[ad_1]

One other day, one other contradictory financial information level. For the final a number of months, the U.S. financial system has been throwing off complicated and sometimes conflicting alerts about what’s to return. Some indicators present that the U.S. financial system is performing comparatively nicely, whereas others are flashing ominous indicators of a recession. So which is it? Is the U.S. heading in direction of a recession in 2023, or can the Federal Reserve really pull off the “tender touchdown” it has been aiming for?

For many of the final 12 months, I’ve been firmly within the “there will probably be a recession” camp, and I haven’t essentially modified my thoughts, however it’s unattainable to disregard a few of the better-than-expected financial information that has been launched lately. I’m not saying a tender touchdown will occur, however I do suppose it’s extra doubtless now than it was just some months in the past. Under, I’ll present proof for and towards a recession, and you may resolve for your self what you suppose will occur.

The Case for a Recession

Rising rates of interest

Any dialog a few recession has to begin with the Fed’s actions to boost rates of interest. Since March, the federal funds charge has risen from close to zero, to about 4.5%, in an effort to fight rampant inflation. Rising rates of interest make it dearer to borrow, which may cut back borrowing, spending, and funding. It will probably take months, and even years, for the financial cooling results of rising charges to take impact, and it’s very doubtless we now have not absolutely felt the affect of charge hikes that occurred months in the past—not to mention the truth that they’re nonetheless occurring.

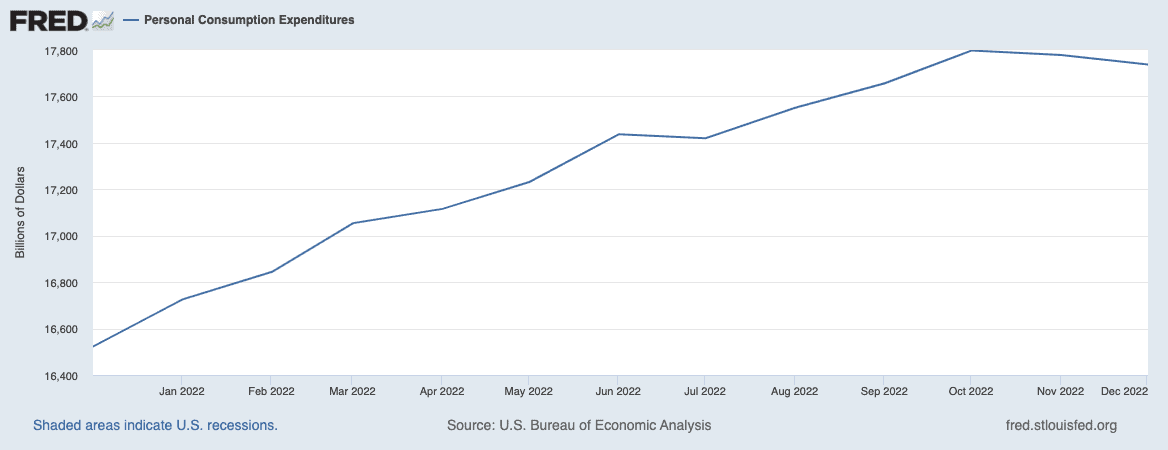

That mentioned, there are already indicators that financial exercise is slowing down. Notably, shopper spending has been down for the final two months.

