[ad_1]

Buying and selling is very similar to a recreation of basketball. Two groups are taking part in. One facet are the bulls and the opposite facet are the bears. Each side battle to push their crew for that win. Basketball is a recreation that’s whereby momentum performs a really large position. In actual fact, {many professional} gamers would agree that it’s a recreation of runs. One large play can change the chemistry of a crew. Gamers might be making errors right here and there, however one large shot or a dunk can deliver the followers on their toes and the crew again within the recreation. All of the sudden, the dropping crew would begin hitting their photographs and switch the sport round. That is referred to as a run. The identical is true with buying and selling. One large transfer in worth can shift the momentum. One large candle can flip the market sentiment round.

Similar to in basketball the place one large shot can snowball right into a run, a single momentum breakout can begin a development. Momentum buying and selling methods are very highly effective. Sure, it may well push worth in the identical route very simply within the subsequent few candles, nevertheless it may additionally have an impact additional alongside the worth chart if it causes the market to begin a development.

Acceleration Bands

Acceleration Bands are customized technical indicators which has similarities to band or channel-based technical indicators. It plots traces that envelope worth motion more often than not and helps merchants determine overbought or oversold market circumstances, in addition to momentum breakout situations.

Acceleration Bands plot three traces that type a channel on the worth chart. The center line is a modified transferring common which is characteristically very clean and but follows worth motion fairly carefully. The outer traces are shifted above and beneath worth motion primarily based on an element derived from the center line. The result’s a channel like construction which envelopes worth motion.

This indicator can be utilized to determine developments primarily based on the placement of worth in relation to the center line. Worth would additionally usually keep on the half of the channel the place the development is transferring.

It will also be used to determine short-term imply reversals. The outer traces generally is a foundation for overbought and oversold market circumstances. Worth motion rejecting these dynamic assist and resistances could point out that worth is reversing again to its imply.

However, this indicator will also be used as a foundation for momentum breakouts. Sturdy momentum candles that break outdoors of the channel can point out a robust momentum breakout state of affairs. This momentum breakouts may be the beginning of a brand new development.

Superior Oscillator

The Superior Oscillator (AO) is a momentum indicator which identifies development route primarily based on the crossing over of its underlying transferring common traces.

The AO is computed by the worth of a 34-period Easy Transferring Common (SMA) from a 5-period Easy Transferring Common (SMA). Nonetheless, as a substitute of utilizing the standard shut of every candle, AO computes its underlying SMA traces primarily based on the median of every candle. The result’s then plotted as an oscillating histogram bar. The worth of the bars signifies the overall route of the development, whereas the colour of the bars signifies the momentum of the development.

Optimistic inexperienced bars point out a strengthening bullish development, whereas optimistic pink bars point out a weakening bullish development. However, destructive pink bars point out a strengthening bearish development, whereas destructive inexperienced bars point out a weakening bearish development.

Buying and selling Technique

Accelerator Bands Momentum Foreign exchange Buying and selling Technique is a momentum breakout technique that trades on momentum breakouts occurring early in a brand new development that’s growing.

The Acceleration Bands and a 50-period Exponential Transferring Common (EMA) line is used to determine development route and development reversals.

Development reversals are recognized primarily based on the crossing over of the center line of the Acceleration Bands and the 50 EMA line. Nonetheless, as a substitute of buying and selling on the primary signal of a development reversal, we’ll await a momentum breakout affirmation.

The Superior Oscillator must also verify the route of the development. The AO bars ought to typically agree with the route of the development primarily based on whether or not the bars are optimistic or destructive.

We then await worth to retrace after the reversal.

After the retracement, worth ought to get away of the channel within the route of the brand new development. The momentum breakout is then confirmed primarily based on the colour and worth of the AO histogram bars.

Indicators:

- Acceleration_Bands

- 50 EMA

- Superior

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and every day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York periods

