We’ll do your taxes

and discover each greenback

you deserve

When your Full Service knowledgeable does your taxes,

they’ll solely signal and file after they understand it’s 100% right

and also you’re getting one of the best consequence doable, assured.

Do you know not everybody or each greenback earned is taxed the very same quantity?

It’s because america tax system goals to be progressive. A progressive tax system tries to gather extra tax from those that earn extra. In essence, one million greenback earner pays extra whole tax, in addition to a better proportion of their revenue in tax, than somebody who earns far much less.

What’s a Tax Bracket?

One of many methods our tax system achieves that is by means of tax brackets. A tax bracket is solely a spread of incomes which are taxed at a set price based mostly in your taxable revenue.

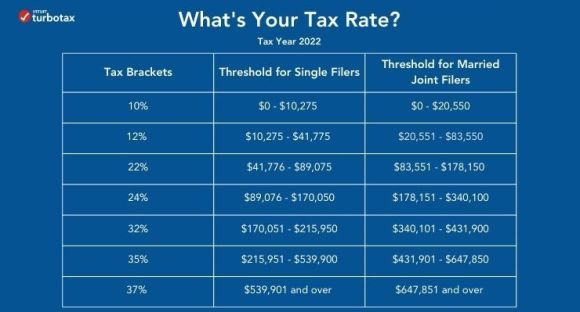

There are seven tax brackets of various measurement, with the bottom bracket being topic to a ten% marginal tax price and the very best being topic to 37% marginal tax price. Your marginal tax price will likely be dependent upon your taxable revenue throughout the brackets.

How Do I Know What Tax Bracket I’m In?

Let’s see how this works in actual life. When you’re a single filer who earns $60,000 a 12 months after you’re taking all the mandatory exemptions, changes and deductions, the primary $10,275 in earnings will likely be taxed 10%. From $10,276 to $41,775 you’ll be taxed 12%. On the remainder, you’ll be taxed 22%. You’re within the 22% tax bracket, although your efficient tax price will likely be a lot decrease.

If you’re married submitting collectively, the primary $20,550 will likely be taxed 10%. Any quantity over $20,550 to $83,550 is taxed at 12%.

Earlier, I discussed that there have been exemptions, changes, and deductions. The revenue you earned out of your job is taken into account unusual or gross revenue, however you’re taxed in your adjusted gross revenue, which is your revenue minus these exemptions, changes, and deductions.

When you understand your tax bracket, you may simply calculate how useful totally different tax deductions are for you. If you’re within the 22% tax bracket, a $1,000 deduction will scale back your tax legal responsibility by $220.

Not your entire revenue is taxed based mostly on these brackets. If in case you have long-term capital features and certified dividends, you’ll be taxed at 0%, 15%, or 20% relying in your revenue. If in case you have a short-term achieve, will probably be taxed as unusual revenue utilizing your marginal tax price.

So My Tax Brackets Are Totally different From Final 12 months?

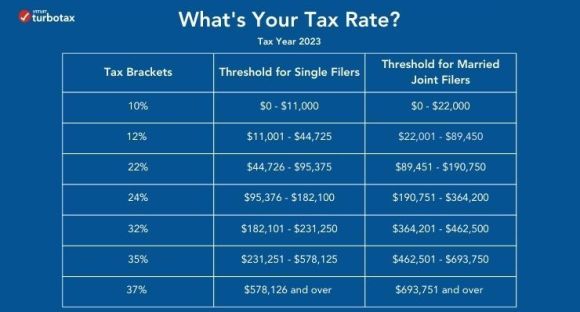

Every new tax 12 months the revenue thresholds for every tax bracket are up to date. The seven tax bracket percentages haven’t been modified since tax 12 months 2018.

The present tax brackets are: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The revenue thresholds for these brackets are under within the charts:

Understanding how tax brackets work, in addition to which bracket you’re in, will help you make higher knowledgeable monetary choices, however you don’t must know methods to calculate tax brackets whenever you use TurboTax. TurboTax will robotically work out your tax bracket based mostly in your data, and provide the tax deductions and credit you deserve based mostly in your entries.

Don’t fear about understanding these tax guidelines. Meet with a TurboTax Full Service knowledgeable who can put together, signal and file your taxes, so that you might be 100% assured your taxes are finished proper. Begin TurboTax Reside Full Service as we speak, in English or Spanish, and get your taxes finished and off your thoughts.

We’ll do your taxes

and discover each greenback

you deserve

When your Full Service knowledgeable does your taxes,

they’ll solely signal and file after they understand it’s 100% right

and also you’re getting one of the best consequence doable, assured.

4 responses to “What’s a Tax Bracket?”