[ad_1]

Relating to investing, the choices are overwhelming.

Plus, the returns aren’t all the time what you anticipate. When you’ve been fortunate with investments and do not thoughts taking a danger, you could wish to take a look at one thing unique and strategic, like a hedge fund.

And no, a hedge fund isn’t a piggy financial institution stuffed with change to save lots of up for a boundary of shrubs round your private home. Hedge fund buyers depend on funding portfolio administration software program to trace and handle funding portfolios.

What’s a hedge fund?

A hedge fund refers to pooled investments pulled by a partnership of accredited or institutional buyers. Fund managers make investments the amassed funds in a wide range of non-traditional property for above-average returns. Managing these funds entails danger administration and complex portfolio development.

When studying that definition above, it appears hedge funds are similar to any outdated funding. Nonetheless, there’s so much that units them aside. Let’s go over the fundamentals of hedge fund asset administration to grasp what makes them particular and interesting to these on the lookout for funding alternatives.

Examples of hedge funds

Under are the highest 10 hedge funds by way of property beneath administration (AUM).

- Bridgewater Associates

- Man Group

- Renaissance Applied sciences

- Millennium Administration

- Citadel

- D.E. Shaw Group

- Two Sigma Investments/Advisers

- Davidson Kempner Capital Administration

- Farallon Capital Administration

- TCI Fund Administration

Supply: Visible Capitalist

Hedge fund fundamentals

Hedge funds are referred to as different investments, that means the traits of the funds, the technique behind the funding, and the rules overseeing the method set these funds other than different monetary actions. These funds use riskier methods alongside and leverage property whereas investing in choices and futures derivatives. The actual attraction of hedge funds lies within the repute of managers who deal with hedge fund investing.

Hedge fund managers usually take hedged bets when investing, placing a portion of their property in the other way of the fund’s focus to make up for any losses in core holdings. For instance, hedge funds specializing in cyclical sectors like journey might make investments a portion in non-cyclical sectors like vitality to offset cyclical inventory losses.

Tip: Getting your finance terminology blended up? Study the fundamentals of a sinking fund to see the way it’s totally different from a hedge fund.

Traits of a hedge fund

Listed below are the seven key traits that every one hedge funds have, making it a novel funding alternative.

- Restricted to accredited buyers. Hedge funds are unique. Solely accredited buyers and high-net-worth people (HNWIs) can partake in a hedge fund. These people are deemed certified by the U.S. Securities and Alternate Fee (SEC), that means they acknowledge that these individuals can afford the dangers related to hedge funds.

- Barely regulated. As a result of the individuals concerned with the pooled funding are acknowledged by the SEC on a person degree, the hedge fund itself isn’t required to register. Some funds will register simply to present their buyers peace of thoughts, but it surely isn’t mandatory. Regardless of in the event that they register or not, it’s nonetheless unlawful for hedge funds to violate legal guidelines regarding insider buying and selling, fraud, and some other monetary regulation.

- Offers a number of choices. Different investments, like mutual funds or exchange-traded funds (ETFs), are restricted to placing cash in the direction of shares and bonds, Hedge funds, alternatively, have extra freedom. They will spend money on something, together with shares, actual property, and currencies.

- Contains leverage. A whole lot of instances, hedge funds will use monetary leverage, or borrowed cash that’s invested, for capital progress.

- Illiquid. One other key characteristic of hedge funds is that they’re illiquid. Most managers will restrict what number of instances buyers can withdraw their cash. Because of this in case you make investments your cash in a hedge fund, you’re in it for the long term. The cash you make investments might be held for years.

- Aggressive. Excessive-risk high-return is put into motion with hedge funds. Nonetheless, if the methods being applied are working, the buyers will repeatedly see a revenue.

- Larger charges. Hedge funds cost each an expense ratio and a efficiency price. An expense ratio is solely the cash put in the direction of administrative, administration, and promoting bills. A efficiency price is a fee made to the supervisor of the hedge fund for optimistic efficiency of the funding.

What’s the typical hedge fund price construction?

