[ad_1]

What Is the Common True Vary (ATR)?

The common true vary (ATR) is a technical evaluation indicator launched by market technician J. Welles Wilder Jr. in his e book New Ideas in Technical Buying and selling Techniques that measures market volatility by decomposing your entire vary of an asset worth for that interval.1

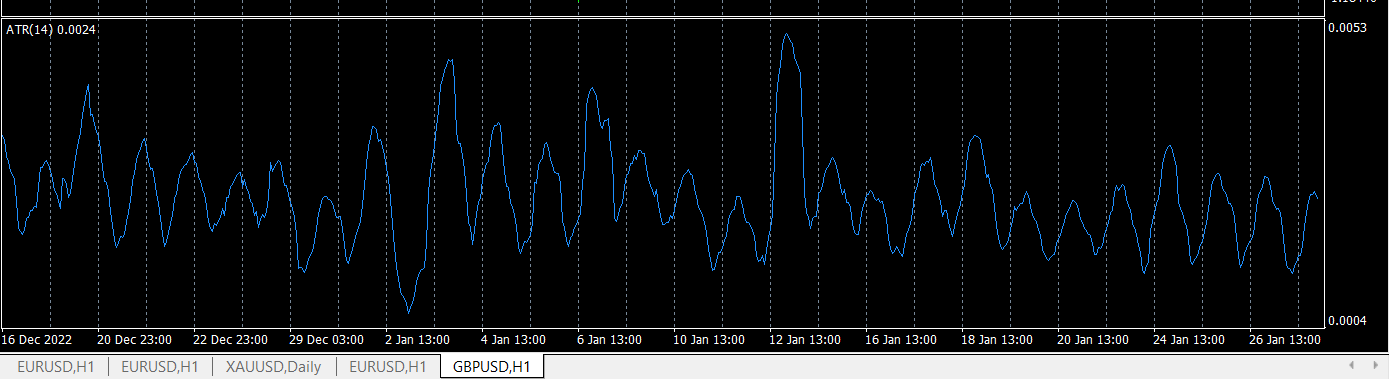

The true vary indicator is taken as the best of the next: present excessive much less the present low; absolutely the worth of the present excessive much less the earlier shut; and absolutely the worth of the present low much less the earlier shut. The ATR is then a transferring common, usually utilizing 14 days, of the true ranges.

Merchants can use shorter intervals than 14 days to generate extra buying and selling indicators, whereas longer intervals have a better chance to generate fewer buying and selling indicators.

KEY TAKEAWAYS

- The common true vary (ATR) is a market volatility indicator utilized in technical evaluation.

- It’s sometimes derived from the 14-day easy transferring common of a sequence of true vary indicators.

- The ATR was initially developed to be used in commodities markets however has since been utilized to all sorts of securities.

- ATR exhibits buyers the typical vary costs swing for an funding over a specified interval.

What Does the ATR Inform You?

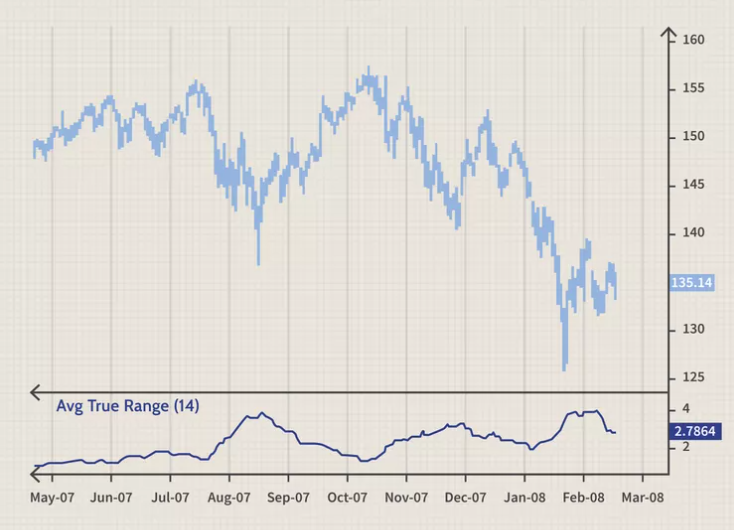

Wilder initially developed the ATR for commodities, though the indicator may also be used for shares and indices.1 Merely put, a inventory experiencing a excessive stage of volatility has a better ATR, and a decrease ATR signifies decrease volatility for the interval evaluated.

The ATR could also be utilized by market technicians to enter and exit trades and is a great tool so as to add to a buying and selling system. It was created to permit merchants to extra precisely measure the day by day volatility of an asset by utilizing easy calculations. The indicator doesn’t point out the value path; as a substitute, it’s used primarily to measure volatility attributable to gaps and restrict up or down strikes. The ATR is comparatively easy to calculate, and solely wants historic worth information.

The ATR is often used as an exit technique that may be utilized irrespective of how the entry choice is made. One common method is named the “chandelier exit” and was developed by Chuck LeBeau. The chandelier exit locations a trailing cease underneath the very best excessive the inventory has reached because you entered the commerce. The space between the very best excessive and the cease stage is outlined as some a number of multiplied by the ATR.

Instance of Methods to Use the ATR

As a hypothetical instance, assume the primary worth of a five-day ATR is calculated at 1.41, and the sixth day has a real vary of 1.09. The sequential ATR worth might be estimated by multiplying the earlier worth of the ATR by the variety of days much less one after which including the true vary for the present interval to the product.

