[ad_1]

Bounce to:

Gross sales tax and use tax are essential sources of income for the federal government however correctly calculating, accumulating, and reporting these taxes can rapidly get sophisticated. That is very true as corporations develop and more and more attain shoppers exterior of their geographic borders.

Persons are most likely most conversant in gross sales tax however an essential oblique tax that isn’t to be neglected is use tax. Actually, every state that imposes gross sales tax levies a use tax for purchases made exterior of the state.

The fact is that the taxing authorities need shoppers to pay a tax on all purchases they make. Due to this fact, companies should perceive each gross sales and use tax, know the variations and similarities, and have the assets to assist them guarantee compliance.

What’s use tax?

Use tax is a tax that’s imposed on the use, storage, or consumption of products and companies that have been bought with out paying gross sales tax. It’s usually imposed by the state or native authorities the place the products or companies are used, and the speed is commonly the identical because the gross sales tax price. It’s designed to make sure that individuals who buy items and companies from out-of-state distributors or on-line retailers pay the identical quantity of tax as they’d in the event that they bought the products or companies domestically. Like gross sales tax, use tax income is used to fund varied authorities packages and companies.

Whereas each gross sales and use tax are paid to the federal government on the purchases of products or companies, there are notable variations in how they’re collected and paid to the federal government.

Every state that imposes gross sales tax levies a use tax for purchases made exterior of the state. That is so state residents can’t keep away from gross sales tax by shopping for taxable items through the Web, and even by means of a catalog, or the cellphone.

How does use tax work?

Use tax most frequently happens when a shopper orders items from exterior of the state (comparable to on-line) and the retailer (not having nexus, or presence, within the shopper’s state) doesn’t should cost gross sales tax on the acquisition. When this occurs, the burden of remitting the tax to taxing authorities shifts to the patron.

To additional clarify, let’s check out how two completely different states — on this case, Washington and Massachusetts — method use tax.

In Washington state, use tax, which applies to each companies and people, applies to objects getting used within the state the place gross sales tax has not been paid. Every new proprietor of an merchandise is charged with paying the use tax.

The use tax price is identical because the gross sales tax price the place the merchandise is getting used and is due when the merchandise is first used within the state. It’s calculated on the worth of the property, which is often the acquisition value. Each calendar yr due date, the taxpayer pays when submitting their revenue tax.

In Washington state, in-state use tax dues happens when the next:

- Gadgets are bought over the Web (or through the cellphone or catalogs), with out paying gross sales tax, and are delivered to Washington to be used within the state.

- A shopper merchandise is bought in one other state, with out paying gross sales tax, is introduced into Washington to be used.

- Gadgets bought in Washington the place gross sales tax has not been paid. This consists of objects bought by means of non-public events.

When buying autos, use tax often is paid to the Division of Licensing on the time of registration. For different objects, nevertheless, Washington state requires that use tax be reported on a chosen tax return. As an example:

- If it’s a registered enterprise, they need to report use tax on their common excise tax return.

- Whether it is a person or a enterprise not required to register with the Division of Income, use tax will get reported on the Client Use Tax Return.

In Massachusetts, use tax have to be paid on tangible private property (together with objects ordered on-line, through the cellphone, or by means of mail order, in addition to electronically transferred software program) or sure telecommunications companies wherein the next apply:

- No gross sales tax (or a gross sales tax price lower than the 6.25 % Massachusetts price) was paid, and

- It’s for use, saved, or consumed in Massachusetts.

Examples of use tax

To additional illustrate how use tax works, let’s discover a number of examples of use tax.

As famous earlier, Massachusetts requires that use tax be paid on tangible private property or sure telecommunications companies if sure situations apply. So let’s assume that you just bought some furnishings on your Massachusetts enterprise or house.

Based on the state, should you purchase furnishings on your Massachusetts enterprise or house from an out-of-state firm, you don’t pay gross sales tax, however you continue to have to pay the use tax. The use tax applies as a result of the furnishings wasn’t topic to a gross sales tax within the different state and since it’s to be used in Massachusetts. The customer typically pays the use tax on to Massachusetts.

