[ad_1]

After rising three weeks in a row, the Indian equities took a breather, ending the week on a unfavorable notice a lot on the anticipated strains whereas resisting the important thing ranges. There was a slight divergence between the Indian markets and the worldwide markets. Structurally talking, SPX and different key European Indices like DAX look stronger than NIFTY; nevertheless, it may be mentioned that they’re maybe enjoying a catchup of their relative underperformance over the previous months. The buying and selling vary acquired wider as NIFTY oscillated in a 398-points vary over the previous 5 periods. Whereas persevering with to withstand the important thing ranges, the headline index closed with a web lack of 111.40 factors (-0.61%) on a weekly foundation.

VIX, too, noticed a decline. Whereas remainin at comparatively one in all its lowest ranges, INDIAVIX declined by 4.28% to 12.30. We enter the expiry week of the present month’s by-product sequence and the markets are set to remain influenced by the expiry and rollover-centric actions. Whereas not evaluating the NIFTY chart with international indices charts and taking a look at them in isolation, it seems that some unfavorable divergence in efficiency could keep for some extra time. The by-product information exhibits NIFTY going through stiff resistance within the 18350-18500 zone; except this zone is taken out meaningfully, no runaway rally may be anticipated within the markets.

In his speech yesterday the place he was interviewed by a prime US Central Financial institution staffer, the Fed chief Jerome Powell made extremely scripted and unclear remarks, saying it’s unclear if U.S. rates of interest might want to rise additional. He additional mentioned that the central financial institution would now make choices “meeting-by-meeting,” additional including that, after a 12 months of aggressive price will increase, they’ll afford to have a look at the information and evolving outlook to make cautious assessments.

Monday is once more anticipated to see a quiet begin; NIFTY is prone to discover resistance at 18350 and 18480 ranges. The helps will are available at 18040 and 17800 ranges. The buying and selling vary will keep wider than ordinary.

The weekly RSI is 57.50; it stays beneath 60 and impartial with out displaying any divergence towards the value. The weekly MACD is bullish and trades above the sign line. No notable formations had been seen on the candles.

The sample evaluation exhibits that the NIFTY is enjoying out effectively to the falling pattern line that begins from 18600 and joins the following decrease tops. The index resisted this trendline a number of instances earlier than crossing above it and taking help on it twice. Proper now, the index trades close to one other sample resistance level of 18389; this makes the 18350-18500 zone a powerful resistance zone for the index.

All in all, we’re not but fully out of the woods; the technical construction of the markets means that the ranged consolidation could proceed and the markets will proceed discovering promoting stress at greater ranges. There isn’t a technical proof current on the chart that implies a steep decline; nevertheless, there will not be any steep up-move within the markets both except the 18350-18500 zone is taken out convincingly. It’s strongly really useful to proceed approaching the markets on a extremely selective foundation and vigilantly defend income at greater ranges.

Sector Evaluation for the Coming Week

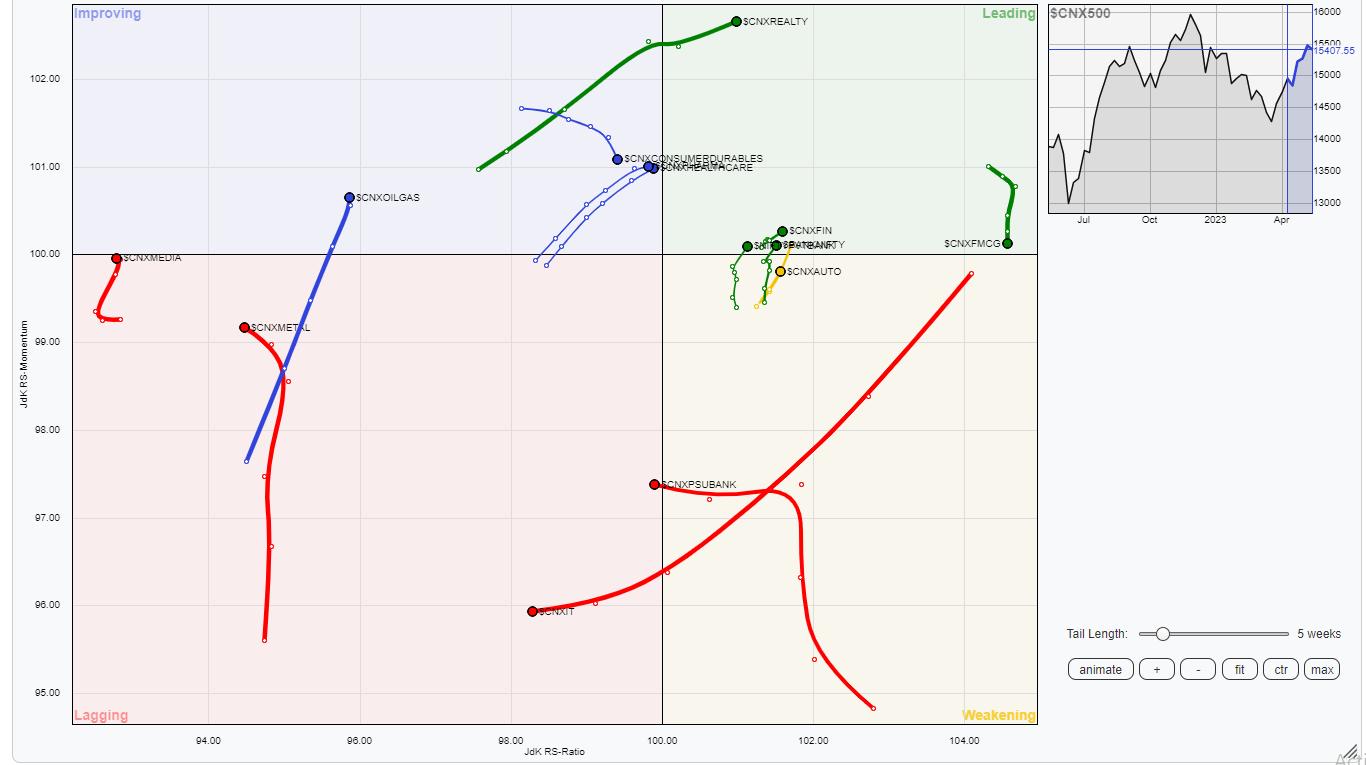

In our have a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits NIFTY Realty, BankNifty, Consumption, and Monetary Companies indices are contained in the main quadrant. These teams are prone to present relative outperformance towards the broader NIFTY 500 Index. The FMCG, Midcap 100, and Infrastructure indices are additionally contained in the main quadrant. Some relative outperformance may be anticipated from these teams as effectively, however they look like giving up on their relative momentum.

NIFTY PSE Index has rolled contained in the weakening quadrant. The Auto index additionally stays within the weakening quadrant, however exhibits some enchancment in its relative momentum.

The Nifty PSU Financial institution index has rolled contained in the lagging quadrant. The IT Index can also be seen languishing contained in the lagging quadrant. The Media, Commodities, and Metallic indices are additionally seen positioned contained in the lagging quadrant.

The Power and the Pharma Indices are contained in the enhancing quadrant.

Vital Notice: RRG™ charts present the relative energy and momentum of a bunch of shares. Within the above chart, they present relative efficiency towards NIFTY 500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, at present in its 18th 12 months of publication.

Subscribe to Analyzing India to be notified each time a brand new submit is added to this weblog!

[ad_2]