[ad_1]

A seismic shift in capital flows is taking part in out in Europe’s bond and foreign money markets as buyers modify to a world with out central financial institution stimulus.

Article content material

(Bloomberg) — A seismic shift in capital flows is taking part in out in Europe’s bond and foreign money markets as buyers modify to a world with out central financial institution stimulus.

Commercial 2

Article content material

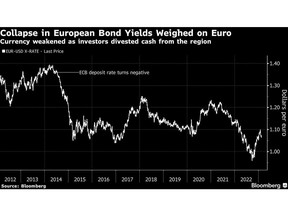

300 foundation factors of interest-rate hikes by the European Central Financial institution since July have halted the years-long exodus from the area’s fixed-income funds. Internet outflows that hit €818 billion ($872 billion) in late 2021 — probably the most in not less than twenty years — have now been reversed, information compiled by Deutsche Financial institution AG present.

Article content material

The juicier bond yields, in addition to reduction that the battle in Ukraine hasn’t sparked a deeper power disaster, are additionally eradicating a basic drag on the only foreign money as capital shifts from higher-yielding markets just like the US into euro-denominated belongings.

“Underlying move dynamics are turning dramatically extra optimistic for the euro this yr,” mentioned George Saravelos, the financial institution’s international head of FX analysis. “Cash managers are telling us they’re seeing waves of funding flows into European mounted revenue for the primary time in an extended whereas.”

Commercial 3

Article content material

The ECB saved rates of interest damaging for years to slash borrowing prices and hoovered up trillions of bonds, first to battle stagnant development after which the Covid outbreak.

Traders balked, reducing the share of euro-denominated bonds in European funding funds by 14 share factors between 2014 and 2021 — finally creating an underweight place equal to half a trillion euros, in accordance with Deutsche Financial institution’s strategists.

Closing the Hole

Now, with yields at their highest in years and sentiment towards mounted revenue much more optimistic because the ECB catches up with the Federal Reserve’s charge will increase, internet flows are poised to show optimistic, the Deutsche Financial institution information recommend. Cash markets are pricing virtually 125 foundation factors of additional ECB hikes in contrast with a further 75 foundation factors within the US.

Commercial 4

Article content material

“There shall be a closing of the hole between the Fed and ECB charges,” mentioned Paul Jackson, international head of asset allocation analysis at Invesco Asset Administration Ltd. “That’s the reason the euro most likely will proceed to strengthen all through this yr.”

The u-turn in flows is a key issue underpinning Deutsche Financial institution’s bullish long-term view, at the same time as a resurgent greenback has pressured the pair decrease this month. The euro was buying and selling round $1.07 on Friday, down from a latest peak of $1.1033 on Feb. 2.

The bloc’s December steadiness of funds, revealed on Friday, pointed to an enhancing euro move image, mentioned Jordan Rochester, FX strategist at Nomura. Along with portfolio inflows, the present account — boosted by decrease power costs — ticked up additional to a €16 billion surplus.

Commercial 5

Article content material

To make sure, any repatriation of capital to the euro space is prone to be a multi-year course of that can ebb and move: outflows have been easing within the years earlier than the pandemic, solely to speed up below a brand new spherical of stimulus that drove down yields as soon as once more.

And customary debt gross sales — seen as one other potential catalyst for a significant influx of capital — are probably nonetheless years away. That’s at the same time as requires joint issuance ramped up after the Ukraine battle underscored the pressing want to spice up funding in defence and power safety.

Different optimistic elements are nonetheless in play.

The fee for international buyers to hedge US debt holdings has rocketed, eroding their returns simply as yields of their residence markets begin to look extra enticing. That’s prone to drive a repatriation of capital to Europe simply because it has for Japan, the place buyers offloaded a file quantity of abroad debt final yr.

Commercial 6

Article content material

With decrease power costs serving to the EU’s current-account surplus develop again, it’s not unthinkable the euro might ultimately return to its pre-QE buying and selling vary, in accordance with Package Juckes, chief international FX strategist at Societe Generale SA. The shared foreign money hit a decade-high of $1.40 in 2014.

“The ECB crowded European buyers out of European bonds, and is now successfully letting them again in,” he mentioned.

Subsequent Week:

- Focus shall be on February surveys of buying managers within the UK and the euro space, with buyers in search of clues on how far central-bank hike cycles would possibly prolong

- Financial institution of England officers making an look embody Catherine Mann, Jon Cunliffe and Silvana Tenreyro and the European Central Financial institution will maintain a non-monetary coverage assembly in Finland

- Euro-zone sovereign issuance is about to sluggish to round €25 billion, in accordance with Commerzbank AG strategists, with auctions scheduled in international locations together with Germany and Italy

- Within the UK, it is going to be a heavy week of provide, with the BOE endeavor medium- and short-dated gilt gross sales below its quantitative tightening program alongside authorities auctions of bonds maturing in 2029 and 2053

—With help from Libby Cherry.

[ad_2]

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We now have enabled e-mail notifications—you’ll now obtain an e-mail if you happen to obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Neighborhood Tips for extra data and particulars on how one can modify your e-mail settings.

Be a part of the Dialog