[ad_1]

Shutterstock (SSTK), the American artistic content material options agency, has been using a doozy of a downtrend from October 2021 to the tip of 2022. Apart from the bear mauling, SSTK’s fundamentals weren’t completely disappointing. There have been two optimistic (but dwindling) earnings and income “beats,” one combined earnings report, and, lastly, a full-on destructive miss on each counts in Q2 earlier than hints of a combined restoration in Q3, punctuated by an earnings beat and a income miss.

Nonetheless, the final report did little or no to kindle “inexperienced shoots” in market sentiment. The corporate even acquired a stinging downgrade in November from funding financial institution JMP Securities, due to elevated competitors from generative AI. In accordance with the financial institution, Shutterstock’s inventory pictures might lose worth due to AI’s means to generate photographs from easy textual content prompts.

However that narrative modified in January 2023. A flurry of bulletins hinted that Shutterstock wasn’t going to be overrun by the AI development. The corporate was making strides to assert a large stake within the coming “singularity” engine.

SSTK Claims a Stake within the “Singularity” House

Maybe it was a matter of seizing alternative, hedging in opposition to near-term disruption, or gaining early favor with the longer term “masters” of singularized humankind. Both means, SSTK introduced its strategic partnerships with key AI gamers Meta, OpenAI, and LG AI Analysis in an effort to advance generative AI analysis (the very factor analysts claimed would disrupt SSTK’s future prospects). SSTK additionally launched its personal generative AI-based artistic platform, one which creates visuals primarily based on (you guessed it) textual content prompts.

To sweeten the deal for its shareholders, SSTK additionally elevated its dividend (by $0.27 per share) payout by 13% over the earlier quarter. Dividends primarily based on the present worth degree quantities to a 1.41% yield.

SSTK share worth surged 50% following the bulletins and is now up 41% YTD, simply because it’s slated to report This fall 22 earnings on Thursday, February 9, 2023, earlier than the open.

