[ad_1]

My morning practice WFH reads:

• Crypto’s Anti-Institution Zeal Runs Headfirst Into Chapter Forms: Indignant retail buyers are talking up in advanced authorized brawls over the stays of Voyager, Celsius and BlockFi. (Businessweek)

• SPACs Delivered Simple Cash, however Now Firms Are Operating Out: Companies are burning by money raised in SPAC offers with few methods to fill the hole. (Wall Avenue Journal) see additionally Why Most SPACs Suck (2020): Most SPACs are subpar. However right here’s a unclean little secret: Most funding merchandise are at greatest mediocre. They are usually costly and underperform versus a easy passive index. (The Massive Image)

• The Greatest No-Brainer Funding Proper Now? It is sensible buyers are contemplating making a swap from a complete bond market index fund to some kind of money equal — T-bills, CDs, cash market funds, on-line financial savings accounts, and so on. You will get yields within the 4-5% vary in cash-like automobiles and also you don’t have to fret about period or volatility from adjustments to rates of interest. (A Wealth of Widespread Sense)

• How A lot Can We Take? I don’t know the place the tipping level is, however the obvious reply to this query is much more than anybody thought. Issues aren’t excellent, however we recovered all the roles misplaced in the course of the pandemic, the unemployment fee remains to be close to report lows, and inflation goes in the fitting course. (Irrelevant Investor)

• When Will I Retire? How About By no means: For many individuals, the thought of stopping work is a nonstarter—an inevitable path to boredom, ailing well being and a life devoid of which means. (Wall Avenue Journal)

• Musk Bets the Home of Tesla on Low Costs and Razor-Skinny Margins: The person who upended the auto business is now providing steep reductions for his electrical automobiles. Is that this extra disruption, or desperation? (Businessweek)

• Somebody has to run the fabs: Egalitarianism is essential however we neglect STEM training at our peril. (Noahpinion)

• Disney lawsuit reveals Ron DeSantis at his bullying, bumbling worst: The 77-page authorized criticism, filed in federal courtroom in Gainesville, Fla., goals to cease what it phrases “a focused marketing campaign of presidency retaliation — orchestrated at each step by Gov. DeSantis as punishment for Disney’s protected speech.” (Los Angeles Instances) see additionally Disney’s had sufficient — it’s taking Ron DeSantis to courtroom: In a brand new lawsuit, Disney accuses DeSantis of “a focused marketing campaign of presidency retaliation.” (Vox)

• Crimson States Are Attempting To Battle The World On Local weather: “You may take a look at the EPA web site and see all of what they’re against … carbon, methane. All this stuff immediately have an effect on … our main industries in our state, our oil business, our ag[ricultural] business.” (FiveThirtyEight)

• Molly Ringwald bites again: ‘I used to be projected because the candy American lady subsequent door. It wasn’t me’: Hollywood success within the 80s was so disagreeable that Ringwald moved to France. Since then she has made a jazz album, written a novel and translated a memoir about Final Tango in Paris star Maria Schneider. (The Guardian)

You’ll want to take a look at our Masters in Enterprise subsequent week with Ben Clymer, founder & chairman of Hodinkee, and Jeffery Fowler the agency’s CEO. Fowler and Clymer (dubbed the “Excessive Priest of Horology“) talk about all issues wristwatches and timepieces, together with their experiences on the 2023 Watches & Wonders, why {the marketplace} has exploded over the previous few years, and what are their favourite grail watches.

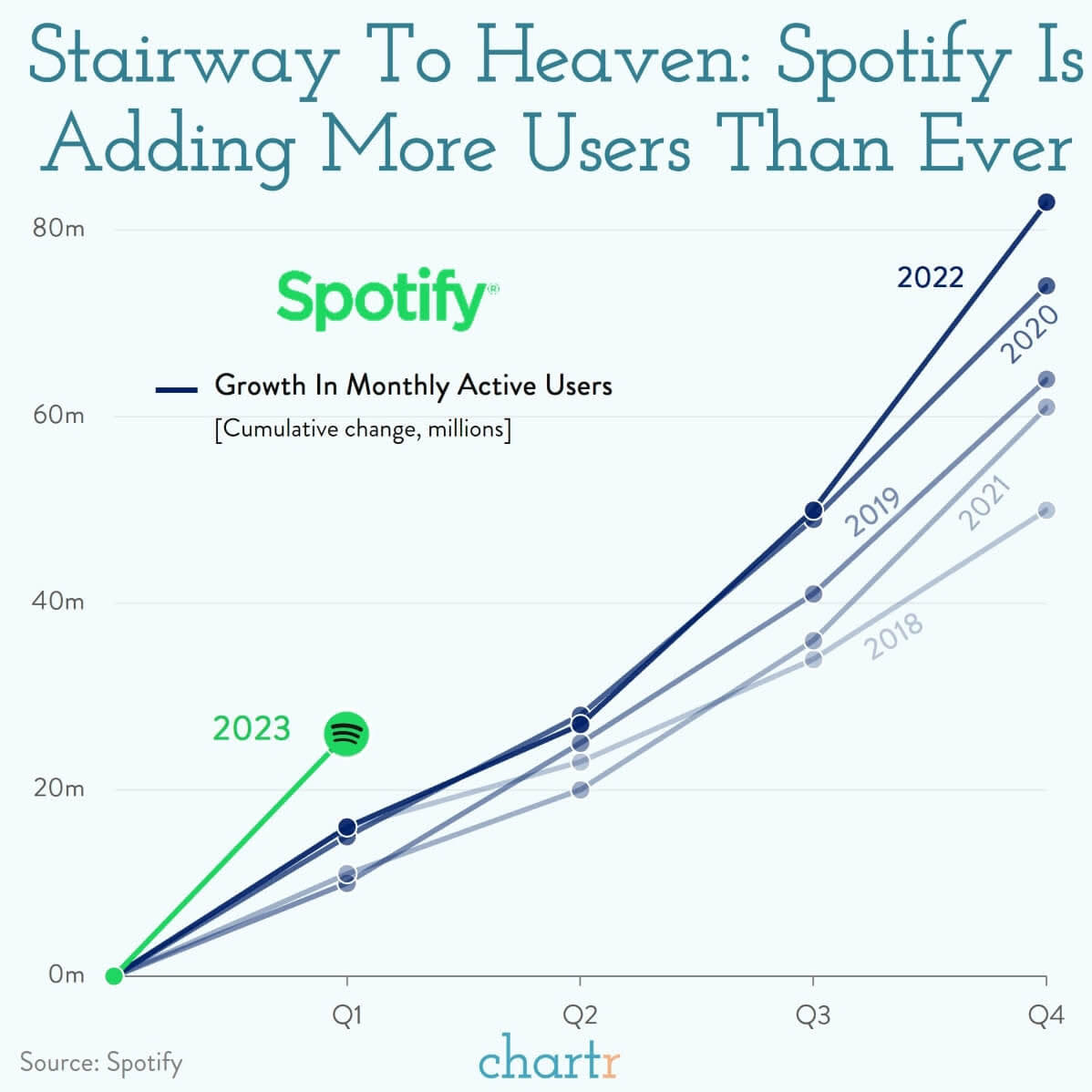

Spotify has reached half a billion month-to-month energetic listeners

Supply: Chartr

Join our reads-only mailing record right here.

[ad_2]