[ad_1]

XAUUSD, Day by day

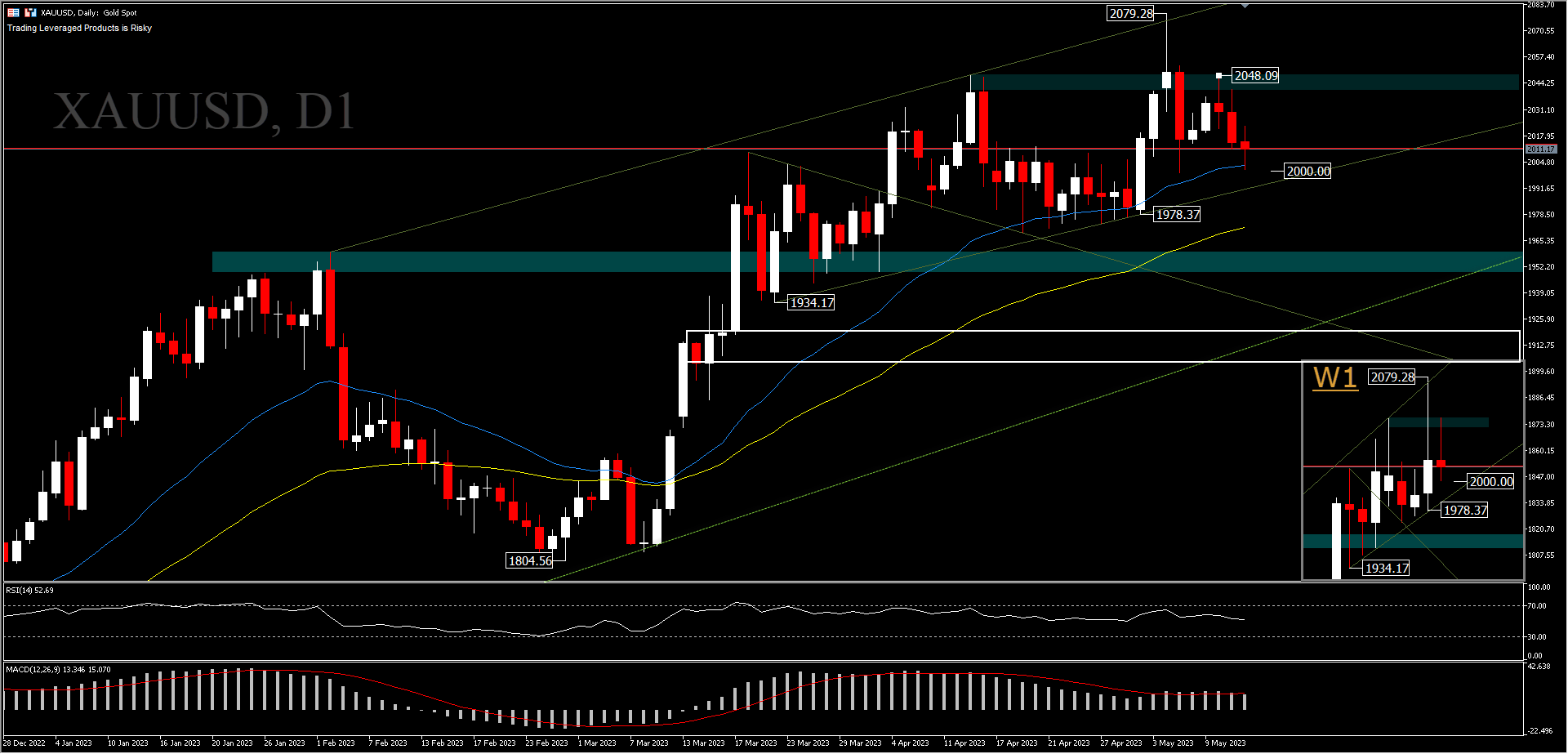

XAUUSD, has scored 3 historic peaks with practically the identical peak, the final recorded on Might 4, 2023 at 2079.28. XAUUSD on Friday moved decrease and closed with a lack of -0.21% in 2011.17. The Greenback Index rally on Friday and better international bond yields had been detrimental for gold costs. Financial worries that would result in decreased demand for the economic steel additionally weighed on silver costs, after Might’s US College of Michigan shopper sentiment index fell to a 6-month low.

Gold’s current rally was fueled by forecasts of slowing inflation in 2023 and fewer hawkish Fed rhetoric. Because of this, regardless of subsequent rate of interest hikes, 10-year Treasury yields have retreated and the Greenback has depreciated, each of that are tailwinds for gold. Extra help additionally got here from the banking sector turmoil and US debt pay as you go maturing, so buyers have a tendency to carry on to hedging belongings.

The US authorities has warned that its money reserves are operating low and should face default or extreme spending cuts by June 1, 2023. This case is more likely to enhance demand for gold as a hedge towards financial uncertainties. One more reason is that additional declines in yields and the extra Greenback depreciation that may end result from decreased inflation are seemingly to offer gold extra power. US annual inflation charge fell to 4.9% in April, in comparison with 6.4percentin January. If inflation continues to fall in keeping with consensus expectations, this implies a pause in rates of interest is imminent and this might lend some help to gold, though this seems to counteract gold’s preliminary position as a hedge in occasions of excessive inflation. Nevertheless, the components that affect the value of gold are more and more advanced, as a consequence of sentiment.

In the meantime, in response to ABN-AMRO gold positive aspects might be restricted this 12 months and extra positive aspects subsequent 12 months. The primary purpose is that rate of interest markets are anticipating a Fed charge reduce in Q3, in order that ought to be mirrored in gold costs in addition to the restoration for the Greenback within the coming months. The value of a number of Fed charge cuts and a modest greenback restoration will seemingly end in decrease gold costs, however not change the pattern. In the meantime, for 2024 they’re extra optimistic in regards to the prospects for gold costs, as a result of financial coverage easing by the World Central Financial institution might be constructive for gold costs in 2024.

Technical Outlook

XAUUSD, D1 – The gold worth rally from the second rising wave (1804.50) is beginning to lose momentum, with the presence of smaller physique dimension candles and lengthy higher wicks within the final 8 weeks. The weekly inside bar seen as indecision was current final week, above the 2000.00 psychological stage. Bias in the beginning of the week, probably nonetheless comparatively secure, however volatility could happen amid low liquidity in the beginning of the week.

XAUUSD is presently exhibiting a slight detrimental bias within the ascending tunnel, having shaped a decrease excessive at 2048.09 final week. Additional drop under 2000.00 stage might take a look at 1978.37 help (52 day EMA) first. In the intervening time the value remains to be caught on the 26 day EMA. So long as the value is buying and selling above the 2000 stage consolidation is more likely to nonetheless prevail and the upside transfer is more likely to be stalled as nicely on the current highs. The RSI technical indicator is flat at 52 and has not validated any actual worth weak spot, though a bearish divergence has been noticed between it and the MACD. A powerful transfer to the draw back to interrupt the help at 1978.37 is required, to substantiate the beginning of the corrective wave, in any other case the consolidation will last more. The motion under the help 1978.37 put the extent 50.0percentFR (from drawdown 1804.56-2079.28) as a super stage near the help 1934.17.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a normal advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]