[ad_1]

Options that make the lives of your workers and clients simpler are the very best — who would not wish to improve productiveness and delight extra clients on the similar time?

An instance of certainly one of these options is recurring funds. On this article, we’ll cowl the definition of recurring funds, how they work, and which instruments exist that can assist you handle and settle for them.

Recurring Funds

With recurring funds, a buyer supplies their billing data as soon as, and you then cost them primarily based on a cadence that you simply each agreed to.

How do recurring funds work?

Recurring funds (generally referred to as computerized funds) occur when a enterprise will get authorization from a buyer to mechanically invoice them and take cash from their account on a pre-determined schedule (typically month-to-month) to pay for a services or products the client has determined to make use of.

Subscription Funds

Recurring and subscription funds are phrases which can be typically used interchangeably — that is as a result of recurring funds are the way you handle subscriptions.

Subscription funds are when somebody subscribes to your services or products and is then billed at a daily cadence.

Advantages of Recurring Funds

Recurring funds might be useful for your enterprise and your clients. They…

- Save time for purchasers so they do not must manually log right into a system and enter bank card or checking account particulars — or write a test — in an effort to make a cost.

- Guarantee your enterprise is getting paid on time and clients aren’t having to set cost reminders.

- Assist your enterprise predict money circulate.

- Can help you retain extra clients.

- Preserve a single report of all funds a buyer has accomplished and/or owes.

- Can automate your complete recurring cost course of (should you implement a recurring cost instrument).

What forms of companies can profit from recurring funds?

Any enterprise that provides a services or products that requires a subscription can profit from recurring funds. For instance, companies that promote providers and/or non-tangible items similar to software program or a fitness center membership. The identical goes for companies like Eversource that cost for utility utilization.

An instance of a enterprise that sells a tangible product and may benefit from recurring funds is a meal prep supply service like HelloFresh.

Recurring Cost Processing

You is perhaps questioning how recurring cost processing works. Let’s check out how one can course of recurring funds subsequent.

Settle for Recurring Funds

To just accept and course of recurring funds, begin by choosing a recurring cost software program.