Subsequent, divide the sum by the chosen timeframe. For instance, the second worth of the ATR is estimated to be 1.35, or (1.41 * (5 – 1) + (1.09)) / 5. The components may then be repeated over your entire interval.

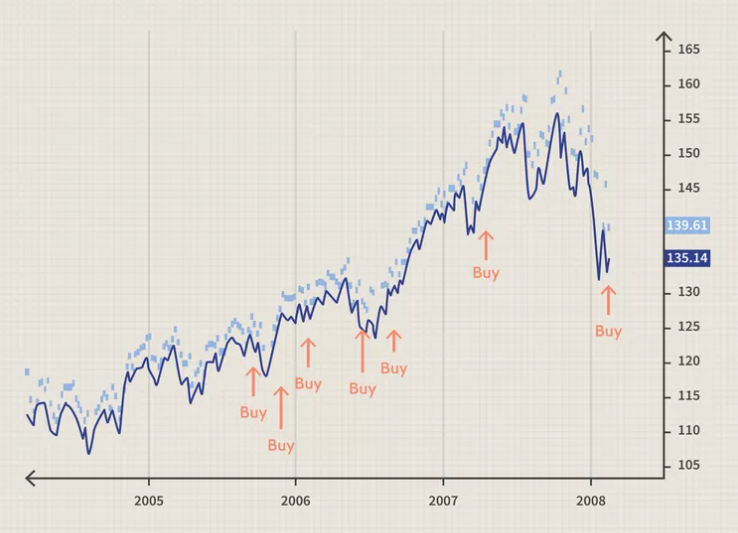

Whereas the ATR would not inform us by which path the breakout will happen, it may be added to the closing worth, and the dealer should purchase every time the subsequent day’s worth trades above that worth. This concept is proven under. Buying and selling indicators happen comparatively occasionally however normally point out important breakout factors. The logic behind these indicators is that every time a worth closes greater than an ATR above the newest shut, a change in volatility has occurred.

How do I exploit the ATR in my buying and selling

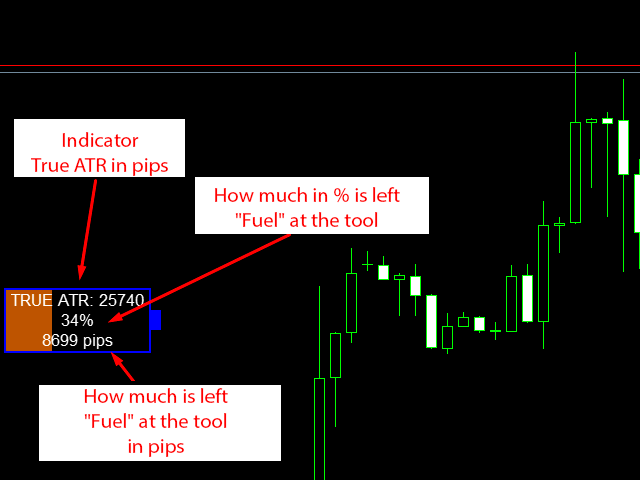

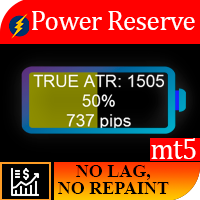

In my buying and selling, I exploit ATP as an indicator displaying the ability reserve of the instrument, that’s, once I see an entry into the market, I additionally examine the presence of vitality within the instrument at a given time till reaching my take revenue. The usual ATR is a little bit troublesome to shortly decide the state of affairs available in the market and isn’t solely informative. So I created my very own indicator based mostly on ATR and now I’ll clarify how and why it’s helpful to me.

I named my indicator Energy reserve, that indi permits to know how a lot “gas remains to be left with the software.” Think about the state of affairs, you drove off in a automobile with a half-discharged battery, on common, normally this quantity of vitality is sufficient for a automobile for 250 km, respectively, with all of your need, you can not overcome a path of 700 km. So for every instrument, there’s a sure day by day worth motion, and because of statistical observations, it was revealed that 95% of the time the asset passes 1 ATR per day, and solely 5% of the time 2 or extra ATR.

Instance, day by day ATR EURUSD = 682 pips. You enter a commerce, for example, at a breakdown of the extent with a TP of 500 pips, it will appear that you just set the proper TP measurement, however you didn’t have in mind that the asset had already handed 90% of its day by day ATR by the point the commerce was opened, and accordingly, the instrument most probably doesn’t have sufficient vitality to obtain you TP, if you happen to noticed that the instrument had solely 10% cost left, you’ll most probably both modify the TP, or not enter the commerce in any respect.

The Energy Reserve indicator calculates how a lot in % and in factors the instrument has used up inertia and the way a lot it nonetheless has left.

The indicator itself is made within the type of a battery indicator, which we’re used to seeing in digital units.

Utilizing this indicator, you instantly perceive:

- – day by day worth motion (the screenshot exhibits Bitcoin’s day by day ATP, so do not be afraid of such giant numbers)

- – your attainable TP measurement

- – as a proportion, it’s indicated how a lot % of the inventory strikes the instrument has left for at present, under you see the identical indicator however in factors

Right here is an instance on GBPUSD

Agree that, in comparison with a regular indicator, mine makes it instantly clear what’s what and how you can use it. I hope this data shall be helpful to you, put likes and write your feedback. I hugged everybody, good revenue to all!

Those that can be occupied with utilizing my indicator can buy it right here for a nominal payment.

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392

Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410

[ad_2]