[ad_1]

My morning practice WFH reads:

• 5 Clues This Isn’t Only a Bear Market Rally: The S&P 500 is up 17% from the October lows, the identical magnitude because the 17% rally we noticed final summer time. Again then, shares rolled again over and made new lows, one thing most strategists on television are saying will occur once more. Properly, the details are altering for us, and as Keynes instructed us within the quote above, we had higher change our minds as effectively. So listed below are 5 clues that this rally is on firmer footing and can seemingly proceed. (Carson)

• Don’t consider what anybody says in regards to the economic system. Together with me. It’s one of the best of instances, the worst of instances, the spring of hope, the winter of despair. Everyone seems to be wanting on the similar set of numbers and one way or the other coming to reverse conclusions. (Washington Put up) however see additionally One believable rationalization for this too-good-to-be-true economic system: Probably the most believable rationalization of all is that the pandemic and subsequent restoration have been so uncommon that the conventional guidelines of economics don’t apply. (Washington Put up)

• Container Transport Prices Plunge as Shopper Spending Declines: “The worth of delivery items on important international commerce routes has fallen 85% under its peak as the price of dwelling disaster hits client spending + pandemic-related provide chain disruption eases.” (Monetary Instances)

• You May Dwell to 100. The Trick Is Not Working Out of Cash. You May Dwell to 100. The Trick Is Not Working Out of Cash. (Barron’s)

• New Automobiles Are Just for the Wealthy Now as Automakers Rake In Income: With pandemic-era chip shortages fading, producers are maintaining inventories low — and costs excessive. The shift to EVs will make issues worse. (Bloomberg)

• Bosses wish to pay you extra however offer you much less: A rising variety of staff are going freelance, taking larger wages over advantages and job safety. (Vox)

• ‘I’ll name an Uber or 911’: Why Gen Z doesn’t wish to drive. Zoomers are shunning automobiles and driver’s licenses. Will it final? (Washington Put up) see additionally 10 guidelines of productive on-line communication – gen Z version: A decade from now, this piece will almost definitely develop into outdated. I’m excited to see how will probably be renovated sooner or later. (Many One Percents)

• Is an Arctic ‘Chilly Battle’ coming? How local weather change and the struggle in Ukraine are driving tensions. Melting ice and geopolitics are making for a harmful combine on the “prime of the world.” (Grid)

• Astronomers Uncover Our Photo voltaic System Has a Mysterious ‘Ghostly’ Glow: After accounting for all identified mild sources, there’s nonetheless mild leftover—equal to the glow of 10 fireflies in a darkish room. The place is it coming from? (Fashionable Mechanics)

• The Many Methods LeBron James Can Rating: The Los Angeles Lakers star’s recreation has advanced over the previous 20 years, making him a risk from everywhere in the courtroom — regardless of how previous he will get. (New York Instances)

Be sure you try our Masters in Enterprise interview this weekend with Tim Buckley, CEO of the Vanguard Group, which manages $7.2 trillion in belongings. He started his profession at Vanguard 32 years in the past as an assistant to then Chairman John Bogle. He beforehand served roles as Chief Data Officer, in addition to Chief Funding Officer.

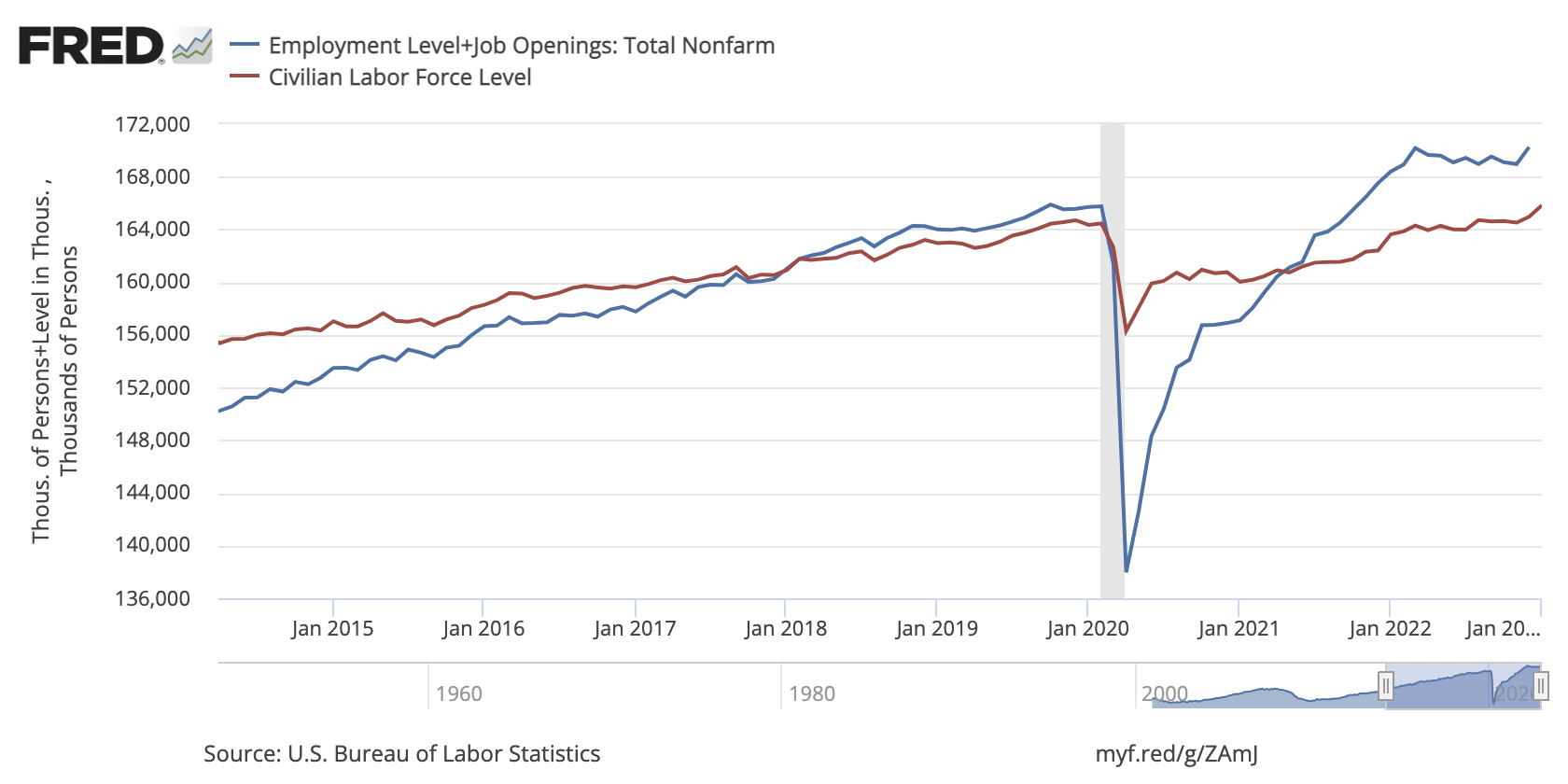

Are labor provide and labor demand out of steadiness?

Supply: FRED

Join our reads-only mailing listing right here.

[ad_2]