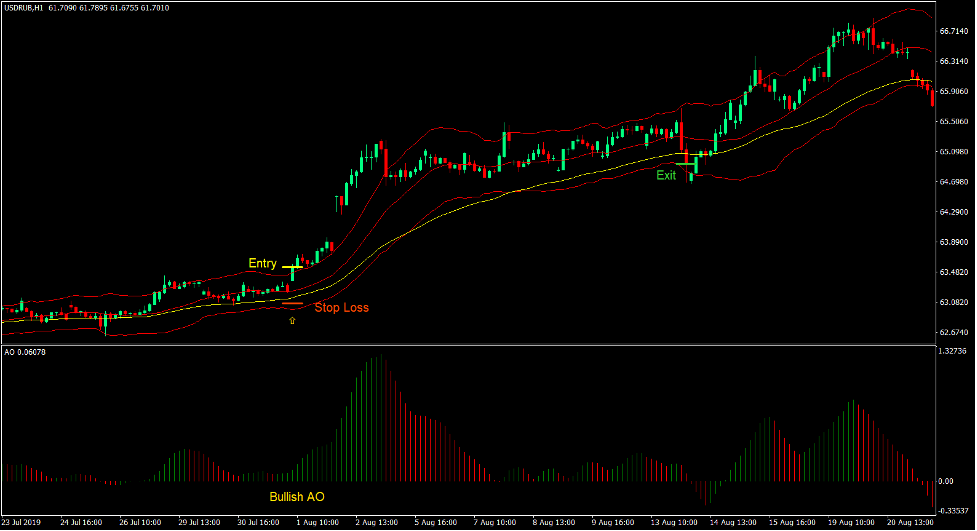

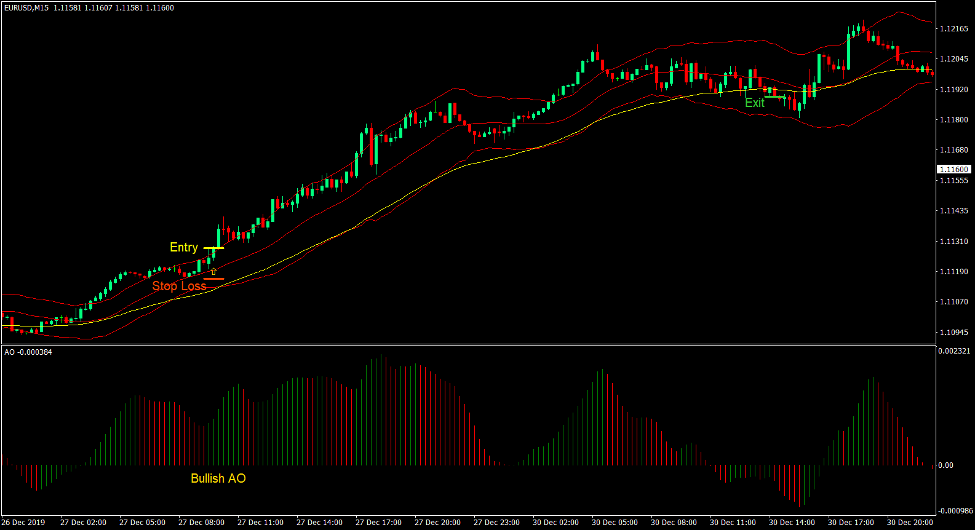

Purchase Commerce Setup

Entry

- The center line of the Acceleration Bands ought to cross above the 50 EMA line.

- The AO bars ought to typically be optimistic.

- Worth ought to contract after the preliminary bullish worth swing.

- A bullish momentum candle ought to shut above the higher line of the Acceleration Bands.

- The AO bars needs to be optimistic inexperienced.

- Enter a purchase order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the assist stage beneath the entry candle.

Exit

- Shut the commerce as quickly as worth closes beneath the 50 EMA line.

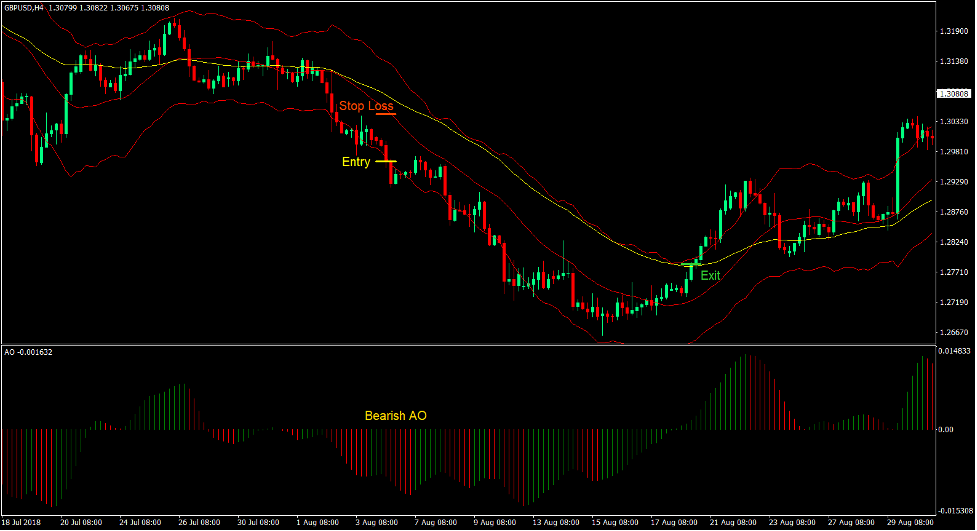

Promote Commerce Setup

Entry

- The center line of the Acceleration Bands ought to cross beneath the 50 EMA line.

- The AO bars ought to typically be destructive.

- Worth ought to contract after the preliminary bearish worth swing.

- A bearish momentum candle ought to shut beneath the decrease line of the Acceleration Bands.

- The AO bars needs to be destructive pink.

- Enter a promote order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the resistance stage above the entry candle.

Exit

- Shut the commerce as quickly as worth closes above the 50 EMA line.

Conclusion

This straightforward buying and selling technique is a brand new technique of buying and selling momentum breakouts primarily based on Accelerator Bands. Momentum breakout methods utilizing channels and bands are very efficient. It’s because it objectively permits merchants to determine market contraction and market enlargement phases. Momentum breakouts usually happen proper after a market contraction part. This technique permits merchants to identify these circumstances objectively and enter the market because the momentum breakout is confirmed. Merchants may then simply trip the brand new development if the momentum breakout does proceed to turn into a development.

Foreign exchange Buying and selling Methods Set up Directions

Accelerator Bands Momentum Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past knowledge and buying and selling alerts.

Accelerator Bands Momentum Foreign exchange Buying and selling Technique gives a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Really helpful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

How one can set up Accelerator Bands Momentum Foreign exchange Buying and selling Technique?

- Obtain Accelerator Bands Momentum Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Accelerator Bands Momentum Foreign exchange Buying and selling Technique

- You will note Accelerator Bands Momentum Foreign exchange Buying and selling Technique is on the market in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]