The price construction for hedge funds is usually known as Two and Twenty. Buyers are charged a 2% administration price, whatever the efficiency of the hedge fund. Then, they’re charged a 20% efficiency price provided that the fund exceeds the hurdle charge. A hurdle charge is a minimal charge a hedge fund expects to earn on an funding.

Hedge fund construction

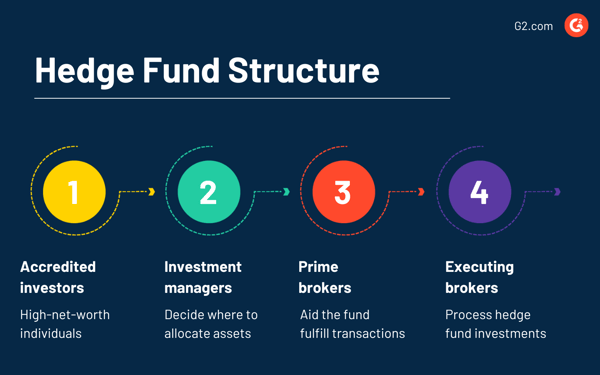

Most hedge funds are structured as restricted partnerships, and there are a few key gamers within the group.

- Buyers: Folks investing in a hedge fund have to be accredited buyers (yearly revenue of $200,000 or extra) or high-net-worth people (web value exceeds $1 million).

- Funding supervisor: An funding supervisor makes plenty of the selections for the hedge fund, like selecting the place to allocate capital and managing the market danger.

- Prime dealer: This particular type of dealer will assist the fund full massive funding transactions.

- Executing dealer: The executing dealer is liable for the completion and processing of the hedge fund’s investments. They may guarantee the whole lot is compliant with the insurance policies and procedures that apply to them.

Kinds of hedge funds

Hedge funds rigorously consider and choose investments which can be more likely to generate most income. Under are 4 sorts of hedge funds that buyers usually discover.

- International macro hedge funds leverage macroeconomic elements and monetary circumstances like actual alternate charges and inflation charges to revenue from market swings.

- Fairness hedge funds spend money on world or home shares that supply safety in opposition to fairness market downturns by promoting overvalued shares or inventory indices.

- Relative worth hedge funds generate higher returns by leveraging the worth variations or unfold inefficiencies of associated securities.

- Activist hedge funds spend money on firms that take motion on totally different calls for, like cost-cutting, change on the board of administrators, and asset restructuring.

Whereas all hedge funds share the traits above, they’ll method incomes cash just a little in a different way.

Widespread hedge fund methods

There are two phrases you must know earlier than we go over the methods for hedge fund administration.

- Lengthy commerce: an asset {that a} dealer hopes will go up in worth.

- Quick commerce: an asset a dealer hopes will go down in worth.

Lengthy/quick fairness

A protracted/quick fairness hedge fund technique is sort of easy. Buyers purchase equities which can be predicted to extend in worth and promote these which can be more likely to lower in worth. One lengthy commerce and one quick commerce. It is not uncommon for buyers to do that with two companies in the identical business: spend money on a predicted winner and loser. The income of the cash from the winner can be utilized to finance the losers. When executed accurately, the fund will see a revenue both method.

Market impartial

The market impartial technique locations equal worth on the quick and lengthy trades available in the market. Get it? They’re impartial to the present circumstances of the market. Buyers match the positions they tackle quick and lengthy shares. So if one finally ends up doing higher than the opposite, they win both method.

Merger arbitrage

Arbitrage methods try and make the most of worth variations between investments which can be carefully associated. The method usually entails utilizing monetary leverage.

In a merger arbitrage, an investor will take opposing sides in two firms which can be presently merging. The inventory is purchased earlier than the merger happens, and the investor expects a return as soon as it’s over. Nonetheless, they need to keep in mind the truth that the merger may not shut on time or in any respect.

Convertible arbitrage

A convertible arbitrage hedge fund is lengthy on convertible bonds, or bonds that may be transformed into shares, and quick on the shares that these convertible bonds can turn into. This technique makes an attempt to revenue off the inefficiencies of a enterprise’s convertible bonds.

