[ad_1]

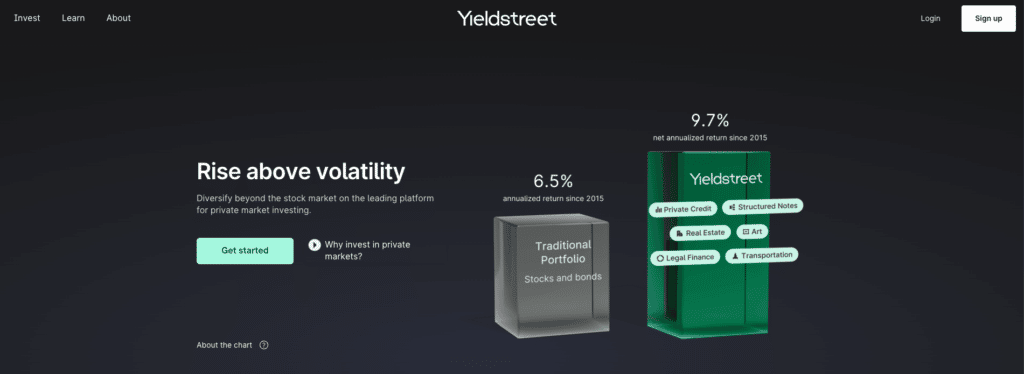

All of us witnessed the inventory market’s volatility in 2022, as hovering inflation led to aggressive charge hikes over the course of the yr. Many shares plummeted, with traders promoting off their shares attributable to considerations a few potential recession. These fears have many traders involved about the place to take a position their cash in 2023.

When you’re bored with watching your inventory investments drop in worth and are on the lookout for a option to diversify, you might need to take into account various investments. A method to do this is thru Yieldstreet.

- Entry to big range of other asset lessons

- Entry to ultra-wealthy investments

- Can make investments for revenue or development

What Is Yieldstreet?

Yieldstreet is an alternate funding platform for individuals seeking to diversify past mainstream investments, like shares and bonds. Yieldstreet investments range from paintings to multi-family actual property properties.

Yieldstreet is right for classy traders prepared to tackle riskier tasks they will’t discover elsewhere, with the potential for greater returns. With over 400,000 traders, Yieldstreet’s platform is exclusive for its various funding automobiles. As a result of the platform holds numerous property – actual property, cryptocurrencies, paintings, and extra – the common person holds about seven investments.

You’ll be able to construct a customized Yieldstreet portfolio beginning at $10,000 throughout numerous asset lessons as an accredited investor.

There’s additionally an possibility for non-accredited traders to get entangled by investing a minimal of $2,500 in Yieldstreet’s Prism Fund. The fund allocates the cash in direction of artwork, business property, client, authorized, and company asset lessons.

Key Options of Yieldstreet

| Minimal funding | $2,500 for the Prism Fund. $10,000 for all different funding choices. |

| Administration charges | 1.5% for the Prism Fund. 0% to 2.5% administration payment for different investments. |

| Customer support choices | Stay chat or e mail [email protected] |

| Cellular app availability | iOS and Android |

| Promotions | None can be found right now. |

Yieldstreet Options

You could surprise what makes Yieldstreet stand out from different investing platforms. Listed below are some key options the platform has to supply.

Distinctive Asset Courses

The reality is that almost all of us solely have entry to sure funding automobiles, whereas different property have been reserved for the rich or business functions. Yieldstreet permits you to put money into property like personal artwork and revenue notes that you simply gained’t discover wherever else.

Once you undergo the Yieldstreet choices, you’ll be able to filter your outcomes by asset lessons, together with artwork, crypto, authorized, multi-asset class fund, personal credit score, personal fairness, actual property, short-term notes, transportation, and enterprise capital.

You may as well choose your most popular funding technique from the next choices:

- Earnings. For traders seeking to generate revenue with set distribution funds.

- Progress. Investments that ought to acquire worth all through the time period.

- Stability. For traders who need a mixture of development and revenue all through the funding time period.

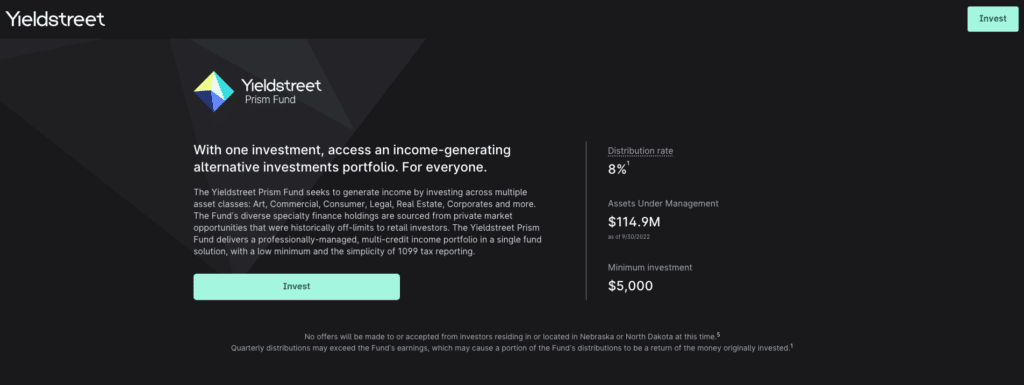

The Yieldstreet Prism Fund

This fund is for non-accredited traders seeking to get began with distinctive funding choices. The Yieldstreet Prism Fund affords a professionally managed, multi-credit revenue portfolio below one fund. You’ll be able to make investments $2,500 or extra, and it comes with 1099 tax reporting.

