[ad_1]

January 26, 2023

Center Class Will get the Most from Medicare

It is a truth of retirement life: older Individuals haven’t paid as a lot into Medicare and Medicaid as authorities spends on their healthcare and nursing residence stays.

It is a truth of retirement life: older Individuals haven’t paid as a lot into Medicare and Medicaid as authorities spends on their healthcare and nursing residence stays.

However it’s middle-class retirees who get essentially the most out of the system, in keeping with a new examine.

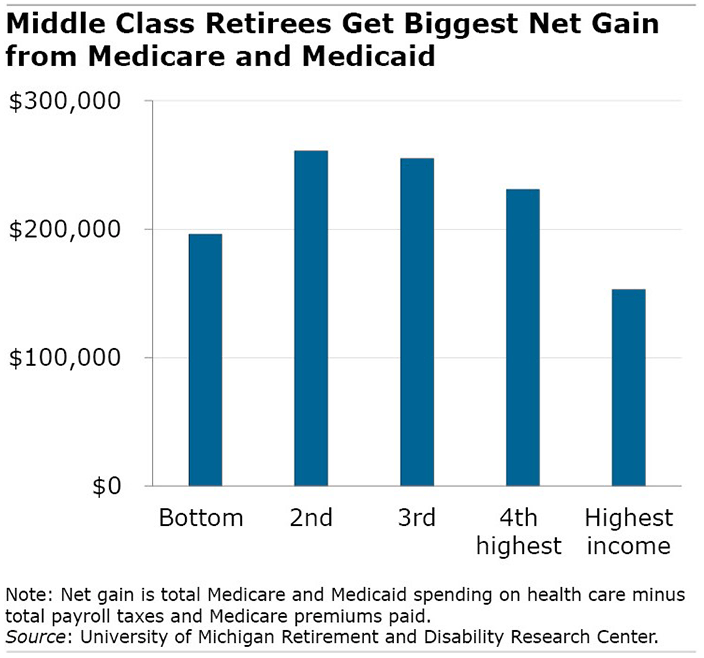

Center-income households obtain about $230,000 to $260,000 extra in Medicare and Medicaid advantages, on common, throughout their retirement years than the whole quantity they’ve paid in. Their contributions include the Medicare payroll and earnings taxes deducted from staff’ paychecks, the portion of their federal and state earnings taxes dedicated to Medicare and Medicaid, and the Medicare Half B and D premiums they’re paying in retirement.

The online advantage of the applications to the center class dwarfs the $153,000 in common web advantages for retired households within the prime fifth of the lifetime earnings distribution, and it additionally exceeds the $196,000 achieve for the underside fifth.

The center class is outlined because the second, third, and fourth of the 5 earnings teams the researchers analyzed on this examine. The annual information used to calculate the well being spending and cost estimates for this evaluation are adjusted for inflation.

Individuals over 65 obtain a 3rd of all of the medical care supplied on this nation. This new analysis, funded by the U.S. Social Safety Administration, makes use of authorities administrative information to match the advantages of Medicare and its smaller companion program, Medicaid, for every earnings group.

Individuals over 65 obtain a 3rd of all of the medical care supplied on this nation. This new analysis, funded by the U.S. Social Safety Administration, makes use of authorities administrative information to match the advantages of Medicare and its smaller companion program, Medicaid, for every earnings group.

There are two causes the center class will get essentially the most from the system. First, though the highest earners reside the longest and obtain essentially the most medical care, the center class lives nearly as lengthy and finally ends up receiving a big quantity of care.

Second, the taxes the center class pays to fund Medicare and Medicaid are lower than is paid by the highest earners. Center-income staff and retirees have a decrease marginal tax charge for the portion of their federal and state earnings taxes that go towards retiree medical care. And since their earnings are decrease, they pay much less in whole for the Medicare payroll tax, which gives the identical well being advantages for everybody however is a set proportion of a employee’s earnings. The much less somebody earns, the much less they pay for his or her future medical care.

Low-income retirees would possibly at first look appear to be the most important beneficiaries, since they’ve paid the least in taxes over their careers and are way more prone to want the means-tested Medicaid program to cowl the medical care that Medicare doesn’t cowl, together with costly nursing properties. Nonetheless, low-income retirees get lower than the center earnings group from this system as a result of they’ve the shortest life span. Though they are usually in poorer well being, they don’t require as a lot well being care general as different retirees.

The researchers estimated the lifetime web advantages utilizing surveys of staff who turned 65 someday between 1999 and 2004. They paired the surveys with authorities information on earnings to estimate the whole taxes paid by staff in every earnings group. Individually, they estimated the federal government subsidies of retirees’ medical care underneath Medicare Components A, B, and D and Medicaid, which is a joint federal-state program.

The evaluation is sophisticated however the researchers’ message is obvious. “The biggest beneficiaries of Medicare and Medicaid are these in the course of the earnings distribution.”

To learn this examine, authored by Karolos Arapakis, Eric French, John Bailey Jones, and Jeremy McCauley, see “How Redistributive are Public Well being Care Schemes? Proof from Medicare and Medicaid in Previous Age.”

The analysis reported herein was derived in entire or partly from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t characterize the opinions or coverage of SSA, any company of the federal authorities, or Boston School. Neither the USA Authorities nor any company thereof, nor any of their staff, make any guarantee, specific or implied, or assumes any authorized legal responsibility or accountability for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular industrial product, course of or service by commerce title, trademark, producer, or in any other case doesn’t essentially represent or indicate endorsement, advice or favoring by the USA Authorities or any company thereof.

[ad_2]