[ad_1]

After ending with positive aspects for 3 weeks in a row, the markets took a breather this time by ending modestly within the crimson. Within the earlier technical observe, it was talked about that the Nifty isn’t solely over-extended on the shorter timeframe charts; the VIX can also be hovering round one among its lowest ranges seen within the current previous. It was additionally talked about that at any cut-off date, the indices might look to right; if not sharply, then at the very least modestly. The buying and selling vary remained according to expectations; the index oscillated in a 309-point vary by means of the week. After consolidating for the most important a part of the week and coming off from its excessive level, the benchmark index NIifty ended with a web lack of 203.95 factors (-1.14%) on a weekly observe.

Over the approaching week, it is very important hold a really cautious and shut tab on a few issues from a technical perspective. The India VIX. This volatility gauge has closed at a brand new low of 11.63 after coming off by 2.33% on a weekly foundation. This has plunged to a brand new low by violating 2021 low of 11.70. With this being persistently at precariously low ranges, this has left the markets weak to sharp profit-taking bouts from present and better ranges. The week may even see the expiry of the month-to-month spinoff sequence; the 17700 strike has the very best built-up of Name OI and that is set to behave as a powerful resistance level for the Index.

The subsequent will see the degrees of 17700 and 17865 performing as sturdy resistance factors. Helps are available at 17500 and 17380.

The weekly RSI is 50.15; it stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD stays bearish and under the sign line.

The sample evaluation reveals that the excessive level of the earlier week, i.e., 17863 is sort of develop into a right away prime for the short-term; no significant up-move is probably going except this stage is taken out. In addition to this, an vital help zone for the NIFTY falls within the 17367 and 17187; the 50-week, and the 100-Week MA of NIFTY. Nevertheless, the opportunity of testing these ranges would improve provided that the index finally ends up violating 17500 ranges.

As we method the markets over the approaching days, we might want to do it on a really cautious observe. The long-only market individuals might want to give attention to discovering alternatives from the broad market universe; it will be imprudent from this time one to chase the up-move within the indices and its constituents. Some relative outperformance is anticipated from the defensive area like FMCG, Consumption, Pharma, PSE, and so on. A extremely selective method is suggested for the approaching week.

Sector Evaluation for the approaching week

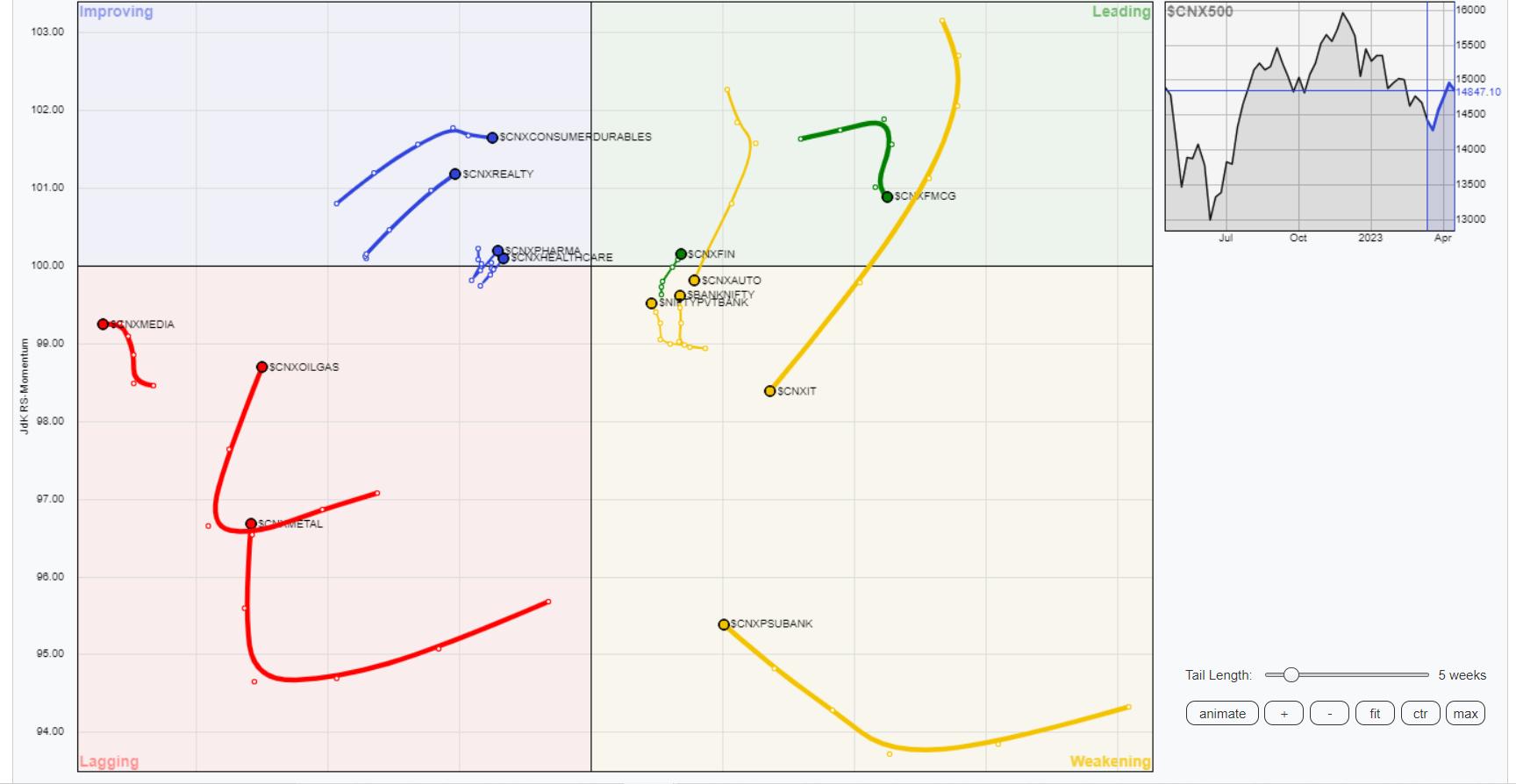

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed

The evaluation of Relative Rotation Graphs (RRG) doesn’t present any main change within the sectoral arrange over the earlier week. We have now NIFTY Infrastructure, Midcap 100, and PSE index positioned contained in the main quadrant and they’re anticipated to comparatively outperform the broader markets. The Monetary Providers Index has rolled contained in the main quadrant.

The IT and the Auto Index have rolled contained in the weakening quadrant. This will effectively finish their section of relative outperformance and we might even see these pockets taking a breather. Banknifty and PSU Financial institution indices are additionally contained in the weakening quadrant. Nevertheless, they’re seen enhancing on their relative momentum in opposition to the broader markets.

Media and Steel Indices are seen within the lagging quadrant; all of them look like attempting to consolidate and put a possible base in place by exhibiting enchancment of their relative momentum in opposition to the broader markets. The NIFTY Providers sector index can also be contained in the lagging quadrant. All these teams are more likely to comparatively underperform the broader NIFTY500 Index.

The Vitality, Pharma, and Commodities indices have rolled contained in the enhancing quadrant. The Consumption Index and the Realty Index can also be seen rolling firmly contained in the enhancing quadrant. These teams are more likely to see resilient efficiency over the approaching week.

Essential Word: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, at present in its 18th 12 months of publication.

Subscribe to Analyzing India to be notified each time a brand new publish is added to this weblog!

[ad_2]