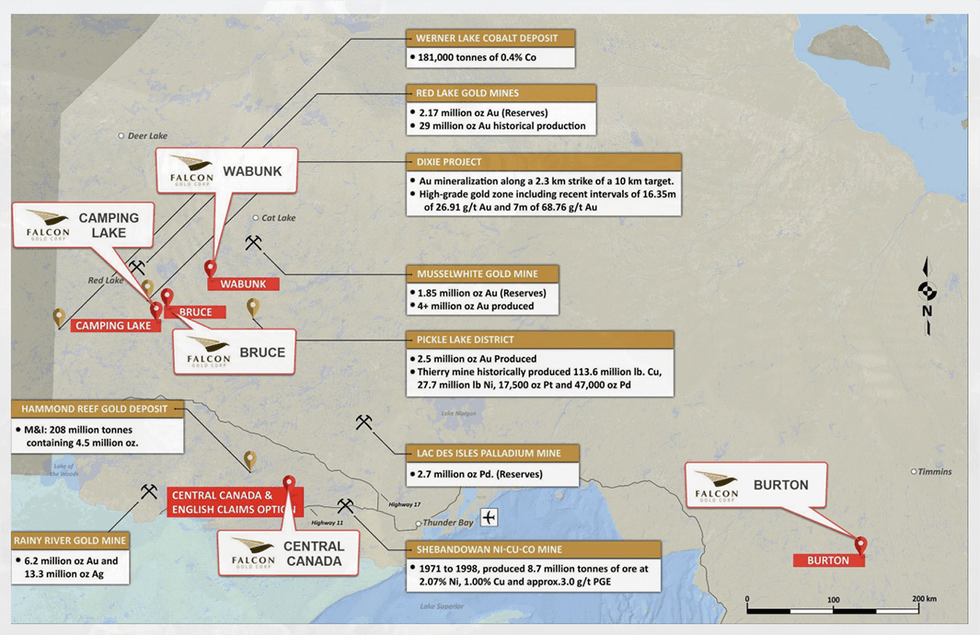

One such mining exploration firm with a challenge in Atikokan is Falcon Gold (TSXV:FG,FWB:3FA,OTCQB:FGLDF). Its flagship Central Canada gold and polymetallic challenge leverages strategic positioning 20 kilometers east of Agnico Eagle’s Hammond Reef gold deposit. The world-class deposit presently has an estimated 3.32 million ounces of gold mineral reserves at 0.84 g/t gold grading and an indicated mineral useful resource at 2.3 million ounces. The Central Canada challenge has a excessive potential to imitate this distinctive high-grade gold mineralization with additional exploration and discovery.

In July 2020, Falcon acquired an extra 7,477 hectares of mineral claims consisting of 369 models within the extremely operational Atikokan-based gold camp, increasing its three important property claims within the surrounding space. The Hammond Reef gold property in Central Canada lies on the Hammond shear zone, a northeast-trending splay off of the Quetico Fault Zone (QFZ). The flagship challenge’s different authentic Central Canada property lies on an analogous main northeast-trending splay of the QFZ.