As of September 2022, this fund has $114.9M in property below administration and an 8% distribution charge. The distributions are made quarterly each February, June, September, and December and are routinely reinvested into Yieldstreet’s Dividend Reinvestment Program (DRIP) until you opt-out.

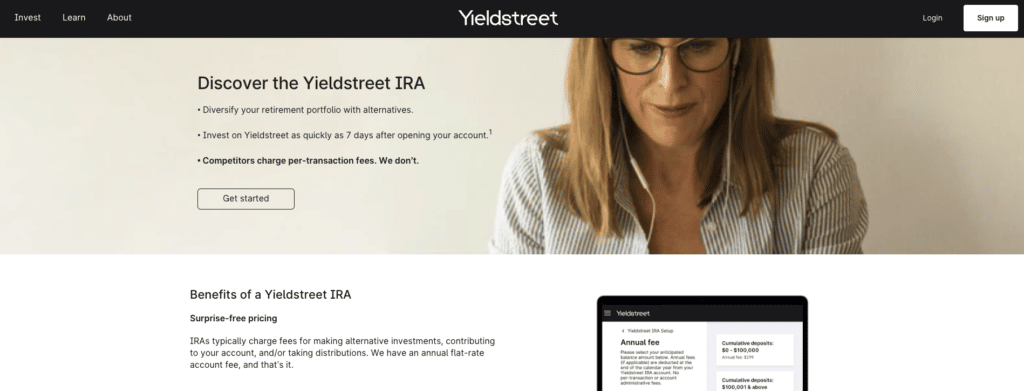

Yieldstreet IRA

The Yieldstreet IRA permits you to put money into various property whereas guaranteeing that your investments are tax-efficient so you’ll be able to hold extra of your cash in the long run.

The Yieldstreet IRAs mean you can diversify your portfolio with out worrying about getting hit with per-transaction charges. Account balances of $100,000 or much less have a flat payment of $299, whereas account balances of $100,001 and better include a payment of $399.

Yieldstreet helps each Conventional and Roth IRAs, and clients who want to switch a 401k or different IRA account to Yieldstreet can accomplish that.

Yieldstreet Pockets

One other good thing about signing up for an account with Yieldstreet is that you would be able to entry a checking account with a better rate of interest than you’d in any other case discover.

Your Yieldstreet Pockets is an FDIC-insured checking account with Evolve Financial institution & Belief. You’ll be able to at present earn an APY of two.75% in your Yieldstreet Pockets, and also you routinely get your pockets account when your investor account is activated. There aren’t any account minimums or limits, so you’ll be able to maintain your money there whereas increase the capital to your subsequent funding.

Yieldstreet Charges

You’ll pay charges to take a position with Yieldstreet. The choices you see include an annual administration payment that ranges from 0 to 2.5%, as acknowledged within the providing particulars.

There are additionally annual fund charges that traders pay which come out of the money circulation from the funding, and the charges depend upon the authorized construction of each give you see. This payment construction additionally implies that the marketed internet goal returns you see on all choices listed on the platform are internet of the administration payment.

The Yieldstreet Prism Fund has a $2,500 minimal requirement to get began and a payment of round 1.5% yearly on the cash invested.

Yieldstreet Execs & Cons

As with all funding platform, there are execs and cons that you need to take into consideration earlier than investing your hard-earned cash.

The professionals of utilizing Yieldstreet:

- Entry to various investments. There aren’t many platforms that mean you can put your cash into artwork, crypto, personal fairness, and enterprise capital all on one platform.

- You’ll be able to diversify your portfolio. We’ve all seen the advantages of diversification through the risky occasions available in the market. When you’re able to shift a few of your cash away from shares, Yieldstreet gives a number of various funding automobiles.

- You’ll be able to flick through provide particulars with out signing up. Skim via the Yieldstreet choices to see the obtainable info, together with funding sort, minimal funding, time period, cost schedule, and tax paperwork.

Listed below are the cons of utilizing Yieldstreet:

- It’s a must to wait to see any returns in your cash invested. Some platforms will start paying dividends inside three months, whereas Yieldstreet requires investing for an prolonged interval on some holdings.

- The investments are illiquid. You’ll be able to’t money out after a yr, so that you’re locking your cash up for an prolonged time (until you put money into the Prism Fund).

- A sure diploma of experience is required. Wanting via the funding choices, it’s evident that you simply want some understanding of superior investments. For instance, placing $15,000 into automotive insurance coverage financing with a 5.5-year time period is a complicated proposition for the common investor.

