[ad_1]

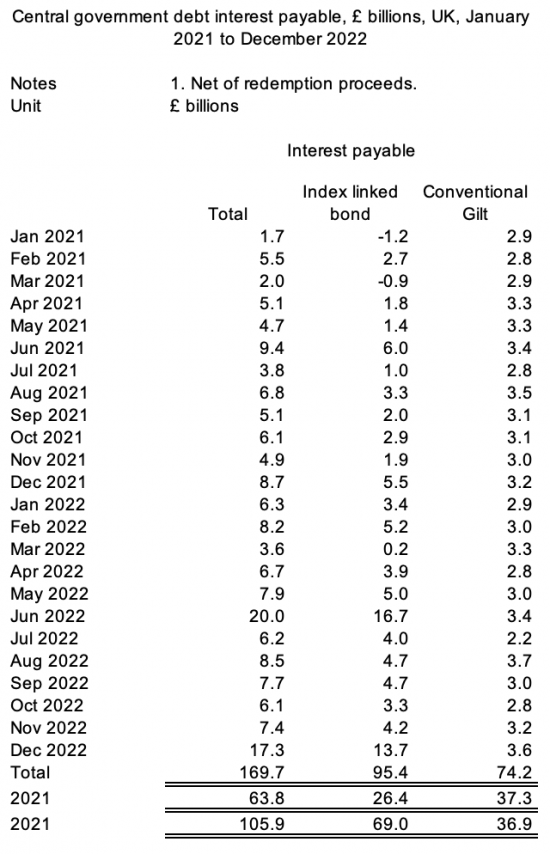

I’ve been requested a lot of questions since returning to the difficulty of the surplus curiosity funds recorded because of the extraordinary accruals being made for redemption prices in listed linked bonds. Because of this, I’ve ready the next desk:

The information initially comes from the Workplace for Nationwide Statistics. That on gilts in difficulty and Financial institution of England holdings is from the most recent Debt Administration Workplace publication, which is the perfect out there.

What is obvious is that the problem being addressed right here relates fully to index-linked bonds. There isn’t a difficulty with typical gilts.

The speed of return on index-linked bonds has risen according to inflation, hardly surprisingly. Nevertheless, as inflation tumbles, as it is going to, that charge may even fall. In reality, it’s potential it is going to grow to be adverse, as the information exhibits is fully potential. In different phrases, it is a very short-term phenomenon.

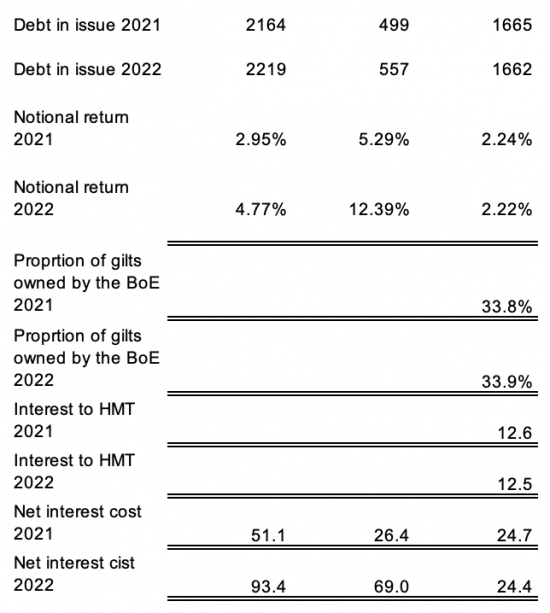

Merely equating the charges of return, there was an extra value to index-linked bonds in 2022 of about £57 billion. That calculation could possibly be refined: it might not a lot change the conclusions if it was.

If that extra value was unfold, as I recommend acceptable, over the 17-year interval that these bonds have, on common, remaining in existence then the associated fee to be recorded in 2022 would have been roughly £3.4 billion, which is available in at neither right here nor there.

As a substitute, it has been recorded as if an extra and persevering with value when it’s neither. My suggestion is that that is deliberate misaccounting to gas the austerity agenda.

When accounting is utilized in that method it has ceased to be goal, true or honest and the Workplace for Nationwide Statistics ought to know that. Regardless of the accounting commonplace they use, there may be all the time a real and honest choice they’ll use for reporting for decision-making functions. They aren’t utilizing that choice and that’s, for my part, a gross failure on their half.

No solely is the curiosity ion the nationwide debt the sum they report as a result of they don’t state it net6 of sums paid to HM Treasury, in addition they intentionally overstate the price of index-linked bonds that must be accrued over their life. Accounting failures don’t come a lot greater than this. The overstatement of curiosity value was roughly £66 billion (£57 extra value of gilts much less £3 billion apportioned value plus £12 billion of curiosity paid to the Treasury). That is a fail in anybody’s e-book.

[ad_2]