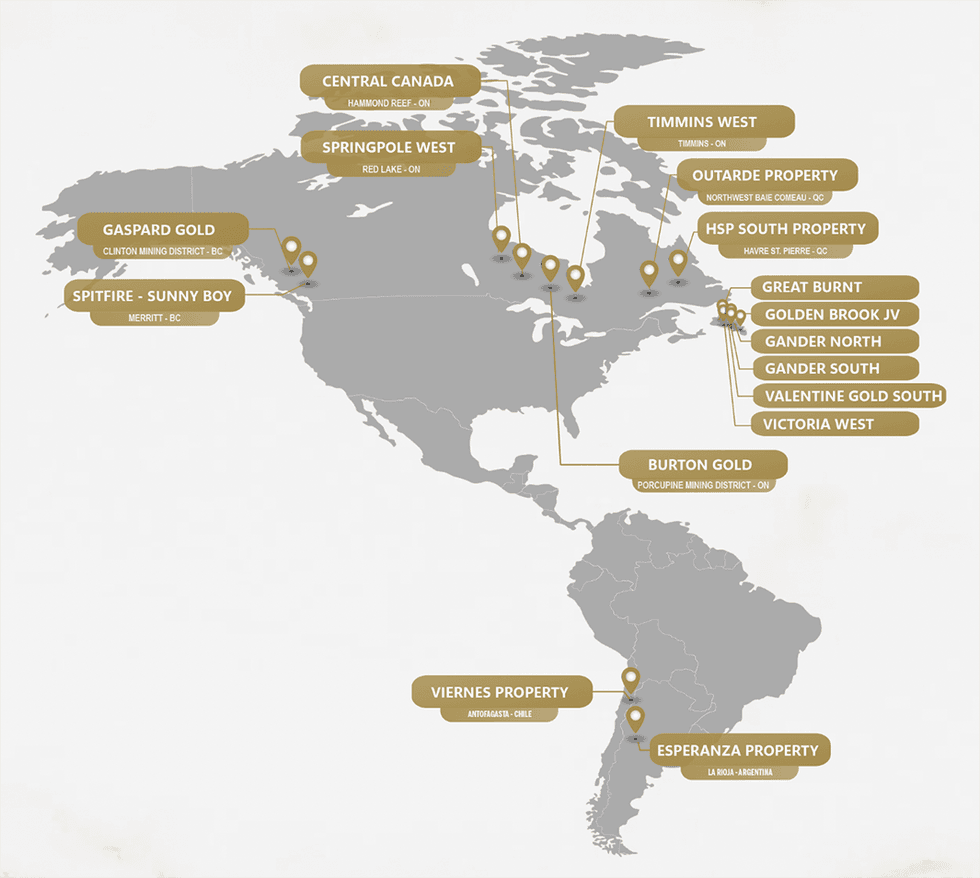

The corporate’s portfolio of mineral tasks additionally contains these in prolific mining jurisdictions of Ontario, British Columbia and Argentina. In April 2021, Falcon created the Argentina-based Falcon Gold LatamARG S.A. to handle its South American exploration and growth operations. This creation got here at an optimum time with the corporate’s acquisition of the Esperanza gold-silver-copper challenge in La Rioja, Argentina. Falcon intends to discover additional pursuits in South America’s mining-friendly jurisdictions.

Future plans for the corporate embrace further exploration and growth of its mineral belongings, together with a 2021 work program on the Central Canada gold challenge targeted on the outcrop exposures and trench areas the place Falcon’s geological group will probably be conducting detailed structural mapping. Expansive growth of its Esperanza challenge in Argentina and 230,000-ounce historic useful resource validation can also be within the works.

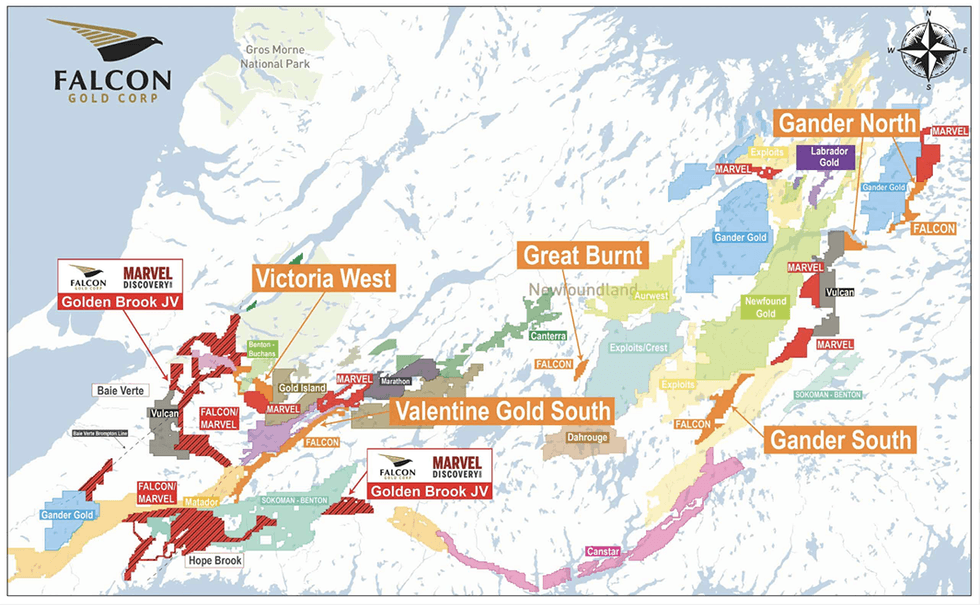

Falcon additionally elevated its land place throughout the Hope Brook Space, Newfoundland by staking a complete of 996 claims (24,900 hectares) that are strategically positioned and contiguous to First Mining Gold, Sokoman Minerals-Benton three way partnership, and Marvel Discovery.

