[ad_1]

The US500 has been caught in a decent vary near this 12 months’s highs for 33 buying and selling periods now, for the reason that starting of Q2. It has traded largely between 4100 and 4150 with some (very) short-lived excursions in the direction of each 4175 and 4050. No surprise, with the way forward for so many macroeconomic elements unsure: the most recent component to be added to the puzzle was the debt ceiling debate.

HFM · US500 stays indecisive as Cash Markets proceed to develop

Janet Yellen just lately said that the US may default on its money owed as early as the start of June, and this has helped to push the short-end of the US curve even increased.

Proper now, the 1 month US T-bill is yielding 5.55%, 47 bps above the Fed Funds, and that’s due to the increased notion of threat.

Information exhibits that People had already began withdrawing cash from the banking system when charges began to rise whereas their checking account yields didn’t, earlier than the numerous outflows after SVB and Signature Financial institution disaster when clients withdrew practically $100 billion in 1 week from regional banks.

Yearly Change, Billions, Deposits, All Industrial Banks. Fred

And the place did all this cash find yourself? Apparently, not a lot in the direction of shares or bonds however in the direction of Cash Market (MM) Funds. These are a kind of mutual fund that invests in high-quality, short-term debt devices, money, and money equivalents – issues just like the 1-month US T-bill. A deeply protected, liquid, virtually money equal product. And which presently provides greater than respectable returns.

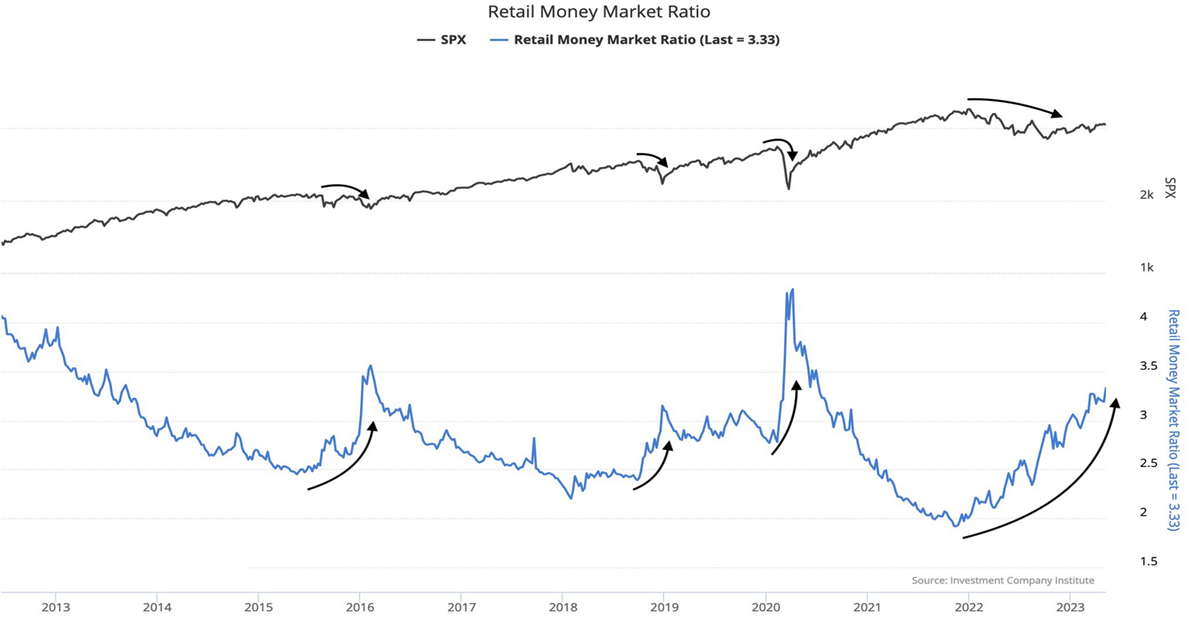

Clearly, persons are very attracted by these sorts of returns, which may go even increased within the subsequent few weeks. A examine by ICI that associated the expansion of MM amongst retailers to the long-term efficiency of the US500 confirmed that it’s fairly clear that when cash is shifted massively right into a cash-like product with a really low threat profile, the US500 suffers, generally closely. One has to surprise if being -13% from ATH is a full low cost of those flows or not.