Mounted-income arbitrage

The fixed-income arbitrage technique is a technique the place the hedge fund invests in either side of opposition available in the market to account for small worth discrepancies. These hedge funds will control fixed-income returns, like on authorities bonds. Once they sense mispricing, they may take an extended and quick place, usually with leverage, after which see a revenue when the pricing is fastened available in the market.

Occasion-driven

An occasion pushed technique consists of hedge funds shopping for inventory when costs inflate and deflate after a sure occasion, like a takeover or restructuring. These funds will typically buy the debt of firms which can be in monetary misery or have gone bankrupt. They may first purchase senior debt as a result of it’s the cash {that a} bankrupt enterprise should pay again first.

Credit score

A credit score hedge fund is one other instance of a fund that invests within the debt of different companies. Investing in a credit score targeted hedge fund takes quite a lot of data within the debt facet of the capital construction.

International macro

International macro hedge funds spend money on shares, bonds, and currencies in an try and revenue from the impact of political or financial occasions on a selected market. This course of entails deep evaluations of the rise and decline of a nation’s economic system. They place themselves to revenue off a selected final result of an financial or political occasion.

Quick solely

The quick solely technique is principally attempting to uncover accounting fraud or any misrepresentation of the worth of inventory in a monetary assertion.

How do hedge funds earn cash?

Hedge funds earn cash by incomes a flat price together with a proportion of income or optimistic returns that exceed the hurdle charge. The flat price relies on the price construction that buyers pay on the premise of complete property beneath administration.

Hedge funds vs. mutual funds

The important thing distinction is that: hedge funds are extra aggressive and solely accessible to accredited buyers, whereas mutual funds are much less dangerous and face buying and selling restrictions.

Hedge funds leverage high-risk ways like quick promoting shares and taking speculative positions in by-product securities to generate greater returns whatever the market circumstances.

Mutual funds supply particular person buyers a cost-efficient strategy to create a diversified inventory portfolio which can embody publicly traded securities like bonds, shares, or short-term investments. A mutual fund supervisor goals to outperform a benchmark index.

| Hedge funds | Mutual funds | |

| Funding goal | Maximize returns to extend efficiency charges | Outperform a benchmark index |

| Charges | 2% administration charges and 20% of the income | An expense ratio ranging between 0.5% to 2% |

| Shareholder necessities | Accredited buyers solely | Accessible to anybody |

| Liquidity alternatives | Each quarter, half-year, or typically longer | Simple to purchase and promote apart from funds with lock-in durations |

| Regulation | Not necessary to register with the SEC | Mandatorily registered with the SEC |

Hedge fund efficiency tips

Whereas the supervisor of the hedge fund will see a revenue it doesn’t matter what, they nonetheless need that 20% efficiency price. Additionally, a cheerful investor. Let’s go over a few of the vital elements of evaluating the success of a hedge fund.

- Charge of return: The speed of return is the acquire or loss an funding sees over a set time frame.

- Normal deviation: The usual deviation of funding exhibits how usually the speed of return deviates from the typical.

- Drawdown: The share distinction between the height and trough efficiency throughout a particular time frame for an funding. The investor ought to keep in mind the period of time it took for the funding to recuperate.

- Draw back deviation: Basic damaging motion of the economic system or the worth of a safety.

- Minimal funding: How a lot the fund requires to take a position. Redemption phrases: The compensation of any fixed-income safety.

- Fund measurement: What number of buyers are allowed to contribute to the fund.

Hedge fund regulatory necessities

Hedge funds should adhere to restrictions and rules together with recordkeeping and commerce reporting necessities of publicly traded securities. Most of the hedge funds within the U.S. are regulated by the Commodity Futures Buying and selling Fee (CFTC), Commodity Pool Operators (CPO), and Commodity Buying and selling Advisors (CTA).

The Regulation D beneath the Securities Act of 1993 restricts hedge funds to boost capital solely in private choices and from accredited buyers with a minimal web value of $1,000,000 or minimal revenue of $200,000.

The Dodd-Frank Wall Road Reform and Shopper Safety Act of 2010 allowed the SEC to regulate the web value and revenue requirements because it deems acceptable for people. Banks and entities should have minimal complete property value $5,000,000.

