[ad_1]

Extra central banks world wide are pausing their tightening campaigns as inflation exhibits indicators of cooling and economies decelerate.

Article content

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Advertisement 2

Article content material

Extra central banks world wide are pausing their tightening campaigns as inflation exhibits indicators of cooling and economies decelerate.

Article content material

Policymakers from Hungary to Chile left rates of interest unchanged this week, whereas the Financial institution of Canada signaled it could quickly pause to evaluate the impression of coverage up to now. Officers in South Africa and Colombia downshifted to smaller hikes amid dangers to progress.

Within the US, the Federal Reserve’s key inflation gauges ebbed in December to the slowest annual paces since late 2021. Measures of wholesale inflation fell in some European nations final month, together with Finland and Slovakia.

Listed below are a few of the charts that appeared on Bloomberg this week on the newest developments within the international economic system:

Commercial 3

Article content material

World

Colombia shocked most analysts by slowing the tempo of financial tightening because the economic system exhibits indicators of a pointy slowdown, whereas the Financial institution of Canada raised rates of interest for an eighth consecutive and doubtlessly ultimate time. Hungary, Sri Lanka, Paraguay, Ukraine and Chile stood pat, whereas Pakistan, Nigeria, Thailand and South Africa stored mountain climbing.

Central bankers attempting to make sure that surging shopper costs don’t feed but extra inflation are doing what they’ll to maintain their very own homes so as. For employees working for US Fed Chair Jerome Powell, his euro-zone counterpart Christine Lagarde and their international friends, annual pay changes can’t keep away from the impression of a once-in-a-generation cost-of-living shock.

Commercial 4

Article content material

US & Canada

The Fed’s most popular inflation measures eased in December to the slowest annual paces in over a 12 months whereas shopper spending fell, serving to pave the way in which for officers to additional cut back the tempo of interest-rate hikes.

The economic system beat expectations within the final quarter of 2022, posting the type of delicate slowdown that the Fed desires to see because it makes an attempt to tame inflation with out choking off progress. Economists who dug into the small print, although, noticed sufficient warning indicators – particularly in weakening demand amongst shoppers – to recommend {that a} recession stays a giant threat this 12 months.

Housing prices, and Canada’s distinctive means of capturing them in inflation, recommend that shopper worth features could gradual quickly in coming months.

Commercial 5

Article content material

Rising Markets

Brazil’s annual inflation eased barely for the eighth-straight month on smaller rises in transportation and housing prices because the central financial institution holds its rate of interest excessive. Nonetheless, the architect of the inflation-targeting regime stated the objectives of three.25% for 2023 and three% for subsequent 12 months are far too low.

Chile’s central financial institution President Rosanna Costa is pushing again towards bets that policymakers will begin a sequence of steep interest-rate cuts in April. Inflation stays “terribly excessive” and the financial institution wants extra time to make sure it’s slowing towards the goal earlier than it may well ease financial coverage, Costa stated in a Bloomberg Tv interview, after policymakers determined to carry charges at 11.25% for a second-straight assembly.

Commercial 6

Article content material

Europe

The private-sector economic system within the euro space unexpectedly returned to progress firstly of 2023, providing additional indicators the area could keep away from a recession. A wide range of components together with slowing inflation, a warmer-than-usual winter in energy-strapped Europe and an easing of supply-chain constraints are fanning optimism within the 20-member foreign money zone.

The UK authorities sank deeper into debt in December as rising debt-interest funds and the price of insulating shoppers and companies from the energy-price shock strained the general public funds. The finances deficit stood at £27.4 billion ($34 billion), a file for the month and nearly triple the £10.7 billion shortfall a 12 months earlier.

Asia

Japan continues to foretell it may well stability its finances within the 12 months beginning April 2026 beneath a high-growth situation, regardless of plans to ramp up protection spending over the approaching years.

Commercial 7

Article content material

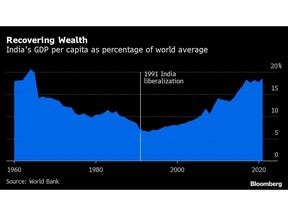

India’s financial transformation is kicking into excessive gear. The federal government is spending almost 20% of its finances this fiscal 12 months on capital investments, probably the most in no less than a decade. Prime Minister Narendra Modi is nearer than any predecessor to with the ability to declare that the nation — which can have simply handed China because the world’s most populous — is lastly assembly its financial potential.

—With help from Philip Aldrick, Vrishti Beniwal, Enda Curran, Matthew Malinowski, Jana Randow, Tom Rees, Isabel Reynolds, Andrew Rosati, Augusta Saraiva, Zoe Schneeweiss, Kai Schultz, Yuko Takeo and Randy Thanthong-Knight.

[ad_2]