[ad_1]

The Indian fairness markets prolonged their positive factors for the third week in a row; nevertheless, they’ve ended up getting a bit over-extended on the charts. All 4 buying and selling classes within the shortened week led to positive factors; in reality, NIFTY has closed with positive factors for 9 classes in a row with VIX staying at one in all its lowest ranges seen within the current previous. The buying and selling vary remained slim; the index moved in 244 factors previously 4 classes. The markets have largely stayed bullish via the week; the benchmark index ended with a web achieve of 228.85 factors (+1.30%) on the weekly foundation.

The approaching week stays as soon as once more vital; the INDIAVIX stays at one of many lowest ranges seen within the current previous whereas it remained largely flat via the week. The NIFTY has tried to maneuver out of the small falling channel that it has shaped for itself; it has additionally raised the help ranges increased within the course of. The Index has additionally crossed above the 20-Week MA which stands at 17789 by closing a notch above that time. The helps have been dragged increased at 17300 ranges. The markets stare at some imminent corrective retracement after unabated up-move; the low ranges of INDIAVIX will proceed to remain a priority for the speedy brief time period.

Monday is prone to see a tepid begin to the week. The degrees of 18000 and 18180 will act as speedy resistance factors; the helps are available in a bit decrease at 17500 and 17380 ranges. The buying and selling vary for the approaching week is predicted to get wider once more than common.

The weekly RSI is 53.36; it continues to stay impartial and doesn’t present any divergence towards the worth. The weekly MACD stays bearish and under its sign line. No main formation was seen on the Candles.

The sample evaluation of the weekly charts reveals that the NIFTY has rebounded off the 100-Week MA after a minor violation of that stage. The 100-Week MA presently stands at 17163. This level adopted by the 50-Week MA which is positioned at 17343 makes 17300-17100 an important help zone for the markets within the close to time period.

The approaching week must be approached with a heightened diploma of warning. The markets have seen an unabated rise over the previous 9 classes. On prime of it, INDIAVIX stands at 11.91; this stage stays one of many lowest ranges seen within the current previous. Any spike within the VIX will go away merchants uncovered and susceptible to violent profit-taking bouts from the present ranges. From a technical standpoint, the markets stay due for some imminent corrective retracement; this makes any extra upsides capped in nature.

Any up-move that we see from the present ranges must be used for cover earnings on the positions. Any further, emphasis should be positioned on utilizing the strikes within the markets to e book earnings and take cash off the desk; mindlessly chasing the up strikes is one thing that must be prevented. A extremely cautious strategy is suggested for the approaching week.

Sector Evaluation for the approaching week

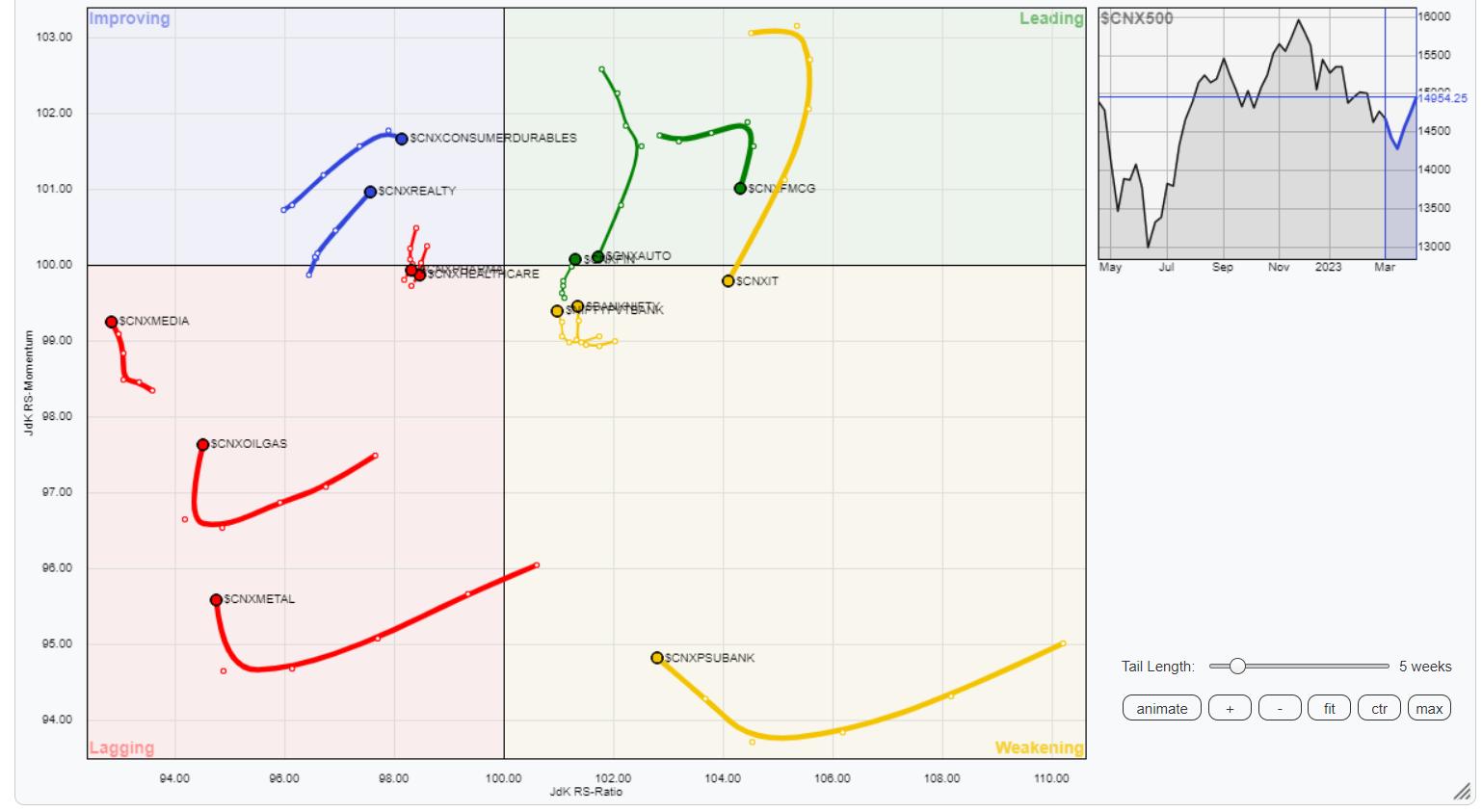

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed

The evaluation of Relative Rotation Graphs (RRG) reveals that NIFTY Infrastructure, Midcap 100, and PSE index are positioned contained in the main quadrant and they’re anticipated to comparatively outperform the broader markets. The AUTO, IT, and FMCG indices are additionally contained in the main quadrant however they look like taking a breather and giving up on their relative momentum.

Banknifty, PSU Financial institution, and Monetary Companies index are additionally contained in the weakening quadrant. Nevertheless, they’re seen bettering on their relative momentum towards the broader markets.

NIFTY Commodities, Power, Pharma, Media, and Metallic Indices are seen within the lagging quadrant; all of them seem like making an attempt to consolidate and put a possible base in place. The NIFTY Companies sector index can also be contained in the lagging quadrant. All these teams are prone to comparatively underperform the broader NIFTY500 Index.

The Consumption Index is contained in the bettering quadrant; the Realty Index can also be seen rolling firmly contained in the bettering quadrant. These teams are prone to see resilient efficiency over the approaching week.

Necessary Be aware: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Each day / Weekly Market Outlook” — A Each day / Weekly E-newsletter, presently in its 18th yr of publication.

Subscribe to Analyzing India to be notified every time a brand new put up is added to this weblog!

[ad_2]