[ad_1]

Final week, the Fed raised its benchmark rate of interest by half a proportion level, a slowdown from earlier sprints. Nonetheless, the federal funds fee is at its highest since 2007. Whereas merchants are betting the Fed will start decreasing the federal funds fee within the second half of 2023, historic developments counsel a special timeline. And whereas economists from main corporations are cut up on the place and when charges will peak, Fed policymakers have signaled that charges will doubtless stay elevated till 2024.

Why the various estimates? Nobody is definite how lengthy it’ll take for high-interest charges to affect the job market or whether or not we’ll enter a recession. Inflation has been cussed (albeit declining) largely because of low unemployment and provide chain points, consultants say.

When Has the Fed Reduce Curiosity Charges Traditionally?

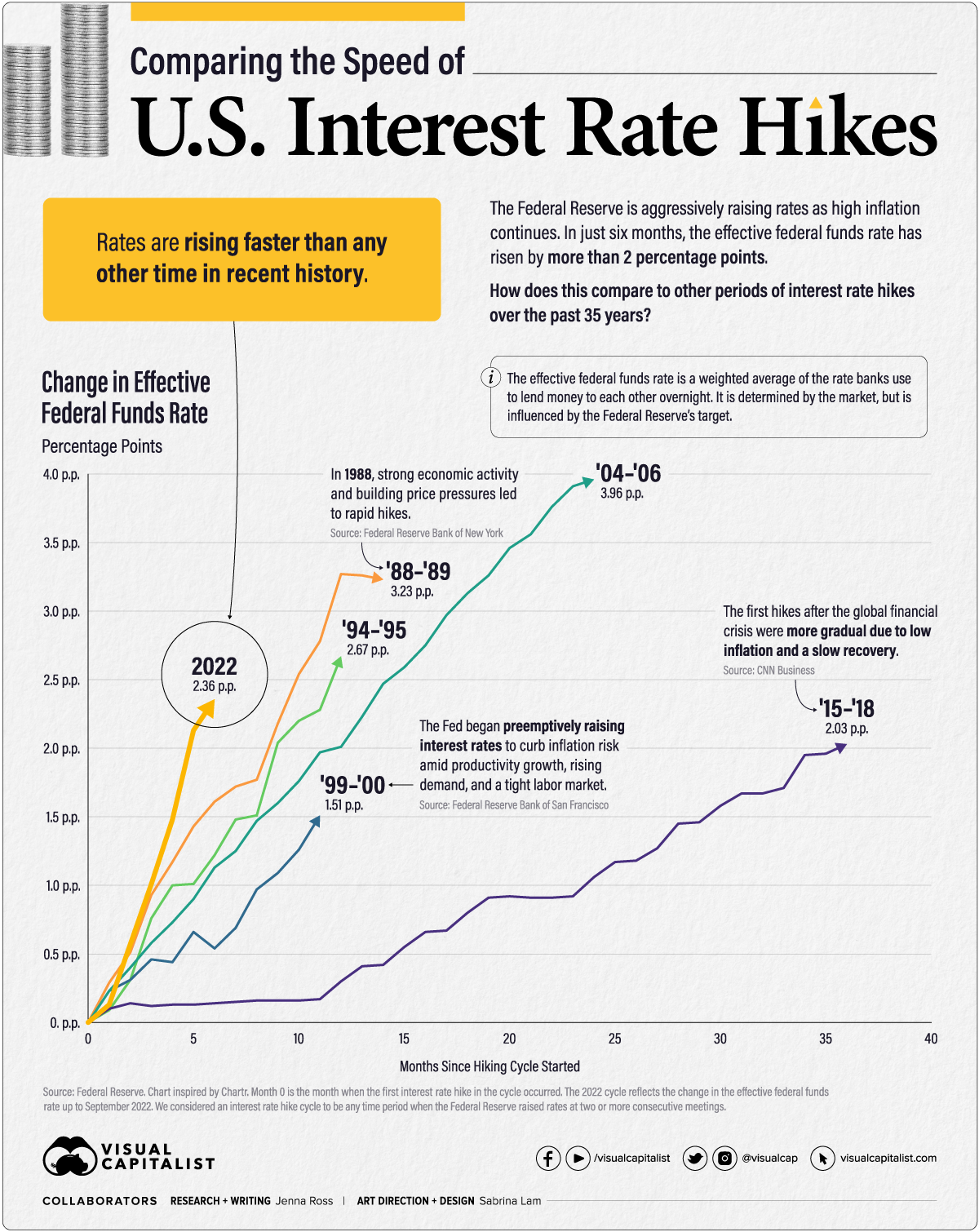

Rates of interest have peaked for a median of 11 months over the past 5 cycles. In previous fee hike cycles, nevertheless, the Fed acted earlier to tame inflation and steadily raised charges.

Since excessive inflation in 2022 was initially considered a short lived, “transitory” results of the worldwide pandemic, inflation was allowed to exceed goal for 12 months earlier than the Fed took motion. This led to the quickest fee hike cycle, an increase of greater than two proportion factors in solely six months. With inflation stickier than prior to now, a longer-than-average holding interval may additionally be required.

Fed policymakers forecast further will increase in 2023 to a variety of 5%-5.25%. Price cuts usually are not anticipated to occur earlier than 2024. However that’s not set in stone. The Fed’s personal forecast clashes with dealer expectations, whereas historical past appears to help the Fed’s timeline. Nonetheless, a sooner lower is feasible if a deep recession takes maintain, analysts say.

What Are Economists Anticipating This Time Round?

Monetary agency Morningstar expects inflation to show round quicker than the Fed at the moment forecasts, predicting fee cuts within the second half of 2023 that proceed into 2024. The agency contends that the Fed is trying to “discuss” the market within the path of sustaining tight monetary situations whereas dropping bond yields over the past two months and slowing financial development, suggesting the battle to regulate inflation will finish in 2023.

Barclays initially anticipated charges to return down within the third quarter of 2023 as properly however has pushed again the forecast to November of 2023 because of the resilience of inflation. However the agency’s estimates stay forward of the Fed’s schedule because of a excessive chance of an upcoming recession. And Morgan Stanley continues to foretell the primary reduce taking place in December of 2023. Researchers at JPMorgan Chase say the Fed might reduce charges subsequent 12 months as properly—however provided that components like growing unemployment, decrease inflation, and weakening financial exercise converge in time.

In the meantime, many of the buyers the financial institution surveyed don’t anticipate charges to fall till 2024. Economists at Goldman Sachs agree. Chief Economist Jan Hatzius says inflation has been extra persistent than anticipated and doesn’t anticipate fee cuts till 2024.

Nonetheless, Bloomberg Economics is almost sure a recession will take maintain inside a 12 months, and most economists agree. Some say if unemployment rises sufficient, the Fed might relaxation its makes an attempt to hit the goal inflation fee of two% since there are indicators the inflation fee will stay above that focus on for the foreseeable future. In any case, future fee will increase into 2023 are possible, which is able to affect mortgage charges as properly. Even in a best-case state of affairs, most consultants don’t anticipate mortgage charges to return down till the finish of 2023, and so they might keep elevated into 2024 if a resilient economic system requires the Fed to be extra aggressive.

On The Market is introduced by Fundrise

Fundrise is revolutionizing the way you put money into actual property.

With direct-access to high-quality actual property investments, Fundrise means that you can construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has rapidly change into America’s largest direct-to-investor actual property investing platform.

Observe By BiggerPockets: These are opinions written by the creator and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]