[ad_1]

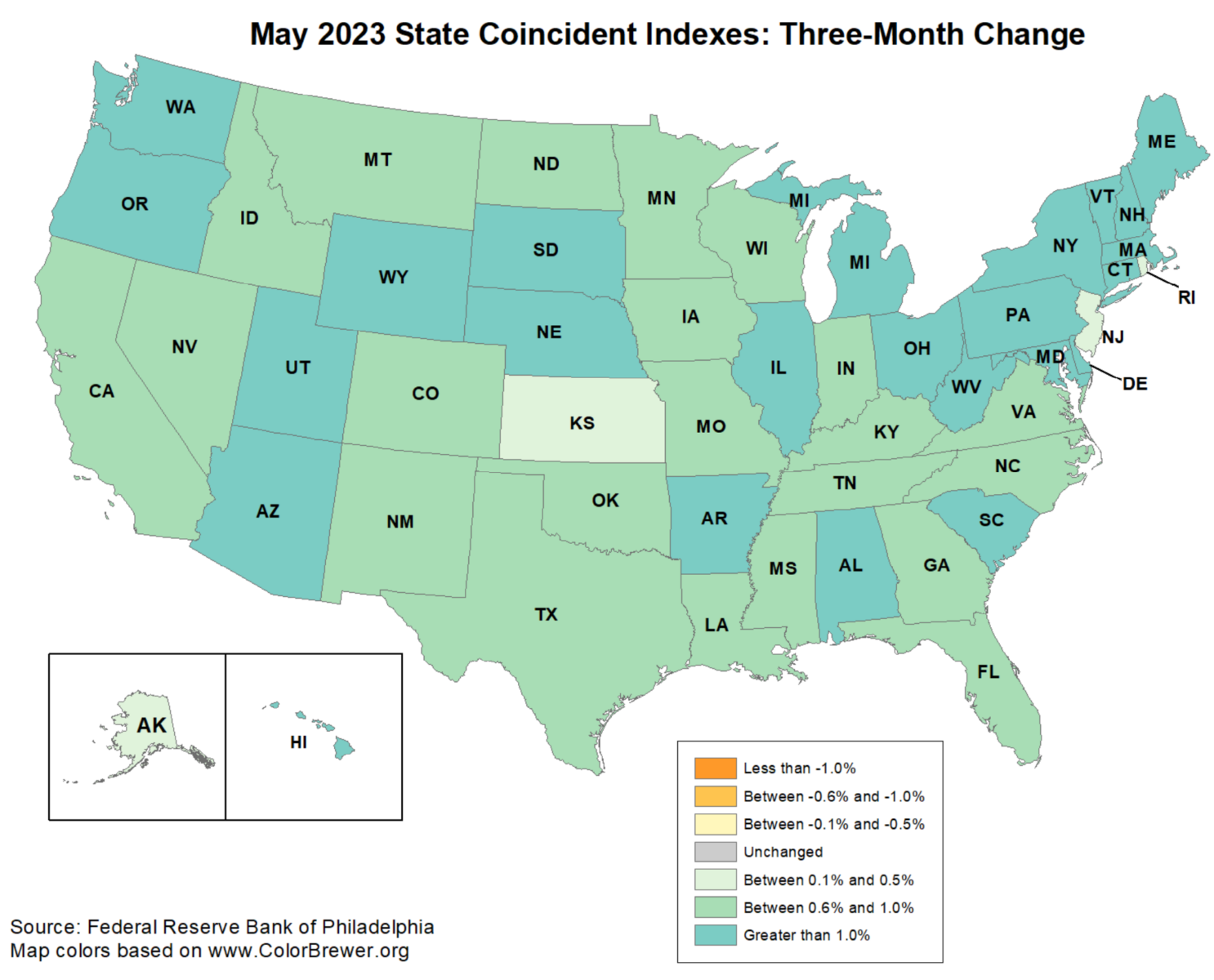

Rising charges, falling financial savings, elevated deficits, doubtful GDP: Ever for the reason that yield curve inverted and warnings of “imminent recession” crammed the air, the Philly Fed’s map of State Coincident Indexes has supplied an excellent real-time snapshot of the state of the financial system. Friday’s launch may need snuck by, however its full of upside surprises which might be value taking a look at.

