[ad_1]

Whereas concern about stability is comprehensible, fear about prices relies on critical misperceptions.

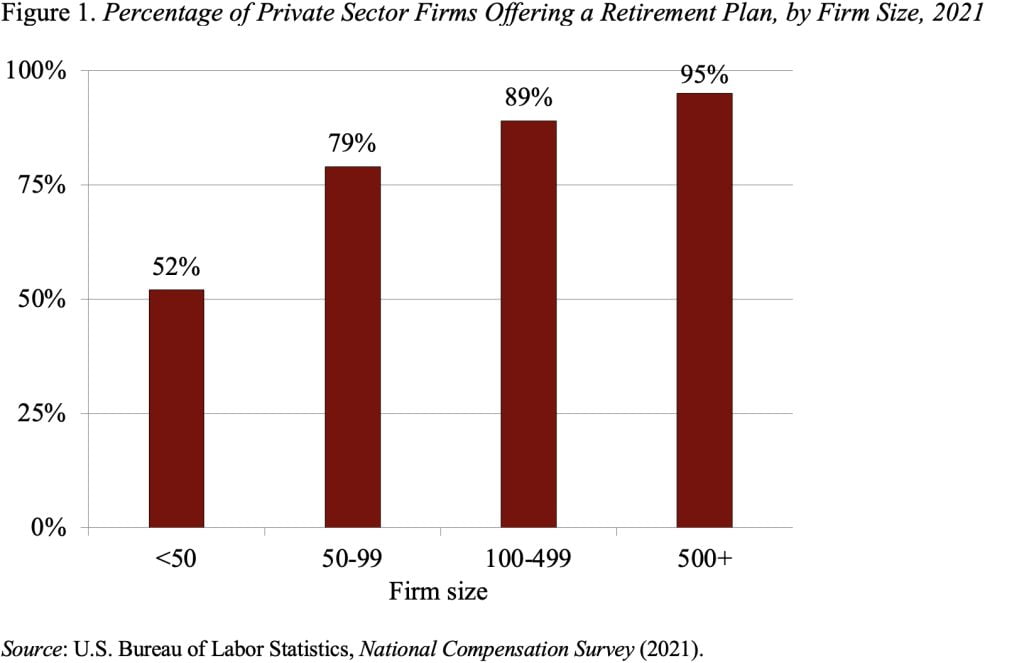

At any given time, solely about half of personal sector staff in america are lined by an employer-sponsored retirement plan, and few staff save with out one. Quite a few research have proven that providing a retirement plan is carefully associated to agency dimension; corporations with fewer than 100 staff are a lot much less prone to supply a plan than bigger corporations (see Determine 1).

In consequence, observers are likely to dismiss small corporations as a supply for future development in protection. Actually, although, many small companies do supply retirement plans. The query is what’s stopping different small corporations from taking the leap?

Whereas latest surveys have touched on small companies and retirement plans, the final complete survey was greater than 20 years in the past. Traditionally, small corporations have persistently cited the identical three main limitations: unsure revenues that make it onerous to decide to a plan; worker preferences for wages and different advantages; and the prices related to establishing and administering a plan.

To find out whether or not perceived limitations have modified over time, we labored with EBRI and Greenwald Analysis to copy their 1998 survey. Interviews had been carried out between February and April 2023 with 703 corporations with 100 or fewer staff.

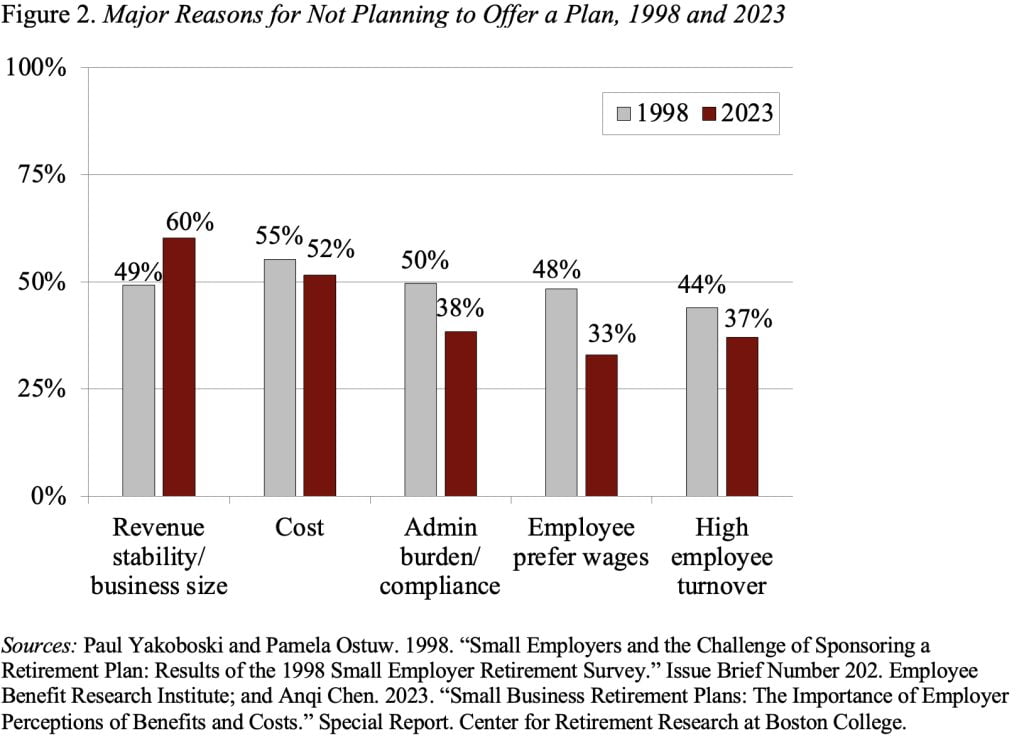

Determine 2 compares the responses of small companies in 1998 and 2023. The highest two limitations that forestall small corporations from providing a retirement plan – income considerations/enterprise dimension and prices or administrative burden – have remained essential. In the present day, nevertheless, employers are far much less prone to cite “worker prefers wages” as a serious purpose for not providing a plan.

The primary concern – income stability/enterprise dimension – appears compelling. Certainly, many small corporations are new, and corporations could must turn into established earlier than organising a office retirement plan is seen as a viable possibility.

The second barrier, price or administrative burden, nevertheless, appears to be pushed by misperceptions. A fast Google search yielded a number of 401(okay) choices the place annual employer prices would solely be about $2,500 for a agency with 10 staff and $5,000 for a agency with 50 staff. However, over half of small corporations imagine offering a retirement plan would price greater than $10,000 per yr; and almost 30 p.c suppose it will price greater than $20,000 per yr.

Not solely do small corporations overestimate the price of providing a plan, the overwhelming majority – notably these with fewer than 50 staff – usually are not conscious that they’ll declare a tax credit score of as much as $5,000, for 3 years, to assist offset the prices of beginning a plan. Curiously, about 80 p.c of employers say that such a credit score would make providing a plan extra engaging.

These outcomes counsel that many corporations overestimate the monetary and time prices required to supply a plan and that higher consciousness of lower-cost plan choices for employers and tax credit may assist transfer the needle on the protection hole.

[ad_2]