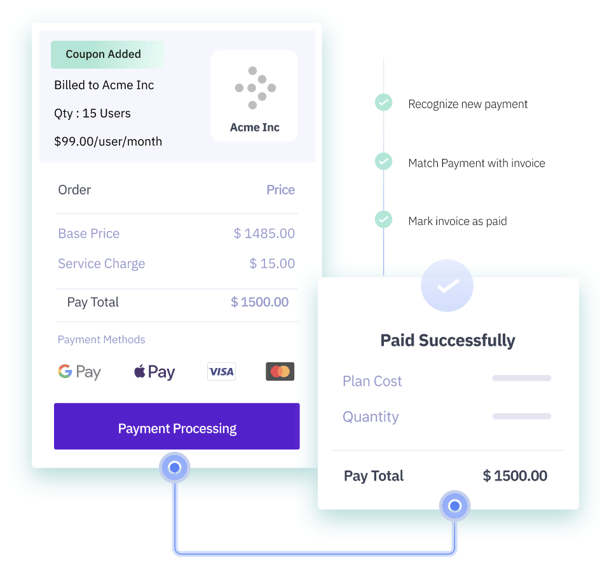

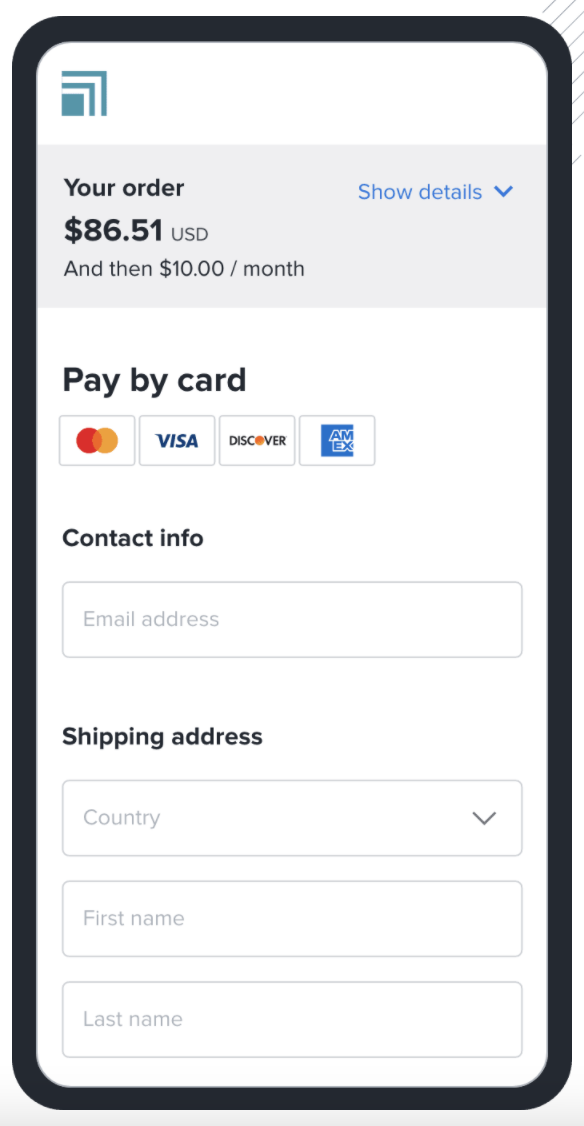

Then, present your buyer with the flexibility to pick a cost plan and schedule, in addition to their most popular cost methodology (platform like PayPal, bank card, checking account). Your instrument of alternative will safely retailer your buyer’s billing and cost particulars.

Then, as soon as it is time for cost, the instrument will mechanically invoice the client and concern them an bill.

Finest Recurring Cost Processing

- HubSpot Funds for companies that promote providers seeking to handle subscription memberships.

- Chargebee for providing a number of cost strategies in varied currencies and mechanically rectifying any recurring cost failures.

- Wave for organising guide and computerized recurring funds at a small enterprise.

- Recurly for international, recurring income firms.

- Sq. for companies that already use Sq. Invoices or wish to ship free invoices and arrange yearly, month-to-month, weekly, or day by day recurring funds.

Listed here are a couple of of the very best recurring cost processing instruments.

1. HubSpot funds

Get began with the Funds instrument

Finest recurring funds instrument for: Companies that promote providers and wish to handle subscription memberships in addition to combine funds with their CRM.

Worth: Credit score and debit playing cards: You pay a flat 2.9% of the transaction quantity. ACH funds: you pay 0.5% of the transaction quantity, capped at $10 per transaction

Key options and advantages:

- Splendid for companies that promote providers (similar to companies or monetary establishments) relatively than tangible objects and must handle subscription memberships.

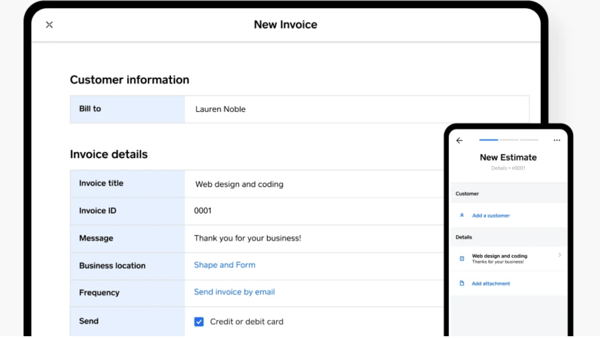

- Ship a quote to a buyer with a recurring cost hyperlink they usually can then transact in that actual second.

- HubSpot additionally supplies a seamless buyer expertise by integrating along with your CRM — that means you’ll be able to supply personalised shopping for experiences and streamlined cost all with linked knowledge. For instance, you’ll be able to take one have a look at a buyer profile and decide that they are up for renewal. Then, you’ll be able to simply get Advertising concerned to allow them to rapidly nurture the client wherever they’re of their journey in a customized.