The overview is straightforward: Over the previous 3 months, the coincident indexes for all 50 states indexes have elevated (Diffusion index = 100). Final month (Could 2023), indexes elevated in 47 of fifty states, have been flat in 2 states (Minnesota and Rhode Island), and fell in simply 1 (Wisconsin). Different states that have been softish embody New Jersey, Arkansas, and Kentucky.

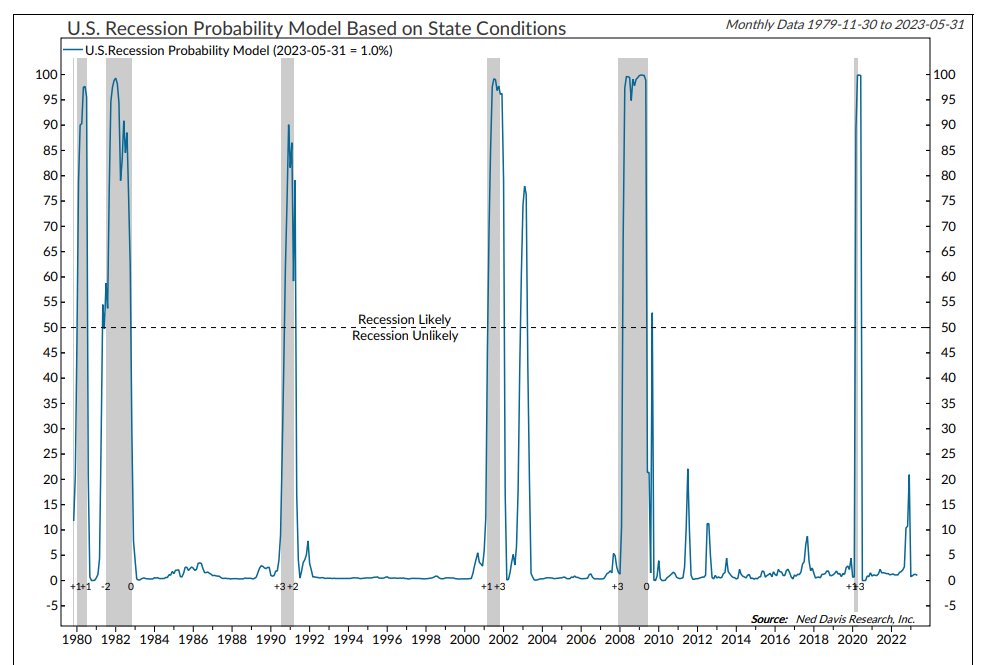

Ned Davis Analysis crunches the state coincident indexes right into a likelihood chart that exhibits however a 1% likelihood we’re at the moment in a recession. This isn’t a prediction, however moderately, a studying of the coincident indexes as a present recession indicator.

NDR Recession Chance Mannequin: 1% likelihood of a recession at the moment

NDR through Ryan Detrick

Facet observe: The yield curve has been inverted for what looks like eternally. Be aware that the 10 12 months minus the 3-Month Treasuries — the recession forecast indicator created by Duke Fuqua faculty of enterprise professor Harvey Campbell inverted in 2019, then once more briefly in 2020, then went deep as soon as the FOMC started elevating charges in 2022:

Regardless of its near-perfect historical past of recession forecasting, maybe the yield curve inversion is much less prophetic when coming off of a decade of Fed Funds at zero. Regardless, this can be very troublesome to objectively have a look at the present knowledge and state we’re in a recession at the moment or might be anytime quickly.

The wildcard? How a lot the FOMC overtightens charges and causes a recession by means of their too quick/too many/too excessive future price hikes…

Beforehand:

Are We in a Recession? (No) (June 1, 2022)

What Knowledge Makes NBER Recession Calls? (September 1, 2022)

The Submit-Regular Financial system (January 7, 2022)

10 Unhealthy Takes On This Market (Could 19, 2023)

Sources:

State Coincident Indexes Present Report (PDF)

Federal Reserve Financial institution of Philadelphia, Could 2023

[ad_2]