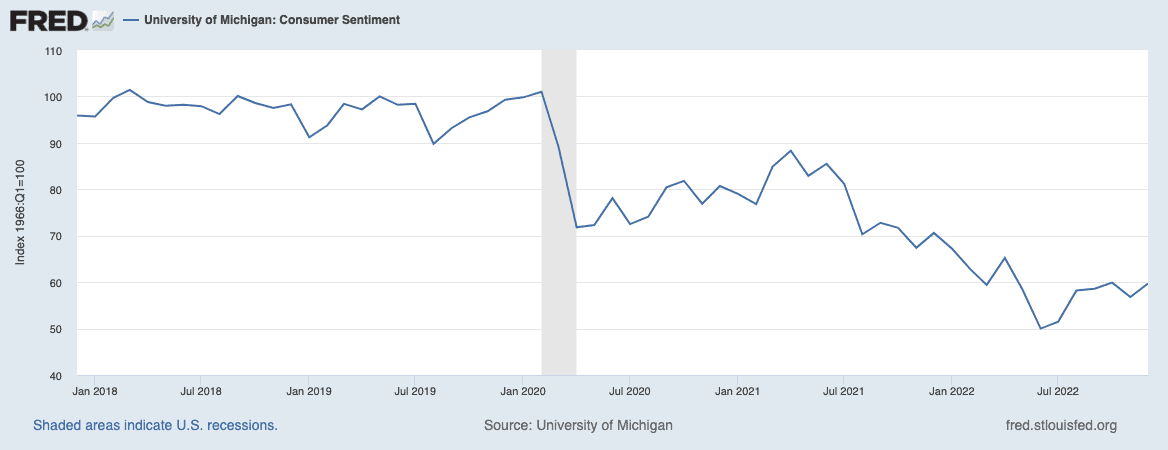

Declining shopper spending and sentiment

Shopper spending is the engine of the U.S. financial system, because it makes up roughly 70% of the gross home product (GDP). After years of excessive inflation, a foul 12 months for the inventory market in 2022, and quite a lot of financial pessimism, it looks like Individuals are chopping again on spending and bracing for troublesome occasions forward.

It’s value mentioning that though shopper sentiment has rebounded barely from summer time 2022 lows, it’s nonetheless extraordinarily low. Which means it’s not wanting doubtless shopper spending will choose up anytime quickly.

A puzzling labor market

The labor market is a puzzle proper now, however there have been some main high-profile layoffs over the past a number of months. The tech sector has been hit notably onerous with firms like Amazon, Microsoft, Google, Netflix, Spotify, and plenty of extra shedding massive swaths of extremely paid workers. We’re additionally seeing layoffs in some monetary {and professional} service sectors.

Whereas these layoffs haven’t impacted the unemployment charge simply but, there’s a common sense that that is simply the tip of the iceberg, and extra layoffs are forthcoming. Moreover, persevering with unemployment claims (those that have been searching for work for some time) have ticked up modestly of late, indicating that it’s taking laid-off staff longer to discover a new job. In fact, any vital will increase within the unemployment charge would tremendously enhance the probabilities of a recession.

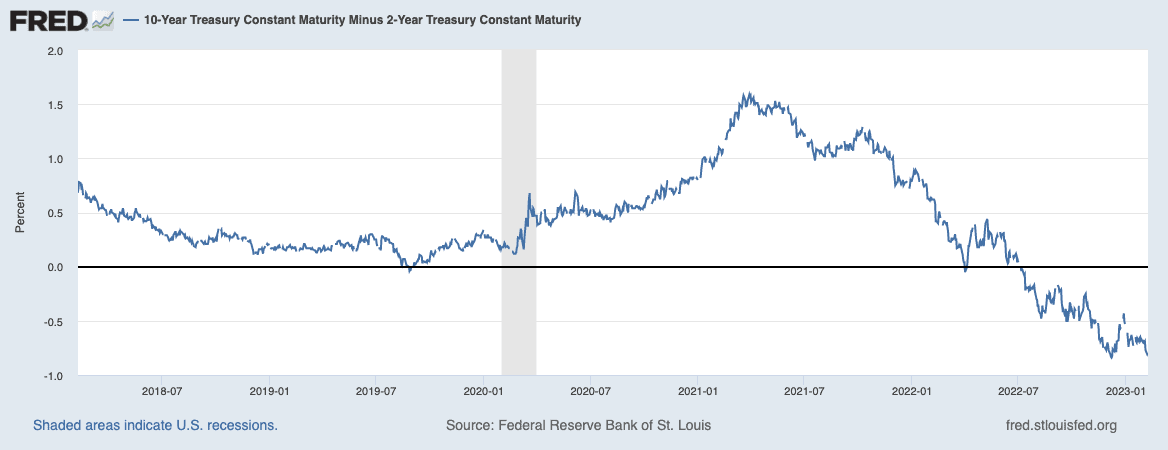

An inverted yield curve

Lastly, there’s the yield curve, some of the dependable predictors of a recession over the past 40 years. It predicted all however one recession precisely over that point. An inverted yield curve occurs when long-dated U.S. Treasury bonds yield greater than short-dated bonds.

