[ad_1]

On Friday night time, the Financial institution of Japan will announce its rate of interest decision till June 16. If nothing else, the central financial institution will preserve its unfavorable rate of interest coverage since January 2016, with the benchmark price remaining at -0.1% whereas the 10-year authorities bond yield goal stays at 0%. A Reuters ballot of economists confirmed that round 50% of contributors anticipate the BoJ to probably take away easing, together with changes to its yield curve management (YCC) programme, in July or September.

For the yen in opposition to the greenback, 145 is a threshold to observe – which isn’t unattainable if the BoJ continues to keep up an accommodative financial coverage. The survey outcomes additionally present that 54% of economists consider the BOJ would probably take motion if the yen fell beneath 145 in opposition to the greenback, i.e. problem a warning or intervene within the foreign money market, whereas some 43% consider the central financial institution wouldn’t act till the alternate price fell beneath 150.

It’s price noting that the Japanese authorities carried out extra intervention measures in September and October final 12 months, which led to the yen reversing its development after hitting a 32-year low close to 152 in opposition to the US greenback. This was adopted by an surprising adjustment to the YCC by the Financial institution of Japan in December as effectively. At 14:30 GMT on the identical day, BOJ Governor Kazuo Ueda will maintain a press convention on financial coverage. Kazuo Ueta’s rhetoric thus far in workplace has been dovish, and he has stated that “the top of easing will depend upon attaining the two% inflation goal in addition to wage development”. When will this be achieved? Greater than 70% of economists assume this would possibly occur when wages develop in 2024. Up to now this 12 months, Japanese wages have risen by greater than 3%, a 30-year excessive, in opposition to a backdrop of excessive inflation and a tightening labour power.

Technical evaluation:

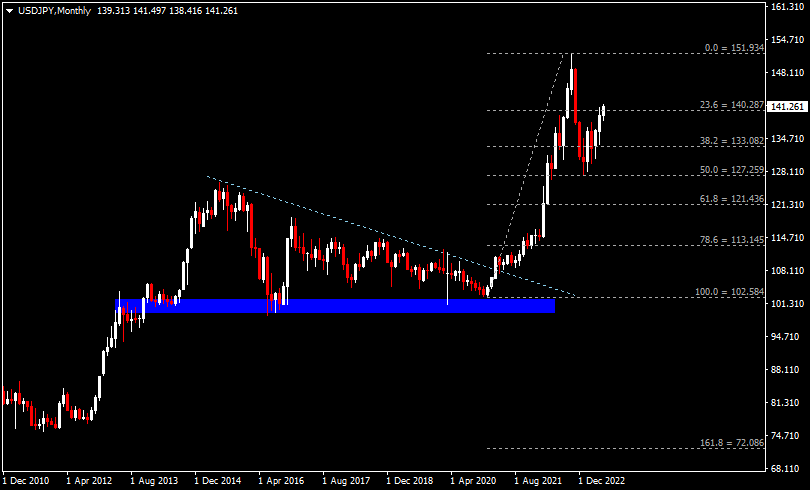

All through the final 20 years or so, the USDJPY hit decrease peaks in August 1998, January 2002 and June 2007 at 147.71, 135.19 and 124.12 respectively. the downtrend continued into late 2011-2012 (when it hit a low of 75.56 in October 2011). The pair began a bullish rally within the fourth quarter of 2012 and recovered from the June 2007 to late 2011-2012 decline in mid-2015. For the following 5+ years, USDJPY traded in a descending triangle space till March 2021 when it broke the development line and began the following spherical of rallies. In October 2022, the pair touched 151 for the primary time since August 1990 after which began a quick pullback sample earlier than discovering help round 127 in January 2023.

The “W” sample on the weekly chart may sign a continuation of the lengthy momentum.

The “W” sample on the weekly chart may sign a continuation of the lengthy momentum.

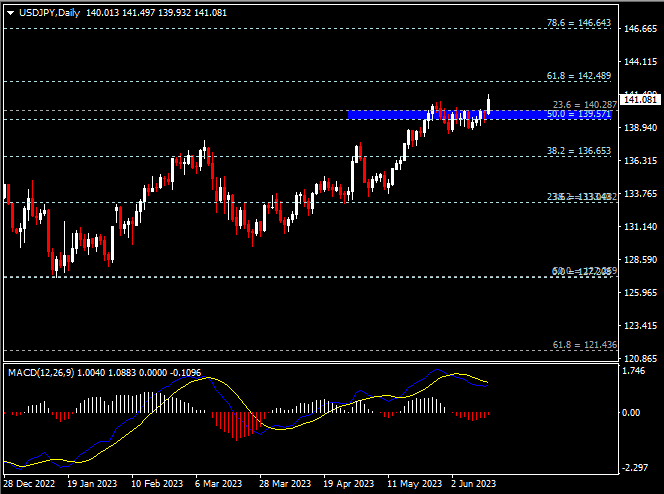

Trying on the each day chart, the alternate price is presently attempting to face agency above the 139.55 to 140.30 space. So long as the alternate price closes above this stage, the upside motion may nonetheless proceed and take a look at the 142.50 resistance, the minor resistance at 144.70, and 145 (crucial!) . Alternatively, if the alternate price falls beneath 139.55, we may see a technical correction with the following help at 139.65. The MACD double line stays optimistic.

Trying on the each day chart, the alternate price is presently attempting to face agency above the 139.55 to 140.30 space. So long as the alternate price closes above this stage, the upside motion may nonetheless proceed and take a look at the 142.50 resistance, the minor resistance at 144.70, and 145 (crucial!) . Alternatively, if the alternate price falls beneath 139.55, we may see a technical correction with the following help at 139.65. The MACD double line stays optimistic.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]