The Funding Firm Act of 1940 additionally prohibits hedge funds from making public choices and are topic to anti-fraud provisions as per the Securities Act of 1933 and Securities Alternate Act of 1934.

Hedge fund managers

Hedge fund managers profit from the Two and Twenty price construction. Whereas the 20% efficiency price solely helps them in the event that they put the work in, the two% administration price ensures they see a revenue, irrespective of their quantity of effort.

Let’s say a supervisor is working with a $100 million hedge fund. They may put their ft up and sip on a latte all day with out working and nonetheless obtain their 2%, which might be $2 million. That’s a fairly respectable pay day.

Nonetheless, simply because these buyers have some huge cash and really feel like risking just a little little bit of it, doesn’t imply they settle for an unorganized operation. Hedge fund managers will use monetary providers buyer relationship administration (CRM) software program to verify their buyers really feel taken care of.

Hedge fund taxes

Hedge funds keep away from sure rules that different funding autos are required to concentrate to, that means they’ll have interaction in sure monetary actions which can be off limits to others. Hedge funds can maneuver these guidelines, so the managers and buyers are barely taxed. For this reason you have to be an accredited investor or a high-net-worth particular person to spend money on a hedge fund.

A whole lot of hedge funds make the most of carried curiosity, the place the fund is handled and taxed as a partnership: the fund supervisor is the overall accomplice, after which buyers are the restricted companions.

The fund supervisor’s revenue is taxed as a return on funding, not a wage.

Nonetheless, when a hedge fund returns cash to its buyers, that return is topic to capital features tax, which is a tax on the optimistic distinction between an asset’s sale worth and the unique worth at which it was bought. There’s a quick time period capital features tax that applies to income on investments held for lower than one yr. For investments held longer than one yr, the capital features tax can go as excessive as 20%.

spend money on hedge funds

To spend money on hedge funds, you must search for hedge funds accepting new buyers. Apart from utilizing on-line instruments to search out these funds, it’s best to all the time seek the advice of with trusted monetary consulting suppliers who should have filed a Uniform Software for Funding Adviser Registration (ADV) kind with the SEC. You’ll additionally have to confirm that you simply’re an accredited investor. Plus, you’ll have to offer particulars of revenue, money owed, and property.

What to think about earlier than investing in hedge funds

Try the next finest practices earlier than you spend money on hedge funds.

- Learn the fund’s prospectus or providing memorandum to grasp fund methods, location, fund supervisor charges, supervisor’s battle of curiosity, and kind of investments they make. Think about talking to a monetary advisor earlier than making funding choices.

- Dive deep into the fund’s funding technique. Funds might use diversification methods or a single technique. Understanding these methods will make it easier to discover funds that align together with your danger tolerance, time horizons, or your purpose of getting a diversified portfolio.

- Perceive using speculative funding methods. Hedge funds typically use leverage (borrowed cash) together with investor’s capital to extend returns. They will spend money on fund of funds, derivatives, and short-selling devices. You could expertise potential acquire or volatility due to these fund allocation methods.

- Analyze asset valuation strategies. Some hedge funds spend money on extremely illiquid securities, which can be troublesome to worth. That’s why it’s vital to understand how unbiased sources worth a fund’s securities.

- Have a look at the fund’s revenue and efficiency. Verify if the earlier efficiency information displays money or property that the fund obtained. Now, measure this information in opposition to the estimated fund asset worth modifications to grasp how the fund determines efficiency.

- Pay attention to limitations on redeeming shares. Hedge funds usually impose a lock-up interval throughout which you’ll be able to’t money in shares. Plus, they could cost you redemption charges earlier than you may promote shares. Understanding these limitations will make it easier to discover the fitting fund.

Over the hedge

Large exhale. Hedge funds can get fairly difficult. With the totally different traits, methods, tax rules (or lack of), and controversies, understanding hedge funds is so much to chew. Nonetheless, if you’re trying to make funding and also you meet the necessities of the individuals that may make investments, it may be an awesome supply of revenue.

Try the most effective monetary analysis software program for knowledgeable funding decision-making.

This text was initially revealed in 2019. It has been up to date with new info.

[ad_2]