That is uncommon as a result of long-dated bonds often supply greater yields because of the greater danger of inflation and default over an extended interval. The yield curve solely inverts when traders are betting on a decline in long-term rates of interest (attributable to an financial slowdown). Everyone knows the Fed is presently elevating rates of interest, however the yield curve tells us that traders are betting that there will probably be a recession and the Fed will in the end have to chop charges.

There are many different financial alerts that point out a recession, however these are a few of the clearest and most dependable datasets we now have.

The Case for a Mushy Touchdown

For months now, the Federal Reserve has been telling us that they’re aiming for and imagine a “tender touchdown” is feasible. A tender touchdown principally signifies that the financial system would cool off sufficiently to scale back inflation however not sufficient to trigger a recession. As I wrote above, I assumed this was fairly far-fetched just a few months in the past, however some information suggests a tender touchdown continues to be possible.

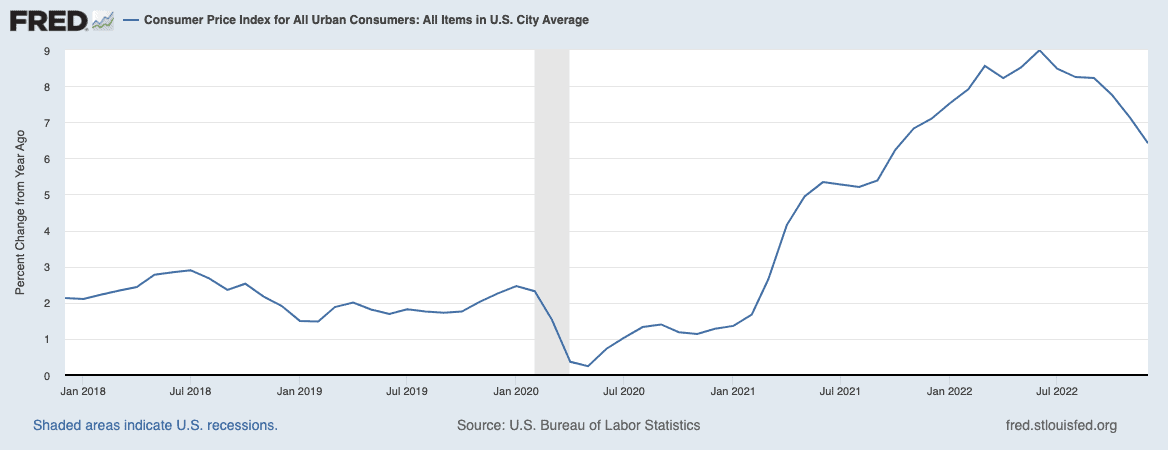

Declining inflation

Before everything, inflation is declining, as I’ve written about extensively. It’s nonetheless very excessive (final studying at 6.4% 12 months over 12 months), however the downward pattern is obvious, and the month-to-month readings have been very encouraging of late.

For the reason that major recessionary pressures on the financial system are inflation and the Fed’s actions to tame inflation, any discount within the inflation charge is optimistic information for the financial system. If the Fed stops elevating charges, it can take away quite a lot of uncertainty from the financial system, which may assist it stabilize.

