[ad_1]

The Fed has turned off the cash pump once more.

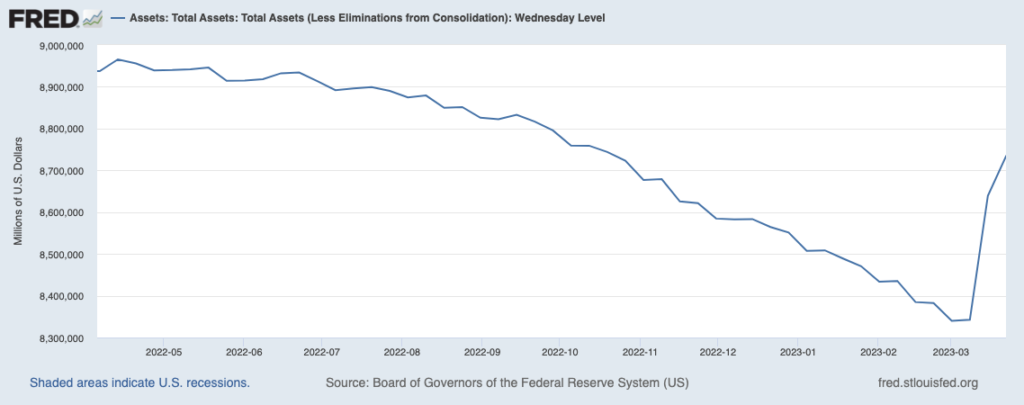

In the event you’re searching for a motive why shares erupted increased beginning in early March, look no additional than the beneath chart of the Fed’s steadiness sheet. As you may see, throughout the regional banking disaster triggered by the collapse of Silicon Valley Financial institution, the Fed started increasing its steadiness sheet quickly.

How quickly?

Practically $400 BILLION in two weeks’ time. Not because the depths of the 2020 crash has the Fed printed this a lot cash.

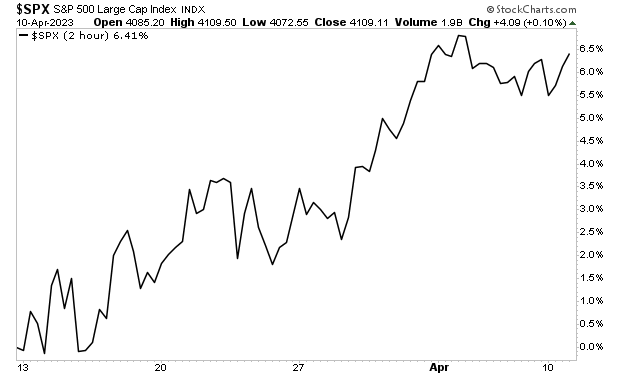

Shares bottomed quickly after this… exploding increased by 6+% in a single month.

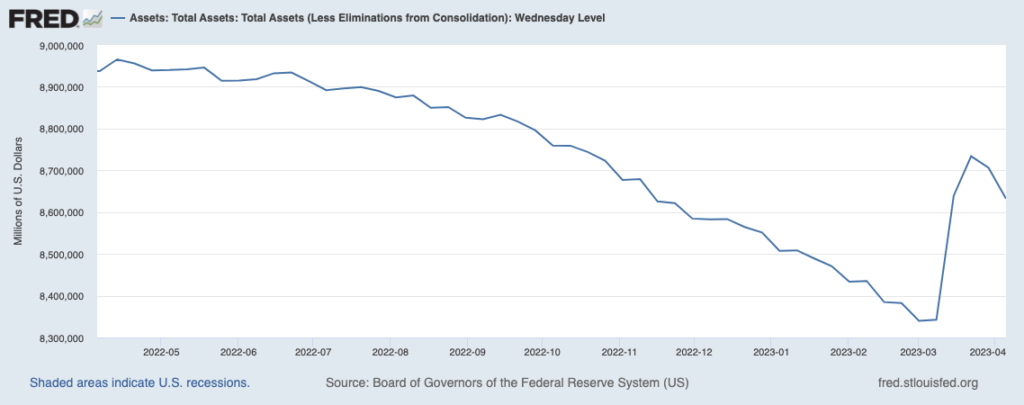

I carry all of this up, as a result of the Fed has turned off the cash printer once more. Over the past week, the Fed’s steadiness sheet has fallen by $100 billion.

What does this imply?

The clock is ticking for shares. And with a recession simply across the nook… it’s solely a matter of time earlier than the market breaks to new lows.

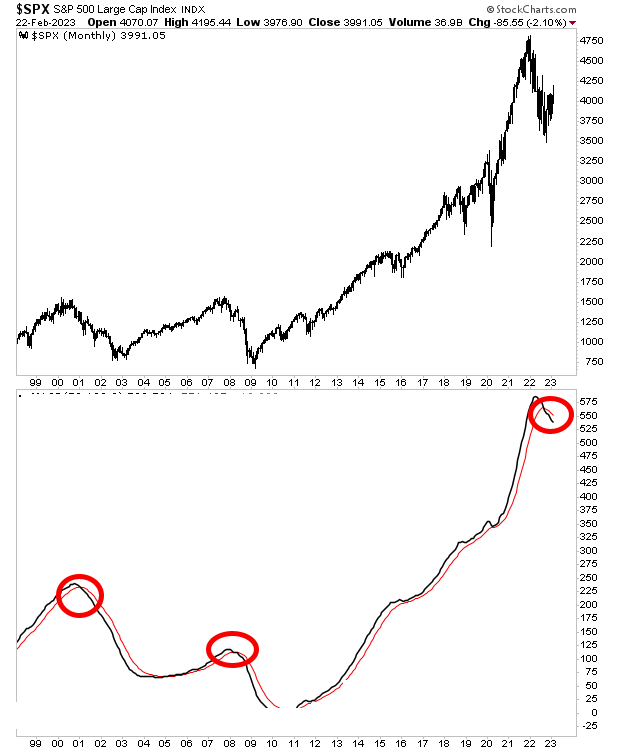

Certainly, our proprietary Crash sign has simply triggered its third confirmed sign within the final 25 years. The final two occasions it signaled?

2000 and 2008.

[ad_2]