[ad_1]

It was an immensely unstable and eventful week for the Markets as they headed in the direction of the final weekly shut earlier than the Union Finances. The final three periods, extra notably, the final two periods remained marred by the severely bearish reactions to Hindenburg Analysis’s report on the Adani Group shares. Hindenburg Analysis is a “forensic monetary analysis” that makes a speciality of recognizing firms across the globe which might be engaged in wrongdoings and frauds they usually have accused Agani Group of brazen inventory manipulation and working an accounting fraud scheme for many years.

The NIFTY, which was seen taking assist on the 20-Week MA for 5 weeks in a row, suffered a powerful bearish transfer on the draw back; it violated essential assist ranges and dragged resistance ranges decrease. The index noticed a large buying and selling vary of 707.70 factors over the earlier week. It will definitely ended with a web lack of 423.30 factors (-2.35%); from the intra-week excessive level, the NIFTY got here off by 600-odd factors. Volatility spiked; INDIAVIX rose sharply by 25.65% to 17.32.

The injury that the previous periods have inflicted on the markets has been important from a technical perspective. Extra so once we head into the Union Finances this coming week. The NIFTY has violated the 20-Week MA on the weekly charts stands at 17896 and in addition the 100-DMA which is at the moment positioned at 17950. Within the course of, the index has dragged its resistance factors decrease. The approaching week has robust resistance at 17750 and 17860 ranges. Helps are available at 17400 and 17250 ranges.

The weekly RSI is at 47.95; it has marked a brand new 14-period low which is bearish. It stays pure and doesn’t present any divergence towards the worth. The weekly MACD is bearish and trades beneath the sign line.

A big Engulfing candle has emerged; its emergence whereas violating essential assist makes it much more potent in nature.

The sample evaluation exhibits that the NIFTY has ended up violating two essential assist ranges on totally different timeframes of charts. It has breached the 20-Week MA which is at 17896 and has additionally ended up violating the 100-DMA which stands at 17950. This value motion has dragged the resistance factors for NIFTY fairly decrease. It additionally signifies that all technical pullbacks will discover robust resistance at this level and should meet with promoting stress until the zone of 17900-17950 is taken out convincingly.

We head into Union Finances this week; Union Finances is scheduled to be tabled on Thursday, February 02. That is set to infuse quite a lot of volatility over the approaching days. On one aspect, the markets are but to complete their response to Hindenburg Report the place the allegations leveled are completely critical in nature; however, additionally it is set to react to Finances proposals that shall be offered.

Whereas the markets face the double-edged sword of volatility, the easiest way to navigate such an unsure setting is to maintain leveraged exposures at modest ranges. In addition to this, it will be greatest to remain invested in sectors like PSE, IT, FMCG, Pharma, and so forth., that are displaying good enchancment within the relative power towards the broader markets, or keep invested in low beta sectors that can keep much less unstable than the markets typically. From a technical standpoint, NIFTY won’t present any significant and sustainable up transfer as long as it stays beneath 17950. Total, a extremely cautious strategy is suggested for the approaching week.

