[ad_1]

Momentum breakouts are prime buying and selling circumstances whereby merchants can discover good buying and selling alternatives. It’s because momentum breakouts are likely to trigger worth to maneuver in a single normal route and will usually end in a development.

Momentum buying and selling is a technical buying and selling method whereby merchants would purchase or promote a tradeable instrument based mostly on the power of a development. Principally, merchants buying and selling momentum methods are buying and selling with a powerful drive behind a worth transfer. These sturdy worth actions usually trigger worth to maneuver in the identical route and will usually end in a trending market.

Momentum outdoors of buying and selling is a results of mass and velocity. In buying and selling, mass and velocity may be recognized based mostly on quantity and the gap traveled by worth inside a brief interval.

One solution to determine sturdy momentum is by observing for momentum candles. Momentum candles are lengthy, full-bodied candles with little to no wicks. This means that worth moved in a single route inside that candle interval. That is usually accompanied by excessive quantity buying and selling inside that candle.

On this technique, we will probably be utilizing a few technical indicators as a way to affirm momentum.

Dynamic Value Channel

Dynamic Value Channel is a customized channel kind indicator which is predicated on the Common True Vary (ATR).

The ATR is mainly the common vary of worth candles inside a predetermined interval.

The Dynamic Value Channel incorporates the ATR with transferring averages as a way to determine development, volatility, momentum and imply reversals.

The Dynamic Value Channel plots transferring common line as its predominant line and is represented by a dashed yellow line. This line might both be a Easy Shifting Common (SMA), Exponential Shifting Common (EMA), or a Smoothed Shifting Common (SMMA). Merchants can choose the choice within the parameters tab of the indicator.

Then, six traces radiate from the transferring common line. Three above and three under. These traces are plotted a distance away from the center line, which is the transferring common line, based mostly on an element of the ATR.

The indicator can be utilized as a volatility indicator. Merchants can determine volatility based mostly on the contraction and growth of the bands away from the center line.

It can be used to determine development route, based mostly on how the center line is sloped and based mostly on whether or not sure traces act as a dynamic help or resistance within the route of the development.

It may additionally point out overbought or oversold markets based mostly on how worth reacts in opposition to the outer bands. If worth motion is exhibiting indicators of worth rejection on the outer bands, then the market might both be overbought or oversold. These circumstances are prime for a imply reversal.

Alternatively, the identical outer traces can be utilized to find out sturdy momentum. If worth motion is exhibiting indicators of sturdy momentum breakout in opposition to the outer traces, the market might be gaining sturdy momentum which might end in a development.

Relative Energy Index

The Relative Energy Index (RSI) is a flexible technical indicator which is part of the oscillator household of indicators. It may be used to find out tendencies, momentum and overbought or oversold worth circumstances.

The RSI plots a line that oscillates throughout the vary of 0 to 100. It additionally sometimes has markers at degree 50, which is the midline. If the RSI line is above 50, then the market bias is bullish, whereas if the road is under 50, then the market bias is bearish.

It additionally has markers at degree 30 and 70. An RSI line dropping under 30 might point out an oversold situation, whereas an RSI line above 70 might point out an overbought situation. Each circumstances are prime for a imply reversal.

Nevertheless, momentum merchants can also view a breach above 70 as a bullish momentum indication, and a drop under 30 as a bearish momentum indication. It’s a matter of how worth motion is responding because the RSI line breaches these ranges.

Merchants additionally add degree 45 and 55 to help a trending market indication. The extent 45 acts as a help degree in a bullish trending market, whereas the extent 55 acts as a resistance in a bearish trending market.

Buying and selling Technique

Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique is a momentum breakout technique which trades on confluences between the momentum breakout sign coming from the Dynamic Value Channel indicator and the RSI.

On the Dynamic Value Channel, momentum is recognized based mostly on a powerful momentum candle breaking past the outer traces of the Dynamic Value Channel. That is represented by the crimson traces above and under the center yellow line.

On the RSI, momentum is confirmed based mostly on the RSI line breaching above 70 within the case of a bullish momentum or under 30 within the case of a bearish momentum.

Confluences between the 2 momentum alerts are usually excessive likelihood momentum alerts which might end in a development.

Indicators:

- Dynamic_Price_Channel

- Relative Energy Index

Most well-liked Time Frames: 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