In 2022, Falcon entered into two separate agreements to amass a 100-per-cent curiosity in two battery metals tasks within the province of Ontario and Quebec, collectively often known as the Timmins West and Outarde Nickel tasks northwest of Baie Comeau, Quebec. The primary buy settlement covers 5 mining claims totaling 1,940 hectares throughout the Kamiskotia Gabbroic Advanced (KGC), a gabbroic to anorthositic intrusive mafic to ultra-mafic physique that has documented nickel-copper-cobalt (Ni-Cu-Co) mineralization. The second buy settlement includes 93 claims overlaying 5,138 hectares positioned 120 kms northwest of Baie-Comeau, Quebec.

In November 2022, Falcon accomplished the spin-out of its subsidiary Latamark Sources Corp. The association entitles Falcon shareholders to 1 frequent share in Latamark for each 5.8 frequent shares held in Falcon. Latamark may even subject 5 million Latamark shares to Falcon, as a part of the association.

The Falcon Gold administration group includes mining and mineral exploration heavyweights, together with CEO & director Karim Rayani and company advisor R. Stuart “Tookie” Angus. Angus brings unparalleled experience as an impartial enterprise advisor to the mining business and senior govt for a number of notable holdings corporations. Collectively, the group primes Falcon for excellent gold discovery and financial progress.

Firm Highlights

- Falcon Gold Corp is a mineral exploration firm targeted on exploration, increasing and creating its strong portfolio of extremely potential valuable steel tasks in prolific mining jurisdictions within the Americas.

- The corporate operates a strong challenge portfolio in prolific mining districts. Its flagship Central Canada gold and polymetallic challenge hosts wonderful street entry, gold mineralization and strategic positioning close to Agnico Eagle’s Hammond Reef gold deposit, which comprises a multi-million estimated gold useful resource.

- Along with Central Canada Gold Mine, which presently holds an estimated 3.32 million ounces of gold, Falcon Gold holds 15 further tasks in different prime mining jurisdictions, together with Springpole gold, Burton and Tenting Lake property in Ontario, Spitfire & Sunny Boy and Gaspard gold tasks in British Columbia, and the lately acquired Esperanza gold-silver-copper challenge in La Rioja, Argentina.

- Falcon acquired a 100-per-cent curiosity in two battery metals tasks in Ontario and Quebec, collectively often known as the Timmins West and Outarde Nickel Initiatives northwest of Baie Comeau, Quebec.

- Falcon created the Falcon Gold LatamARG S.A. in 2021 to handle its South American exploration and growth operations on the high-grade Esperanza gold-silver-copper challenge in La Rioja, Argentina.

- Falcon Gold operates a good share construction and pretty low share rely with lower than 100 million shares excellent. Its tight-knit administration group owns roughly 20 % of its shares.

- Falcon Gold accomplished the spin-out of its subsidiary Latamark Sources Corp. in November 2022, giving Falcon shareholders one frequent share within the capital of Latamark for each 5.8 frequent shares held in Falcon. Latamark can also be issuing 5 million Latamark shares to Falcon.

- Falcon has accomplished a spin-out of its Latin American asset, the Esperanza gold challenge, positioned in La Roja Province, Argentina. The corporate will probably be beginning the itemizing utility course of in Q2 2022 for the spinco (Latamark Sources).

- The corporate has a world-class administration group consisting of a number of mining, finance and geological heavyweights with years of expertise in a various portfolio of associated industries.

Key Initiatives

Central Canada Gold & Polymetallic Challenge

The flagship Central Canada gold and polymetallic challenge consists of three key claims: the unique Central Canada property, Hammond South and Hammond West. The whole space spans 10,392 hectares over a historic producer with shaft and mill website capabilities and sits 21.5 kilometers every of Atikokan and 160 kilometers west of Thunder Bay. The challenge is accessible through freeway and street entry and leverages mining-friendly circumstances.

Central Canada has two geological regimes. Its northern claims comprise a greenstone rock underlay courting again to the Archean age. The southern claims of the property are lined by Sapawe Lake and underlain by iron formation and greenstone rock models that host Falcon’s gold and cobalt occurrences. Historic drill intersection outcomes spotlight mineral grades upwards of 0.64 % copper, 0.15 % cobalt, 1.1 % zinc and 0.35g/t gold over a real width of 40 meters.