One other instance is California. For companies, purchases of kit, provides, and books can be topic to tax. Purchases not topic to tax embody meals for human consumption, and electronically downloaded software program, music, and video games (if no tangible storage media is obtained).

So, let’s say an organization bought a case of printer paper on-line to be used in its enterprise. The case of printer paper value $75, together with delivery. They’d it despatched to their workplace and weren’t charged tax in the course of the buy. How a lot use tax does the enterprise owe?

Reply: First, discover the enterprise’s native tax price. Let’s assume the native price is 8.0%. The enterprise would then owe $6 in use tax ($75 x .08 = $6), on this situation outlined by the state authorities.

(Be aware: Transport fees are typically not taxable when objects are shipped by frequent service or U.S. Mail, the bill individually states fees for delivery, and the cost isn’t larger than the precise value for delivery.)

Because it pertains to private use, California states that, typically, an merchandise is topic to make use of tax if it will have been taxable if bought from a California retailer. This consists of objects like clothes, home equipment, toys, books, and furnishings.

What’s nexus?

If you happen to lookup the phrase “nexus” within the dictionary you’ll see it’s outlined as a connection or hyperlink. Moreover, the phrase comes from nectere, a Latin verb which means “to bind.” Nexus refers back to the connection between a enterprise and a state or jurisdiction. Within the context of use tax, nexus is essential as a result of it might probably decide whether or not a enterprise is required to pay use tax on objects that have been bought exterior of the state however are used inside the state. Due to this fact, it is smart that, in terms of gross sales and use tax, nexus is the tie between a vendor and a state that requires the vendor to gather and remit gross sales tax to the state.

If a enterprise has nexus in a state, they’re usually required to pay use tax on objects that they create into the state for their very own use, even when these objects weren’t topic to gross sales tax once they have been bought. The particular guidelines for when use tax applies can fluctuate relying on the state and the circumstances of the transaction, however typically talking, companies with nexus in a state usually tend to be topic to make use of tax than these with out nexus.

Financial nexus and bodily presence are the most typical types of nexus.

Financial nexus

Gross sales tax nexus, which is extra generally known as financial nexus, is created when an financial exercise happens. Financial nexus refers to the kind of nexus that’s established primarily based on a enterprise’s financial exercise inside a state, fairly than its bodily presence. Which means that even when a enterprise doesn’t have a bodily location or workers in a state, they might nonetheless be required to gather and remit gross sales tax in the event that they meet sure financial thresholds. These thresholds are usually primarily based on the variety of gross sales or transactions {that a} enterprise has inside the state over a sure time frame. Financial nexus has change into more and more frequent in recent times, as extra states have adopted legal guidelines requiring out-of-state companies to gather and remit gross sales tax primarily based on their financial exercise inside the state.

So, states often have financial nexus thresholds in place and companies could also be required to register in that state and accumulate gross sales tax in the event that they exceed the financial nexus threshold. That is no matter the place the enterprise, warehouses, or workers are situated.

The South Dakota v. Wayfair Supreme Courtroom ruling marked a significant shift in tax regulation precedent and established a brand new definition of nexus.

Earlier than Wayfair, nexus trusted an organization’s “bodily presence” within the state. Nevertheless, because of the rulings, if a enterprise sells items in any state — even when they don’t have a bodily presence in that state and the transaction is on-line solely — it might now be obligated to register in that state and accumulate gross sales tax.

Which means that, with nexus determined by completely different thresholds in several jurisdictions, companies should comply with nexus legal guidelines throughout all 50 states, fairly than solely these wherein they’ve bodily operations.

In at the moment’s tech-driven market, it’s vital that corporations that do enterprise digitally have the correct instruments and options in place to make sure compliance with use tax necessities.

