[ad_1]

On the subject of doing all of your taxes, it’s pure to really feel stressed. Though most individuals can breathe a sigh of reduction after submitting their annual returns, tens of tens of millions of taxpayers face quite a lot of tax issues that reach the stress yearly.

We go excessive tax issues Individuals face right this moment that can assist you put together for no matter might come your approach. Be taught what every downside is and tips on how to remedy them with our useful tax suggestions.

Hoping to keep away from these tax points altogether? TurboTax helps you precisely report your revenue, declare deductions, and credit so that you could really feel assured about submitting.

High Tax Points Taxpayers Face At this time

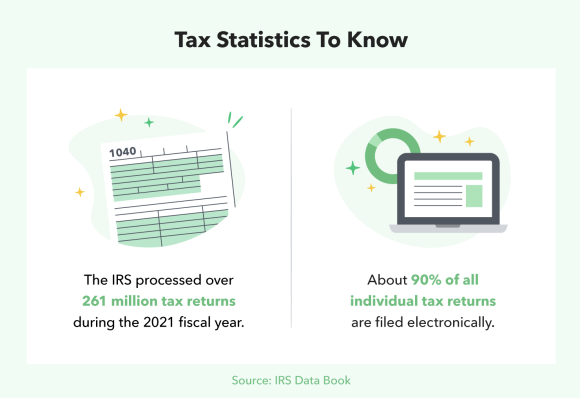

After digging into the newest knowledge from the IRS, we’ve compiled probably the most prevalent tax issues affecting taxpayers right this moment. Be happy to take a look at the desk beneath for a fast snapshot of every downside or scroll right down to learn extra particulars about each.

Notice: All statistics on this put up are from the IRS Knowledge E-book, except one other supply is listed.

1. Tax Penalties

If you fail to adjust to the tax code, you’re topic to IRS penalties. Penalties exist for not following submitting, reporting, or fee necessities outlined by the IRS. The everyday consequence for tax code errors is a civil penalty. And although it’s not frequent, prison prosecution can be attainable relying on the circumstances.

In 2021, the IRS assessed almost 41 million civil penalties amounting to $37 billion in taxpayer {dollars}. About 82% of those penalties got here from particular person and property and belief tax returns. Of the person and property and belief penalties, the 2 most typical had been for failing to pay (51%) and estimated tax penalties for self-employed people (33%).

Examples:

- Failure to pay penalty

- Estimated tax penalty

- Failure to file penalty

- Unhealthy verify penalty

The way to repair it:

If you happen to obtain a discover of a tax penalty from the IRS, you must adjust to all directions. You’ll wish to learn by the letter to confirm that the knowledge is appropriate and ensure to reply by the desired date.

For instance, in the event you acquired a penalty for tax non-payment, you may both pay what you owe or request a penalty waiver. If you happen to’re requesting penalty reduction, ensure you collect the required documentation to assist your declare.

2. Unpaid Taxes

Final 12 months, near 17 million taxpayers filed their tax returns, owed extra taxes, and didn’t pay by the deadline. When you have got unpaid taxes, you’re hit with a 0.5% penalty for each month the quantity isn’t paid in full. On high of this, the IRS will cost curiosity on the steadiness you owe.

At present, the IRS is making an attempt to gather $133 million in owed taxes, penalties, and curiosity from over 10 million delinquent accounts. If you happen to’re on this state of affairs, discover out about your choices for resolving this situation beneath.

The way to repair it:

The very best plan of action to resolve unpaid taxes is to pay the total quantity to the IRS as quickly as attainable. Doing so will imply that you simply owe much less in added penalties and curiosity over the long run.

Not everybody pays in full instantly, so take a look at these different choices for fixing unpaid taxes.

3. Math Error Notices

There are a selection of the reason why individuals discover doing their taxes irritating and crunching the numbers is one in every of them. Final 12 months, the IRS despatched math error notices to over 12 million taxpayers for errors like computational errors, incorrect values, lacking entries, and failing to fulfill eligibility necessities. Meet with a TurboTax Professional who can put together, signal and file your taxes, so that you may be 100% assured your taxes are completed proper. Begin TurboTax Dwell Full Service right this moment, in English or Spanish, and get your taxes completed and off your thoughts.

On the subject of math errors, the IRS has extra freedom to go forward and proper your errors with out you having to regulate something. Learn the part beneath to see what you’ll want to do in the event you get a math error discover within the mail.

The way to repair it:

If you obtain a math error discover, learn it fastidiously. Relying on which discover you acquired, you could owe taxes, have your refund adjusted, or your tax steadiness could also be zero (i.e., you don’t owe something but in addition don’t get a refund).

It is advisable to reply to the discover inside 60 days of receiving it. If you happen to owe taxes, you must pay them by the deadline. If you happen to don’t owe something, you continue to want to reply, however you gained’t must pay.

4. Non-Filers

Yearly, tens of millions of people and companies fail to file their required tax returns by the tax deadline. The IRS makes use of third-party info returns (e.g., W2s or 1099s) to establish non-filers, create substitute tax returns, and assess what taxes, penalties, and curiosity are owed.

