[ad_1]

It’s a morning of very blended messages on the financial system.

Chancellor Jeremy Hunt will on Monday set out a sequence of “Mansion Home reforms” meant to channel tens of billions of kilos of Britain’s pensions financial savings into high-growth firms.

Hunt will use the chancellor’s set-piece annual speech within the Metropolis of London to set out reforms he claims will seize “advantages of Brexit” and make UK capital markets extra enticing.

The second of those paragraphs exhibits how fanciful is Hunt’s pondering. The one option to deal with Brexit now’s by asking to return.

As for the primary, the concept pension fund cash may really be used to fund funding is one thing I’ve lengthy advocated. I’m glad that he has seen that pension cash shouldn’t be getting used on this manner.

However the easy reality is that if pension wealth is at the least 42% of whole UK wealth (as ONS knowledge exhibits) and represents at the least 77% of all UK monetary wealth, with ISAs making up one other 8% of whole monetary wealth, that means 85% of that monetary wealth is now tax incentivised, then if cash shouldn’t be shifting from tax incentivised saving into precise funding there are two attainable explanations.

One is that the tax incentive to save lots of is wrongly structured as a result of it doesn’t require that the saving be linked to funding, that means the return to the state on the funds used to subsidise that financial savings exercise goes to waste.

Or, alternatively, the motivation is being abused by those that use the saved funds to supply fund managers with a return that’s unrelated to any precise funding exercise as a result of the funds are literally used for hypothesis.

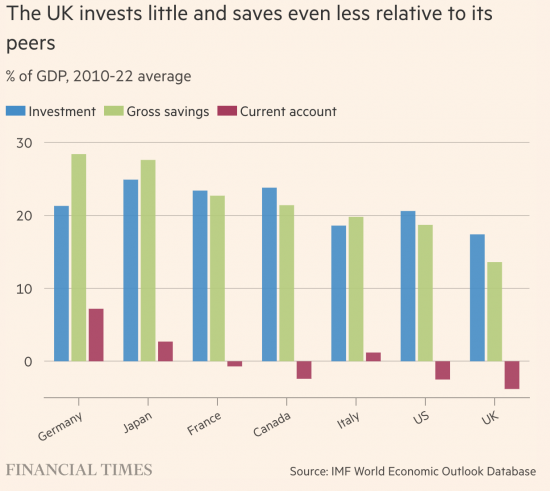

I’d really counsel each these items are taking place. So, I feel does Martin Wolf, additionally within the FT yesterday. He has this chart:

Wolf bemoans our lack of saving, which he hyperlinks to our lack of funding. He doesn’t, nonetheless, make any of the mandatory hyperlinks.

If nearly all our saving is tax incentivised and we don’t save sufficient he doesn’t ask why are the incentives fallacious? Nor does he ask why cannot we afford to save lots of extra, if that’s what we want? And, once more, he fails to ask why is there such a marked disconnect within the UK between financial savings and funding?

The solutions are literally, I counsel, the identical in every case. It’s that we don’t suppose financial savings must be invested on this nation. They solely, it’s thought, must be speculated. That implies that cash saved doesn’t attain the productive financial system within the UK however as an alternative really leaves it altogether to drift in a monetary ether the place it does nothing however assist Metropolis bonuses. Productiveness stays low because of this, that means we should not have the earnings to save lots of extra, and so a vicious cycle ensues.

In the meantime, as Larry Elliott notes within the Guardian:

There are different solutions for the way the federal government may velocity up the inexperienced transition, all of which meet with the identical riposte: that the plans are unaffordable, irresponsible and the stuff of fantasy.

In fact, the true fantasists are those that cling to the idea that we will proceed to take advantage of the pure world to fulfill our wishes. If that is what economics is about, we badly want a brand new economics.

What Larry is noting that the precise response to actual financial want for funding is that we can’t afford it, which is not sensible in any respect. If the UK financial savings price is 13% then that supposedly means we save £325 billion a 12 months. However apparently we can’t discover the cash wanted for local weather change to be addressed as a result of, presumably, that may cease the flows into the Metropolis required to maintain the inventory alternate Ponzi afloat.

We do certainly want a brand new economics. And it has to reconnect financial savings and funding, which is probably the most large disconnect in the entire world financial system, the place most wealth is only a chimaera, constructed on myths supported by accounting that studies every thing however the truth that most revenue is made by exploiting the way forward for life on earth.

Larry is true then a few new economics. However who will hear?

[ad_2]