Bodily presence nexus

Bodily presence nexus refers to the kind of nexus that’s established when a enterprise has a bodily presence in a state. This may very well be as a result of they’ve a bodily location within the state, comparable to an workplace or warehouse, or as a result of they’ve workers or make a certain quantity of gross sales inside the state. Within the context of gross sales tax and use tax, bodily presence nexus is without doubt one of the most typical ways in which a enterprise might be topic to tax legal guidelines in a selected state. Nevertheless, it’s essential to notice that not all states require bodily presence to ascertain nexus, and there are different sorts of nexus that may additionally apply.

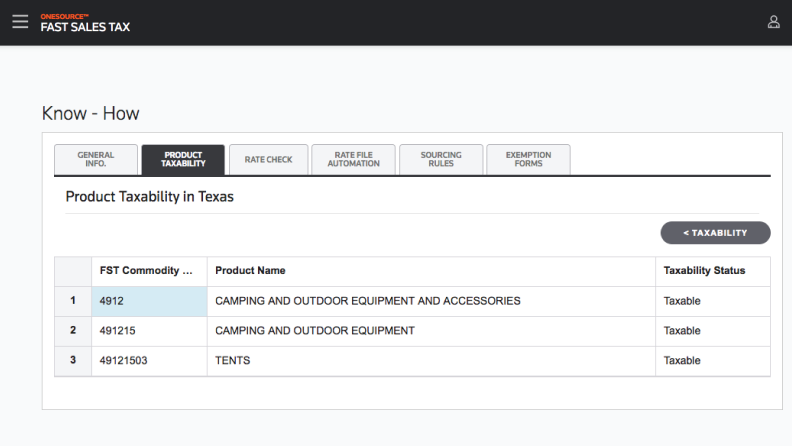

ONESOURCEQuick Gross sales Tax options:

|

|

Gross sales tax vs. use tax

The principle distinction between gross sales tax and use tax is within the level of assortment. Gross sales tax is collected by the vendor on the time of the sale, whereas use tax is paid by the customer once they use or eat a services or products bought from an out-of-state vendor. Gross sales tax is often imposed on all gross sales made inside a jurisdiction, whereas use tax is barely imposed on purchases created from out-of-state distributors. Use tax might be supposed to make sure that all purchases are topic to taxation no matter whether or not they have been made in-state or out-of-state. Each gross sales tax and use tax are essential sources of income for state and native governments and are used to fund public companies and infrastructure initiatives.

It may be simple to confuse gross sales tax and use tax as there are some similarities; nevertheless, there are some notable variations. Due to this fact, it is very important perceive the excellence between the 2.

To briefly recap, gross sales tax and use tax are each a type of oblique tax, which suggests they’re a tax that may be shifted to others. And whereas gross sales tax and use tax are each remitted to the federal government, there are variations in how they’re collected and paid to the federal government.

Gross sales tax is collected by an organization on the retail gross sales of products and companies when the ultimate sale within the provide chain is reached. It’s added to the gross sales value of products and companies after which charged by the retailer to the tip shopper. The retailer is chargeable for remitting that collected tax to the federal government.

Use tax, alternatively, refers back to the tax imposed on the taxable items and companies that weren’t taxed on the level of sale. Not like gross sales tax, the patron is often chargeable for remitting use tax.

Additionally, there may be is exemptions to some taxable objects. Gadgets exempt from gross sales tax are additionally exempt from use tax as properly.

Understanding use tax might be complicated and lots of companies aren’t too conversant in the finer particulars. They might have even made purchases which might be topic to make use of tax and aren’t even conscious. That’s why leveraging the appropriate instruments and options to make sure compliance is vital.

Abstract

In conclusion, use tax is a sort of tax that’s imposed on items or companies which might be bought from out-of-state distributors and used or consumed inside a state. It’s a complementary tax to gross sales tax and is meant to make sure that all purchases are topic to taxation no matter whether or not they have been made in-state or out-of-state.

Use tax could be a complicated and complicated subject, however it is crucial for companies and people to grasp their obligations and adjust to the regulation to keep away from potential penalties and fines. By staying knowledgeable and dealing with trusted advisors, companies and people can navigate the complexities of use tax and be certain that they continue to be in compliance with state and native tax legal guidelines.

[ad_2]