[ad_1]

And what’s the outlook for Gen-Xers and Millennials?

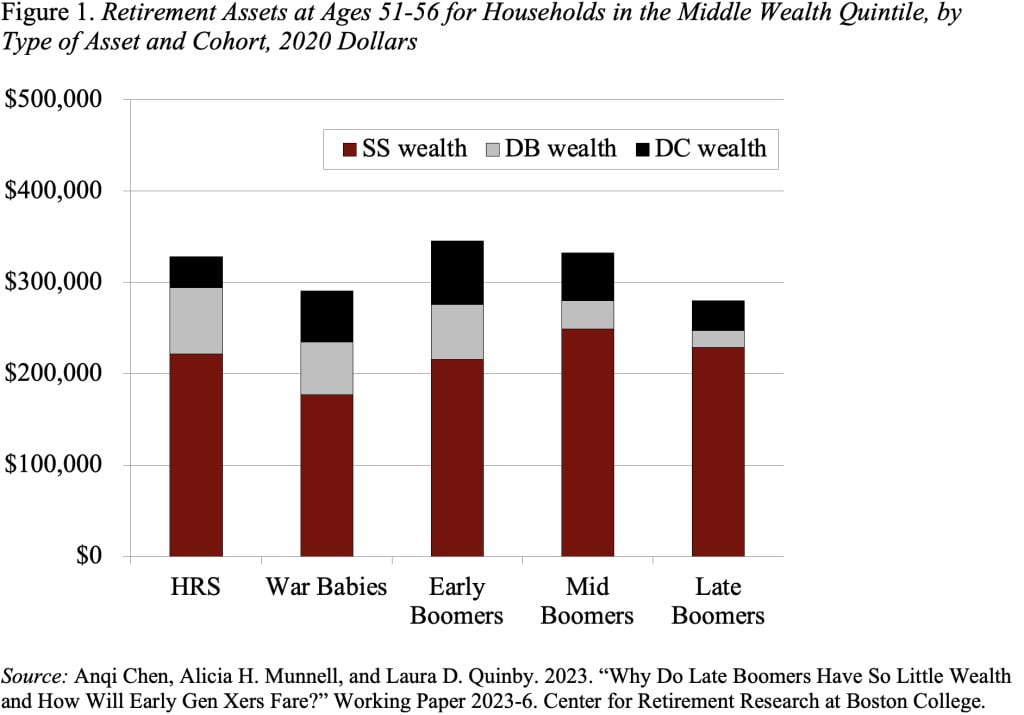

Late Boomers have low ranges of wealth no matter how it’s outlined – complete wealth, retirement wealth, or 401(ok)/IRA wealth. A decline in some wealth elements had been anticipated on account of the rise in Social Safety’s Full Retirement Age, the shift from outlined profit (DB) to outlined contribution (DC) plans, and a drop in housing values throughout the Nice Recession. However rising DC balances had been predicted to offset the hole, since Late Boomers had been the primary era the place employees may have spent their complete profession coated by a 401(ok) plan. That didn’t occur; common DC wealth for these within the center quintile dropped from $52,300 for Mid Boomers to $32,700 for Late Boomers (see Determine 1). In reality, declines occurred throughout all however the high quintile.

My colleagues and I’ve simply accomplished a examine to determine why Late Boomers have so little retirement wealth and what the patterns suggest for Early Gen-Xers and subsequent cohorts. We used a decomposition approach that kinds out the contribution from numerous sources. The findings indicated that two main elements had been at play – a change within the composition of households and a weakening for Late Boomers of the hyperlink between work and wealth accumulation.

This isn’t a story of the deteriorating standing of Black and Hispanic households; certainly, the wealth of non-White households has elevated relative to their White counterparts. However Black and Hispanic households nonetheless have much less wealth than White households, so once they improve as a share of the overall households, common cohort wealth will decline. Equally, a decline within the share of households married or with a school diploma will convey down the typical. For complete wealth and retirement wealth, the altering demographics accounted for 24-29 p.c of the overall decline.

The remainder was attributable to shifting coefficients – a very powerful of which was the weakened hyperlink between work and wealth. This sample is totally in line with information from different surveys which present Late Boomers, who had been of their 40s on the time, had been hit arduous by the Nice Recession and by no means recovered. Even Late Boomers who had a job after the Nice Recession earned much less, had been much less prone to take part in a 401(ok) plan, and amassed fewer property in these plans. Work, for Late Boomers, merely didn’t produce the increase to wealth accumulation that it had for earlier cohorts.

This discovering is doubtlessly excellent news for the wealth holdings of future generations. Whereas the demographic/schooling shifts will proceed to convey down the typical, these elements weren’t the main supply of the decline. The massive change was the weakening of the hyperlink between work and wealth accumulation for the Late Boomers on account of the Nice Recession. To the extent that the decline in wealth is a Nice Recession story, among the downward stress on wealth holdings ought to abate.

Let’s hope we’re proper!

[ad_2]