Yieldstreet Alternate options

Earlier than you signal on with Yieldstreet, I like to recommend testing some related platforms. And whereas Yieldstreet is fairly distinctive in its providing, appropriate options for actual property investing exist. Fundrise and HappyNest are two that you need to take into account.

Fundrise

Fundrise is a high various to Yieldstreet as a result of it permits you to start investing for as little as $10. When you’re seeking to dip your toes in the true property crowdfunding market, you can begin with Fundrise.

The numerous distinction between the 2 investing platforms is that you simply don’t have to take a position $10,000 to begin at Fundrise. It additionally has a clear payment construction for its REITs, charging solely 0.85% in annual administration charges.

Fundrise touts that you would be able to earn wherever from 8-10% in dividends, and the corporate has been round for over a decade now with a confirmed, profitable observe report. What Fundrise lacks is the number of asset lessons that Yieldstreet affords.

- * Put money into actual property with $10

- * Open to all traders

- * On-line simple to make use of website and app

HappyNest

HappyNest is much like Fundrise as a result of you may get began with as little as $10. With a user-friendly cell app, HappyNest is straightforward sufficient to navigate, even when you’re intimidated by the idea of actual property crowdfunding.

With the round-up financial savings function, you’ll be able to join your debit card to the HappyNest app and spherical up each buy to the following greenback. When this round-up pool reaches $5, the app routinely invests the cash into shopping for extra shares.

The main setbacks of utilizing HappyNest are that the app doesn’t have a confirmed observe report but, and there are fewer funding choices. You definitely gained’t discover the distinctive choices right here which can be current on Yieldstreet.

It’s price mentioning that the competitors varies inside the true property funding area, and there are funding apps for each profile and finances.

Yieldstreet FAQs

With over 400,000 customers and $3 billion invested in funds, Yieldstreet is legit and has many opinions you could find on-line. The corporate has a confirmed observe report, and a 3rd get together audits them for client security.

Whereas the Yieldstreet platform is protected to make use of, you have to do not forget that each funding comes with an inherent threat. Investing in property like artwork or enterprise capital comes with a wholly new stage of threat since most traders don’t perceive these industries strongly.

There are 5 phases to the Yieldstreet vetting course of: origination and screening, due diligence, evaluation, committee evaluate, and investor choice. These phases guarantee choices have gone via correct scrutiny.

Yieldstreet is an SEC-regulated entity that should adjust to all SEC guidelines and laws. The monetary statements of the choices on the platform are audited yearly by a third-party auditor, Deloitte & Touche LLP. These audits are then made public to all present Yieldsreet traders for full transparency.

Contemplating your threat profile is at all times vital as a result of investing in various property like revenue notes or artwork debt will include considerations. Any time you make investments your cash in one thing you don’t perceive, issues can come up.

Yieldstreets affords the vast majority of its merchandise solely to accredited traders. Nevertheless, the Prism Fund is out there to non-accredited traders.

Yieldstreet permits you to put money into a number of asset lessons, together with actual property, enterprise capital, personal fairness, personal credit score, paintings, short-term notes, and revenue notes.

The returns differ for each funding on the platform, and Yieldstreet doesn’t assure any particular returns.

Every provide contains an annual administration payment and an annual money yield vary. Nevertheless, not one of the returns are assured.

The Backside Line on Yieldstreet

If you wish to unfold your portfolio throughout asset lessons, Yieldstreet could be a handy means to do this. Different crowdfunded actual property platforms are typically REIT-only, and Yieldstreet has choices you gained’t discover wherever else.

However whereas Yieldstreet permits extra traders to entry asset lessons sometimes reserved for the 1%, the platform isn’t for everybody. Most retail traders lack the experience required to put money into auto insurance coverage financing or international paintings investing. When you wrestle to grasp how an funding works, there’s a superb likelihood you’ll come out on the shedding finish.

Yieldstreet Overview

Product Identify: Yieldstreet

Product Description: Yieldstreet is an alternate funding platform that generates revenue streams throughout quite a few asset lessons.

Abstract

Yieldstreet is an alternate funding platform that generates revenue streams throughout quite a few asset lessons.

-

Price and Charges

-

Buyer Service

-

Person Expertise

Execs

- Entry to various investments

- You'll be able to diversify your portfolio

- Flick through provide particulars with out signing up

Cons

- You gained’t see returns instantly

- Investments are illiquid

- A level of experience is required

Cited Analysis Articles

1. Due.com. (2023, Jan. 5). 5 Finest Crypto to Purchase Now: Purchaser’s Information & Useful Ideas. Retrieved from https://due.com/weblog/best-crypto-to-buy-now/

2. Investopedia. (2022, Could 31). What Is Enterprise Capital and How Does it Work? Retrieved from https://www.investopedia.com/phrases/v/venturecapital.asp

3. SEC. (n.d.) U.S. Securities and Trade Fee. Retrieved from https://www.sec.gov/

4. Fundrise. (n.d.) Retrieved from https://fundrise.com/

5.HappyNest. (n.d.). Retrieved from https://www.happynest.com/

[ad_2]