[ad_1]

After we inform the neighborhood our mandate is to assist B2B tech corporations scaling up into the UK and US, we all know this can be a mouthful and seems like an oddly particular mandate.

The remark we hear most from founders is, “we reached out to you since you assist founders develop into the UK and US, and that’s the bit we want assist with”. And the remark we most hear from buyers is, “why solely B2B tech?”

We’ve written in regards to the first half – how we assist founders – so this weblog is about why we love and deal with B2B.

We all know B2B

Firstly, all of the founding workforce have expertise and monitor document in investing in and constructing tech-driven B2B corporations. Throughout our varied careers, one of many different issues we now have in frequent, which is true if in case you have spent any time in enterprise, is that we now have all had nice successes and devastating failures that we bounced again from.

We use all this expertise to assist our portfolio corporations keep away from making the errors we now have, and we assist supercharge their success by leveraging what we all know works. This helps to create an info asymmetry, which helps to cut back the chance of funding.

The most effective buyers spend money on what they know. Their experience and networks assist scale back friction within the portfolio corporations and see round corners higher.

The provision/demand dynamics are higher for B2B

There are just a few different tailwinds that assist to assist our deal with B2B. 10 years in the past, B2B was comparatively unloved in comparison with B2C.

There are some good the reason why – it’s more durable – the gross sales cycle tends to be longer, so it takes longer to see traction, however this additionally means it’s stickier, and there may be much less churn, so corporations are spending much less time having to replenish their misplaced clients with new ones.

