[ad_1]

I’ve been suggesting that rate of interest rises are fuelling inflation.

That concept would possibly, it appears, shock the Financial institution of England. They appear to suppose that inflation is all the way down to extreme pay will increase. Nonetheless, I’ve some information for them, which is that staff don’t set value will increase. It’s corporations that try this. In that case, let me put ahead a mannequin of a firm that’s largely service-based to discover my suggestion.

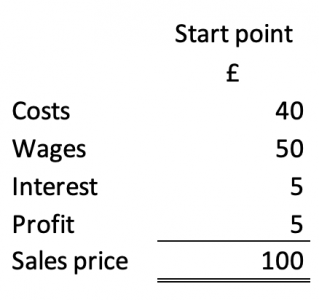

That is the place to begin for this mannequin:

The figures have been chosen for purely representational functions: they’re denominated in financial items (1000’s, tens of 1000’s, or hundreds of thousands: it makes no distinction) but in addition, in impact, point out the share cut up in the associated fee base of the corporate. The proportion of wages suggests it’s service oriented, as most corporations are.

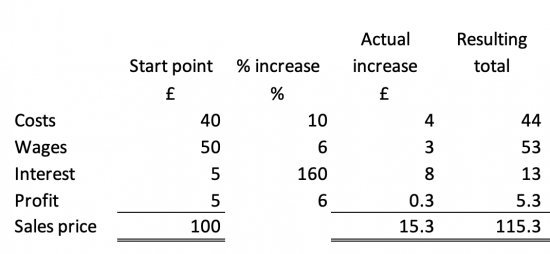

Then I counsel that changes for inflation be taken into consideration, as follows:

Purchased-in prices have elevated by 10% – roughly the speed of inflation within the final yr.

Wage will increase have been stored to six% – which will probably be powerful on many workers.

The massive enhance is, nevertheless, in curiosity prices. The corporate pays curiosity at 3% over financial institution base price. So, the speed has grown from close to sufficient 3% to eight%, or a progress of about 160%.

As compared, earnings have solely been focused to extend on the identical price as wages.

The ensuing general value enhance is 15.3%, with greater than half of that being as a consequence of curiosity, which imposes a much bigger value enhance than exterior prices and the wage settlement mixed.

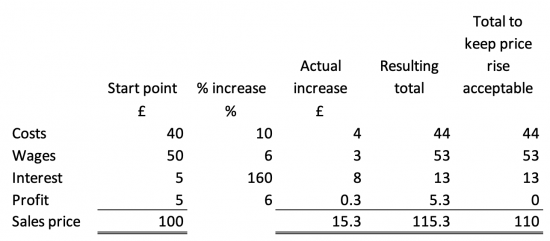

Let’s presume the corporate realises that the market is not going to settle for a 15.3% value enhance, and it retains it to 10%. That is the outcome:

Income have now been eradicated. The corporate’s future is, then, doubtful.

I stress that it is a mannequin.

I’d add that the assumptions appear honest, as does the associated fee construction, though these (in fact) differ extensively.

My factors are threefold. First, it’s not wages which might be driving up inflation.

Second, it’s rate of interest rises which might be driving up costs.

And third, rate of interest rises at the moment are so excessive that many companies will face the specter of failure.

The Financial institution of England is welcome to make use of this mannequin and take into consideration the results which they’ve created. Sadly, I think that they won’t. That is as a result of what this mannequin makes clear is that we face a disaster created in Threadneedle Road, however they don’t have any understanding of what they’ve completed and are doing.

And that is why we face determined financial occasions.

[ad_2]