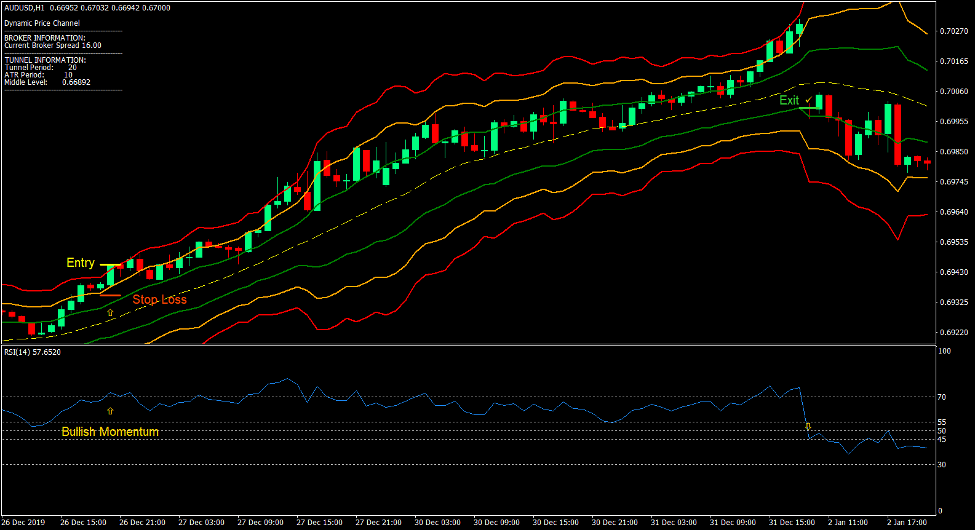

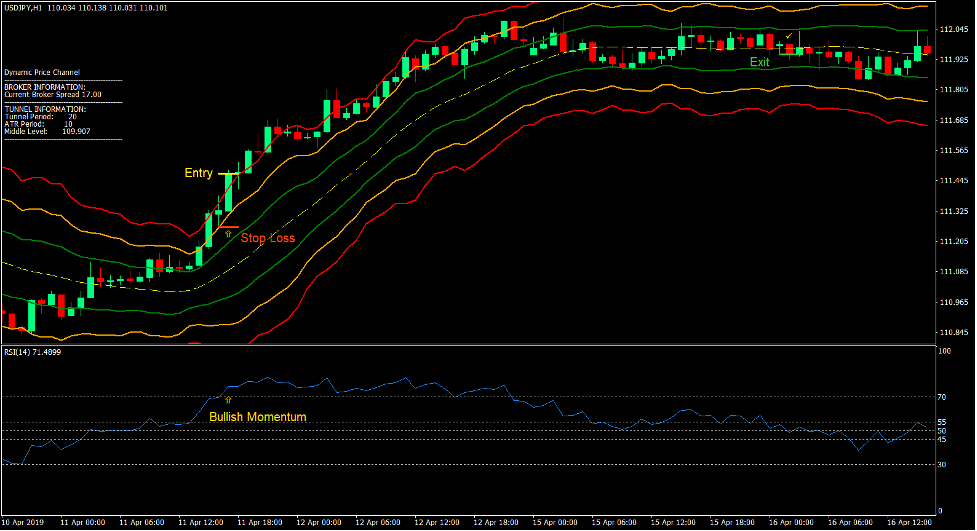

Purchase Commerce Setup

Entry

- A bullish momentum candle ought to breach above the higher crimson line of the Dynamic Value Channel.

- The RSI line ought to breach above 70.

- Enter a purchase order on the confluence of each alerts.

Cease Loss

- Set the cease loss on a help degree just a little under the entry candle.

Exit

- Shut the commerce as quickly because the RSI line drops under 50.

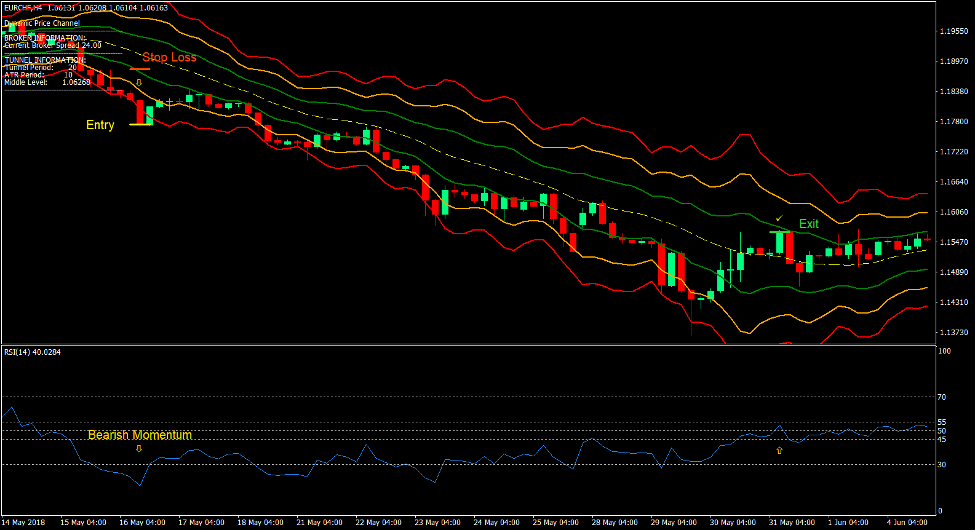

Promote Commerce Setup

Entry

- A bearish momentum candle ought to breach under the decrease crimson line of the Dynamic Value Channel.

- The RSI line ought to drop under 30.

- Enter a promote order on the confluence of each alerts.

Cease Loss

- Set the cease loss on a resistance degree just a little above the entry candle.

Exit

- Shut the commerce as quickly because the RSI line breaches above 50.

Conclusion

This momentum breakout technique produces momentum commerce setups that are based mostly on two prime quality momentum alerts.

There are numerous skilled merchants who commerce utilizing this technique with various parameters and with confluences coming from a number of time frames. Nevertheless, as a standalone momentum sign, this technique might already produce prime quality commerce setups.

Additionally it is vital to notice that these commerce setups are likely to work effectively every time the breakouts got here from a decent market congestion.

Merchants can observe with this technique as part of an total momentum technique with a number of timeframe confluences.

Foreign exchange Buying and selling Methods Set up Directions

Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past knowledge and buying and selling alerts.

Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique supplies a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and alter this technique accordingly.

Really helpful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Learn how to set up Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique?

- Obtain Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique

- You will notice Dynamic Channel Momentum Breakout Foreign exchange Buying and selling Technique is accessible in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]