Falcon has carried out an in depth 17-hole drilling program totaling 2,942.5 meters of core. Each gap efficiently intersected a extremely altered felsic porphyry rock unit with vital pyrite, arsenopyrite, lead telluride and visual gold mineralization. The corporate expects to finish extra concrete useful resource calculations and use sampling and logging outcomes to bear fireplace assay gold evaluation to evaluate the challenge’s full potential.

Tenting Lake Property

The Tenting Lake property consists of 5 claims comprising roughly 2,250 hectares within the Pink Lake mining district in Northwestern Ontario. The property leverages strategic proximity to Nice Bear Sources, which lately reported high-grade gold discoveries. Worldwide Montoro Sources (TSX-V:IMT) has an choice to earn a 51-percent curiosity within the Tenting Lake property.

Historic exploration on the property contains petrographic research; diamond drilling; rock, soil and lake sediment samples; IP/Floor Geophysics and extra. The primary section of the Tenting Lake 2020 exploration program consists of roughly 20-line kilometers of floor VLF/EM geophysics and soil geochemistry.

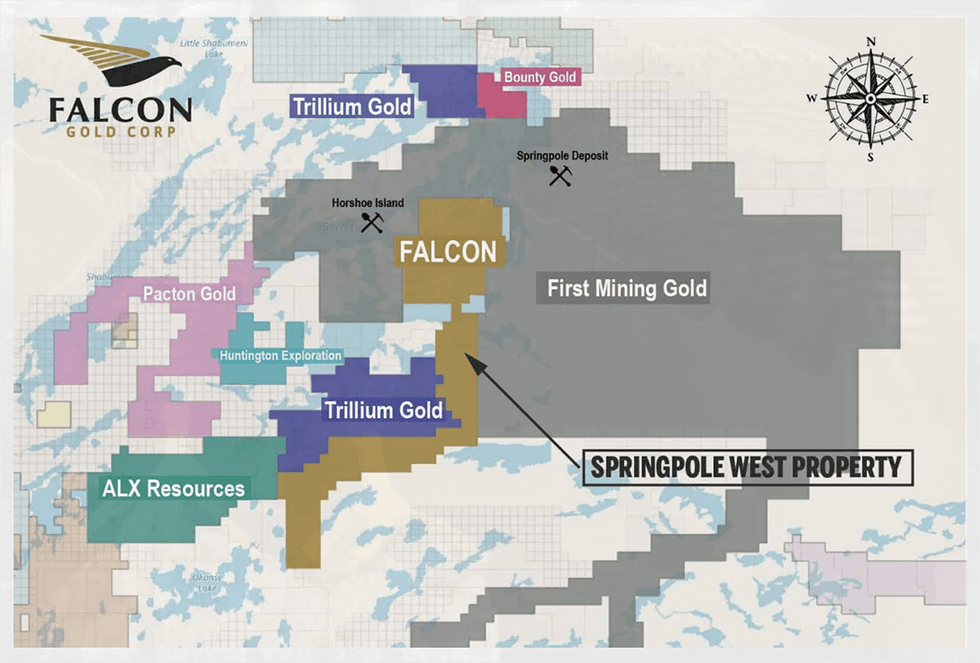

Springpole West Property

The Springpole West property spans 4,440 hectares strategically positioned inside 4 kilometers of First Mining’ Springpole deposit northwest of Pink Lake, Ontario. The asset includes 197 claims containing 217 models and garners accessibility through floatplane, ATV path and winter street.

The property has the potential to imitate equally spectacular indicated useful resource estimates as First Mining, which stands at roughly 139.1 million tonnes at 1.04g/t gold and 5.4g/t silver.

The claims cowl 13.5 kilometers of strike size alongside a gold-bearing silicified mafic volcanic–sedimentary rock contact and a serious property-wide fault zone. Historic work has indicated vital gold and silver values on the floor and at depth. Likewise, historic seize samples have revealed distinctive mineralization with grades as much as 8.38 % zinc, 16g/t silver and 0.05g/t gold.

Burton Gold Property

The Burton gold property consists of six patented and 16 unpatented mining claims overlaying roughly 356 hectares in Esther Township, Ontario. The property has advantageous positioning throughout the very actively explored Swayze Greenstone Belt famend for internet hosting lode gold mines. The property additionally leverages shut proximity to IAMGOLD Corp.’s Cote Lake deposit, which has an indicated useful resource of 35 million tonnes averaging 0.82g/t gold.

