[ad_1]

How the 90/10 Technique Works

A typical utility of the 90/10 technique entails using short-term Treasury Payments (T-Payments) for the ten%, fixed-income part of the portfolio. Funding of the remaining 90% is in higher-risk (however low-cost) index funds.

For instance, an investor with a $100,000 portfolio electing to make use of a 90/10 technique would possibly make investments $90,000 in an S&P 500 index fund. The remaining $10,000 would possibly go towards one-year Treasury Payments, which in our hypothetical situation yield 4% every year.

After all, the “90/10” rule is merely a prompt benchmark, which can be simply modified to mirror a given investor’s tolerance to funding danger. Traders with decrease danger tolerance ranges can regulate decrease fairness parts to the equation.

As an example, an investor who sits on the decrease finish of the danger spectrum might undertake a 40/60 and even 30/70 cut up mannequin. The one requirement is that the investor earmarks the extra substantial portion of the portfolio funds for safer investments, similar to shorter-term bonds which have an A- or higher score

Calculating 90/10 Technique Annual Returns

To calculate the returns on such a portfolio, the investor should multiply the allocation by the return after which add these outcomes. Utilizing the instance above, if the S&P 500 returns 10% on the finish of 1 yr, the calculation is (0.90 x 10% + 0.10 x 4%) leading to a 9.4% return.

Nonetheless, if the S&P 500 declines by 10%, the general return on the portfolio after one yr can be -8.6% utilizing the calculation (0.90 x -10% + 0.10 x 4%).

Actual-World Instance of 90/10 Technique

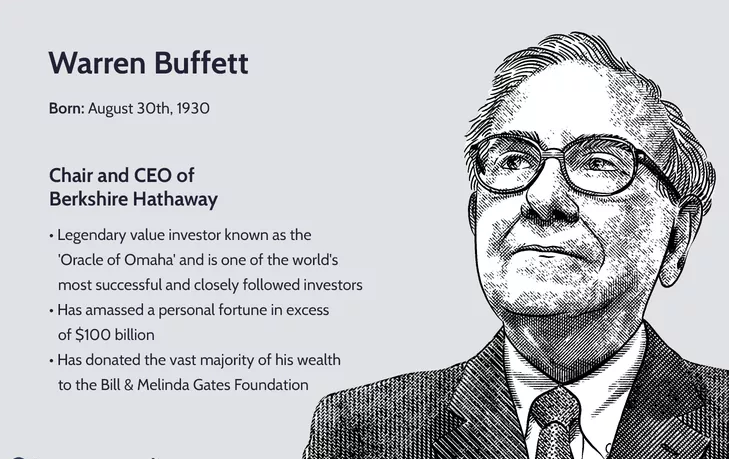

Buffett not solely advocates for the 90/10 plan in concept, however he actively places this precept into observe as reported in Berkshire Hathaway’s 2013 letter to shareholders. Most notably, Buffett makes use of the precept as a belief and property planning directive for his spouse, as specified by his will:

My cash, I ought to add, is the place my mouth is: What I counsel right here is actually an identical to sure directions I’ve laid in my will. One bequest gives that money will probably be delivered to a trustee for my spouse’s profit. (I’ve to make use of money for particular person bequests, as a result of all of my Berkshire shares will probably be totally distributed to sure philanthropic organizations over the ten years following the closing of my property.) My recommendation to the trustee couldn’t be extra easy: Put 10% of the money in short-term authorities bonds and 90% in a really low-cost S&P 500 index fund. (I recommend Vanguard’s.) I consider the belief’s long-term outcomes from this coverage will probably be superior to these attained by most traders—whether or not pension funds, establishments, or people—who make use of high-fee managers.1

Particular Concerns

There are variations of Buffett’s 90/10 investing technique that think about the investor’s age and danger tolerance. As an investor nears retirement, it is continuously a good suggestion to rebalance a portfolio to mirror a extra conservative method towards investing. The investor’s want to guard their nest egg so that they have funds to dwell on throughout retirement turns into paramount over the necessity for steady development. For that reason, the chances within the funding technique would possibly change significantly.

One method has the investor switching the allocations in order that 90% of funds are put in low-risk authorities bonds and 10% are invested in index funds. Moreover, traders who’re bearish might go for these allocation quantities as a part of a crash safety technique.

Different approaches change the chances for every funding kind relying on the investor’s danger tolerance mixed with different components, similar to their need to go away an property to their heirs or the supply of different belongings they’ll draw upon throughout retirement.

What’s the distinction between a Buying and selling robotic and a buying and selling technique?

In actual fact, nothing, this is similar buying and selling technique solely written in code. The robotic is devoid of feelings and prejudices, so it can undoubtedly comply with the technique. The second benefit is you could run the technique on historical past and see precisely whether or not it really works or not and how much revenue it brings and what dangers. If you wish to get your personal buying and selling technique, get one in all our methods already written within the type of a robotic. Our buying and selling methods embodied within the type of robots:

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

Scalper Lego – https://www.mql5.com/en/market/product/90776

Scalper Golden Gate – https://www.mql5.com/en/market/product/87986

EA Impuls Professional MT4- https://www.mql5.com/en/market/product/72402

EA Impuls Professional MT5 – https://www.mql5.com/en/market/product/72335

EA Pump and Dump MT4 – https://www.mql5.com/en/market/product/73165

EA Pump and Dump MT5 – https://www.mql5.com/en/market/product/72403?

[ad_2]