[ad_1]

I like nearly all sorts of breadth indicators, however I’ve realized that every kind of breadth knowledge requires its personal correct method of interpretation. The entire level of taking a look at breadth knowledge is to get a distinct reply about market habits than what costs are saying, and hopefully that completely different reply is a helpful one.

Because of this, I don’t pay a lot consideration to the distinction between New Highs (NH) and New Lows (NL). Every of these gadgets could be fascinating by itself, if interpreted in the fitting method, however placing them collectively will not be very helpful.

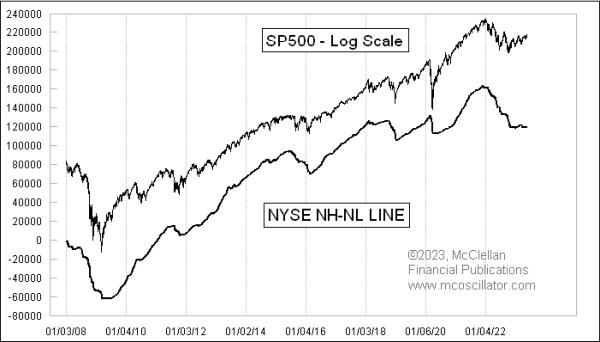

This week’s chart exhibits a cumulative every day NH-NL Line, which is constructed like a every day Advance-Decline (A-D) Line. We take the variety of NH and subtract the NL to get the distinction, then add that to the prior day’s worth for this NH-NL Line. It isn’t very helpful as a result of, whereas it matches the value pattern, this NH-NL Line lags costs on the turns. Getting a delayed message a few value pattern change will not be very useful. It additionally doesn’t present us helpful divergences just like the A-D Line does, so we actually can not get any purposeful data from taking a look at NH and NL knowledge that method.

One approach to mix the NH and NL knowledge that’s considerably helpful was developed a few years in the past by a technical analyst named Mike Moody. It includes these similar uncooked knowledge gadgets, however the magic appears to return from the extra math thrown into it.

Moody’s innovation was to take NH and divide it by the sum of NH+NL, then calculate a 10-day easy shifting common of that ratio. Due to the shorter lookback interval, it’s a way more vigorous indicator, one which tracks the shorter-term value strikes fairly effectively. And it does typically present us helpful divergences versus costs. Like all indication of pattern, it’s topic to noise, whipsaws, and delays, and, when it does show a divergence, one doesn’t know at what second this obvious divergence may begin to matter.

I’ve discovered it helpful to have a look at the numbers of NH and NL individually, relatively than collectively. And of those, the numbers of NH have a tendency to present the extra helpful indications.

The every day variety of NH is kind of a bit noisier than the 10-day smoothed model that Moody developed, which is sensible. It additionally exhibits us extra frequent helpful divergences, however, as soon as once more, there may be the issue of not with the ability to know when an obvious divergence may begin to matter. The NL quantity can get much more thrilling, however solely after a selloff that’s extreme sufficient and lengthy sufficient to supply a rising variety of shares making new 52-week lows.

The issue with that is that, by the point you see an enormous quantity for NL, you most likely already know from different indicators that an unsightly value transfer has been occurring. You most likely do not want affirmation from the variety of NL with a view to know that. However one cool function is that, in a pointy selloff, the day of the utmost variety of NL is sort of by no means the identical as the ultimate value low. So, when you see NL making a better worth, you possibly can have some assurance (however not certainty) that the ultimate low is probably going not right here but.

I ought to be aware a few issues about these knowledge. The calculations of NH and NL, for years, have employed a 52-week lookback interval. It has not at all times been that method. Earlier than 1980, the entire tabulations of shares making new 52-week highs or lows had been performed on paper ledgers, and the record-keepers would have a separate ledger for every inventory and for every calendar yr. So, on January 2, a brand new ledger could be began for every inventory, monitoring its value travels in that calendar yr. As a result of utilizing a brand new ledger would imply that on the primary day of the yr, each inventory would both be making a brand new excessive or a brand new low for the yr, that data wouldn’t be helpful in any respect. So the record-keepers would carry over the prior yr’s information for just a few weeks into the brand new yr, earlier than, someday round April, they might swap to the brand new yr’s ledgers.

Due to this recording methodology, the NH and NL knowledge which exist earlier than 1980 may make use of wherever from a 4 to 16 month lookback interval, making them questionable for his or her utility. Beginning in 1980, the information honchos lastly possessed sufficient computing energy to modify over to a extra uniform lookback interval of a yr, and that’s the normal that continues in these statistics to at the present time. It’s also value noting that the tabulation of whether or not a person inventory has made a brand new excessive or a brand new low is predicated on intraday buying and selling. So a inventory may not have a 52-week closing excessive, however it could possibly be counted within the NH column of knowledge if it made a brand new excessive intraday.

Taking a look at every day totals of each NH and NL can also be typically helpful, because the late Jim Miekka confirmed us along with his Hindenburg Omen. That sign was a refinement of Gerald Appel’s outdated “Cut up Market Promote Sign”, which might be triggered any day that noticed each NH and NL for the NYSE exceed 45 on the identical day. This was much like Norman Fosbacks Excessive Low Logic Index, which additionally checked out massive days for each NH and NL. The concept is that seeing each NH and NL rise up to excessive sufficient values was an indication of illiquidity, and an uptrend coming aside. Miekka adjusted for the altering numbers of points over time, and added just a few further guidelines (together with use of the McClellan Oscillator) to get higher alerts.

Coming again to the present day readings, the declining numbers of NYSE NH which can be being recorded these days even because the S&P 500 was making increased value highs was a warning of bother, and is an indication of a lack of broad participation within the rally. That warning doesn’t inform us very a lot in regards to the potential severity of any decline, however it does inform us that there’s a downside.

Subscribe to High Advisors Nook to be notified each time a brand new submit is added to this weblog!

[ad_2]