Historic diamond drill intercepts at Burton embrace 9.34 g/t silver over an intersection size of seven.75 meters on the important Shaft zone and 12.47 g/t silver over an intersection size of three.13 meters on the East zone.

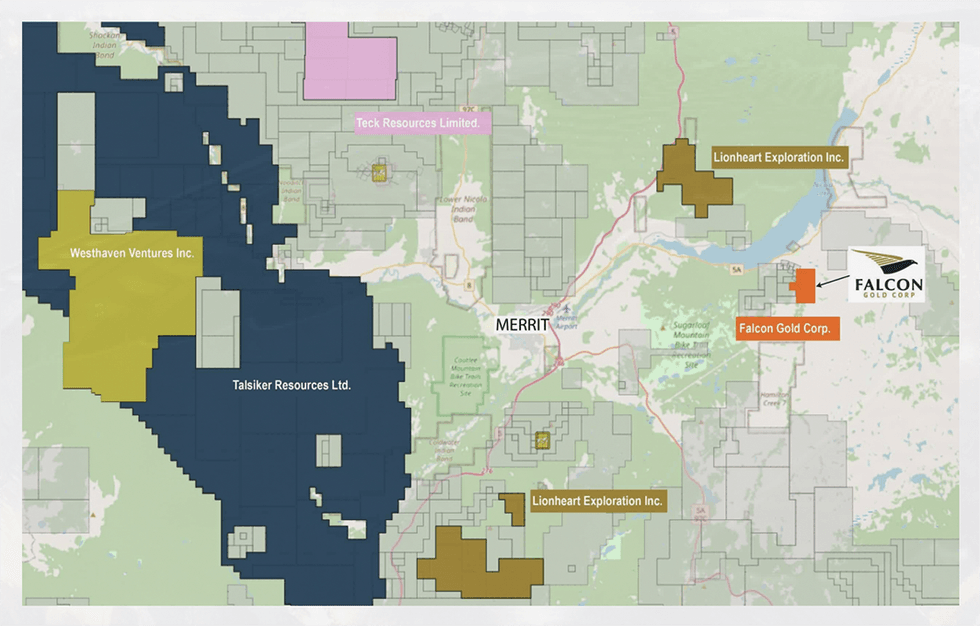

Spitfire & Sunny Boy Property

The Spitfire & Sunny Boy property spans 502 hectares in south-central British Columbia, 16 kilometers east of Merritt. The property boasts wonderful infrastructure and entry with slim however high-grade veining and gold mineralization.

Sampling from 1974 revealed the primary exhibiting, Grasp Vein, hosted high-grade gold mineralization as much as 1,433 g/t gold. 2020 work program and channel samples have returned upwards of 122 g/t gold over a meter and 59.8 g/t gold over 2.2 meters. The asset has the potential to host further vein buildings downslope from the Grasp vein, which Falcon intends to discover in future growth packages.