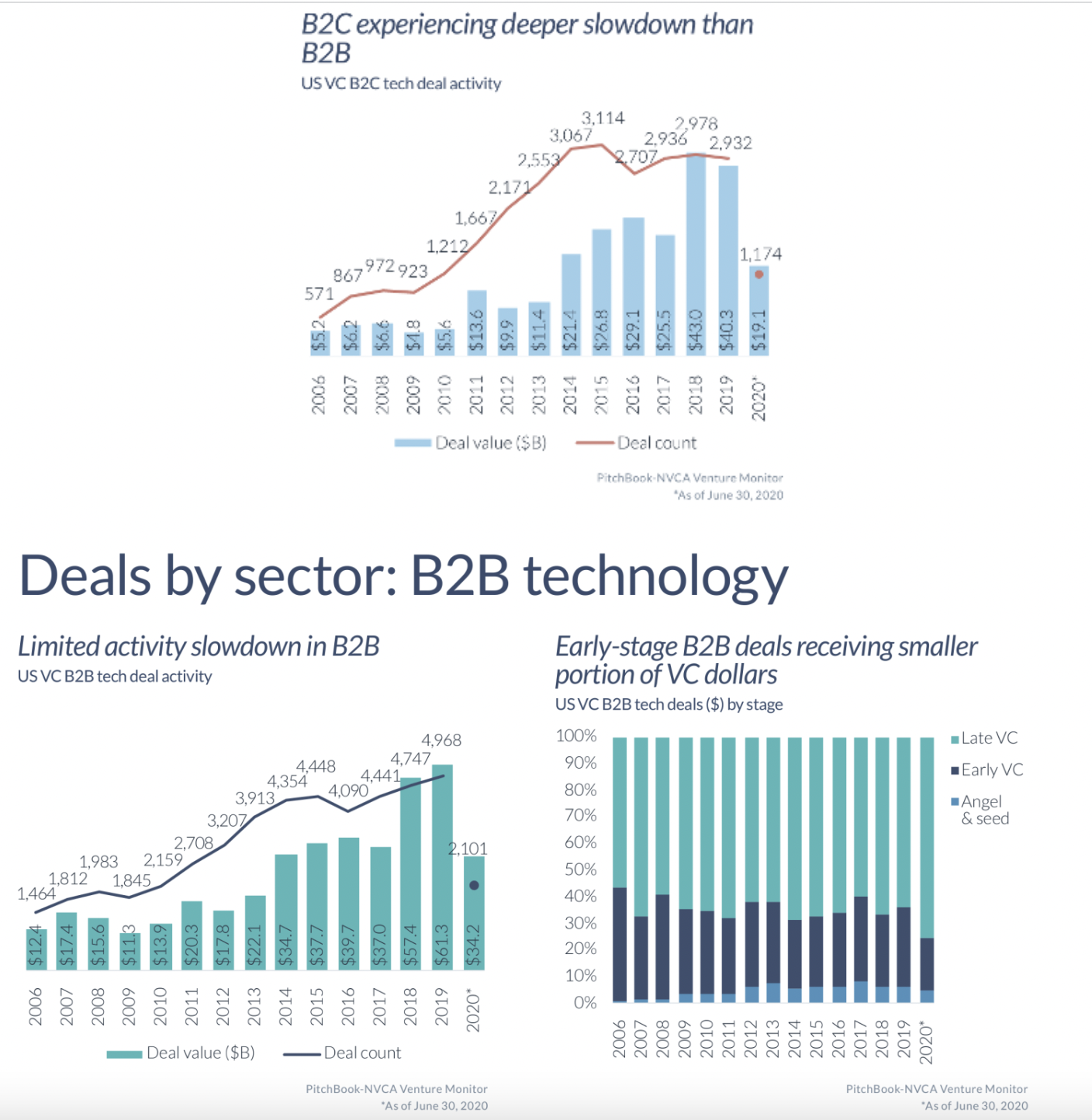

Nevertheless, now we see funding into B2B outpace B2C by about 4 to 1, notably on the later levels.

Within the latest post-pandemic market correction, we’ve witnessed B2B exercise contract at a decrease fee than different verticals, so it’s been extra resilient.

B2B isn’t attractive however it has an incredible persona

Many B2B companies aren’t ‘attractive’. You don’t typically hear folks speaking breathlessly about their enterprise software program at a cocktail party.

Nevertheless, this additionally means B2B is much less inclined to fads. B2B is the dad bod of VC sectors – not the flashiest, however it’s reliable and nonetheless passes for engaging in an excellent go well with. In our thoughts if there was ever an space for the affected person capital that enterprise represents, B2B is it.

B2B is usually much less value delicate than B2C, companies are about return on what they’re spending, and due to this fact B2B corporations that may ship excessive worth can preserve excessive margins. It’s additionally much less discretionary, so much less inclined to being culled in tighter financial situations.

Lastly, B2B corporations can typically generate income from the get-go, which is advantageous in comparison with B2C corporations, who typically should construct scale earlier than studying to monetise it.

There may be nonetheless a chance for worth

The rising relative quantities of capital for B2B is a double-edged sword – it’s horrible if the capital availability drives up competitors and valuations, however I’ll get to that in a second. Extra importantly, in enterprise one of many methods nice corporations can nonetheless wilt on the vine and fail is that if they don’t have sufficient capital out there to assist their later levels.

Larger capital at later levels means that there’s a prepared pool of follow-on capital to spend money on corporations we assist develop. This additionally helps to cut back danger.

And with the latest market corrections, we didn’t see competitors driving up costs. The truth is, we’re seeing a correction under the median. So when you consider there may be more likely to be a correction again in the direction of the median, then we now have some alternative for worth investing or worth arbitrage.

The exit panorama is healthier

Delivering good exits is as a lot a part of outsized returns as making good investments.

We consider the exit technique for B2B companies are extra easy with a higher universe of acquirers and fewer reliance on how broad open the IPO market is, which we additionally consider helps to cut back the chance for buyers.

What we see is that the M&A surroundings stays robust for B2B, which once more helps mitigate danger.

For all the explanations above, we predict {that a} clear deal with B2B helps us present our buyers with a technique that may bias returns for buyers by making the most of market tailwinds, offering entry to high quality deal circulate, including worth as a result of we now have seen the film play out many, many occasions earlier than, and creating pathways to exit.

For the foreseeable future, we see this arc of relevance is lengthy for B2B. However we now have additionally been round lengthy sufficient to know that issues change, and we have to be prepared for it. We function with a ‘robust opinions loosely held’ mantra.

Which means that as we learn the tea leaves of each the macro and micro surroundings, we reserve the appropriate to vary our thoughts and pivot to make sure our investor’s returns are prioritised.

This isn’t as a result of we don’t have conviction, it’s as a result of our different mantra is to prioritise the preservation of our investor’s capital over a dogmatic method inside an ever-changing market.

- Elaine Stead is the Chief Funding Officer & cofounder of Tribe World Ventures.

[ad_2]