Sector Evaluation for the approaching week

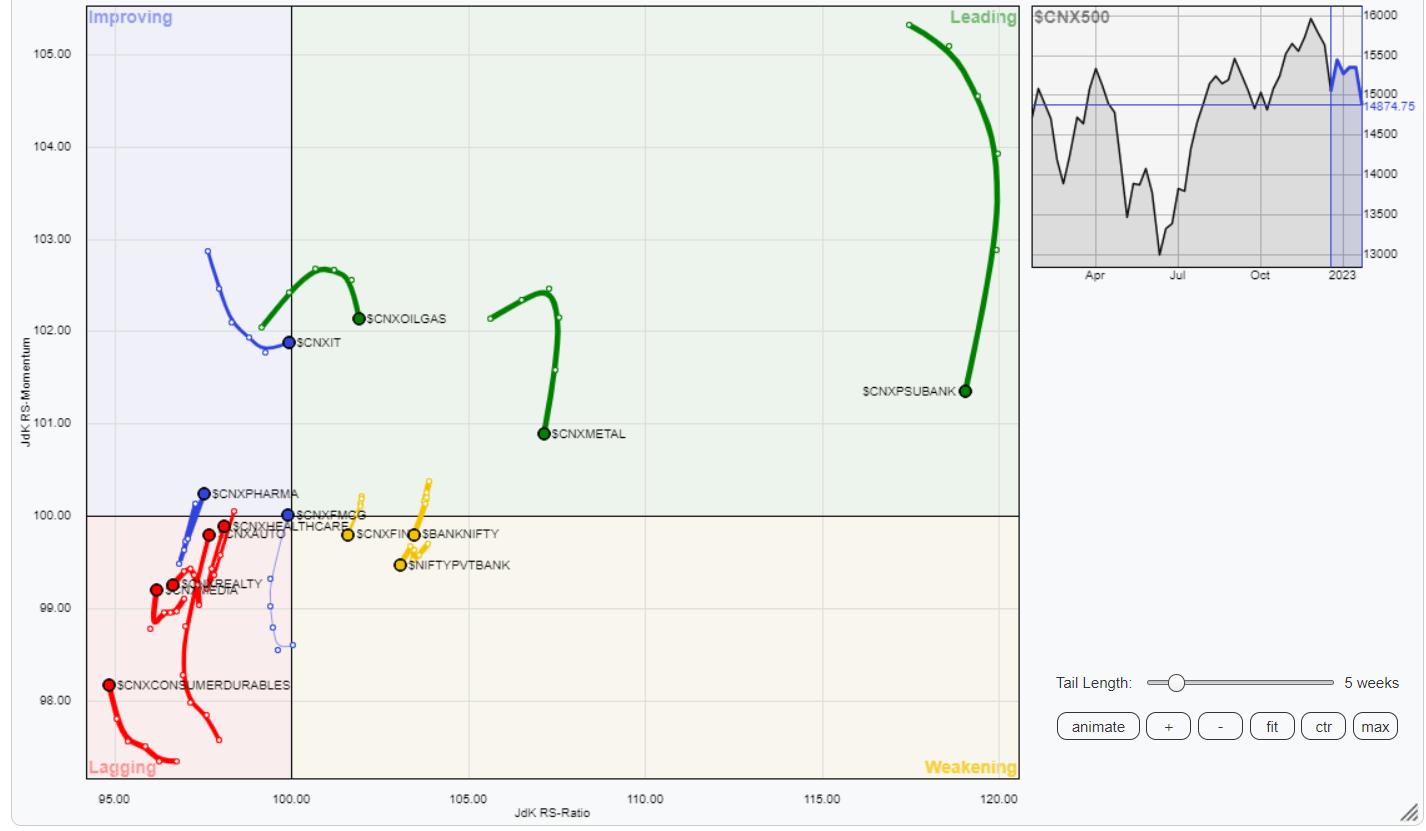

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed

The evaluation of Relative Rotation Graphs (RRG) exhibits some seen modifications within the general sectoral setup as in comparison with the earlier week. NIFTY PSE, Steel, Infrastructure, PSU Financial institution, and commodities are positioned contained in the main quadrant. Out of this, PSE is the one sector that’s seen firmly rotating inside this quadrant. The others are displaying paring of relative momentum towards the broader markets.

Banknifty, Nifty Companies Sector, and Monetary Companies Sector index have rolled contained in the weakening quadrant. They might proceed to carry out individually however might not carry out effectively on relative phrases.

NIFTY Realty and Media Sector indexes are seen languishing contained in the lagging quadrant. Nevertheless, other than this, Auto, Consumption, Midcap 100, and FMCG indices are contained in the lagging quadrant however they’re seen sharply enhancing on their relative momentum.

The pharma index has rolled contained in the enhancing quadrant and is firmly positioned together with the IT Index. The Power Sector index can also be contained in the enhancing quadrant however it’s seen barely giving up on its relative momentum.

Necessary Be aware: RRG™ charts present the relative power and momentum for a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, at the moment in its 18th 12 months of publication.

Subscribe to Analyzing India to be notified at any time when a brand new put up is added to this weblog!

[ad_2]