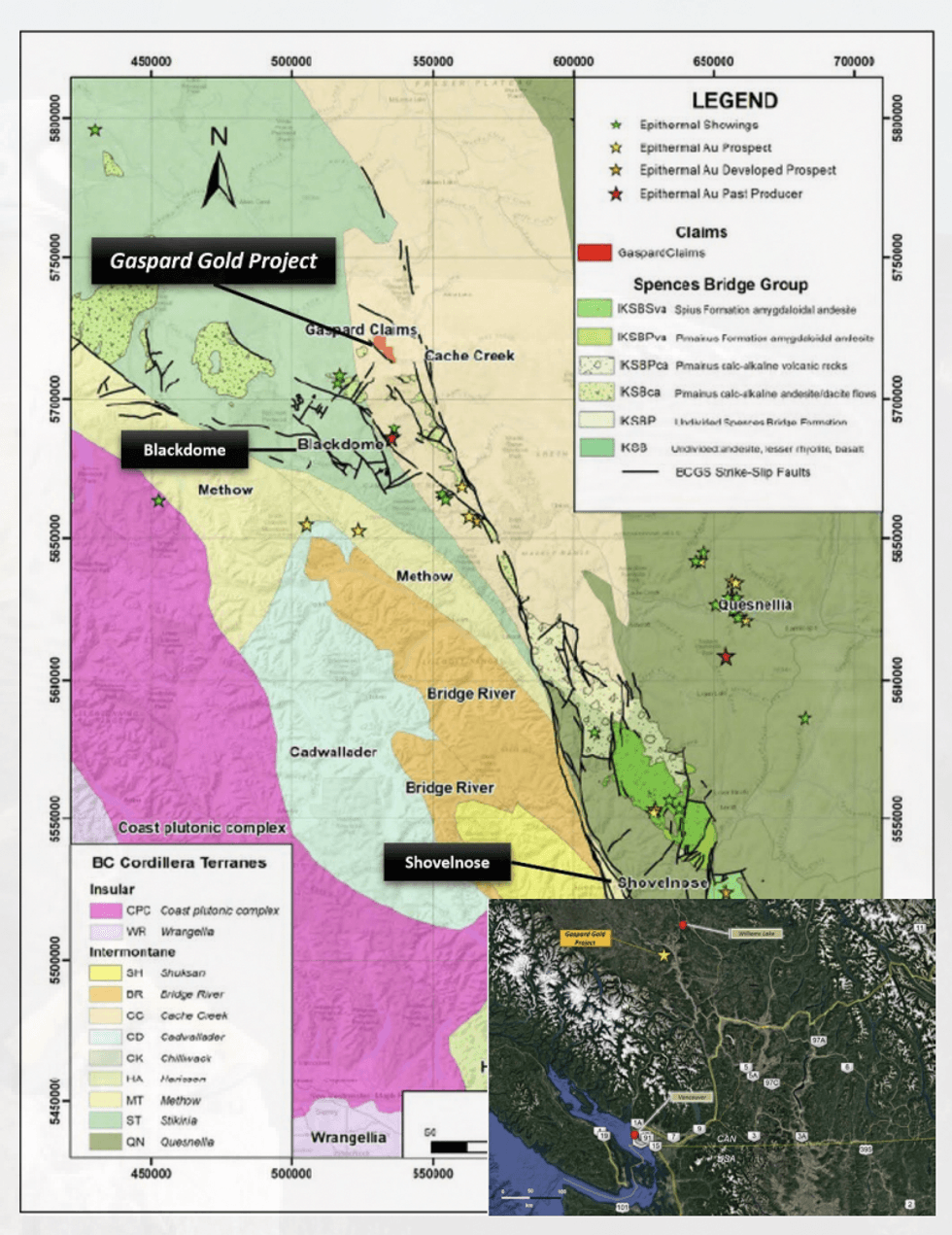

Gaspard Gold Challenge

The Gaspard gold challenge includes three mineral claims overlaying 3,955 hectares within the Clinton mining district of central British Columbia. The property has year-round entry with a strong community of energetic logging roads and favorable positioning close by Williams Lake’s regional provide middle for mining, logging and ranching.

The property is positioned roughly 26 kilometers south of the Blackdome gold mine challenge, which reportedly has indicated sources of 144,500 tonnes grading 11.29 g/t gold and 50.01 g/t silver. Gaspard has the potential to imitate this widespread mineralization and high-grade valuable steel yield with its potential anomalous grades of stream sediment samples.

Esperanza Gold-Silver-Copper Challenge

Falcon’s ERZA property consists of ten mineral concessions spanning an mixture space of 11,768 hectares. The big land bundle leverages good street accessibility and nice useful resource networks with shut proximity to the city of Chepes throughout the Sierra de Las Minas district of La Rioja. Argentina.

The primary discovery of high-grade gold mineralization occurred in 1865 on the Callanan occurrences, adopted by restricted mining carried out on a gold, silver and copper zone. Falcon intends to proceed validating the historic workings of Esperanza and exploring this very high-grade system.

Administration Group

Karim Rayani – CEO & Director

For the previous 15 years, Karim Rayani has targeted on financing home and worldwide mineral exploration and growth. Most lately, Rayani was head of Bloomberry Capital Group, a Vancouver-based service provider financial institution and capital advisory agency. He labored independently as a administration guide and financier. He’s presently chair of R7 Capital Ventures Ltd; director of Fiber Crowne Manufacturing Inc., chair of District 1 Exploration Corp. Rayani has developed an in depth community of contacts all through North America and Europe, specializing in company growth and finance.

Geoff Balderson – CFO

Geoff Balderson has over 20 years of capital markets expertise, having labored in private and non-private observe. Balderson is a senior officer and director of a number of TSX Enterprise listed corporations and presently runs a non-public consulting observe Concord Company Companies Ltd., offering company advisory, accounting, submitting and secretarial providers to many publicly traded corporations. Balderson was an funding advisor at Union Securities and Georgia Pacific Securities, and a College of British Columbia graduate in advertising and marketing and gross sales administration.