A complicated however resilient labor market

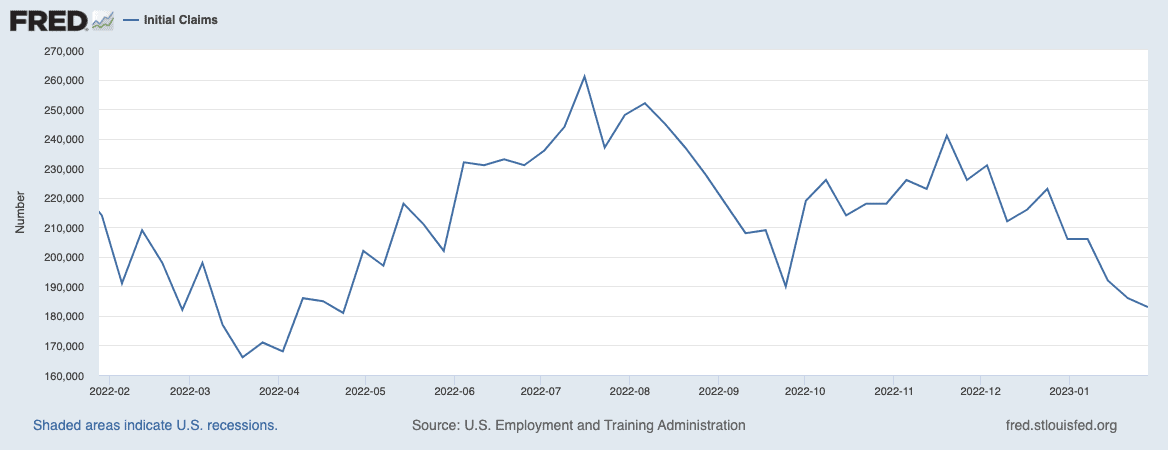

The second encouraging issue is the labor market. Sure, I do know I wrote that the labor market is displaying indicators of recession, however it’s all displaying indicators of resilience. It’s very complicated. Regardless of the high-profile layoffs which can be making headlines, there are indicators the labor market is doing fairly nicely. After rising over the summer time, the variety of preliminary jobless claims (individuals who declare unemployment advantages for the primary time) has been ticking down over the past couple of weeks.

There are nonetheless over 10.5 million job openings within the U.S., which far outnumbers job seekers. Because of this, the unemployment charge stays extraordinarily low, at 3.5% (as of December 2022). In fact, there’s a massive query of whether or not the open jobs line up with the job seekers, and as I discussed above, extra layoffs may very well be across the nook. However whichever manner you take a look at it, the labor market has proven super resilience up so far.

