[ad_1]

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job every week diving into the specifics of the newsflow in What Are Your Ideas?

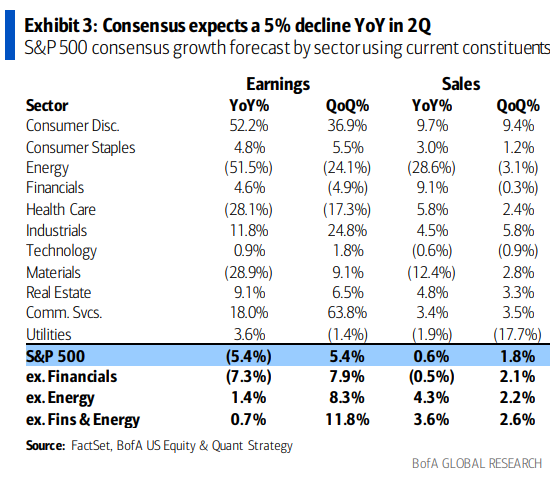

Don’t miss my favourite chart from this week’s dialogue 46 minutes deep into the episode; its from Financial institution of America by means of Batnick (above).

The entire fall-off surrounding the 8% pullback in S&P 500 income — actually, greater than 100% of it — is because of the enormous drop in vitality income. Recall 2022, vitality was one of many few vivid spots as oil costs rallied principally because of the Russian invasion of Ukraine. This yr, with decrease oil costs, vitality firm income dropped in half

Again out the 51.5% drop in Vitality income Yr-over-Yr, and SPX income are up 1.4%. Q/Q its +8.3%. The flip facet of that is the sectors that acquired shellacked in 2022 are actually exhibiting huge revenue recoveries. Shopper Discretionary Yr-over-Yr is +52.2%, Communication + 18%, and Industrials 11.8%.

When taking a look at any knowledge sequence, the Base Results matter. We’ll see one thing related within the subsequent few CPI stories, as the most well liked year-ago numbers drop off from the 12-month sequence.

I’m usually skittish about exhibiting issues “Ex” something — recall my mid-2000s fisking on Inflation Ex Inflation — however on this case, the framing reveals quite than hides what’s going on.

Beforehand:

Earnings

Ex-Inflation, There’s No Inflation (September 26, 2005)

Inflation Ex-Deflation (this time, INCLUDING vitality) (June 22, 2012)

CPI: Imperfect However Helpful (Could 24, 2022)

[ad_2]