Based mostly on the newest knowledge, there are roughly 9 million taxpayers which might be particular person non-filers. There have been additionally 71 million enterprise non-filers, which is near a 42% enhance from the earlier 12 months. To keep away from getting in additional tax hassle, discover ways to repair this downside beneath.

The way to repair it:

If you happen to missed the common or prolonged tax deadline, you must file your taxes as quickly as attainable. Then it’s essential to pay any taxes owed in full, as quickly as you may. You’ll be charged a failure to file penalty of 5% on any excellent taxes for every month you’re late, along with curiosity.

If in case you have but to file however don’t owe taxes (i.e, you anticipate a refund), you gained’t be charged any penalties or curiosity.

5. Tax-Associated Identification Theft

Tax-related id theft occurs when somebody steals your private info (e.g., your Social Safety quantity) to file a tax return and fraudulently declare a tax refund. Thousands and thousands of Individuals are suspected to be or are victims of tax-related id theft yearly.

In 2021, the IRS issued almost 5 million Identification Safety Private Identification Numbers (IP PIN) to taxpayers coping with id theft. IP PINs assist confirm your id with the IRS so that you could file your return.

The way to repair it:

It’s necessary to nonetheless file your taxes on time, even in the event you’re the sufferer of tax-related id theft. You need to obtain a CP01A Discover containing your IP PIN, and you should use it to file your taxes. If you happen to want an IP PIN, use the IRS’s Get an IP PIN software to acquire one.

Keep in mind to reply instantly to any notices from the IRS, and don’t neglect to go to IdentityTheft.gov to be taught what steps you must take to guard your different monetary info as a sufferer of id theft.

6. Underreported Earnings

When a person’s tax return doesn’t match third-party info returns, that is thought of underreported revenue. Underreported revenue is the main contributor to America’s tax hole, which is the distinction between the quantity of taxes owed to the federal government and the quantity that’s truly paid voluntarily and on time.

Not solely is the tax hole a considerable amount of misplaced income, however the IRS should additionally spend time and assets on resolving revenue discrepancies. In 2021, over two million circumstances had been closed underneath the IRS’s Automated Underreporter Program, but it surely’s nonetheless estimated that $600 billion is misplaced yearly.

The way to repair it:

If you happen to’ve acquired a Discover of Underreported Earnings (Discover CP2000), you must evaluate the knowledge fastidiously earlier than deciding tips on how to reply. If you happen to agree with the proposed modifications, mark this in your response and ship it out on time. You’ll must pay any excellent taxes, penalties, and curiosity.

Even in the event you disagree with the discover, you must nonetheless reply on time and supply an evidence of why you disagree and any supporting paperwork. From there, you’ll work with the IRS to resolve any discrepancies.

7. Tax Audits

A latest tax refund stress survey discovered {that a} quarter of American taxpayers are frightened {that a} mistake on their annual tax return will trigger them to get audited by the IRS. In actuality, a lot fewer individuals are truly audited. Actually, lower than one p.c (~739,000 taxpayers) had been audited in 2021.

Though tax audits sound scary, they’re actually simply an examination of your tax return. The IRS checks your return to guarantee that the knowledge you report is verified and correct. Find out about what to do in case the IRS audits your tax return beneath.

The way to repair it:

First, learn by your letter to see what info the IRS is requesting from you. Subsequent, you’ll want to collect your requested paperwork and ship them to the IRS for verification. Ensure you reply in a well timed method and don’t miss the deadline laid out in your letter.

Audits conclude in one in every of 3 ways: no change, agreed, or disagreed.

- No change implies that your info is verified and no modifications are wanted.

- Agreed implies that you perceive and settle for the IRS’s proposed modifications.

- Disagreed means you perceive however don’t settle for their proposed modifications, and can bear additional evaluate.

Don’t neglect you can contact TurboTax Audit Help for assist in the event you’re ever uncertain of what to do with a tax audit.

How To Clear up Tax Issues: 4 Important Ideas

Whether or not you’re coping with a tax audit or have unpaid taxes, tax issues could seem formidable to resolve. It’s necessary to take a deep breath and do not forget that these points are extra frequent than you’d assume. Comply with the following tips that can assist you down the proper path to repair your state of affairs.

Get Began As Quickly As Attainable

If you happen to’ve acquired a discover or letter from the IRS, plan to reply by the designated deadline. Replying in a well timed method and supplying the required documentation helps keep away from miscommunication with the IRS.

The IRS will study your response and any proof you offered to again up your claims. This course of can take months to resolve, and beginning instantly prevents it from happening longer than is critical.

Perceive the Downside

Understanding the difficulty is important to resolving it. At all times learn your letter fastidiously to see what the tax downside is and what steps you must take to repair it. Even in the event you don’t agree with it, comply with all directions for responding and supply proof and data that again up your declare.

Discover the Greatest Resolution for Your Scenario

Keep in mind to all the time do a little analysis on what options can be found to you. It’s attainable to enchantment many varieties of tax issues like a tax audit or underreported revenue. You may also talk about methods to waive penalties or accommodate your monetary state of affairs by fee plans.

Discuss to A TurboTax Professional

Meet with a TurboTax Professional who can put together, signal and file your taxes, so that you may be 100% assured your taxes are completed proper. Begin TurboTax Dwell Full Service right this moment, in English or Spanish, and get your taxes completed and off your thoughts.

[ad_2]