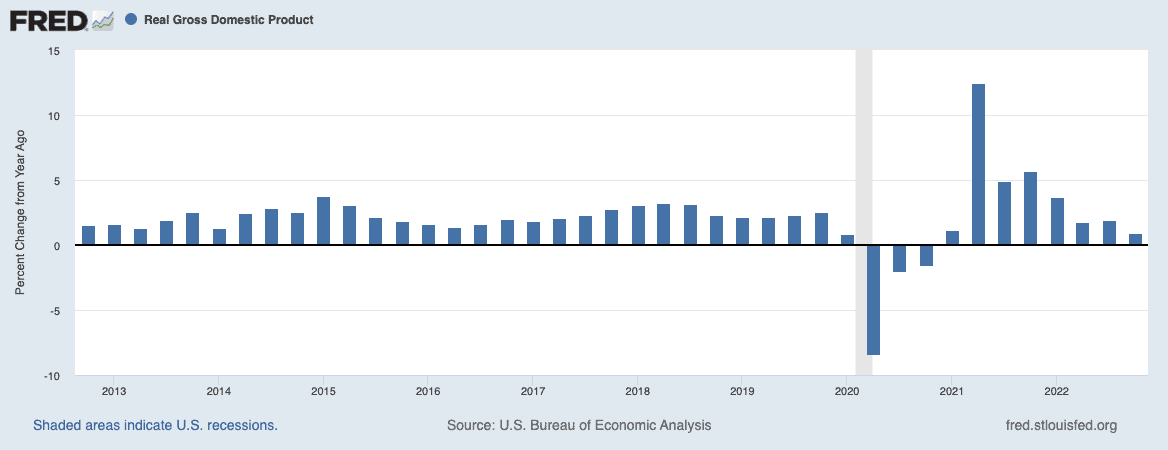

GDP development

Lastly, GDP is rising, even in inflation-adjusted phrases. Actual GDP grew at a 2.9% annualized charge in This autumn, which is principally the antithesis of a recession. Essentially the most generally accepted definition of a recession is 2 consecutive quarters of GDP decline (although that’s not technically how recessions are decided). By that measure, the U.S. is unquestionably not in a recession.

It’s value noting that the majority economists calling for a recession in 2023 are saying it can come within the second half of the 12 months, so GDP development in This autumn of 2022 just isn’t precisely shocking. That mentioned, GDP development is an effective signal for the financial system, in my view.

What Do The Specialists Say?

Regardless of some comparatively good financial information of late, over 70% of surveyed economists nonetheless imagine a recession will happen, in response to a Bloomberg ballot. Each economist does have a special opinion. Nonetheless, the overall consensus of those that imagine there will probably be a recession is that we haven’t but felt the complete affect of excessive rates of interest. We’ll see additional declines in shopper spending and better unemployment all through 2023.

That mentioned, even some detractors admit {that a} tender touchdown is possible. Jason Draho, an economist and Head of Asset Allocation Americas for UBS International Wealth Administration, lately mentioned, “The potential of getting a tender touchdown is larger than the market believes. Inflation has now come down sooner than some lately anticipated, and the labor market has held up higher than anticipated.”

Mark Zandi of Moody’s Analytics lately coined the time period “slowcession” to explain what he thinks will occur: a slowing of the financial system to a close to halt, however with out really going backward.

What Does This All Imply?

In fact, nobody is aware of for positive what’s going to occur over the approaching 12 months, however I feel it’s more and more doubtless that we’ll see a comparatively modest consequence—both a tender touchdown with very minimal development or a recession that isn’t too deep. We regularly like to have a look at issues in black and white and say that it’s “recession or not,” when in actuality, there are various shades of grey.

It’s doubtless we’ll land in a shade of grey.

In fact, issues may change. There are lots of geopolitical dangers, and if the labor market actually breaks or the inventory market dives even farther from right here, there may very well be a deep recession.

For actual property traders, it’s necessary to know that financial slowdowns have a tendency to return with decrease mortgage charges. So whereas nobody needs to be rooting for a recession, there’s an fascinating dynamic at play for actual property traders.

It’s typically mentioned that housing is “first in and first out” in a recession. As a result of actual property is a extremely leveraged asset, throughout a rising rate of interest setting, housing exercise tends to decelerate first. Housing makes up about 16% of GDP, so when housing slows, it could pull the remainder of the financial system right into a recession. As soon as the financial system is in a recession, rates of interest are likely to fall, making mortgages cheaper, and homes extra inexpensive. This will result in an uptick in shopping for amongst householders and actual property traders, and that uptick in housing exercise may also help pull the remainder of the financial system out of a recession. First one in, first one out.

We’re already beginning to see this in some methods. Housing has slowed down over the past couple of months. Mortgage charges are down from the place they had been in November, but when we see a recession, they may come down much more. Mixed with falling housing costs, this might create nice shopping for alternatives that might pull the financial system out of the recession.

In fact, this is only one situation, however it’s the one I see because the almost certainly at this level.

Extra from BiggerPockets: 2023 State of Actual Property Investing Report

After years of unprecedented development, the housing market has shifted course and has entered a correction. Now could be your time to take benefit. Obtain the 2023 State of Actual Property Investing report written by Dave Meyer, to search out out which methods and techniques will revenue in 2023.

What do you suppose will occur in 2023? Do you suppose we’ll see a tender touchdown? A recession? Or one thing within the center. Let me know within the feedback under.

Word By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]