[ad_1]

Breadth is holding up for Nasdaq 100 shares, however deteriorating for S&P 500 shares and I view this as a warning signal for the inventory market. Breadth indicators measure the diploma of participation. For instance, the proportion of S&P 500 shares above the 50-day SMA exhibits what number of shares made it above the 50-day SMA throughout a selected interval. Chartists can examine S&P 500 worth ranges with breadth indicator ranges to search out out if breadth is preserving tempo with worth. Indicators of potential bother emerge when breadth lags worth and participation considerably wanes.

Breadth is holding up for Nasdaq 100 shares, however deteriorating for S&P 500 shares and I view this as a warning signal for the inventory market. Breadth indicators measure the diploma of participation. For instance, the proportion of S&P 500 shares above the 50-day SMA exhibits what number of shares made it above the 50-day SMA throughout a selected interval. Chartists can examine S&P 500 worth ranges with breadth indicator ranges to search out out if breadth is preserving tempo with worth. Indicators of potential bother emerge when breadth lags worth and participation considerably wanes.

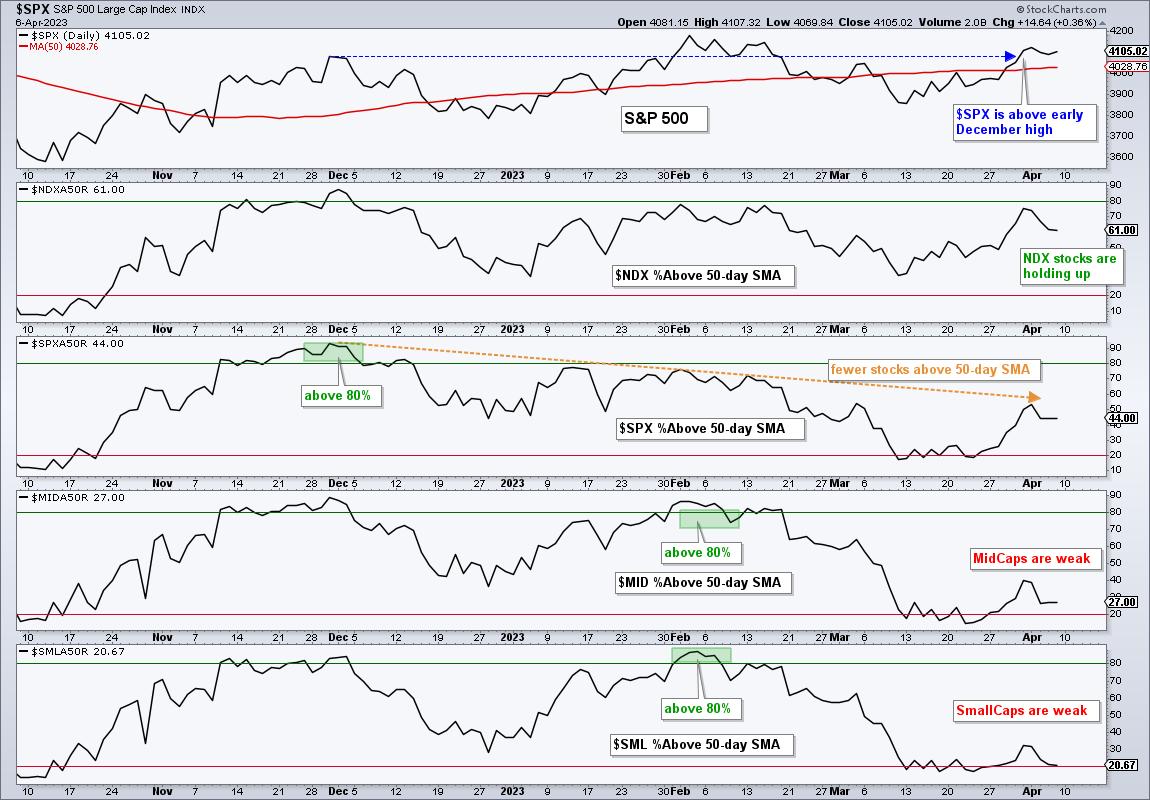

The chart beneath exhibits the proportion of shares above the 50-day SMA for the Nasdaq 100, S&P 500, S&P MidCap 400 and S&P SmallCap 600. Let’s first take a look at the highest half. Nasdaq 100 shares are holding up properly with some 61% of shares above their 50-day SMA. Participation throughout the S&P 500, in distinction, peaked in early December and considerably narrowed over the previous couple of months. Over 80% of S&P 500 shares have been above their 50-day SMAs in early December (inexperienced shading). The S&P 500 exceeded its December excessive in early February, however SPX %Above 50-day SMA didn’t make it again above 80%. Most not too long ago, the S&P 500 superior from mid March to early April and exceeded its December excessive (blue dashed line on worth chart). The proportion of shares above the 50-day SMA didn’t come near its early February peak and barely exceeded 50%. Because the dashed yellow arrow-line exhibits, fewer shares are collaborating within the present advance and this might spell bother.

Mid-caps and small-caps have been main the participation recreation in early February, however succumbed to broad promoting stress in March and didn’t actually get well. Discover that the proportion of shares above the 50-day SMA exceeded 80% in early February, for each mid-caps and small-caps (inexperienced shading). The indicator fell off a cliff from late February to mid March and moved beneath 20%. The proportion of shares above the 50-day SMA recovered considerably over the previous couple of weeks, however stays at very low ranges (27% for mid-caps and 20.67% for small-caps). This exhibits some critical weak point withing the mid-cap and small-cap area.

The Composite Breadth Mannequin at TrendInvestorPro is bullish proper now, however this bullish sign appears to be like fragile due to deteriorating breadth and will flip again to bearish. This mannequin serves because the market timing filter for 2 quantified buying and selling methods: the Bull-Bear Technique utilizing the All Climate ETF Listing and a Development-Momentum Technique for 74 stock-based ETFs. We even have a Imply-Reversion Technique for buying and selling throughout all market situations. Every technique has an in depth article and sign tables are up to date every day. Click on right here to be taught extra.

The Development Composite, Momentum Composite, ATR Trailing Cease and eight different indicators are a part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click on right here to be taught extra and take your evaluation course of to the subsequent degree.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering indicators throughout the pattern, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.

Subscribe to Artwork’s Charts to be notified each time a brand new submit is added to this weblog!

[ad_2]