[ad_1]

Nasdaq-listed Australian software program big Atlassian has seen its shares fall greater than 10% in after hours commerce following the discharge of its December quarter outcomes, which posted a US$99.2 million loss.

The loss compares to a uncommon revenue of $23 million 12 months earlier. Now in its twenty first yr of operations, Atlassian has but to shut out a yr within the black.

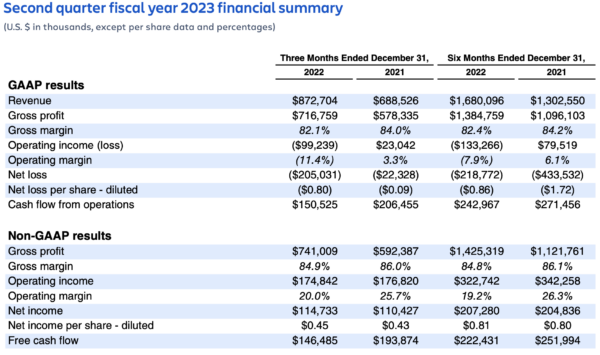

The corporate beat evaluation income expectations with Q2 FY23 nonetheless rising by 27%, year-on-year, to US$872.7 million. The working margin was (11)% for the quarter, in contrast with 3% for Q2 FY22.

The online loss was US$205 million for the December quarter, in contrast with a web lack of $22.3 million for a similar quarter 12 months in the past.

However it’s clear that tech trade layoffs, with tens of 1000’s of jobs going, are slowing buyer development for the collaboration software program enterprise, with the the corporate saying these “two macro-induced headwinds turned extra pronounced in Q2”.

Atlassian ended the 2022 calendar yr with 253,177 energetic prospects, up 4,004 web new prospects for the quarter.

Current prospects are increasing their paid seats at a slower tempo, and whereas there’s robust development in free editions of its cloud merchandise, they’re not changing to the paid model.

An unpredictable yr

Saying the outcomes, cofounder and co-CEO Scott Farquhar mentioned they’re “happy with every little thing we now have completed in yet one more unpredictable yr”, with subscription income development up 40%.

“2023 will probably be all about serving to our prospects navigate these difficult instances, absorbing the macro-driven impacts on our enterprise, and setting Atlassian up for long-term success,” he mentioned.

His co-CEO Mike Cannon-Brookes mentioned they’ll “maintain enjoying offense throughout our three massive markets whereas being pragmatic” amid a sequence of headwinds.

“Our observe report of constructing good funding choices within the service of long-term payoffs continues to yield outcomes as we not too long ago surpassed 45,000 Jira Service Administration prospects, making it one among our fastest-growing merchandise,” he mentioned.

As at all times, the pair included an Australia colloquialism of their shareholder letter, saying: “We’ve positioned ourselves for achievement in a difficult surroundings, and we’re able to get after it. (As we are saying in Australia, ‘we’re not right here to #@!% spiders.’)”

The corporate is predicting income within the vary of $890-910 million for Q3, with one other lack of the playing cards – an working working margin of round (14%) on a GAAP foundation.

That steerage is under analyst forecasts, including to the stress on the corporate’s share worth.

Complete income development year-over-year is anticipated to be round 25%, with cloud income development up 35-40%. The working margin is anticipated to be roughly (11%) on a GAAP foundation.

“We’re rebalancing our expertise and assets to place elevated deal with our largest development alternatives: cloud migrations, the IT service administration market, and serving enterprise prospects. Atlassian is effectively positioned in these areas with important momentum that may assist us energy by the turbulence forward,” Cannon-Brookes and Faruqhar mentioned within the shareholder letter.

“Over our seven years as a public firm, you’ve constantly seen us play the lengthy recreation whereas being extremely capital environment friendly. That’s a profitable technique and we’re sticking with it.”

Final month, the board signed off on the repurchase as much as US$1 billion of Atlassian’s Class A Frequent Inventory.

The stability sheet ended the quarter at US$1.7 billion in money and money equivalents plus short-term investments.

Atlassian’s share worth is down round 40% on 12 months in the past closing at US$182.41 on Thursday commerce, however has recovered to begin 2023, up 44%. It’s fallen 13% to round US$170 after hours.

Atlassian’s Q2 FY23 earnings. Supply: Atlassian

Disappointing outcomes

Stake markets analyst Megan Stals mentioned January’s development was primarily pushed by indicators of cooling inflation moderately than firm fundamentals.

“For Atlassian traders, at the moment’s outcomes will probably be disappointing, and will counsel the current tech rebound was untimely,” she mentioned.

Atlassian beat earnings per share estimates, however the fee of buyer development continues to say no and the corporate is struggling to transform free customers into paying prospects. Given the current tech trade layoffs, it isn’t shocking that its JIRA product, which primarily helps tech groups to collaborate, has struggled.”

Stals mentioned enterprise software program revenues are normally extra sturdy throughout financial downturns, however for unprofitable firms that depend on steady development that is typically not sufficient.

“In a unfavorable near-term sign for enterprise tech, Amazon’s cloud arm, AWS, additionally missed estimates final quarter. Progress within the cloud phase has slowed throughout the trade and Atlassian once more lowered expectations for 2023,” she mentioned.

“The large theme for tech companies throughout this earnings season has been effectivity, and Atlassian is not any exception, expressing a plan to cut back ‘decrease precedence endeavours’ in its shareholder letter. However it has a comparatively excessive R&D spend, largely resulting from salaries. As one of many few tech firms that hasn’t introduced layoffs, it might ultimately come below stress to cut back headcount.”

The Stake analyst mentioned Atlassian’s standing as one Australia’s few homegrown tech success tales means it nonetheless has important affect on the native market and the drop in its share worth in after hours buying and selling, may dampen sentiment for ASX-listed techn shares similar to Xero and Appen.

[ad_2]