James Farley – Director

James Farley has been concerned within the capital markets for over 25 years, initially as a monetary advisor and subsequently as a non-public businessman. He’s presently a enterprise guide for the mining and oil and fuel industries, specializing in well being security and environmental administration.

Michelle Suzuki – Director

Michelle Suzuki has spent the final 25 years as an advisor with a spotlight in publishing and media relations. She has managed investor communication campaigns for Canada’s largest digital content material suppliers for tons of of C-Suite purchasers all through North America, from life sciences, and expertise to mining corporations.

Within the Canadian markets, she is broadly recognized for her expertise in these fields working with many prime CEOs, senior investor relations executives, funding dealer sellers and publication writers on digital syndication serving to educate on the significance of mining and the way forward for the business.

John Bossio – Director

John Bossio is a registered psychologist, having obtained a grasp of arts in counseling psychology from Metropolis College, Bellevue, Wash., in 2002 and a bachelor of science in household research from the College of Alberta, Edmonton, in 1991. He’s a member of each the Psychologists Affiliation of Alberta and the School of Alberta Psychologists. Bossio is an avid investor and skilled board member. He has a community of contacts specializing in small-cap, publicly traded corporations.

R. Stuart “Tookie” Angus – Company Advisor

Stuart “Tookie” Angus is an impartial enterprise adviser to the mining business and is presently chair of K92 and chair of San Marco Sources Inc. and Kenadyr Mining (Holdings) Corp. He’s the previous head of the worldwide mining group for Fasken Martineau. For the previous 40 years, Angus has targeted on structuring and financing vital worldwide exploration, growth and mining ventures. Extra lately, he was managing director of mergers and acquisitions for Endeavour Monetary and was answerable for merger and acquisition mandates.

Angus is the previous chairman of the board of BC Sugar Refinery Ltd. He was a director of First Quantum Minerals Ltd. till June 2005, a director of Canico Useful resource Corp. till its takeover by Brazil’s CVRD in 2005, a director of Bema Gold Corp. till its takeover by Kinross Gold Corp. in 2007, a director of Ventana Gold Corp. till its takeover by AUX Canada Acquisition Inc. in 2011 and a director of Plutonic Energy Corp. till its merger with Magma Power Corp. in 2011. He resigned 2017 as chair of Nevsun Sources Ltd. following its acquisition of Reservoir Minerals in 2017.

Ian Graham – Geological Advisor

Ian Graham is an achieved mining govt with over 20 years of worldwide expertise exploring for and creating mineral deposits. He has spent over half of his profession working for main mining corporations, together with roles at Rio Tinto and Anglo American. Graham possesses industrial minerals expertise and is well-known for his successes throughout the diamond sector.

From 1990 to1994, Graham acted as principal geologist in exploration for Anglo American and accomplice in De Beers Group’s South Africa division. In 1994, he joined Rio Tinto in Canada because the analysis supervisor for the Diavik diamond mine, then went on to change into chief geologist for diamonds with Rio Tinto’s Challenge Era Group. Throughout his 15 years at Rio Tinto, Graham was concerned with the analysis and pre-development of a number of tasks, together with the Diavik diamond mine within the Northwest Territories and the Decision copper deposit in Arizona.

Glayton Dias – Exploration Supervisor

Glayton Dias is a geologist with 12 years expertise each domestically and internationally, creating, managing and exploring mineral deposits from early-stage to mine growth and 3D ore estimation. Most lately his work has been targeted on the Spences Bridge Gold Belt, having been posted as a challenge supervisor for the Shovelnose Deposit presently developed by Westhaven Sources with a useful resource of 791,000 ounces of gold and three,894,000 ounces of silver Indicated (Reference under). Previous to being a Challenge Supervisor for Westhaven he labored as a consulting geologist for Ximen Sources on its multi-metallic Treasure Mountain deposit, Exploration Supervisor for Avant and Gdgeo, main tasks in world-class deposits as Andrade (Arcelor Mittal), Germano (Samarco) and Serra das Eguas (Magnesita SA).

Dias information and expertise in valuable and base steel tasks on high-grade epithermal low sulfidation together with porphyry copper-gold geology will probably be worth add as we begin up operations once more at each Spitfire-Sunny Boy, Gaspard tasks in B.C., and our South America tasks.

[ad_2]