Professional Tip: Use HubSpot funds to ship quotes with recurring cost hyperlinks to prospects to allow them to transact at that actual second.

2. Chargebee

Finest recurring funds instrument for: Providing a number of cost strategies in varied currencies and mechanically rectifying any recurring cost failures.

Finest recurring funds instrument for: Providing a number of cost strategies in varied currencies and mechanically rectifying any recurring cost failures.

Worth: You may get began at no cost and/or schedule a demo.

Key options and advantages:

- Arrange a cost card business (PCI)-compliant cost expertise in your clients in addition to supply your clients over 23 completely different cost gateways.

- Supply pricing and recurring billing in over 100 currencies and cost strategies when you’ve got a global buyer base. There’s additionally a cost dunning function that can assist you gather recurring funds even after one-time failures.

3. Wave

Finest recurring funds instrument for: Establishing guide and computerized recurring funds at a small enterprise.

Finest recurring funds instrument for: Establishing guide and computerized recurring funds at a small enterprise.

Worth: 2.9% + 30¢ per transaction for Visa, Mastercard, Uncover; 3.4% + 30¢ per transaction for American Categorical; Financial institution funds (ACH) 1% per transaction ($1 minimal payment).

Key options and advantages:

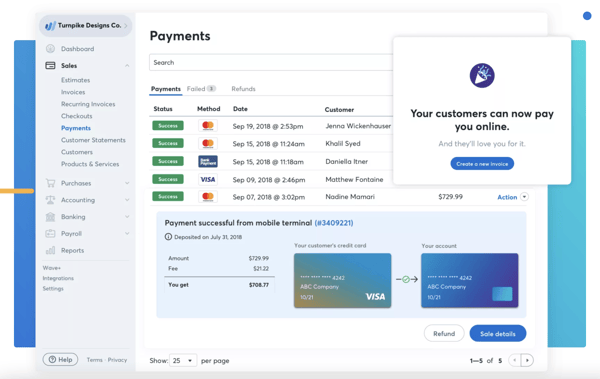

- Arrange a buyer’s bank card particulars after which change between computerized and guide funds relying on which sort of billing methodology is preferable.

- Routinely ship your buyer a receipt when auto-payment is on — when the function is off, the instrument will ship your buyer an bill.

- Drag-and-drop editor makes organising recurring billing and creating invoices quick. With Wave, you may also customise invoices along with your branding, emblem, messages, date, and time zone.

4. Recurly

Finest recurring funds instrument for: World, recurring income firms.

Worth: Plans beginning at $149/mo + 0.9% of income.

Key options and advantages:

- Automate the method of billing and invoicing irrespective of which of your product/ service and cost plans a buyer makes use of.

- Personalize invoices along with your recipient’s data in addition to your organization’s branding. Moreover, automate bill creation and supply, and handle one-time bill adjustments, refunds, credit, and extra with ease.

- Helps you with taxes to make sure you adjust to all native and international requirements.

5. Sq.

Finest recurring funds instrument for: Companies that already use Sq. Invoices or wish to ship free invoices and arrange yearly, month-to-month, weekly, or day by day recurring funds.

Worth: Invoices are free to ship. If clients pay on-line with a credit score or debit card, you then pay 2.9% + 30¢ per bill. If clients have you ever retailer their card, you pay 3.5% + 15¢.

Key options and advantages:

- Arrange recurring funds that invoice your clients yearly, month-to-month, weekly, or day by day. With Sq., invoices are free to ship — you pay a processing fee after they’re paid on-line.

- You will be paid mechanically and as typically as you and your buyer have determined upon in case your clients present their cost particulars.

- Ship automated emails to your clients for recurring funds or print invoices and ship bodily copies, relying on what’s preferable.

Wrap Up

Recurring funds guarantee on-time cost for each your enterprise and clients. They make the lives of your clients simpler whereas additionally saving your workforce time and bettering buyer loyalty.

[ad_2]

.jpg?width=3654&name=Create%20a%20Payment%20Link%20-%20Line%20items%20(billing%20frequency).jpg)