SSTK’s Sector and Trade Rankings

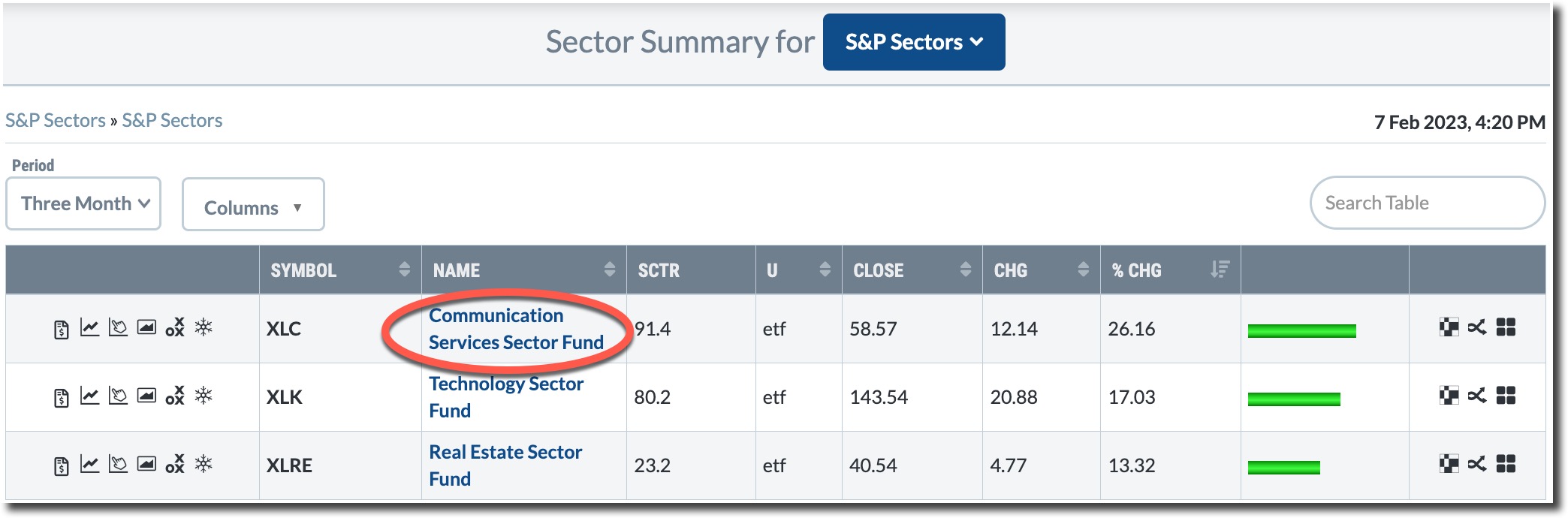

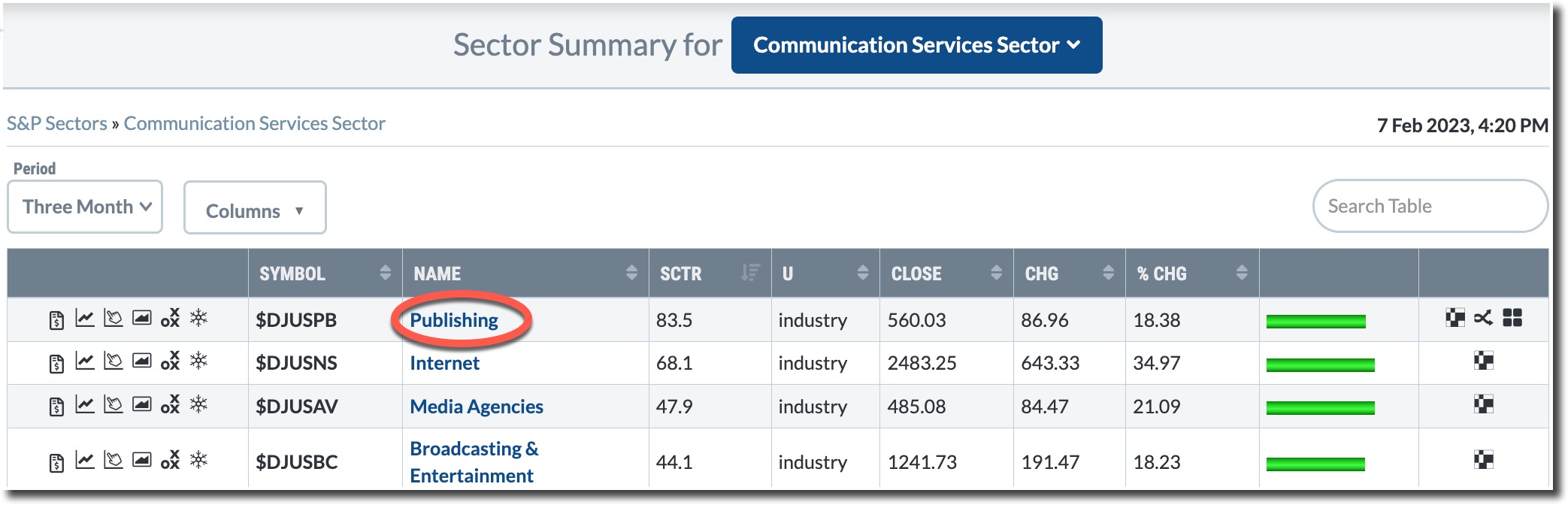

Let’s step again and have a look at SSTK’s place inside its bigger Communication Providers sector efficiency. Wanting again on a three-month interval…

- The Communications Providers Sector fund (XLC) sector is outpacing all 11 S&P sectors, with a robust achieve of 26.16% and a StockCharts Technical Rating (SCTR) ranking of 91.4. Now let’s zoom in to see trade efficiency.

- Among the many six industries inside the sector, Publishing holds the best SCTR rating (83.5) primarily based on a three-month lookback.

- And inside that trade group, SSTK holds the best SCTR rating of 91.8, inserting its technical favorability on the prime vary of potential performers.

SSTK’s Technical Image on the Eve of Earnings

CHART 1: SHUTTERSTOCK’S DAILY PRICE CHART PRE-EARNINGS. SSTK has a couple of issues going for it: a Golden Cross, it is up in opposition to its 38.2% Fib retracement degree, and a basic pivot. However a divergence between worth and the stochastic oscillator might imply a reversal could also be underway. Chart supply: StockCharts.com. For illustrative functions solely.

CHART 1: SHUTTERSTOCK’S DAILY PRICE CHART PRE-EARNINGS. SSTK has a couple of issues going for it: a Golden Cross, it is up in opposition to its 38.2% Fib retracement degree, and a basic pivot. However a divergence between worth and the stochastic oscillator might imply a reversal could also be underway. Chart supply: StockCharts.com. For illustrative functions solely.

Within the above chart, you possibly can see the affect that the bulletins have had on SSTK’s share worth.

- Utilizing the Fibonacci retracement ranges from the October 2021 excessive of 126.12 and November 2022 low of 44.40, SSTK broke above its 38.2% retracement ranges however stalled and pulled again.

- The swing resulting in SSTK’s eight-month excessive at 81.23 correlates with a divergence on the stochastic oscillator, suggesting a near-term reversal that’s underway.

- SSTK’s robust momentum was sufficient to generate a Golden Cross studying. The 50-day transferring common (yellow line) is now above the 200-day transferring common (blue line).

Will SSTK Shock or Shutter Come Earnings?

A lot is using on SSTK’s earnings report on Thursday (February 9), as merchants weigh the prospect of any earnings beat, miss, or combine and steerage in opposition to the longer-term prospects that set the inventory to surge in January.

A dismal earnings report might ship SSTK down beneath the $60 vary, placing SSTK’s technical (together with its basic) prospects in query. Remember to add this inventory to one in all your ChartLists. When the earnings report is launched, contemplate any developments in firm steerage and different partnership bulletins.

If the earnings report surprises and the inventory strikes greater, there’s a variety of upside room. If you will open a protracted place, the 38.2% Fib degree can be a possible cease degree. SSTK could also be taking part in the lengthy recreation, however developments within the AI area are additionally transferring at an accelerated fee.

Karl Montevirgen is an expert freelance author who focuses on finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in vital research/writing and music composition from the California Institute of the Arts.

Study Extra

Subscribe to Do not Ignore This Chart! to be notified at any time when a brand new submit is added to this weblog!

[ad_2]