Retail MM Ratio vs SP500

Technical Evaluation

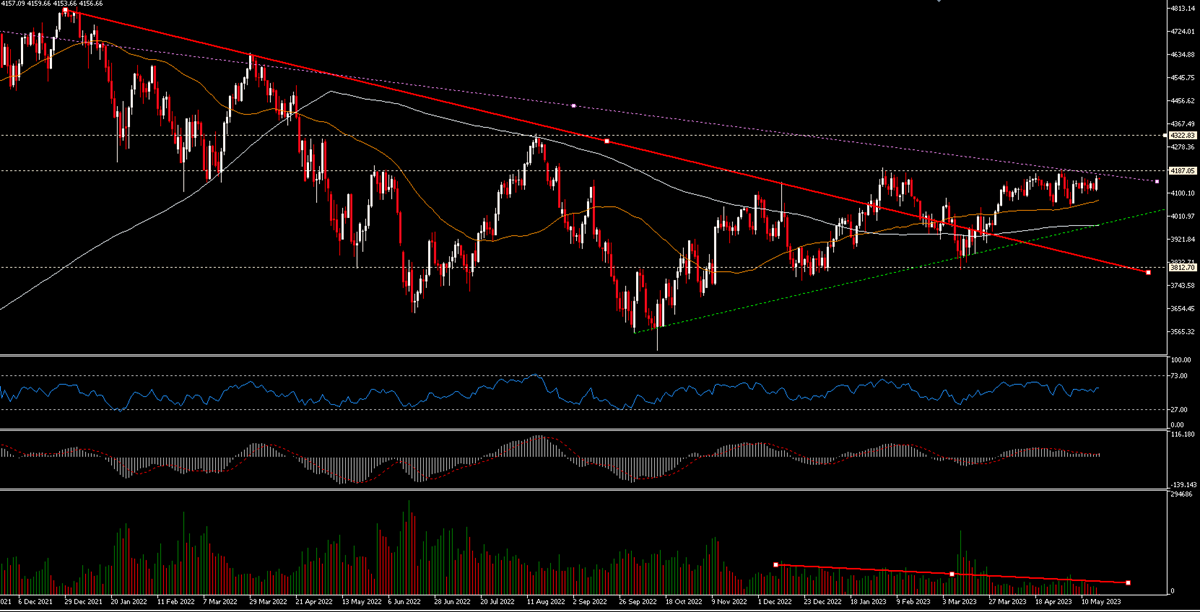

The simplest interpretation of the value motion of the index is that it has clearly damaged the bearish (crimson) development that began on the finish of 2021: it has risen 18% for the reason that October 2022 lows, it’s above the MA200 and the MA50 is positively tilted; the RSI (14) is at 55 and the MACD is constructive.

HOWEVER, volumes have been dropping as the value has been pushing increased, which isn’t an excellent signal. To be able to at all times have an different state of affairs out there, we need to attempt to contemplate the chance that the long-term downtrend may be even much less inclined than beforehand thought and represented by the Purple Channel. The US500 is buying and selling near the higher a part of the Purple Channel, which is presently within the 4190 space the place probably the most fast and strongest resistance is as nicely. If these ranges are damaged upwards there’ll most likely be room in the direction of 4325 to begin with. If as an alternative the present vary is damaged down (beneath 4050), the primary take a look at can be the inexperienced uptrend (presently round 4000) after which perhaps 3910, 3860.

What is for certain is that the stasis inside the 4050-4175 vary is not going to final endlessly and the route of the break-up will give a reasonably clear indication of the following leg.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]